EX-99.1

Published on July 29, 2025

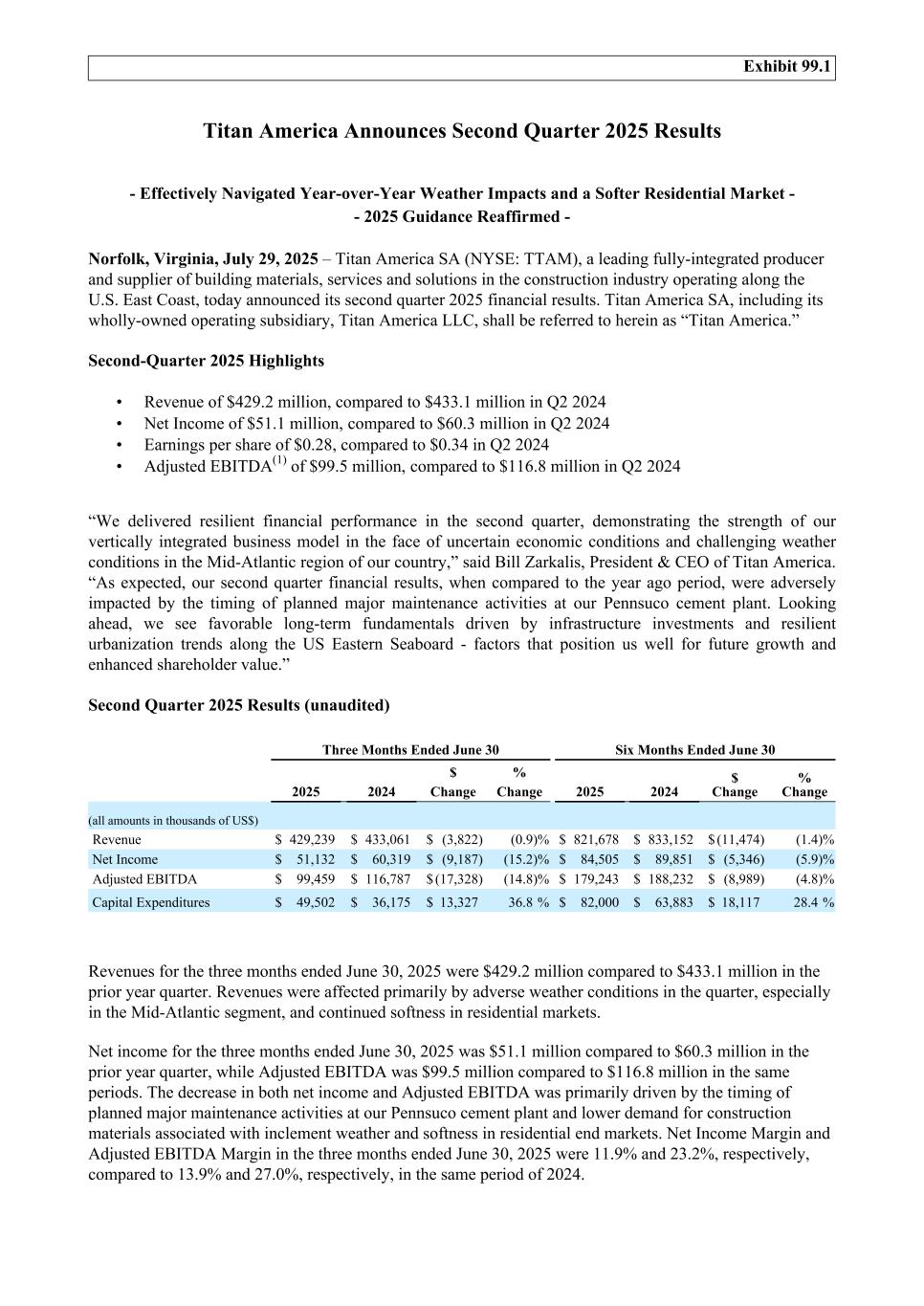

Titan America Announces Second Quarter 2025 Results - Effectively Navigated Year-over-Year Weather Impacts and a Softer Residential Market - - 2025 Guidance Reaffirmed - Norfolk, Virginia, July 29, 2025 – Titan America SA (NYSE: TTAM), a leading fully-integrated producer and supplier of building materials, services and solutions in the construction industry operating along the U.S. East Coast, today announced its second quarter 2025 financial results. Titan America SA, including its wholly-owned operating subsidiary, Titan America LLC, shall be referred to herein as “Titan America.” Second-Quarter 2025 Highlights • Revenue of $429.2 million, compared to $433.1 million in Q2 2024 • Net Income of $51.1 million, compared to $60.3 million in Q2 2024 • Earnings per share of $0.28, compared to $0.34 in Q2 2024 • Adjusted EBITDA(1) of $99.5 million, compared to $116.8 million in Q2 2024 “We delivered resilient financial performance in the second quarter, demonstrating the strength of our vertically integrated business model in the face of uncertain economic conditions and challenging weather conditions in the Mid-Atlantic region of our country,” said Bill Zarkalis, President & CEO of Titan America. “As expected, our second quarter financial results, when compared to the year ago period, were adversely impacted by the timing of planned major maintenance activities at our Pennsuco cement plant. Looking ahead, we see favorable long-term fundamentals driven by infrastructure investments and resilient urbanization trends along the US Eastern Seaboard - factors that position us well for future growth and enhanced shareholder value.” Second Quarter 2025 Results (unaudited) Three Months Ended June 30 Six Months Ended June 30 2025 2024 $ Change % Change 2025 2024 $ Change % Change (all amounts in thousands of US$) Revenue $ 429,239 $ 433,061 $ (3,822) (0.9) % $ 821,678 $ 833,152 $ (11,474) (1.4) % Net Income $ 51,132 $ 60,319 $ (9,187) (15.2) % $ 84,505 $ 89,851 $ (5,346) (5.9) % Adjusted EBITDA $ 99,459 $ 116,787 $ (17,328) (14.8) % $ 179,243 $ 188,232 $ (8,989) (4.8) % Capital Expenditures $ 49,502 $ 36,175 $ 13,327 36.8 % $ 82,000 $ 63,883 $ 18,117 28.4 % Revenues for the three months ended June 30, 2025 were $429.2 million compared to $433.1 million in the prior year quarter. Revenues were affected primarily by adverse weather conditions in the quarter, especially in the Mid-Atlantic segment, and continued softness in residential markets. Net income for the three months ended June 30, 2025 was $51.1 million compared to $60.3 million in the prior year quarter, while Adjusted EBITDA was $99.5 million compared to $116.8 million in the same periods. The decrease in both net income and Adjusted EBITDA was primarily driven by the timing of planned major maintenance activities at our Pennsuco cement plant and lower demand for construction materials associated with inclement weather and softness in residential end markets. Net Income Margin and Adjusted EBITDA Margin in the three months ended June 30, 2025 were 11.9% and 23.2%, respectively, compared to 13.9% and 27.0%, respectively, in the same period of 2024. Exhibit 99.1

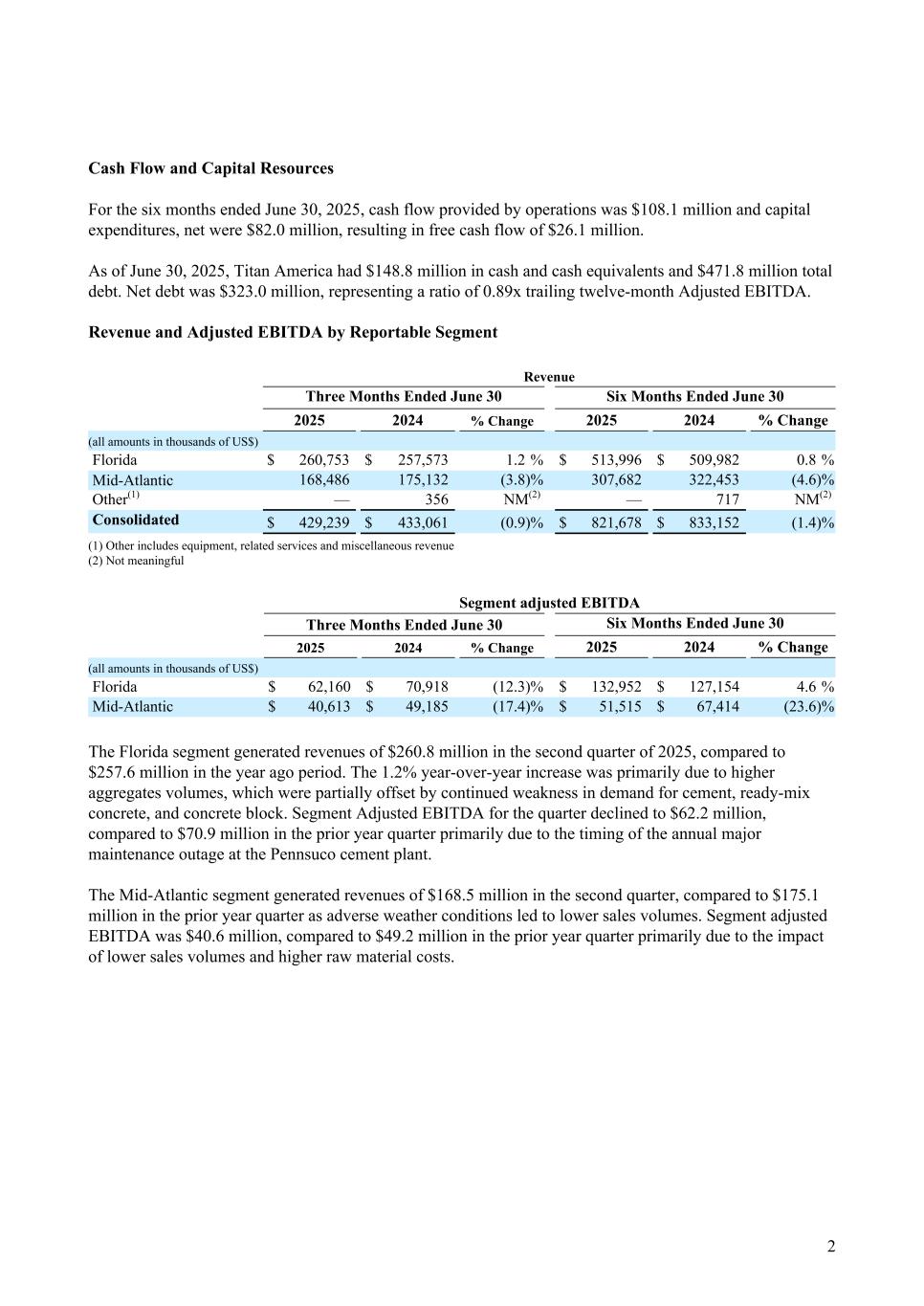

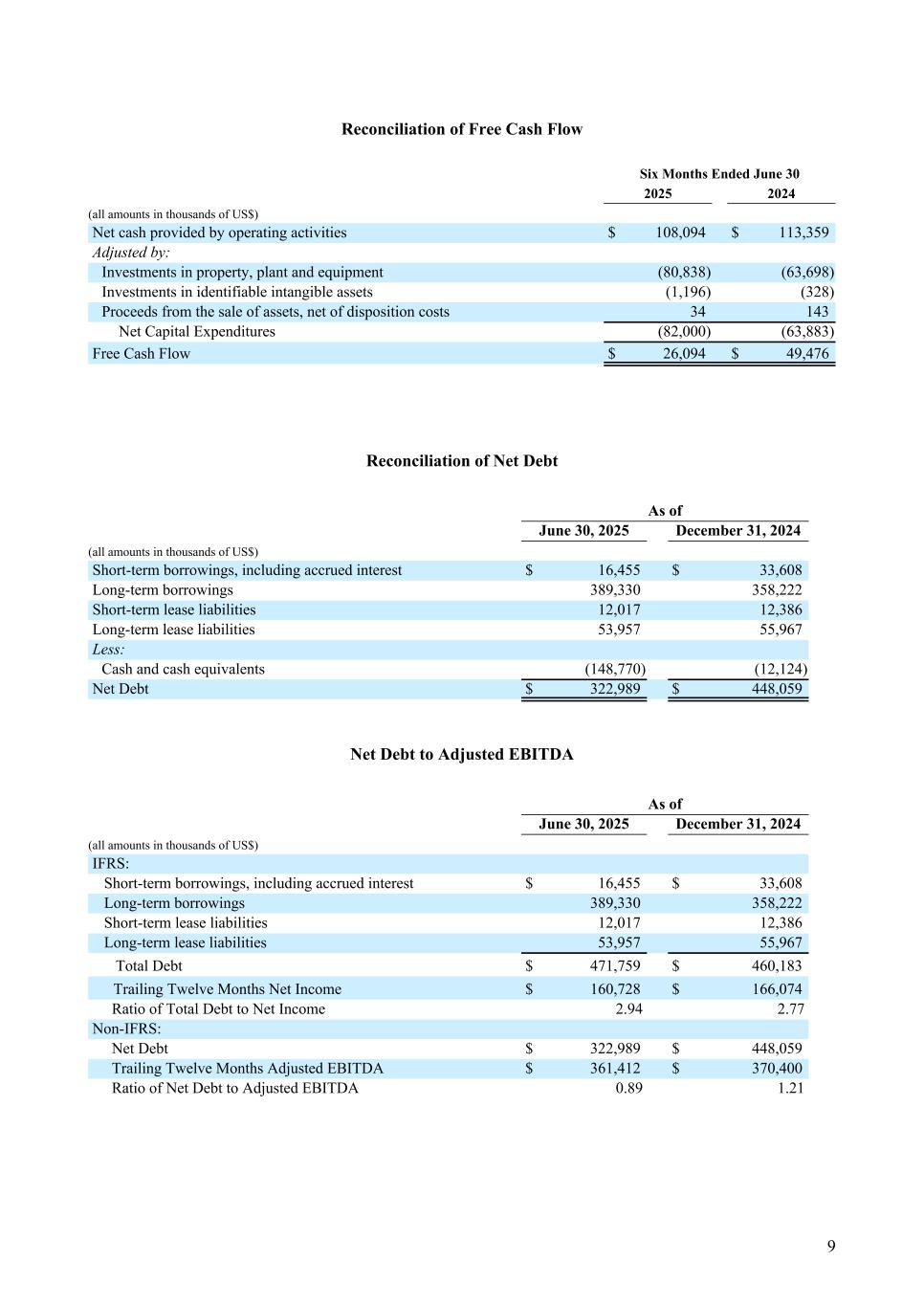

Cash Flow and Capital Resources For the six months ended June 30, 2025, cash flow provided by operations was $108.1 million and capital expenditures, net were $82.0 million, resulting in free cash flow of $26.1 million. As of June 30, 2025, Titan America had $148.8 million in cash and cash equivalents and $471.8 million total debt. Net debt was $323.0 million, representing a ratio of 0.89x trailing twelve-month Adjusted EBITDA. Revenue and Adjusted EBITDA by Reportable Segment Revenue Three Months Ended June 30 Six Months Ended June 30 2025 2024 % Change 2025 2024 % Change (all amounts in thousands of US$) Florida $ 260,753 $ 257,573 1.2 % $ 513,996 $ 509,982 0.8 % Mid-Atlantic 168,486 175,132 (3.8) % 307,682 322,453 (4.6) % Other(1) — 356 NM(2) — 717 NM(2) Consolidated $ 429,239 $ 433,061 (0.9) % $ 821,678 $ 833,152 (1.4) % (1) Other includes equipment, related services and miscellaneous revenue (2) Not meaningful Segment adjusted EBITDA Three Months Ended June 30 Six Months Ended June 30 2025 2024 % Change 2025 2024 % Change (all amounts in thousands of US$) Florida $ 62,160 $ 70,918 (12.3) % $ 132,952 $ 127,154 4.6 % Mid-Atlantic $ 40,613 $ 49,185 (17.4) % $ 51,515 $ 67,414 (23.6) % The Florida segment generated revenues of $260.8 million in the second quarter of 2025, compared to $257.6 million in the year ago period. The 1.2% year-over-year increase was primarily due to higher aggregates volumes, which were partially offset by continued weakness in demand for cement, ready-mix concrete, and concrete block. Segment Adjusted EBITDA for the quarter declined to $62.2 million, compared to $70.9 million in the prior year quarter primarily due to the timing of the annual major maintenance outage at the Pennsuco cement plant. The Mid-Atlantic segment generated revenues of $168.5 million in the second quarter, compared to $175.1 million in the prior year quarter as adverse weather conditions led to lower sales volumes. Segment adjusted EBITDA was $40.6 million, compared to $49.2 million in the prior year quarter primarily due to the impact of lower sales volumes and higher raw material costs. 2

2025 Outlook Regarding Titan America’s outlook, Titan America President & CEO Bill Zarkalis stated, “We are reaffirming our full-year 2025 outlook based on the strength of our order book and an expected return to more normal weather patterns as compared to H2 2024 when our operations were severely impacted by three significant hurricanes. Under this assumption, we expect revenue growth in the mid-single digit percent range, with modest improvement in Adjusted EBITDA margins compared to 2024.” Conference Call Titan America will host a conference call at 5:00 p.m. ET on July 29, 2025. The conference call will be broadcast live over the Internet. Additionally, a slide presentation will accompany the conference call. To listen to the call and view the slides, please visit the Investors section of Titan America’s website at https:// www.titanamerica.com/. For those who are unable to listen to the live broadcast, an audio replay of the conference call will be available on the Titan America website for 30 days. About Titan America SA Titan America is a leading vertically-integrated producer of cement and building materials in the high- growth economic mega-regions of the U.S. East Coast, with operations and leading market positions across Florida, the Mid-Atlantic, and Metro New York/New Jersey. Titan America’s family of company brands includes Essex Cement, Roanoke Cement, Titan Florida, Titan Virginia Ready-Mix, S&W Ready-Mix, Powhatan Ready Mix, Titan Mid-Atlantic Aggregates, and Separation Technologies. Titan America’s operations include cement plants, construction aggregates and sand mines, ready-mix concrete plants, concrete block plants, fly ash production facilities, marine import and rail terminals, and distribution hubs. Forward-Looking Statements This press release may include forward-looking statements. Forward-looking statements are statements regarding or based upon our management’s current intentions, beliefs or expectations relating to, among other things, Titan America’s future results of operations, financial condition, liquidity, prospects, growth, strategies, developments in the industry in which we operate and the proposed offering. In some cases, you can identify forward-looking statements by terminology such as “believe”, “anticipate”, “continue,” “could,” “expect,” “goal,” “may,” “plan,” “predict,” “propose,” “should,” “target,” “will,” “would” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology. By their nature, forward-looking statements are subject to risks, uncertainties and assumptions that could cause actual results or future events to differ materially from those expressed or implied thereby. These risks, uncertainties and assumptions could adversely affect the outcome and financial effects of the plans and events described herein. Forward-looking statements contained in this report regarding trends or current activities should not be taken as a report that such trends or activities will continue in the future. Titan America undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. You should not place undue reliance on any such forward-looking statements, which speak only as of the date of this report. The information contained in this report is subject to change without notice. No re-report or warranty, express or implied, is made as to the fairness, accuracy, reasonableness or completeness of the information contained herein and no reliance should be placed on it. 3

Financial Measures (Non-IFRS) In addition to the financial information presented in accordance with International Financial Reporting Standards (“IFRS”), this press release includes the following Non-IFRS financial measures: Adjusted EBITDA, Adjusted EBITDA Margin, Net Income Margin, free cash flow, net debt and the ratio of net debt to Adjusted EBITDA. We define Adjusted EBITDA as net income before finance cost, net, income tax expense, depreciation, depletion and amortization, further adjusted to remove the impact of additional items such as (gain)/loss on disposal of fixed assets, asset impairment (recovery)/loss, foreign exchange (gain)/ loss, net, derivative financial instrument (gain)/loss, net, fair value loss on sale of accounts receivable, net, share-based compensation and other non-recurring items, including certain transaction costs related to our initial public offering. We define Adjusted EBITDA Margin as Adjusted EBITDA divided by revenues. We define free cash flow as net cash provided by operating activities, less net payments for capital expenditures, which includes (i) investments in property, plant and equipment, (ii) investments in identifiable intangible assets and (iii) proceeds from the sale of assets, net of disposition costs. We define net debt as the sum of short and long-term borrowings, including accrued interest and short-term and long-term lease liabilities less cash and cash equivalents. We define the ratio of net debt to Adjusted EBITDA as the ratio derived by dividing net debt by Adjusted EBITDA. See “Reconciliation of IFRS to Non-IFRS” section for a detailed reconciliation of Non-IFRS financial measures to the most directly comparable IFRS measure. We believe that in addition to our results determined in accordance with IFRS, these Non-IFRS financial measures provide useful information to both management and investors in measuring our financial performance and highlight trends in our business that may not otherwise be apparent when relying solely on IFRS measures. Non-IFRS financial information is presented for supplemental informational purposes only and should not be considered in isolation or as a substitute for financial information presented in accordance with IFRS. Our presentation of Non-IFRS measures should not be construed as an inference that our future results will be unaffected by unusual or nonrecurring items. Other companies in our industry may calculate these measures differently, which may limit their usefulness as comparative measures. (1) As used throughout this release, the terms Adjusted EBITDA, Adjusted EBITDA margin, Net Income margin, free cash flow, net debt and net debt to Adjusted EBITDA are non-IFRS financial metrics. See “Reconciliation of IFRS to Non-IFRS” for a detailed reconciliation of Non-IFRS financial measures to the most directly comparable IFRS measure. See “Financial Measures (Non-IFRS)” for further discussion on these non-IFRS measures and why we believe they are useful. 4

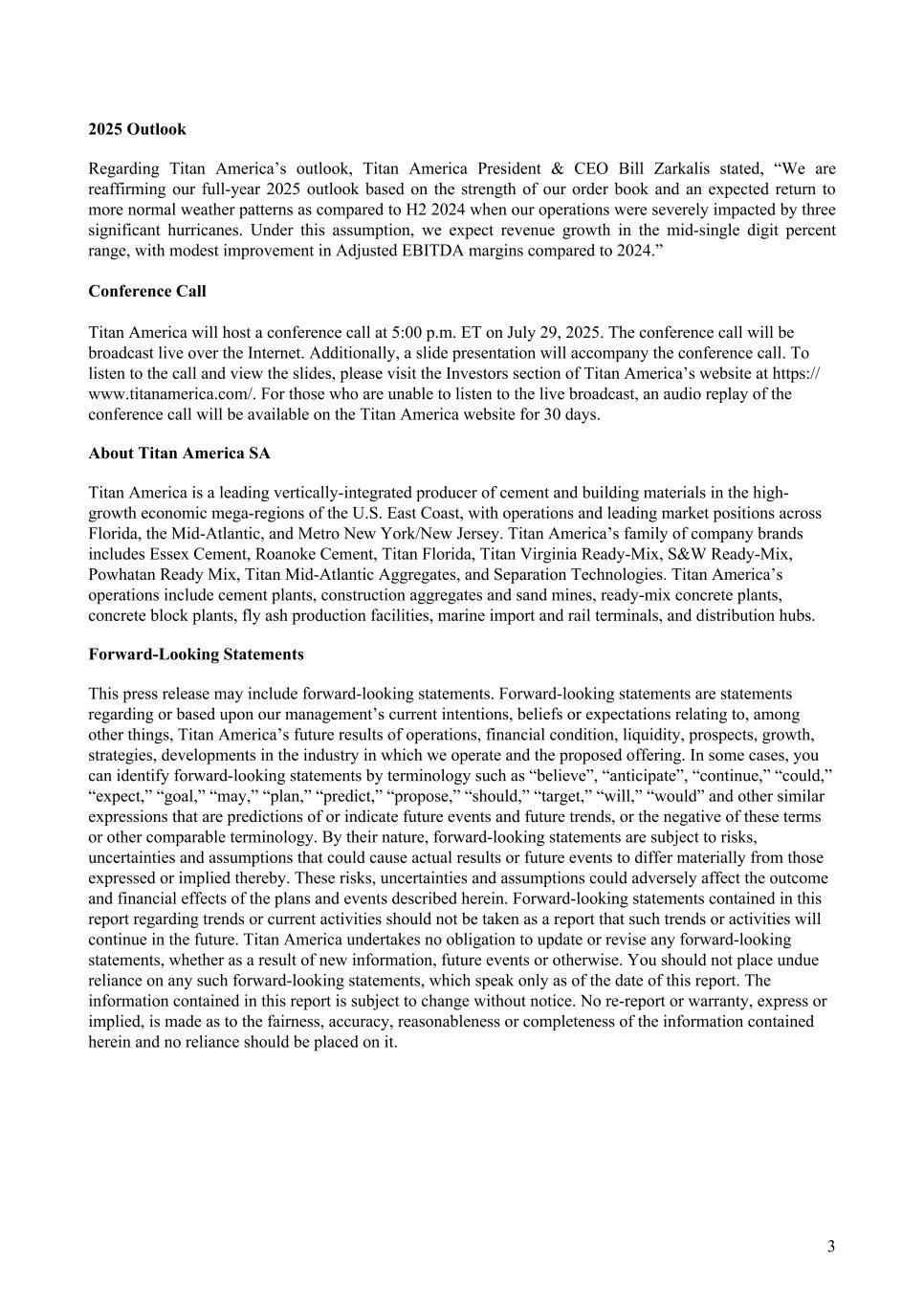

Condensed Consolidated Statements of Income (Unaudited) (all amounts in thousands of US$ except for earnings per share) Three Months Ended June 30 Six Months Ended June 30 2025 2024 2025 2024 Revenue $ 429,239 $ 433,061 $ 821,678 $ 833,152 Cost of goods sold (316,550) (305,454) (617,583) (624,429) Gross profit 112,689 127,607 204,095 208,723 Selling expense (8,611) (7,977) (16,851) (15,847) General and administrative expense (33,285) (30,726) (64,201) (56,265) Net impairment gain/(loss) on financial assets (130) (134) 150 (150) Fair value loss on sale of accounts receivable, net (1,139) (1,422) (2,102) (2,908) Other operating income, net 196 (12) 382 114 Operating income 69,720 87,336 121,473 133,667 Finance cost, net (5,571) (5,985) (12,153) (11,451) Foreign exchange (loss)/gain, net (30,706) 3,362 (44,519) 10,883 Derivative financial instrument gain/(loss), net 33,906 (4,768) 44,810 (14,005) Other non-operating income — — 2,552 — Income before income taxes 67,349 79,945 112,163 119,094 Income tax expense (16,217) (19,626) (27,658) (29,243) Net income $ 51,132 $ 60,319 $ 84,505 $ 89,851 Earnings per share of common stock: Basic earnings per share $ 0.28 $ 0.34 $ 0.46 $ 0.51 Diluted earnings per share $ 0.28 $ 0.34 $ 0.46 $ 0.51 Weighted average number of common stock - basic and diluted 184,362,465 175,362,465 182,323,791 175,362,465 5

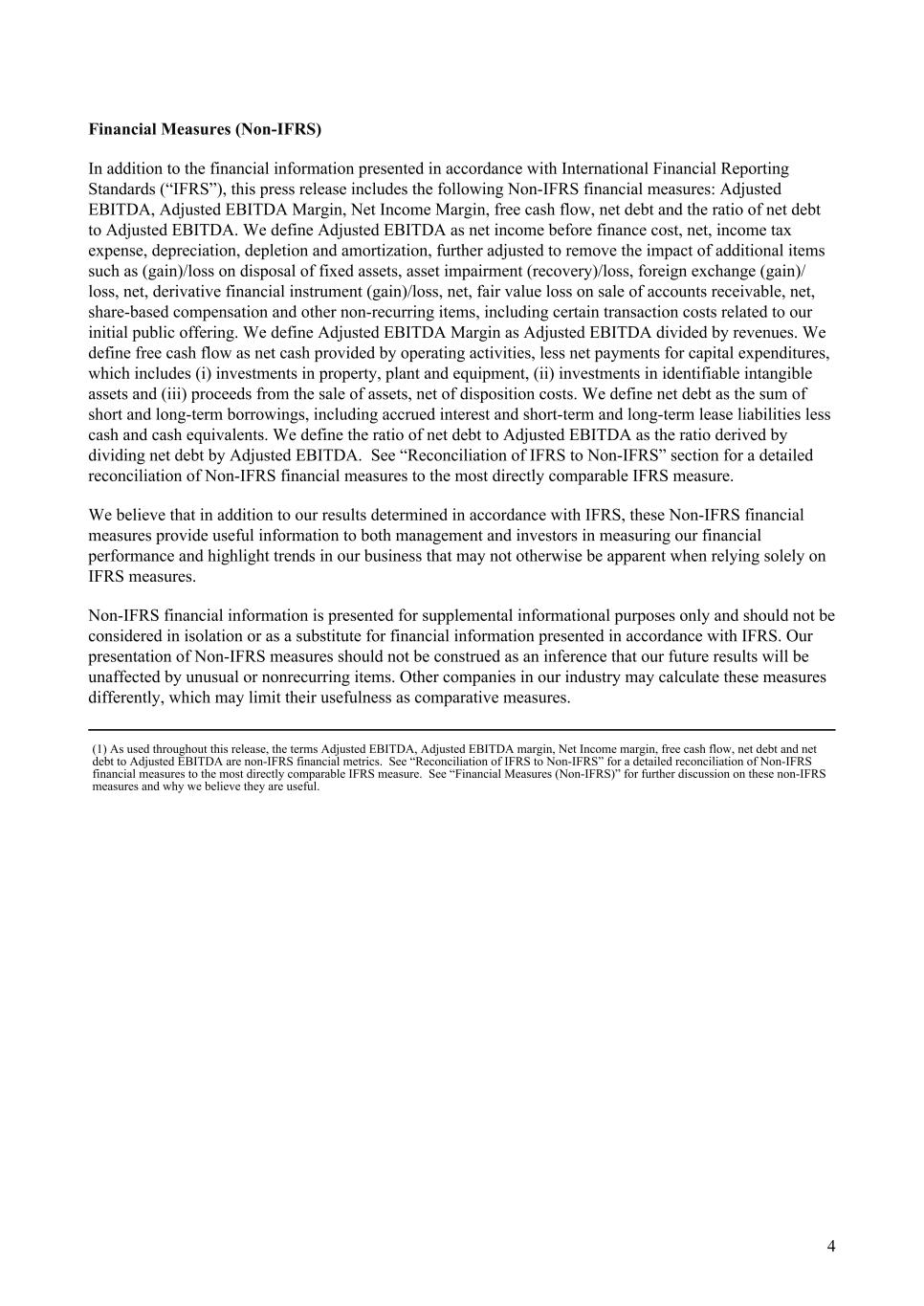

Condensed Consolidated Balance Sheet (Unaudited) June 30, December 31, (all amounts in thousands of US$) 2025 2024 Current assets: Cash and cash equivalents $ 148,770 $ 12,124 Trade and other receivables, net 139,707 106,056 Inventories 219,376 227,638 Prepaid expenses and other current assets 10,118 14,308 Income taxes receivable 30,485 22,802 Derivatives and credit support payments 142 1,328 Total current assets 548,598 384,256 Noncurrent assets: Property, plant, equipment and mineral deposits, net 887,306 851,733 Right-of-use assets 66,916 64,688 Other assets 7,671 10,076 Intangible assets, net 29,045 30,167 Goodwill 221,562 221,562 Derivatives and credit support payments 30,539 3,770 Total noncurrent assets 1,243,039 1,181,996 Total assets $ 1,791,637 $ 1,566,252 Current liabilities: Accounts and related party payables $ 149,719 $ 148,558 Accrued expenses 22,996 24,879 Provisions 9,408 10,081 Income taxes payable 21 1,872 Short term borrowing, including accrued interest 16,455 33,608 Lease liabilities 12,017 12,386 Derivatives and credit support receipts 134 1,318 Other current liabilities 146 6,344 Total current liabilities 210,896 239,046 Non-current liabilities: Long-term borrowings 389,330 358,222 Lease liabilities 53,957 55,967 Provisions 58,379 50,926 Deferred income tax liability 101,194 98,212 Derivatives and credit support receipts 27,216 8,418 Other noncurrent liabilities 6,635 5,447 Total noncurrent liabilities 636,711 577,192 Total liabilities 847,607 816,238 Stockholders’ equity 944,030 750,014 Total liabilities and stockholders’ equity $ 1,791,637 $ 1,566,252 6

Condensed Consolidated Statements of Cash Flows (Unaudited) (all amounts in thousands of US$) Six Months Ended June 30 2025 2024 Cash flows from operating activities Income before income taxes $ 112,163 $ 119,094 Adjustments for: Depreciation, depletion and amortization 51,686 46,256 Gain on divestiture (2,552) — Finance cost 14,432 12,297 Finance income (2,279) (846) Foreign exchange loss/(gain), net 44,519 (10,883) Derivative financial instrument (gain)/loss, net (44,810) 14,005 Changes in net operating assets and liabilities (29,366) (41,916) Other (4,159) (679) Cash generated from operations before income taxes 139,634 137,328 Income taxes, net (31,540) (23,969) Net cash provided by operating activities 108,094 113,359 Cash flows from investing activities Investments in property, plant and equipment (80,838) (63,698) Investments in intangible assets (1,196) (328) Short term investments — (18,919) Interest received 2,091 802 Proceeds from the sale of assets, net of disposition costs 34 143 Proceeds from sale of investment 5,368 — Net cash used in investing activities (74,541) (82,000) Cash flows from financing activities Repayment of affiliated party borrowings (15,002) — Borrowings from affiliated party 4,976 — Offering costs associated with borrowings — (682) Repayment of third party line of credit (25,000) — Lease payments (4,773) (5,042) Share premium distribution (14,749) — Proceeds from IPO 144,000 — Related party recharge for stock-based compensation — (2,830) Derivative credit support receipts/(payments) and settlements 33,564 (12,050) Interest paid (10,602) (11,055) IPO Costs (9,321) (278) Net cash provided by/(used in) financing activities 103,093 (31,937) Net increase/(decrease) in cash and cash equivalents 136,646 (578) Cash and cash equivalents at: Beginning of period 12,124 22,036 Effects of exchange rate changes — 115 End of period $ 148,770 $ 21,573 7

Reconciliation of IFRS to Non-IFRS Reconciliation of IFRS Net Income to Non-IFRS Adjusted EBITDA and IFRS Net Income Margin to Non-IFRS Adjusted EBITDA Margin Three Months Ended June 30 Six Months Ended June 30 2025 2024 2025 2024 (all amounts in thousands of US$) Net income $ 51,132 14,233 $ 60,319 $ 84,505 $ 89,851 Finance cost, net 5,571 14,233 5,985 12,153 11,451 Income tax expense 16,217 14,233 19,626 27,658 29,243 Depreciation, depletion and amortization 27,270 14,233 24,152 51,686 46,256 Loss/(gain) on disposal of fixed assets 338 14,233 93 301 880 Foreign exchange loss/(gain), net 30,706 14,233 (3,362) 44,519 (10,883) Derivative financial instrument (gain)/loss, net (33,906) 14,233 4,768 (44,810) 14,005 Fair value loss on sale of accounts receivable, net 1,139 14,233 1,422 2,102 2,908 Share-based compensation 897 14,233 1,121 1,671 1,907 IPO transaction expenses 298 14,233 2,572 2,182 3,334 Other (203) 14,233 91 (2,724) (720) Adjusted EBITDA $ 99,459 $ 116,787 $ 179,243 $ 188,232 Revenue $ 429,239 $ 433,061 $ 821,678 $ 833,152 Net Income Margin(1) 11.9 % 13.9 % 10.3 % 10.8 % Adjusted EBITDA Margin(2) 23.2 % 27.0 % 21.8 % 22.6 % (1) Net Income Margin is calculated as net income divided by revenues. (2) Adjusted EBITDA Margin is calculated as Adjusted EBITDA divided by revenues. Twelve Months Ended June 30, 2025 December 31, 2024 (all amounts in thousands of US$) Net income $ 160,728 $ 166,074 Finance cost, net 26,877 26,175 Income tax expense 55,959 57,544 Depreciation, depletion and amortization 105,371 99,941 Loss/(gain) on disposal of fixed assets 1,832 2,411 Foreign exchange loss/(gain), net 34,556 (20,846) Derivative financial instrument (gain)/loss, net (36,373) 22,441 Fair value loss on sale of accounts receivable, net 3,814 4,620 Share-based compensation 3,605 3,841 IPO transaction expenses 10,664 11,816 Other (5,621) (3,617) Adjusted EBITDA $ 361,412 $ 370,400 8

Reconciliation of Free Cash Flow Six Months Ended June 30 2025 2 2024 (all amounts in thousands of US$) Net cash provided by operating activities $ 108,094 $ 113,359 Adjusted by: Investments in property, plant and equipment (80,838) (63,698) Investments in identifiable intangible assets (1,196) (328) Proceeds from the sale of assets, net of disposition costs 34 143 Net Capital Expenditures (82,000) (63,883) Free Cash Flow $ 26,094 $ 49,476 Reconciliation of Net Debt As of June 30, 2025 December 31, 2024 (all amounts in thousands of US$) Short-term borrowings, including accrued interest $ 16,455 $ 33,608 Long-term borrowings 389,330 358,222 Short-term lease liabilities 12,017 12,386 Long-term lease liabilities 53,957 55,967 Less: Cash and cash equivalents (148,770) (12,124) Net Debt $ 322,989 $ 448,059 Net Debt to Adjusted EBITDA As of June 30, 2025 December 31, 2024 (all amounts in thousands of US$) IFRS: Short-term borrowings, including accrued interest $ 16,455 $ 33,608 Long-term borrowings 389,330 358,222 Short-term lease liabilities 12,017 12,386 Long-term lease liabilities 53,957 55,967 Total Debt $ 471,759 $ 460,183 Trailing Twelve Months Net Income $ 160,728 $ 166,074 Ratio of Total Debt to Net Income 2.94 2.77 Non-IFRS: Net Debt $ 322,989 $ 448,059 Trailing Twelve Months Adjusted EBITDA $ 361,412 $ 370,400 Ratio of Net Debt to Adjusted EBITDA 0.89 1.21 9

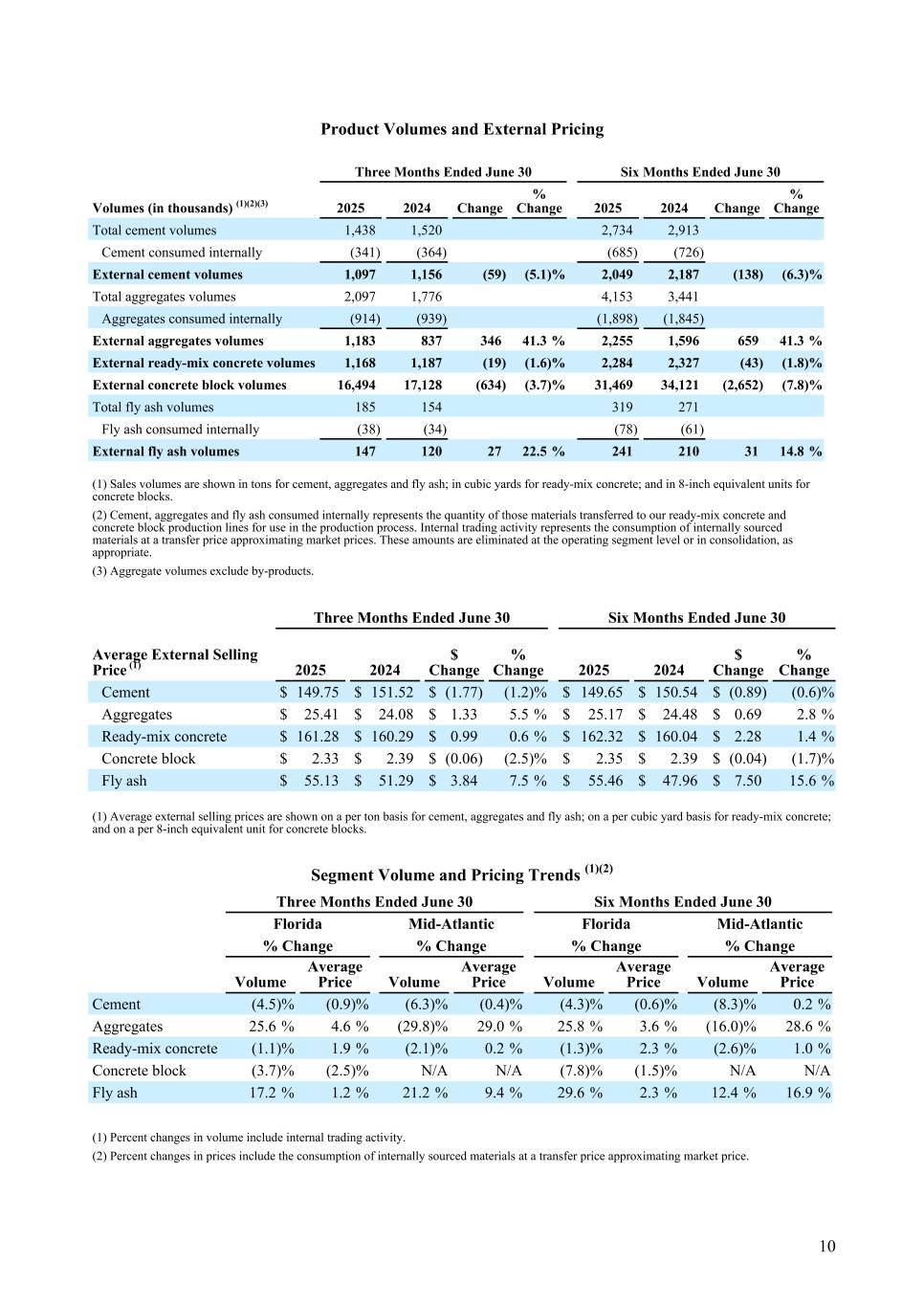

Product Volumes and External Pricing Three Months Ended June 30 Six Months Ended June 30 Volumes (in thousands) (1)(2)(3) 2025 2024 Change % Change 2025 2024 Change % Change Total cement volumes 1,438 1,520 2,734 2,913 Cement consumed internally (341) (364) (685) (726) External cement volumes 1,097 1,156 (59) (5.1) % 2,049 2,187 (138) (6.3) % Total aggregates volumes 2,097 1,776 4,153 3,441 Aggregates consumed internally (914) (939) (1,898) (1,845) External aggregates volumes 1,183 837 346 41.3 % 2,255 1,596 659 41.3 % External ready-mix concrete volumes 1,168 1,187 (19) (1.6) % 2,284 2,327 (43) (1.8) % External concrete block volumes 16,494 17,128 (634) (3.7) % 31,469 34,121 (2,652) (7.8) % Total fly ash volumes 185 154 319 271 Fly ash consumed internally (38) (34) (78) (61) External fly ash volumes 147 120 27 22.5 % 241 210 31 14.8 % (1) Sales volumes are shown in tons for cement, aggregates and fly ash; in cubic yards for ready-mix concrete; and in 8-inch equivalent units for concrete blocks. (2) Cement, aggregates and fly ash consumed internally represents the quantity of those materials transferred to our ready-mix concrete and concrete block production lines for use in the production process. Internal trading activity represents the consumption of internally sourced materials at a transfer price approximating market prices. These amounts are eliminated at the operating segment level or in consolidation, as appropriate. (3) Aggregate volumes exclude by-products. Three Months Ended June 30 Six Months Ended June 30 Average External Selling Price (1) 2025 2024 $ Change % Change 2025 2024 $ Change % Change Cement $ 149.75 $ 151.52 $ (1.77) (1.2) % $ 149.65 $ 150.54 $ (0.89) (0.6) % Aggregates $ 25.41 $ 24.08 $ 1.33 5.5 % $ 25.17 $ 24.48 $ 0.69 2.8 % Ready-mix concrete $ 161.28 $ 160.29 $ 0.99 0.6 % $ 162.32 $ 160.04 $ 2.28 1.4 % Concrete block $ 2.33 $ 2.39 $ (0.06) (2.5) % $ 2.35 $ 2.39 $ (0.04) (1.7) % Fly ash $ 55.13 $ 51.29 $ 3.84 7.5 % $ 55.46 $ 47.96 $ 7.50 15.6 % (1) Average external selling prices are shown on a per ton basis for cement, aggregates and fly ash; on a per cubic yard basis for ready-mix concrete; and on a per 8-inch equivalent unit for concrete blocks. Segment Volume and Pricing Trends (1)(2) Three Months Ended June 30 Six Months Ended June 30 Florida Mid-Atlantic Florida Mid-Atlantic % Change % Change % Change % Change Volume Average Price Volume Average Price Volume Average Price Volume Average Price Cement (4.5) % (0.9) % (6.3) % (0.4) % (4.3) % (0.6) % (8.3) % 0.2 % Aggregates 25.6 % 4.6 % (29.8) % 29.0 % 25.8 % 3.6 % (16.0) % 28.6 % Ready-mix concrete (1.1) % 1.9 % (2.1) % 0.2 % (1.3) % 2.3 % (2.6) % 1.0 % Concrete block (3.7) % (2.5) % N/A N/A (7.8) % (1.5) % N/A N/A Fly ash 17.2 % 1.2 % 21.2 % 9.4 % 29.6 % 2.3 % 12.4 % 16.9 % (1) Percent changes in volume include internal trading activity. (2) Percent changes in prices include the consumption of internally sourced materials at a transfer price approximating market price. 10

Investor Relations ir@titanamerica.com 757-901-4152 https://www.ir.titanamerica.com 11