EX-99.1

Published on April 18, 2025

40 1011.751.174 1 USD NAT. Filing date N°. P. U. D. F-cap 1 ANNUAL ACCOUNTS AND/OR OTHER DOCUMENTS TO BE FILED IN ACCORDANCE WITH THE BELGIAN COMPANIES AND ASSOCIATIONS CODE IDENTIFICATION DETAILS (at the filing date) Name: Titan America Legal form: Public limited company Address: de Meeûssquare N°.: 37 Box: Postal code: 1000 Town: Bruxelles Country: Belgium Register of legal persons - Commercial court Brussels, French speaking Website: E-mail address: Company registration number 1011.751.174 Date 03/03/2025 of filing the most recent document mentioning the date of publication of the deed of incorporation and of the deed of amendment of the articles of association. This filing concerns: ☒ the ANNUAL ACCOUNTS in USD approved by the general meeting of 06/05/2025 ☒ the OTHER DOCUMENTS regarding the financial year covering the period from 19/07/2024 to 31/12/2024 the preceding period of the annual accounts from to 1 Exhibit No. 99.1

Total number of pages filed: 22 Numbers of sections of the standard form not filed because they serve no useful purpose: FULL-cap 6.2.1, FULL-cap 6.2.2, FULL-cap 6.2.3, FULL-cap 6.2.4, FULL-cap 6.2.5, FULL-cap 6.3.1, FULL-cap 6.3.2, FULL-cap 6.3.3, FULL-cap 6.3.4, FULL-cap 6.3.5, FULL-cap 6.3.6, FULL-cap 6.4.2, FULL-cap 6.4.3, FULL-cap 6.5.2, FULL-cap 6.8, FULL-cap 6.9, FULL-cap 6.10, FULL-cap 6.12, FULL-cap 6.13, FULL-cap 6.14, FULL-cap 6.17, FULL-cap 9, FULL-cap 10, FULL-cap 11, FULL-cap 12, FULL-cap 13, FULL-cap 14, FULL-cap 15 beba4e92fe11e5 Marcel Cobuz Chairman of the Board 7d0f9cfe5dfb13 Michael Colakides Director 2

N°. 1011.751.174 F-cap 2.1 LIST OF DIRECTORS, BUSINESS MANAGERS AND AUDITORS AND DECLARATION REGARDING A COMPLIMENTARY REVIEW OR CORRECTION ASSIGNMENT LIST OF DIRECTORS, BUSINESS MANAGERS AND AUDITORS COMPLETE LIST with surname, first names, profession, place of residence (address, number, postal code and town) and position within the company. BACHMANN James . de Meeûssquare 37 1000 BRUSSEL BELGIUM Start date of the mandate: 10-02-2025 End date of the mandate: 12-05-2026 Director SOARES SANTOS Sandra . de Meeûssquare 37 1000 BRUSSEL BELGIUM Start date of the mandate: 10-02-2025 End date of the mandate: 12-05-2026 Director ANTHOLIS William . de Meeûssquare 37 1000 BRUSSEL BELGIUM Start date of the mandate: 10-02-2025 End date of the mandate: 12-05-2026 Director COLAKIDES Michael . de Meeûssquare 37 1000 BRUSSEL BELGIUM Start date of the mandate: 19-07-2024 End date of the mandate: 12-05-2026 Director COBUZ Marcel . de Meeûssquare 37 1000 BRUSSEL BELGIUM Start date of the mandate: 10-02-2025 End date of the mandate: 12-05-2026 Director VAN DER SMISSEN Willem . de Meeûssquare 37 3

1000 BRUSSEL BELGIUM Start date of the mandate: 10-02-2025 End date of the mandate: 12-05-2026 Director DIKAIOS Grigorios . de Meeûssquare 37 1000 Brussel BELGIUM Start date of the mandate: 17-07-2024 End date of the mandate: 10-02-2025 Director BIRAKIS Nikolaos . de Meeûssquare 37 1000 Brussel BELGIUM Start date of the mandate: 17-07-2024 End date of the mandate: 10-02-2025 Director ANDREADIS Nikolaos . de Meeûssquare 37 1000 Brussels BELGIUM Start date of the mandate: 17-07-2024 End date of the mandate: 10-02-2025 Director ZARKALIS Vassilios . de Meeûssquare 37 1000 Brussels BELGIUM Start date of the mandate: 10-02-2025 End date of the mandate: 12-05-2026 Director PWC REVISEURS D'ENTREPRISES (B00009) 0429501944 Culliganlaan 5 1831 Machelen BELGIUM Start date of the mandate: 19-07-2024 End date of the mandate: 13-05-2027 Auditor Directly or indirectly represented by: DELANOYE Didier (A02154) Culliganlaan 5 1831 Machelen BELGIUM 4

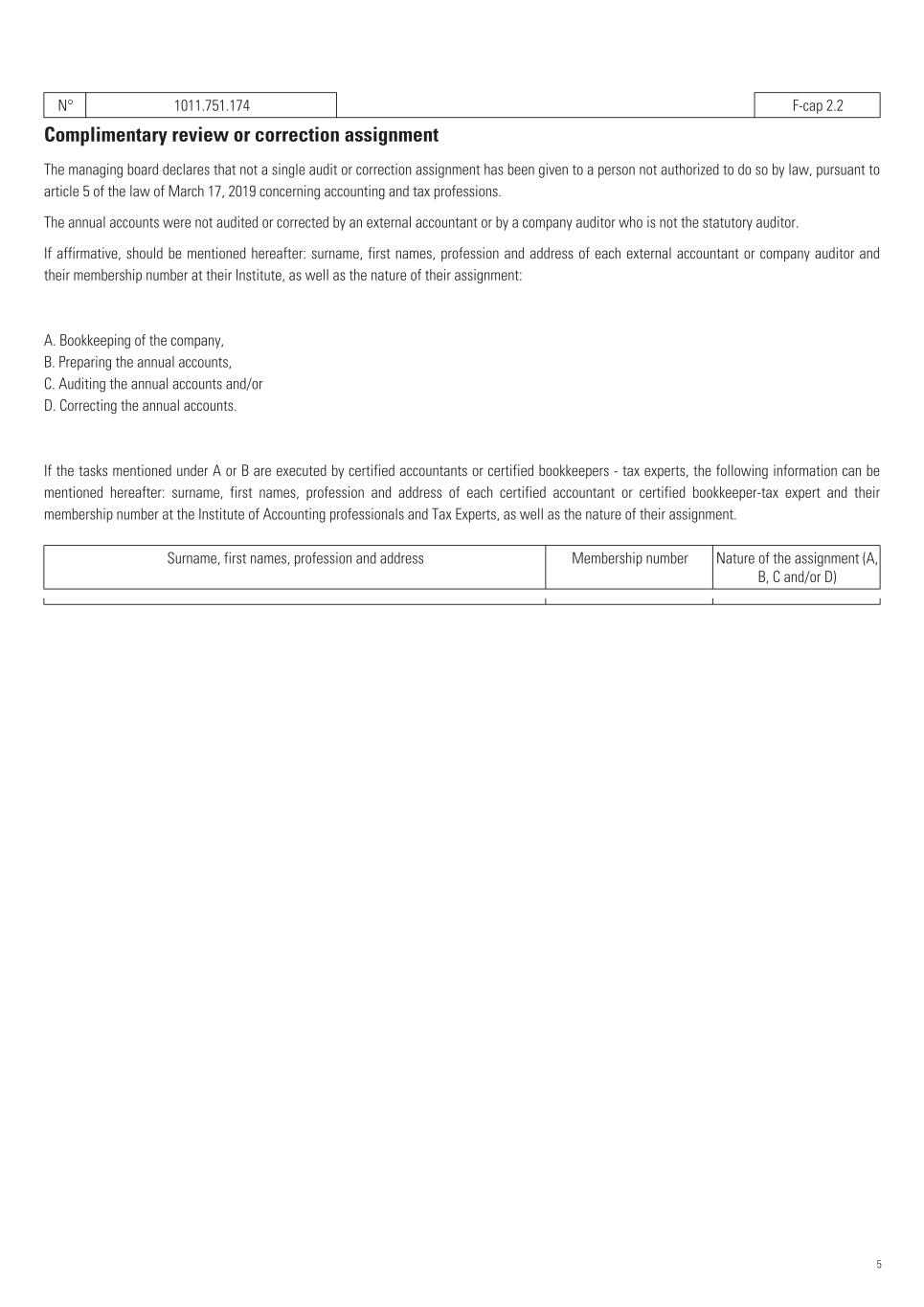

N° 1011.751.174 F-cap 2.2 Complimentary review or correction assignment The managing board declares that not a single audit or correction assignment has been given to a person not authorized to do so by law, pursuant to article 5 of the law of March 17, 2019 concerning accounting and tax professions. The annual accounts were not audited or corrected by an external accountant or by a company auditor who is not the statutory auditor. If affirmative, should be mentioned hereafter: surname, first names, profession and address of each external accountant or company auditor and their membership number at their Institute, as well as the nature of their assignment: A. Bookkeeping of the company, B. Preparing the annual accounts, C. Auditing the annual accounts and/or D. Correcting the annual accounts. If the tasks mentioned under A or B are executed by certified accountants or certified bookkeepers - tax experts, the following information can be mentioned hereafter: surname, first names, profession and address of each certified accountant or certified bookkeeper-tax expert and their membership number at the Institute of Accounting professionals and Tax Experts, as well as the nature of their assignment. Surname, first names, profession and address Membership number Nature of the assignment (A, B, C and/or D) 5

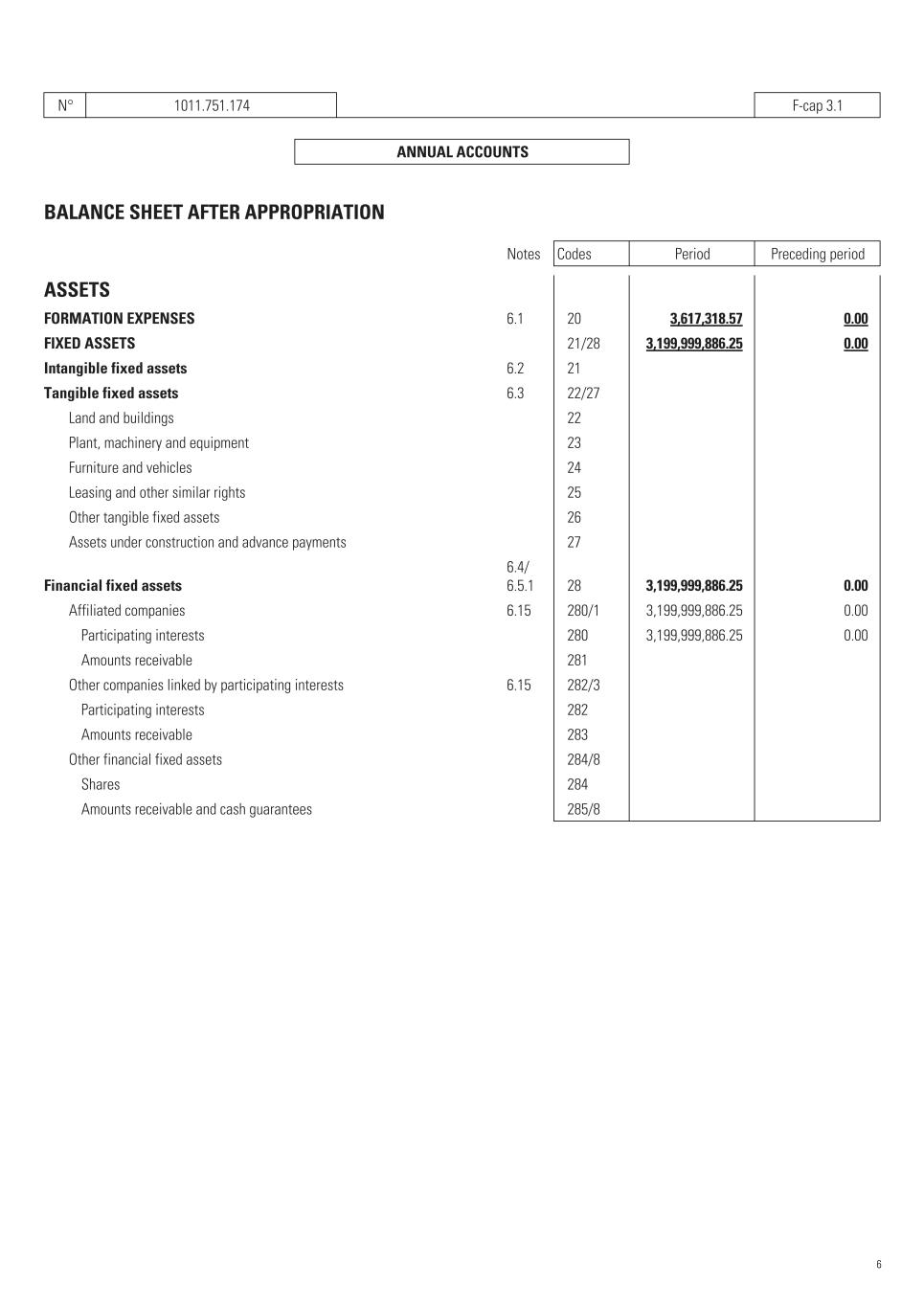

N° 1011.751.174 F-cap 3.1 ANNUAL ACCOUNTS BALANCE SHEET AFTER APPROPRIATION Notes Codes Period Preceding period ASSETS FORMATION EXPENSES 6.1 20 3,617,318.57 0.00 FIXED ASSETS 21/28 3,199,999,886.25 0.00 Intangible fixed assets 6.2 21 Tangible fixed assets 6.3 22/27 Land and buildings 22 Plant, machinery and equipment 23 Furniture and vehicles 24 Leasing and other similar rights 25 Other tangible fixed assets 26 Assets under construction and advance payments 27 Financial fixed assets 6.4/ 6.5.1 28 3,199,999,886.25 0.00 Affiliated companies 6.15 280/1 3,199,999,886.25 0.00 Participating interests 280 3,199,999,886.25 0.00 Amounts receivable 281 Other companies linked by participating interests 6.15 282/3 Participating interests 282 Amounts receivable 283 Other financial fixed assets 284/8 Shares 284 Amounts receivable and cash guarantees 285/8 6

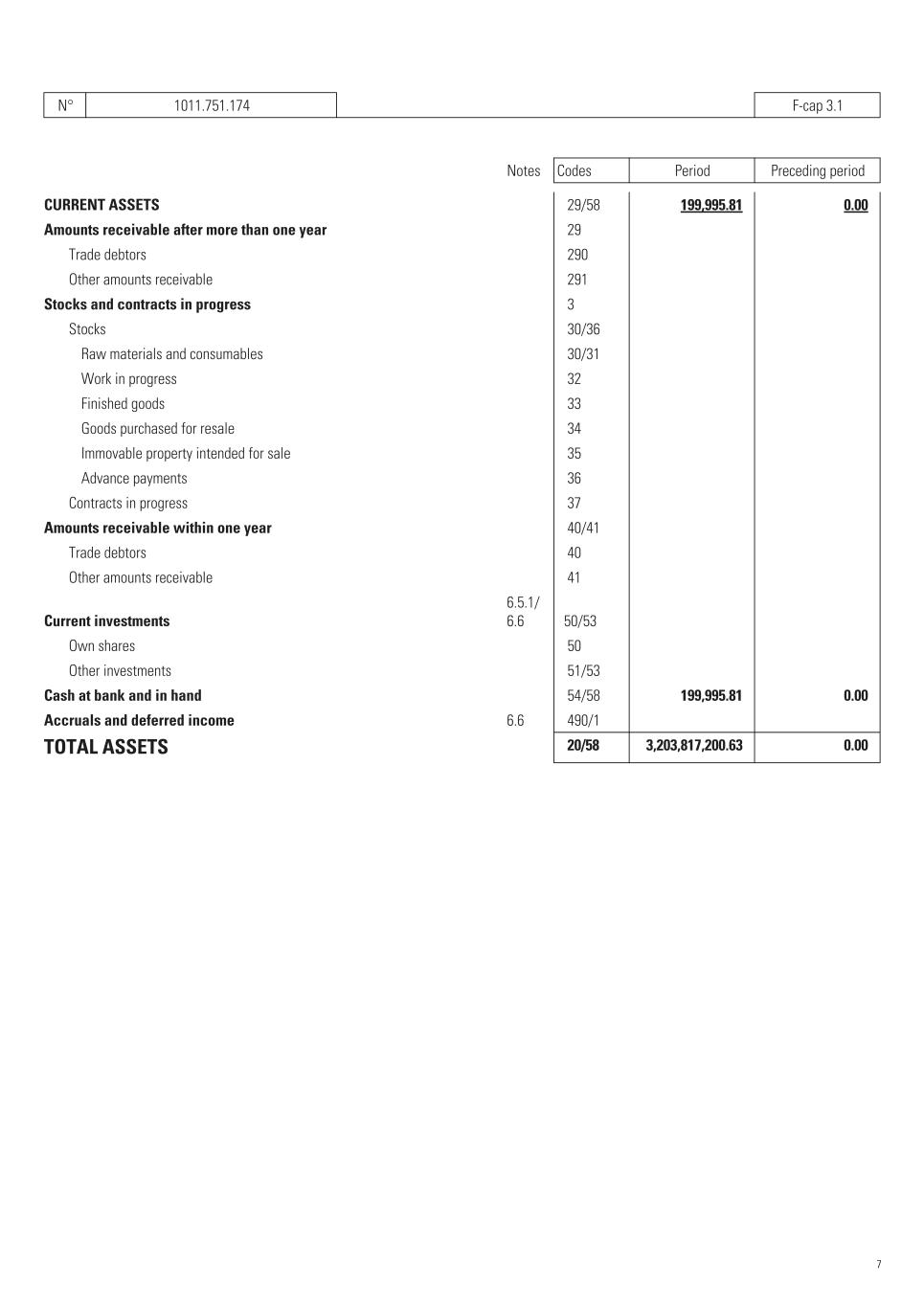

N° 1011.751.174 F-cap 3.1 Notes Codes Period Preceding period CURRENT ASSETS 29/58 199,995.81 0.00 Amounts receivable after more than one year 29 Trade debtors 290 Other amounts receivable 291 Stocks and contracts in progress 3 Stocks 30/36 Raw materials and consumables 30/31 Work in progress 32 Finished goods 33 Goods purchased for resale 34 Immovable property intended for sale 35 Advance payments 36 Contracts in progress 37 Amounts receivable within one year 40/41 Trade debtors 40 Other amounts receivable 41 Current investments 6.5.1/ 6.6 50/53 Own shares 50 Other investments 51/53 Cash at bank and in hand 54/58 199,995.81 0.00 Accruals and deferred income 6.6 490/1 TOTAL ASSETS 20/58 3,203,817,200.63 0.00 7

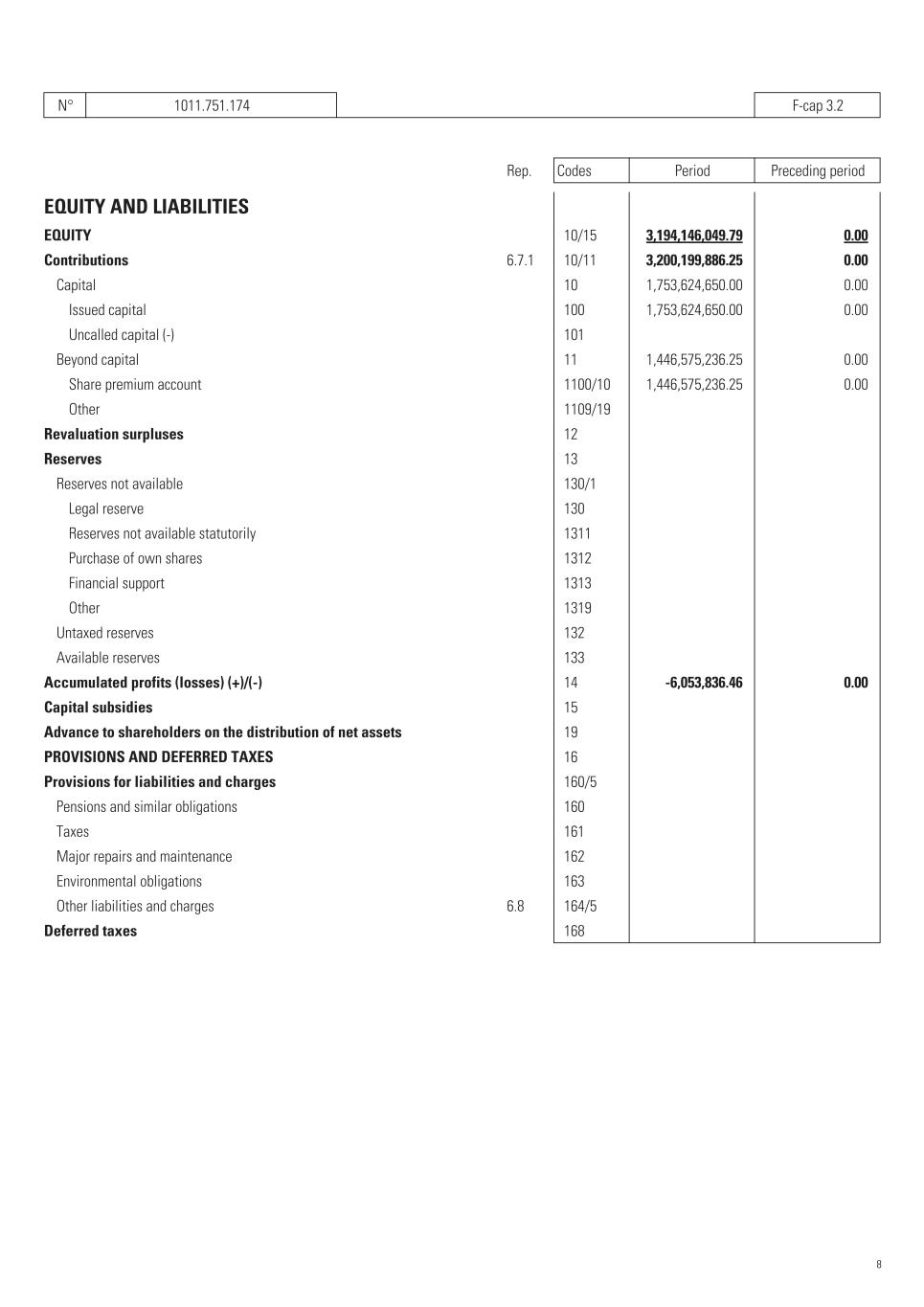

N° 1011.751.174 F-cap 3.2 Rep. Codes Period Preceding period EQUITY AND LIABILITIES EQUITY 10/15 3,194,146,049.79 0.00 Contributions 6.7.1 10/11 3,200,199,886.25 0.00 Capital 10 1,753,624,650.00 0.00 Issued capital 100 1,753,624,650.00 0.00 Uncalled capital (-) 101 Beyond capital 11 1,446,575,236.25 0.00 Share premium account 1100/10 1,446,575,236.25 0.00 Other 1109/19 Revaluation surpluses 12 Reserves 13 Reserves not available 130/1 Legal reserve 130 Reserves not available statutorily 1311 Purchase of own shares 1312 Financial support 1313 Other 1319 Untaxed reserves 132 Available reserves 133 Accumulated profits (losses) (+)/(-) 14 -6,053,836.46 0.00 Capital subsidies 15 Advance to shareholders on the distribution of net assets 19 PROVISIONS AND DEFERRED TAXES 16 Provisions for liabilities and charges 160/5 Pensions and similar obligations 160 Taxes 161 Major repairs and maintenance 162 Environmental obligations 163 Other liabilities and charges 6.8 164/5 Deferred taxes 168 8

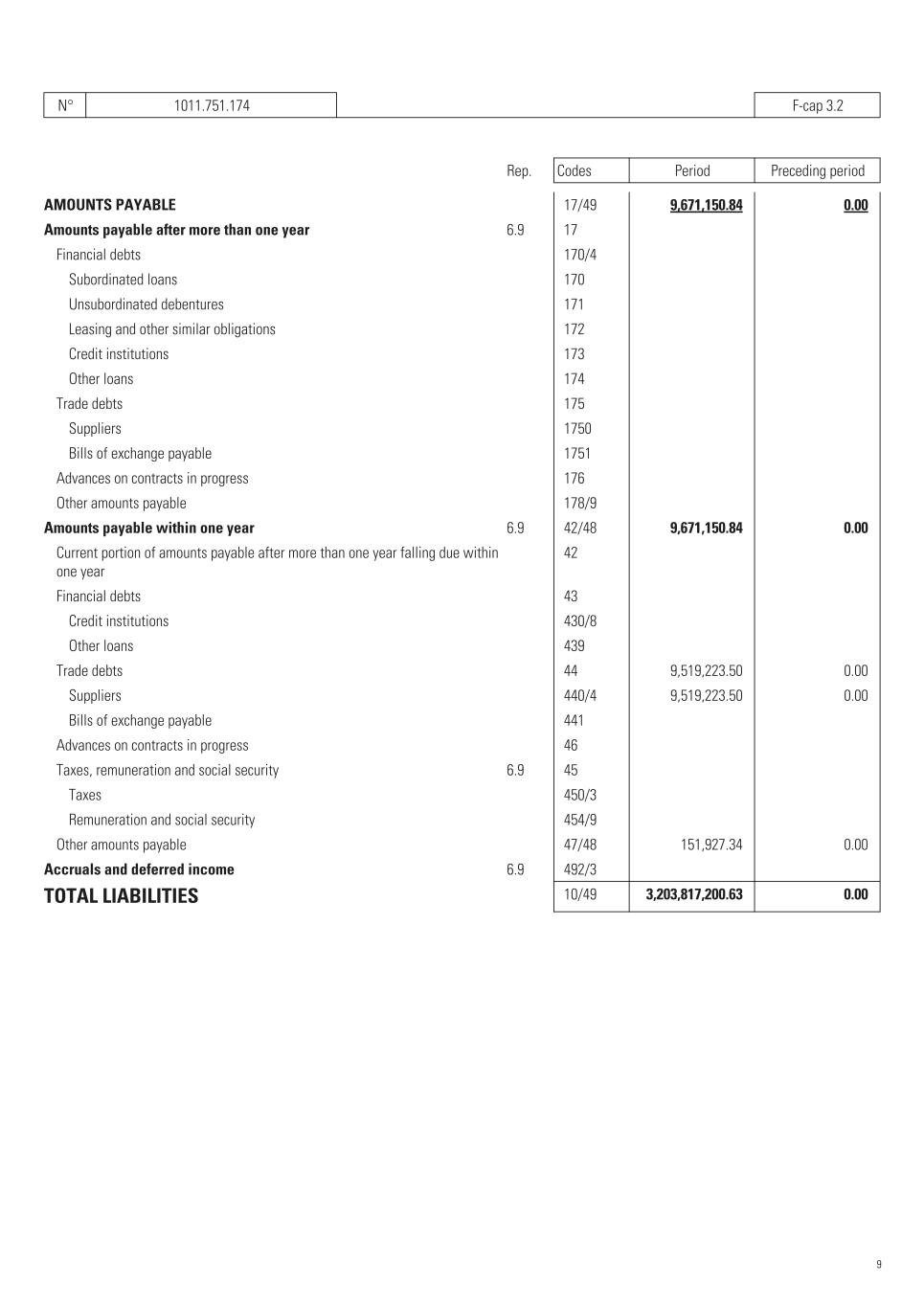

N° 1011.751.174 F-cap 3.2 Rep. Codes Period Preceding period AMOUNTS PAYABLE 17/49 9,671,150.84 0.00 Amounts payable after more than one year 6.9 17 Financial debts 170/4 Subordinated loans 170 Unsubordinated debentures 171 Leasing and other similar obligations 172 Credit institutions 173 Other loans 174 Trade debts 175 Suppliers 1750 Bills of exchange payable 1751 Advances on contracts in progress 176 Other amounts payable 178/9 Amounts payable within one year 6.9 42/48 9,671,150.84 0.00 Current portion of amounts payable after more than one year falling due within one year 42 Financial debts 43 Credit institutions 430/8 Other loans 439 Trade debts 44 9,519,223.50 0.00 Suppliers 440/4 9,519,223.50 0.00 Bills of exchange payable 441 Advances on contracts in progress 46 Taxes, remuneration and social security 6.9 45 Taxes 450/3 Remuneration and social security 454/9 Other amounts payable 47/48 151,927.34 0.00 Accruals and deferred income 6.9 492/3 TOTAL LIABILITIES 10/49 3,203,817,200.63 0.00 9

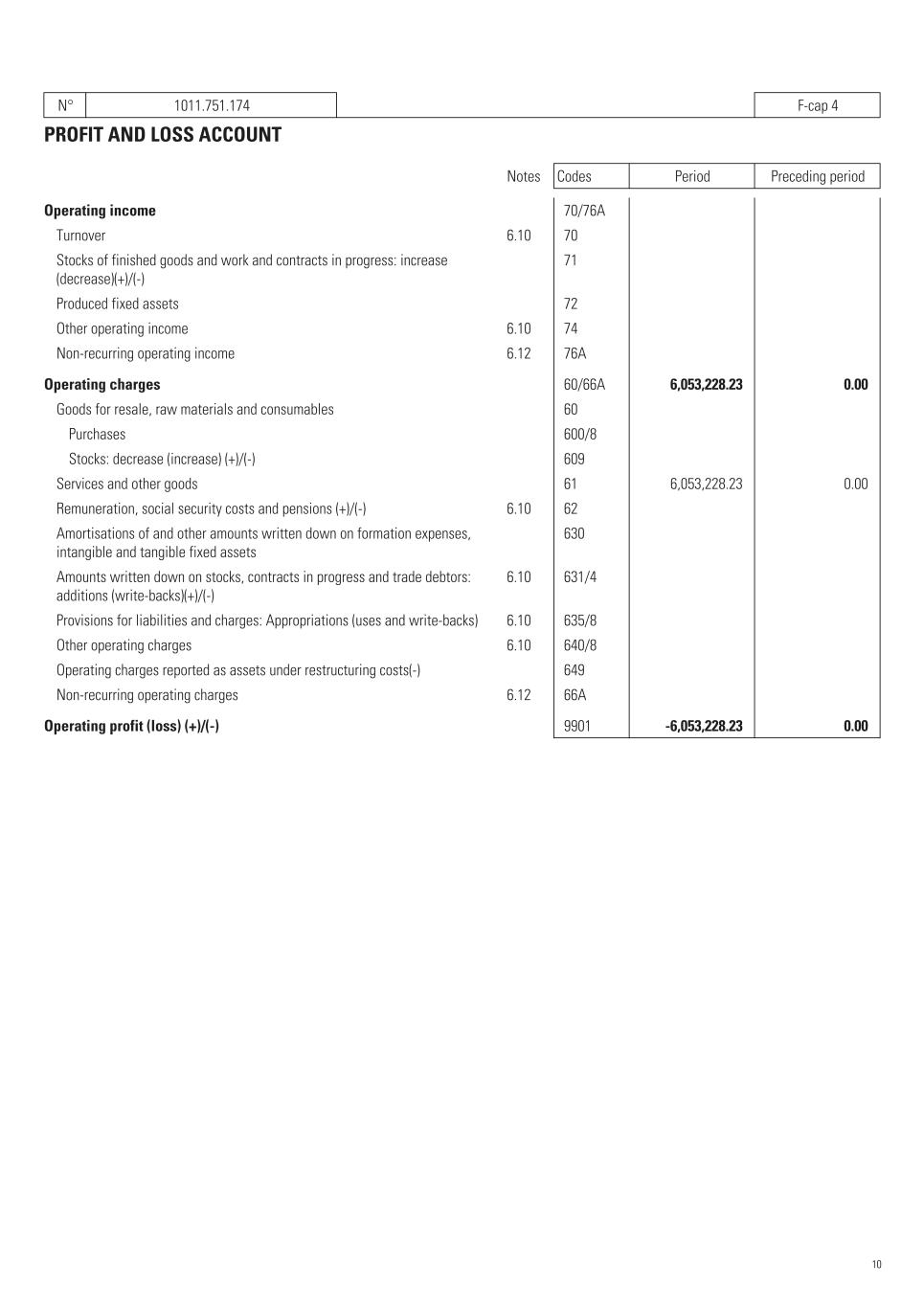

N° 1011.751.174 F-cap 4 PROFIT AND LOSS ACCOUNT Notes Codes Period Preceding period Operating income 70/76A Turnover 6.10 70 Stocks of finished goods and work and contracts in progress: increase (decrease)(+)/(-) 71 Produced fixed assets 72 Other operating income 6.10 74 Non-recurring operating income 6.12 76A Operating charges 60/66A 6,053,228.23 0.00 Goods for resale, raw materials and consumables 60 Purchases 600/8 Stocks: decrease (increase) (+)/(-) 609 Services and other goods 61 6,053,228.23 0.00 Remuneration, social security costs and pensions (+)/(-) 6.10 62 Amortisations of and other amounts written down on formation expenses, intangible and tangible fixed assets 630 Amounts written down on stocks, contracts in progress and trade debtors: additions (write-backs)(+)/(-) 6.10 631/4 Provisions for liabilities and charges: Appropriations (uses and write-backs) 6.10 635/8 Other operating charges 6.10 640/8 Operating charges reported as assets under restructuring costs(-) 649 Non-recurring operating charges 6.12 66A Operating profit (loss) (+)/(-) 9901 -6,053,228.23 0.00 10

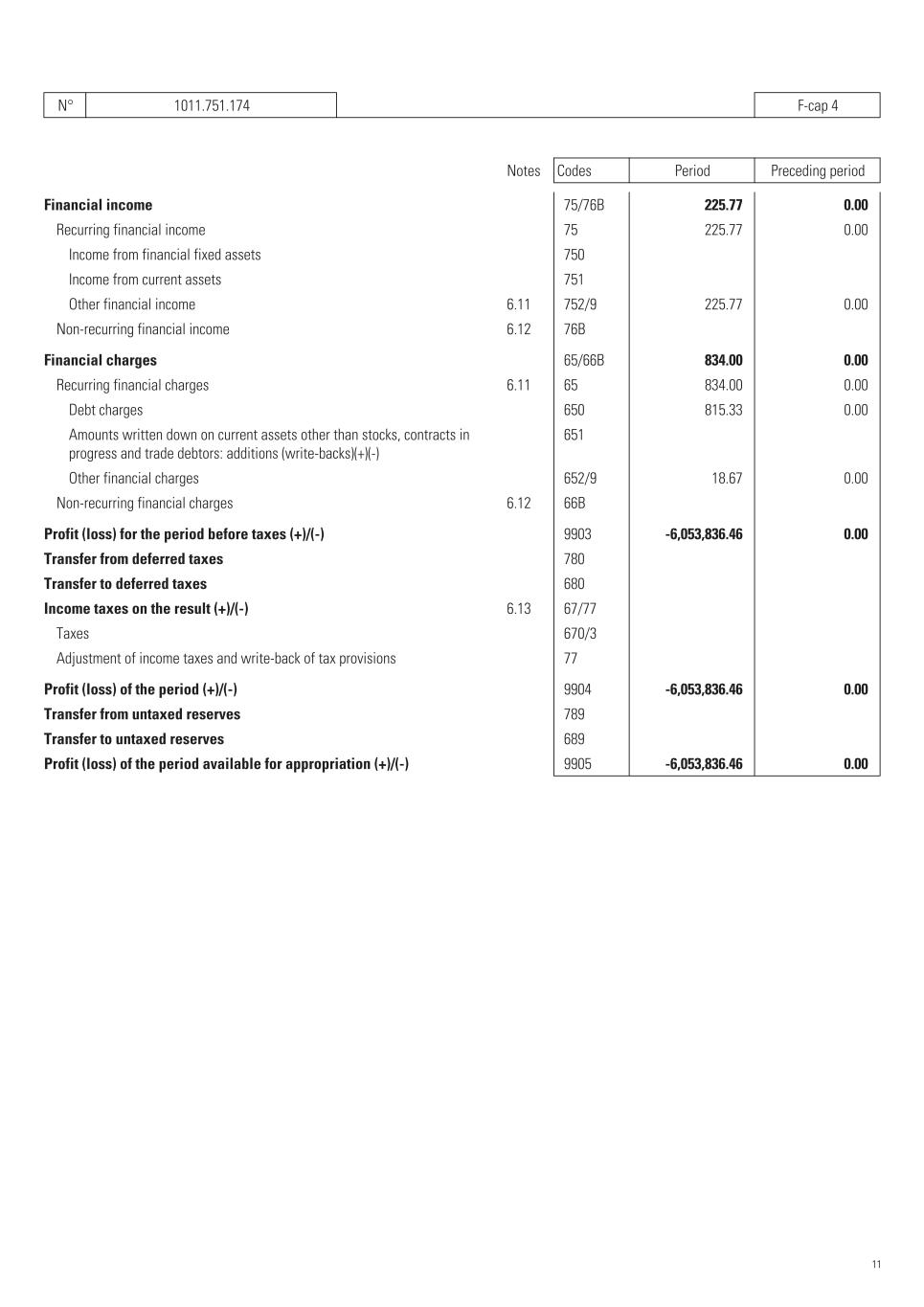

N° 1011.751.174 F-cap 4 Notes Codes Period Preceding period Financial income 75/76B 225.77 0.00 Recurring financial income 75 225.77 0.00 Income from financial fixed assets 750 Income from current assets 751 Other financial income 6.11 752/9 225.77 0.00 Non-recurring financial income 6.12 76B Financial charges 65/66B 834.00 0.00 Recurring financial charges 6.11 65 834.00 0.00 Debt charges 650 815.33 0.00 Amounts written down on current assets other than stocks, contracts in progress and trade debtors: additions (write-backs)(+)(-) 651 Other financial charges 652/9 18.67 0.00 Non-recurring financial charges 6.12 66B Profit (loss) for the period before taxes (+)/(-) 9903 -6,053,836.46 0.00 Transfer from deferred taxes 780 Transfer to deferred taxes 680 Income taxes on the result (+)/(-) 6.13 67/77 Taxes 670/3 Adjustment of income taxes and write-back of tax provisions 77 Profit (loss) of the period (+)/(-) 9904 -6,053,836.46 0.00 Transfer from untaxed reserves 789 Transfer to untaxed reserves 689 Profit (loss) of the period available for appropriation (+)/(-) 9905 -6,053,836.46 0.00 11

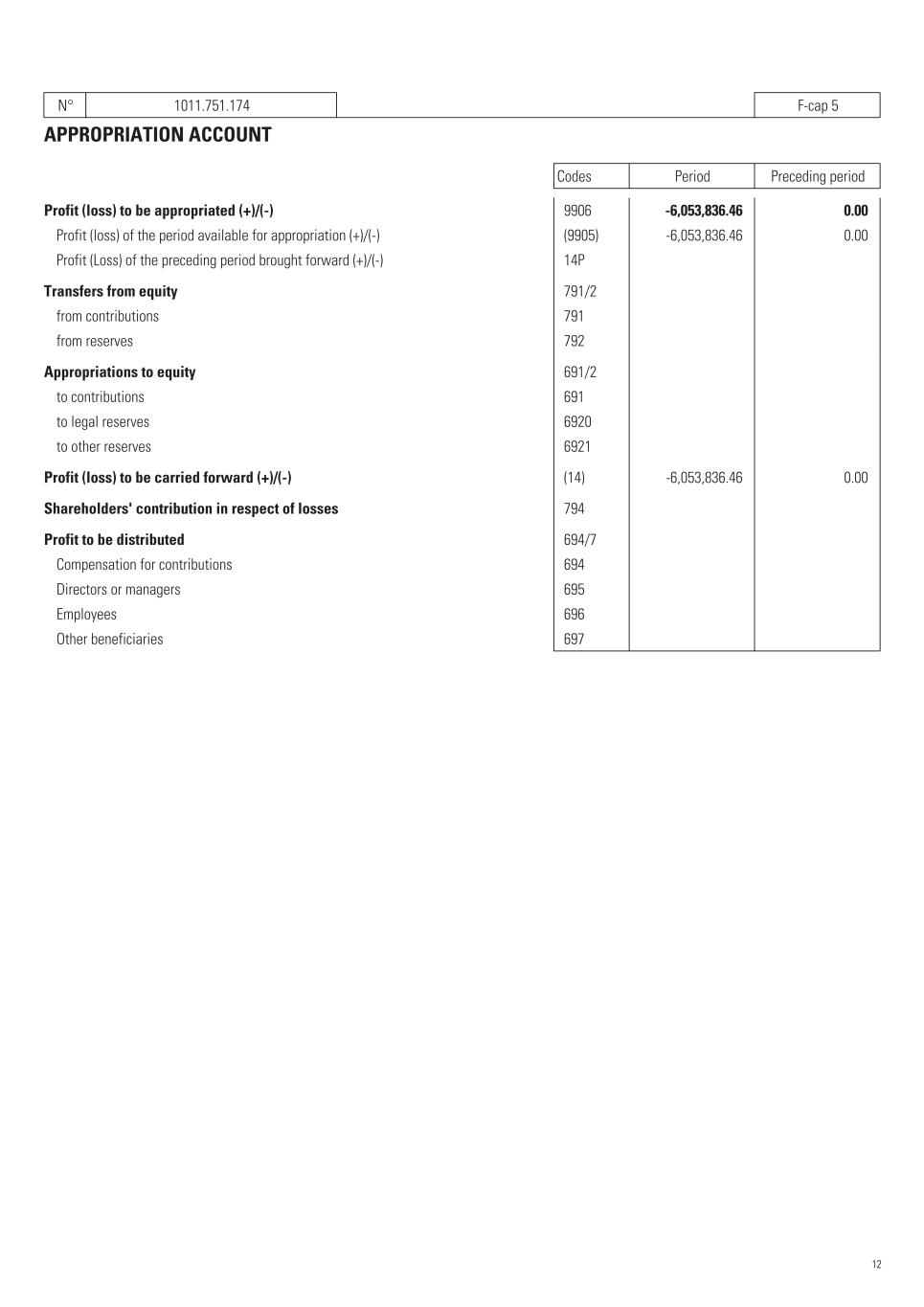

N° 1011.751.174 F-cap 5 APPROPRIATION ACCOUNT Codes Period Preceding period Profit (loss) to be appropriated (+)/(-) 9906 -6,053,836.46 0.00 Profit (loss) of the period available for appropriation (+)/(-) (9905) -6,053,836.46 0.00 Profit (Loss) of the preceding period brought forward (+)/(-) 14P Transfers from equity 791/2 from contributions 791 from reserves 792 Appropriations to equity 691/2 to contributions 691 to legal reserves 6920 to other reserves 6921 Profit (loss) to be carried forward (+)/(-) (14) -6,053,836.46 0.00 Shareholders' contribution in respect of losses 794 Profit to be distributed 694/7 Compensation for contributions 694 Directors or managers 695 Employees 696 Other beneficiaries 697 12

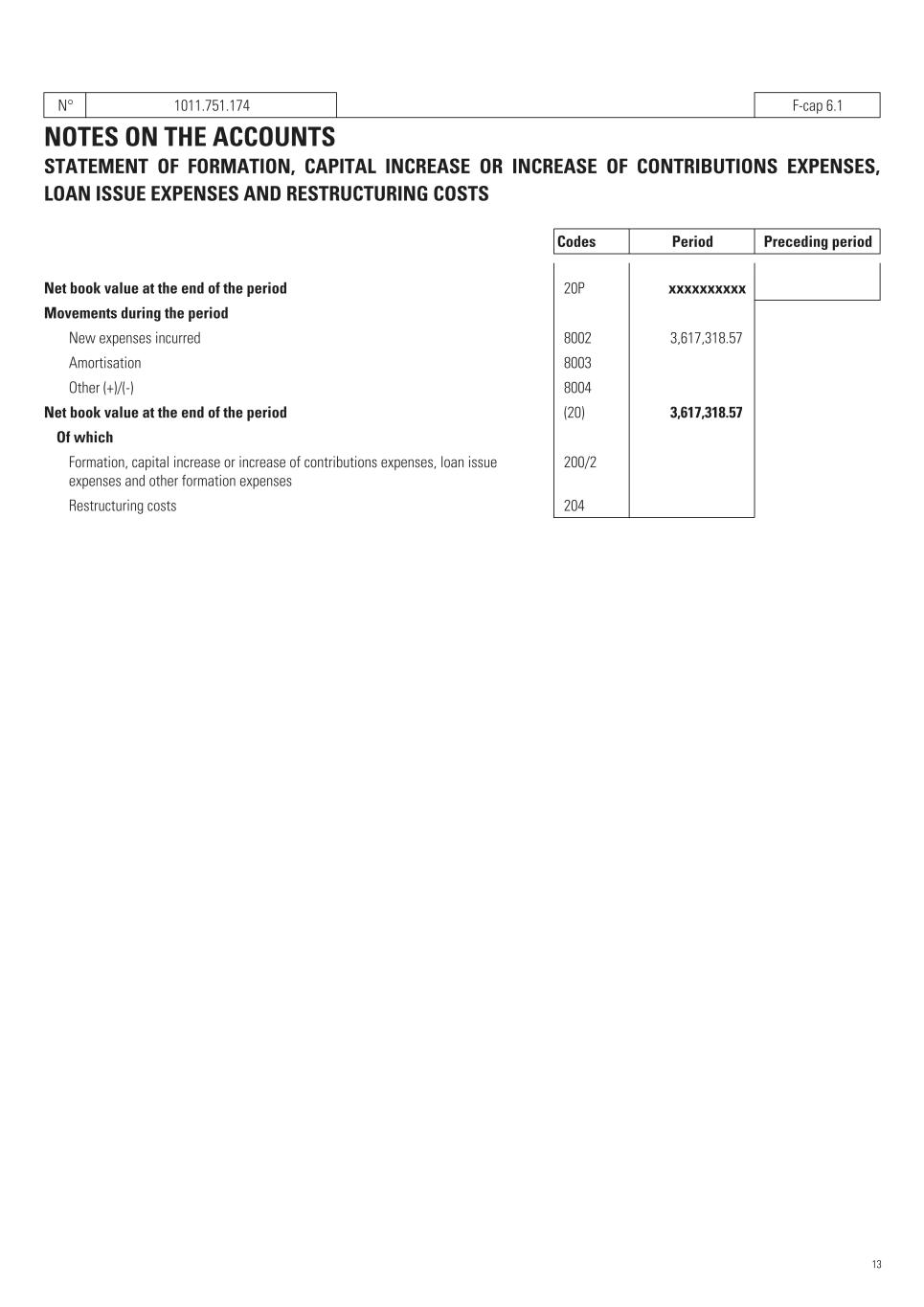

N° 1011.751.174 F-cap 6.1 NOTES ON THE ACCOUNTS STATEMENT OF FORMATION, CAPITAL INCREASE OR INCREASE OF CONTRIBUTIONS EXPENSES, LOAN ISSUE EXPENSES AND RESTRUCTURING COSTS Codes Period Preceding period Net book value at the end of the period 20P xxxxxxxxxx Movements during the period New expenses incurred 8002 3,617,318.57 Amortisation 8003 Other (+)/(-) 8004 Net book value at the end of the period (20) 3,617,318.57 Of which Formation, capital increase or increase of contributions expenses, loan issue expenses and other formation expenses 200/2 Restructuring costs 204 13

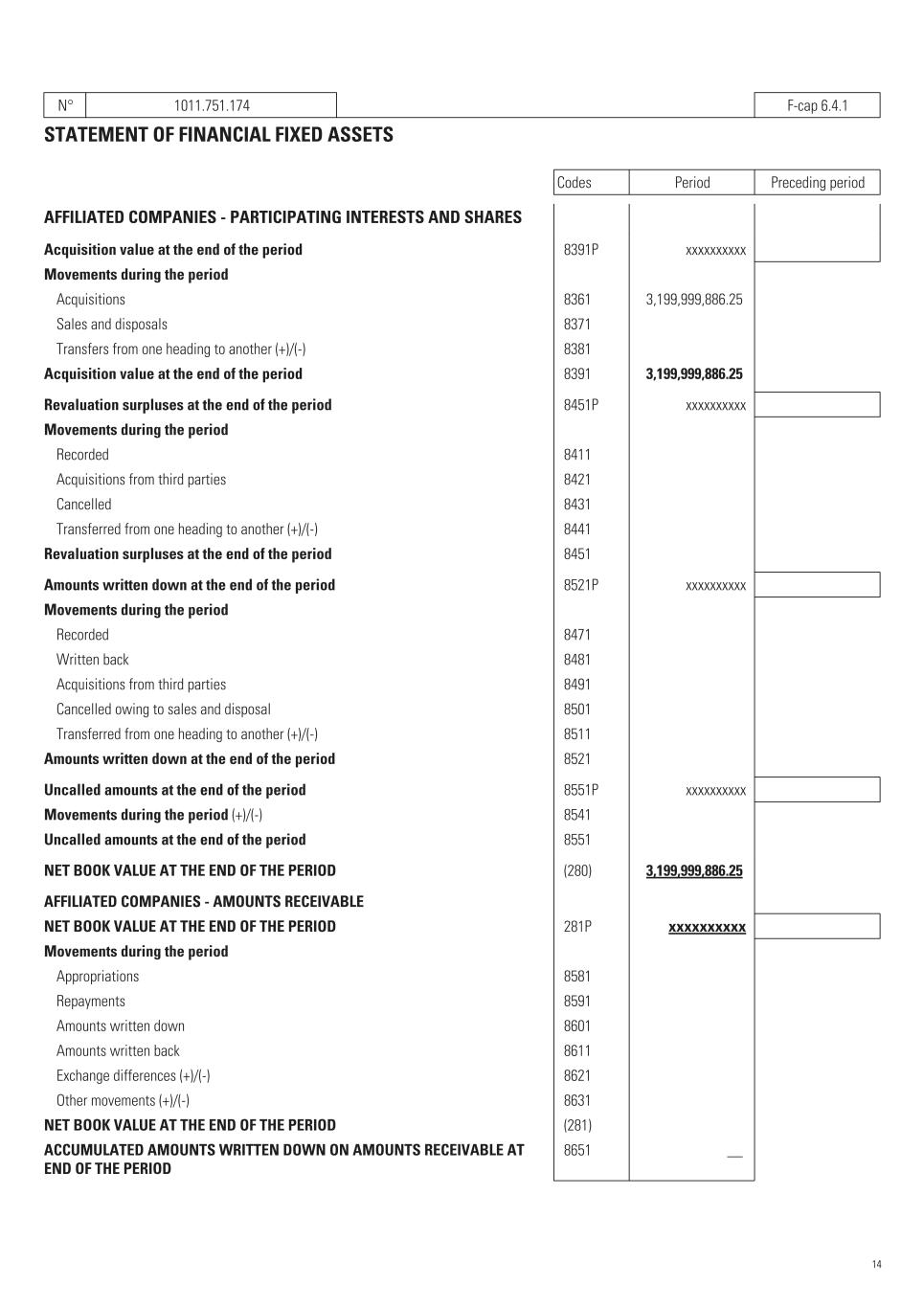

N° 1011.751.174 F-cap 6.4.1 STATEMENT OF FINANCIAL FIXED ASSETS Codes Period Preceding period AFFILIATED COMPANIES - PARTICIPATING INTERESTS AND SHARES Acquisition value at the end of the period 8391P xxxxxxxxxx Movements during the period Acquisitions 8361 3,199,999,886.25 Sales and disposals 8371 Transfers from one heading to another (+)/(-) 8381 Acquisition value at the end of the period 8391 3,199,999,886.25 Revaluation surpluses at the end of the period 8451P xxxxxxxxxx Movements during the period Recorded 8411 Acquisitions from third parties 8421 Cancelled 8431 Transferred from one heading to another (+)/(-) 8441 Revaluation surpluses at the end of the period 8451 Amounts written down at the end of the period 8521P xxxxxxxxxx Movements during the period Recorded 8471 Written back 8481 Acquisitions from third parties 8491 Cancelled owing to sales and disposal 8501 Transferred from one heading to another (+)/(-) 8511 Amounts written down at the end of the period 8521 Uncalled amounts at the end of the period 8551P xxxxxxxxxx Movements during the period (+)/(-) 8541 Uncalled amounts at the end of the period 8551 NET BOOK VALUE AT THE END OF THE PERIOD (280) 3,199,999,886.25 AFFILIATED COMPANIES - AMOUNTS RECEIVABLE NET BOOK VALUE AT THE END OF THE PERIOD 281P xxxxxxxxxx Movements during the period Appropriations 8581 Repayments 8591 Amounts written down 8601 Amounts written back 8611 Exchange differences (+)/(-) 8621 Other movements (+)/(-) 8631 NET BOOK VALUE AT THE END OF THE PERIOD (281) ACCUMULATED AMOUNTS WRITTEN DOWN ON AMOUNTS RECEIVABLE AT END OF THE PERIOD 8651 __ 14

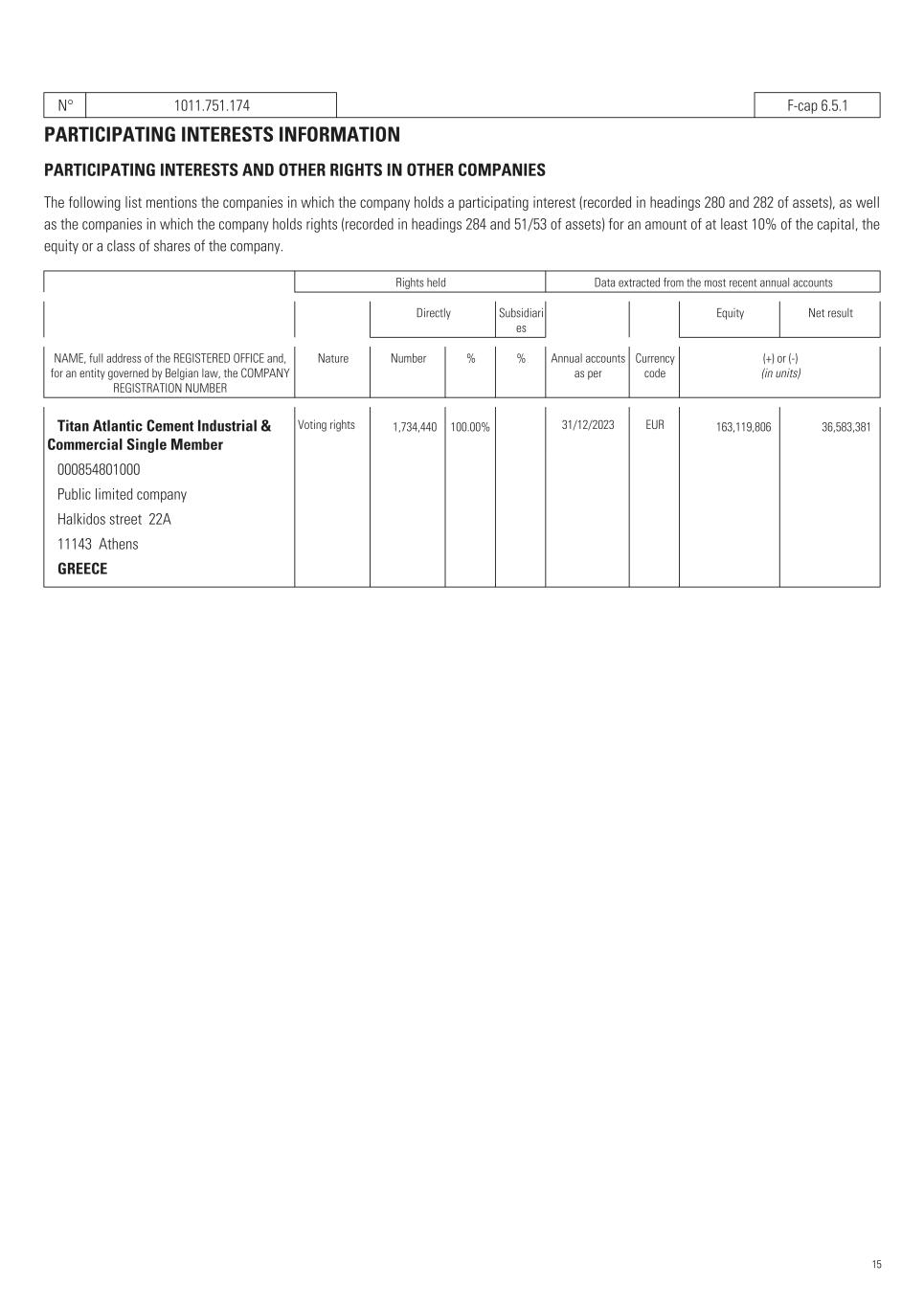

N° 1011.751.174 F-cap 6.5.1 PARTICIPATING INTERESTS INFORMATION PARTICIPATING INTERESTS AND OTHER RIGHTS IN OTHER COMPANIES The following list mentions the companies in which the company holds a participating interest (recorded in headings 280 and 282 of assets), as well as the companies in which the company holds rights (recorded in headings 284 and 51/53 of assets) for an amount of at least 10% of the capital, the equity or a class of shares of the company. Rights held Data extracted from the most recent annual accounts Directly Subsidiari es Equity Net result NAME, full address of the REGISTERED OFFICE and, for an entity governed by Belgian law, the COMPANY REGISTRATION NUMBER Nature Number % % Annual accounts as per Currency code (+) or (-) (in units) Titan Atlantic Cement Industrial & Commercial Single Member Voting rights 1,734,440 100.00% 31/12/2023 EUR 163,119,806 36,583,381 000854801000 Public limited company Halkidos street 22A 11143 Athens GREECE 15

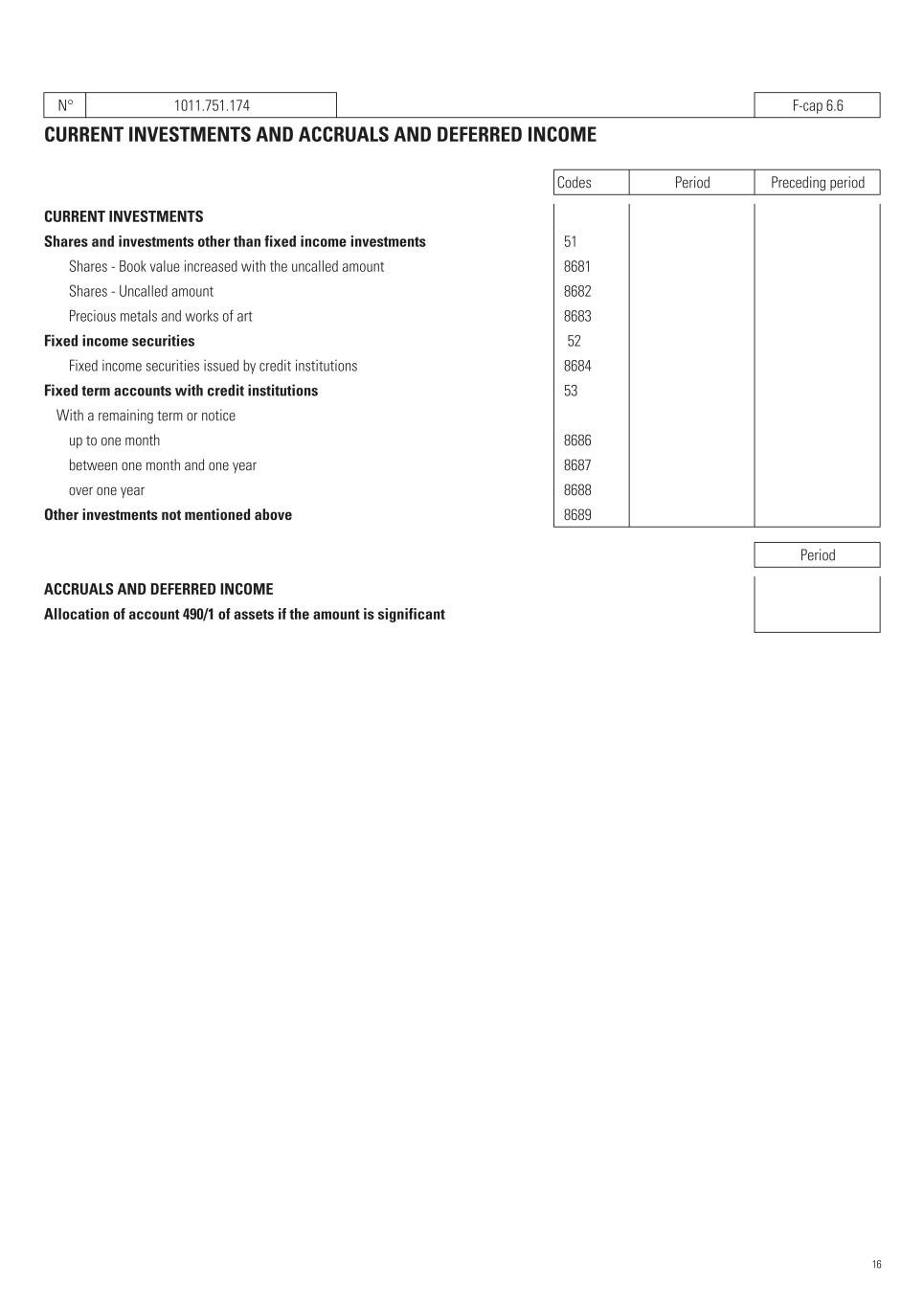

N° 1011.751.174 F-cap 6.6 CURRENT INVESTMENTS AND ACCRUALS AND DEFERRED INCOME Codes Period Preceding period CURRENT INVESTMENTS Shares and investments other than fixed income investments 51 Shares - Book value increased with the uncalled amount 8681 Shares - Uncalled amount 8682 Precious metals and works of art 8683 Fixed income securities 52 Fixed income securities issued by credit institutions 8684 Fixed term accounts with credit institutions 53 With a remaining term or notice up to one month 8686 between one month and one year 8687 over one year 8688 Other investments not mentioned above 8689 Period ACCRUALS AND DEFERRED INCOME Allocation of account 490/1 of assets if the amount is significant 16

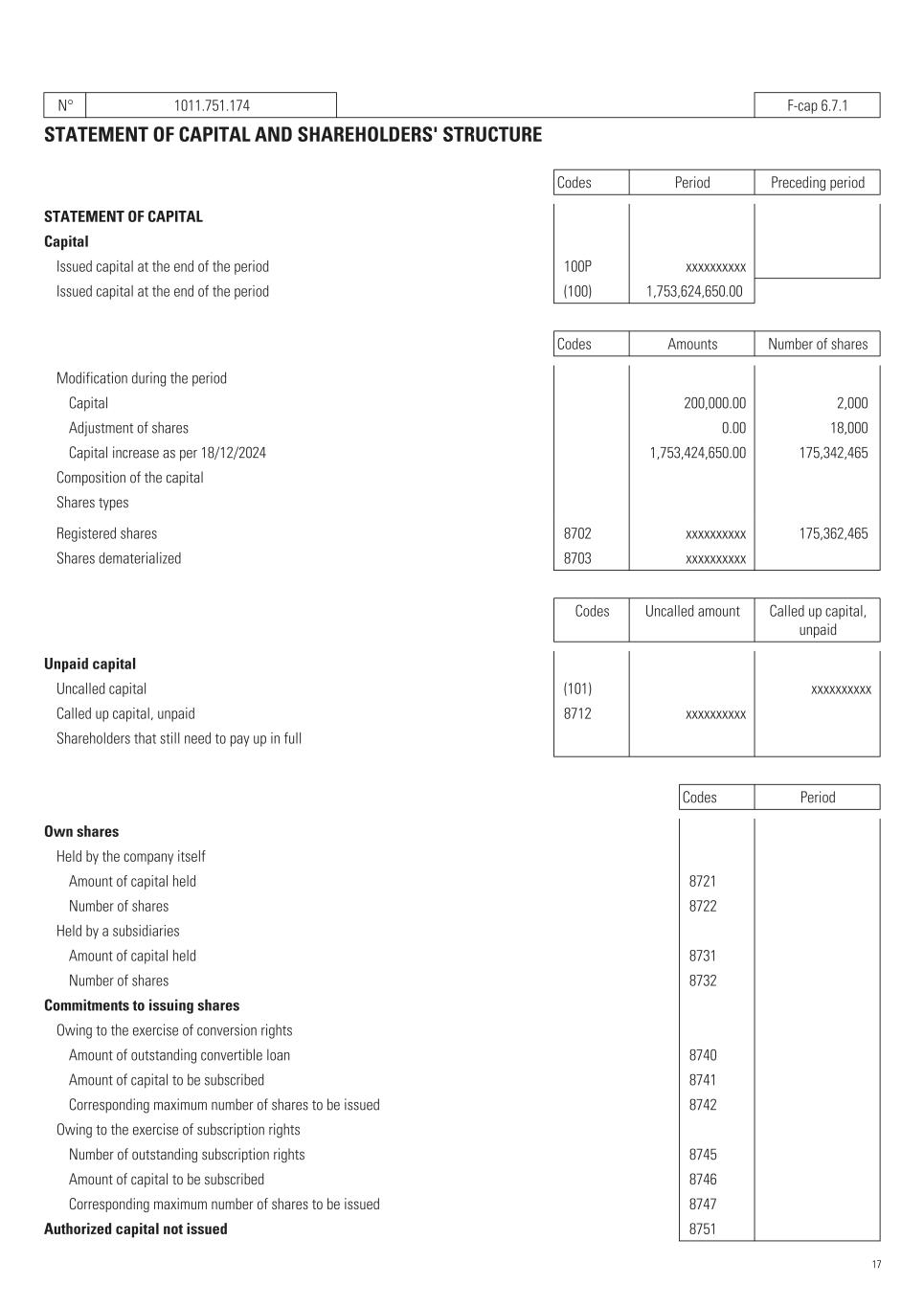

N° 1011.751.174 F-cap 6.7.1 STATEMENT OF CAPITAL AND SHAREHOLDERS' STRUCTURE Codes Period Preceding period STATEMENT OF CAPITAL Capital Issued capital at the end of the period 100P xxxxxxxxxx Issued capital at the end of the period (100) 1,753,624,650.00 Codes Amounts Number of shares Modification during the period Capital 200,000.00 2,000 Adjustment of shares 0.00 18,000 Capital increase as per 18/12/2024 1,753,424,650.00 175,342,465 Composition of the capital Shares types Registered shares 8702 xxxxxxxxxx 175,362,465 Shares dematerialized 8703 xxxxxxxxxx Codes Uncalled amount Called up capital, unpaid Unpaid capital Uncalled capital (101) xxxxxxxxxx Called up capital, unpaid 8712 xxxxxxxxxx Shareholders that still need to pay up in full Codes Period Own shares Held by the company itself Amount of capital held 8721 Number of shares 8722 Held by a subsidiaries Amount of capital held 8731 Number of shares 8732 Commitments to issuing shares Owing to the exercise of conversion rights Amount of outstanding convertible loan 8740 Amount of capital to be subscribed 8741 Corresponding maximum number of shares to be issued 8742 Owing to the exercise of subscription rights Number of outstanding subscription rights 8745 Amount of capital to be subscribed 8746 Corresponding maximum number of shares to be issued 8747 Authorized capital not issued 8751 17

N° 1011.751.174 F-cap 6.7.1 Codes Period Shares issued, non-representing capital Distribution Number of shares 8761 Number of voting rights attached thereto 8762 Allocation by shareholder Number of shares held by the company itself 8771 Number of shares held by its subsidiaries 8781 Period ADDITIONAL NOTES REGARDING CONTRIBUTIONS (INCLUDING CONTRIBUTIONS IN THE FORM OF SERVICES OR KNOW-HOW) 18

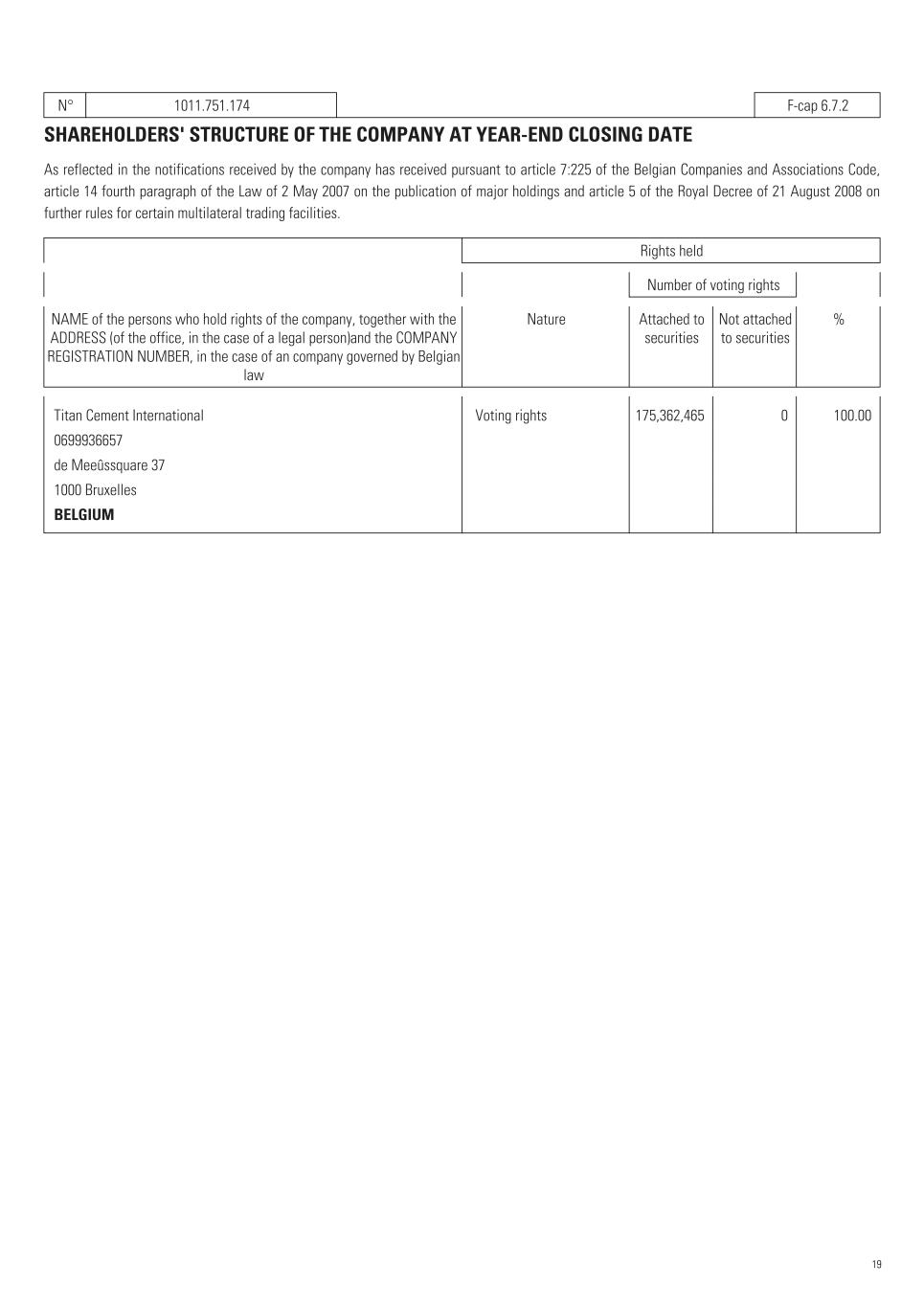

N° 1011.751.174 F-cap 6.7.2 SHAREHOLDERS' STRUCTURE OF THE COMPANY AT YEAR-END CLOSING DATE As reflected in the notifications received by the company has received pursuant to article 7:225 of the Belgian Companies and Associations Code, article 14 fourth paragraph of the Law of 2 May 2007 on the publication of major holdings and article 5 of the Royal Decree of 21 August 2008 on further rules for certain multilateral trading facilities. Rights held Number of voting rights NAME of the persons who hold rights of the company, together with the ADDRESS (of the office, in the case of a legal person)and the COMPANY REGISTRATION NUMBER, in the case of an company governed by Belgian law Nature Attached to securities Not attached to securities % Titan Cement International Voting rights 175,362,465 0 100.00 0699936657 de Meeûssquare 37 1000 Bruxelles BELGIUM 19

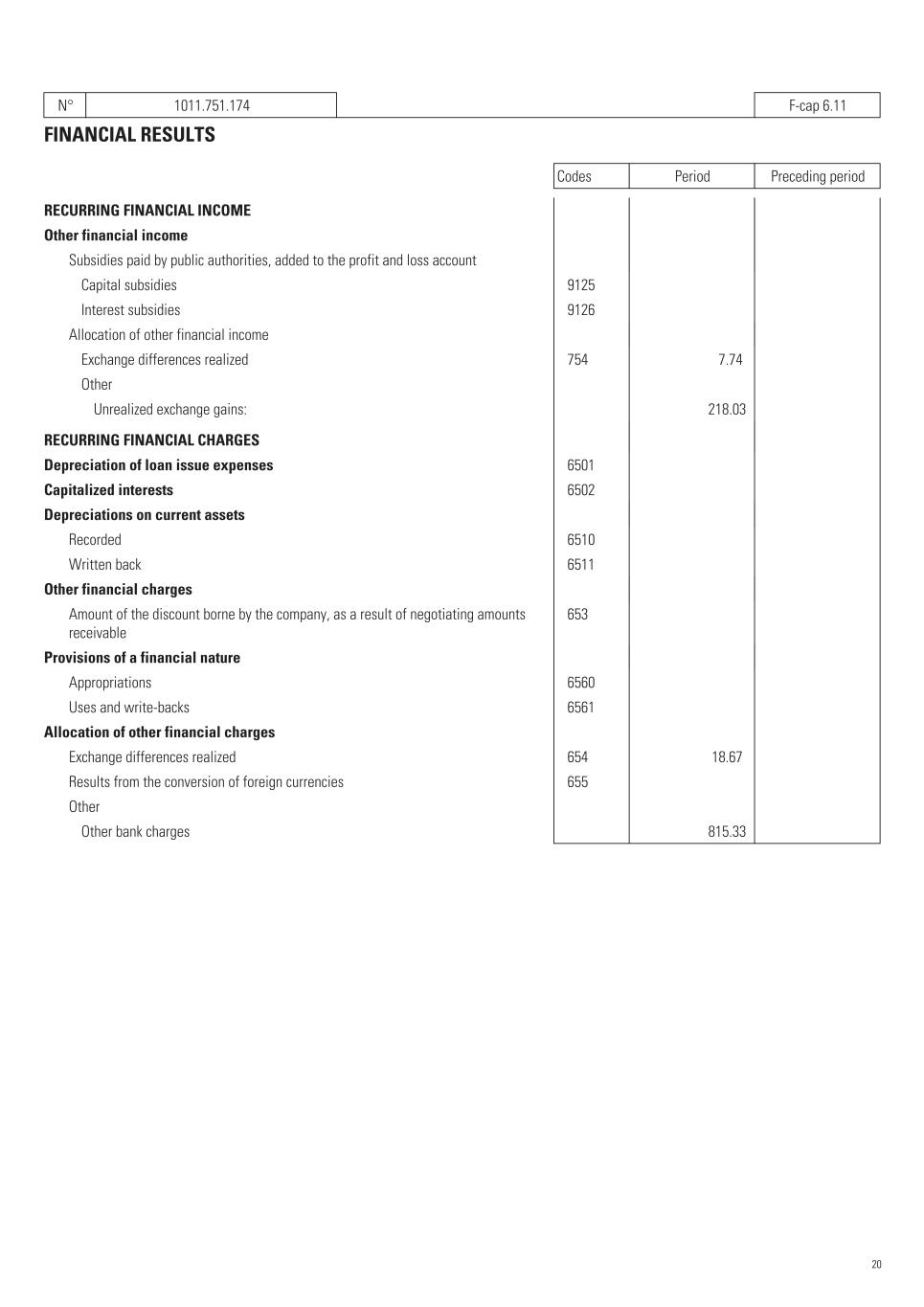

N° 1011.751.174 F-cap 6.11 FINANCIAL RESULTS Codes Period Preceding period RECURRING FINANCIAL INCOME Other financial income Subsidies paid by public authorities, added to the profit and loss account Capital subsidies 9125 Interest subsidies 9126 Allocation of other financial income Exchange differences realized 754 7.74 Other Unrealized exchange gains: 218.03 RECURRING FINANCIAL CHARGES Depreciation of loan issue expenses 6501 Capitalized interests 6502 Depreciations on current assets Recorded 6510 Written back 6511 Other financial charges Amount of the discount borne by the company, as a result of negotiating amounts receivable 653 Provisions of a financial nature Appropriations 6560 Uses and write-backs 6561 Allocation of other financial charges Exchange differences realized 654 18.67 Results from the conversion of foreign currencies 655 Other Other bank charges 815.33 20

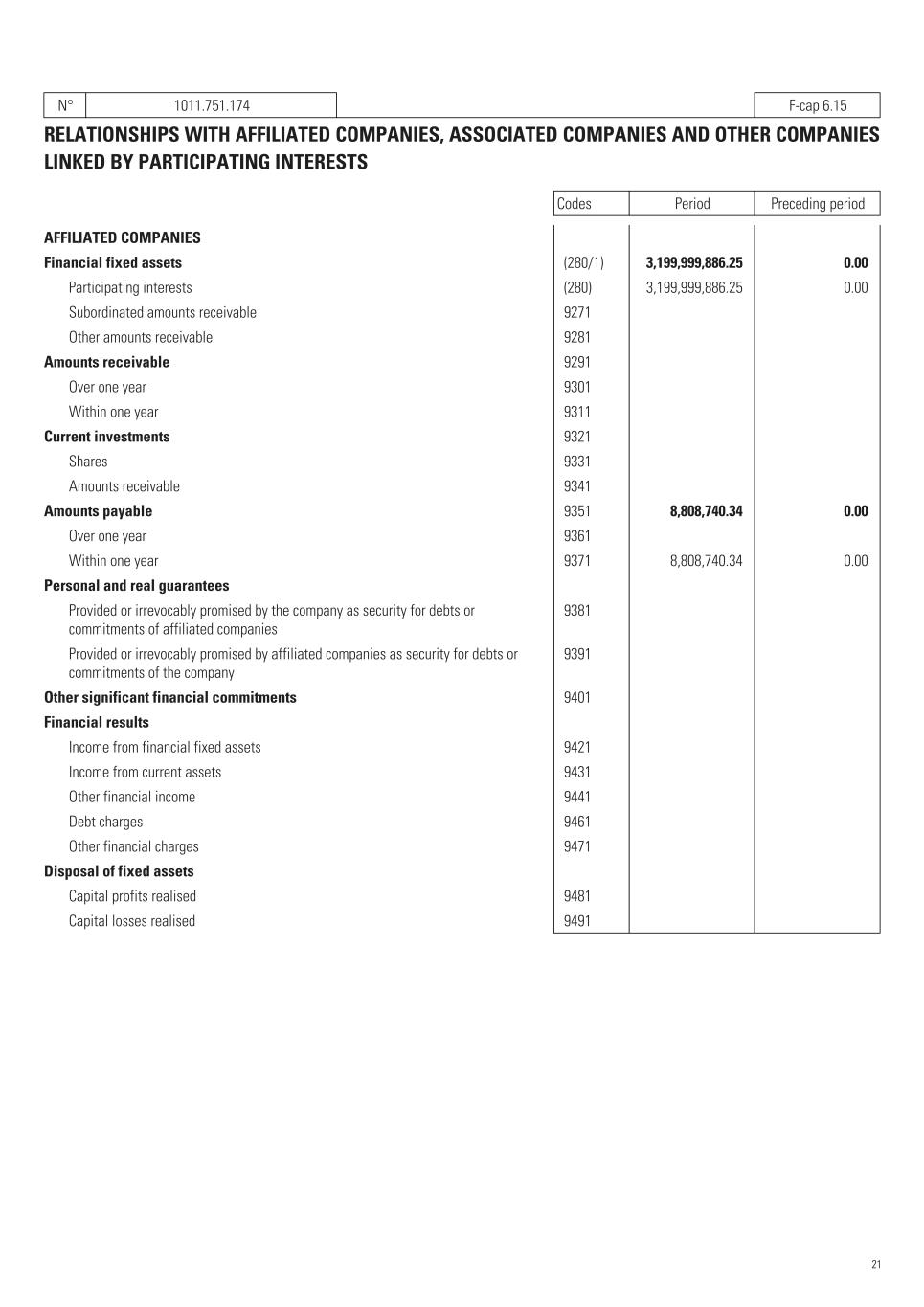

N° 1011.751.174 F-cap 6.15 RELATIONSHIPS WITH AFFILIATED COMPANIES, ASSOCIATED COMPANIES AND OTHER COMPANIES LINKED BY PARTICIPATING INTERESTS Codes Period Preceding period AFFILIATED COMPANIES Financial fixed assets (280/1) 3,199,999,886.25 0.00 Participating interests (280) 3,199,999,886.25 0.00 Subordinated amounts receivable 9271 Other amounts receivable 9281 Amounts receivable 9291 Over one year 9301 Within one year 9311 Current investments 9321 Shares 9331 Amounts receivable 9341 Amounts payable 9351 8,808,740.34 0.00 Over one year 9361 Within one year 9371 8,808,740.34 0.00 Personal and real guarantees Provided or irrevocably promised by the company as security for debts or commitments of affiliated companies 9381 Provided or irrevocably promised by affiliated companies as security for debts or commitments of the company 9391 Other significant financial commitments 9401 Financial results Income from financial fixed assets 9421 Income from current assets 9431 Other financial income 9441 Debt charges 9461 Other financial charges 9471 Disposal of fixed assets Capital profits realised 9481 Capital losses realised 9491 21

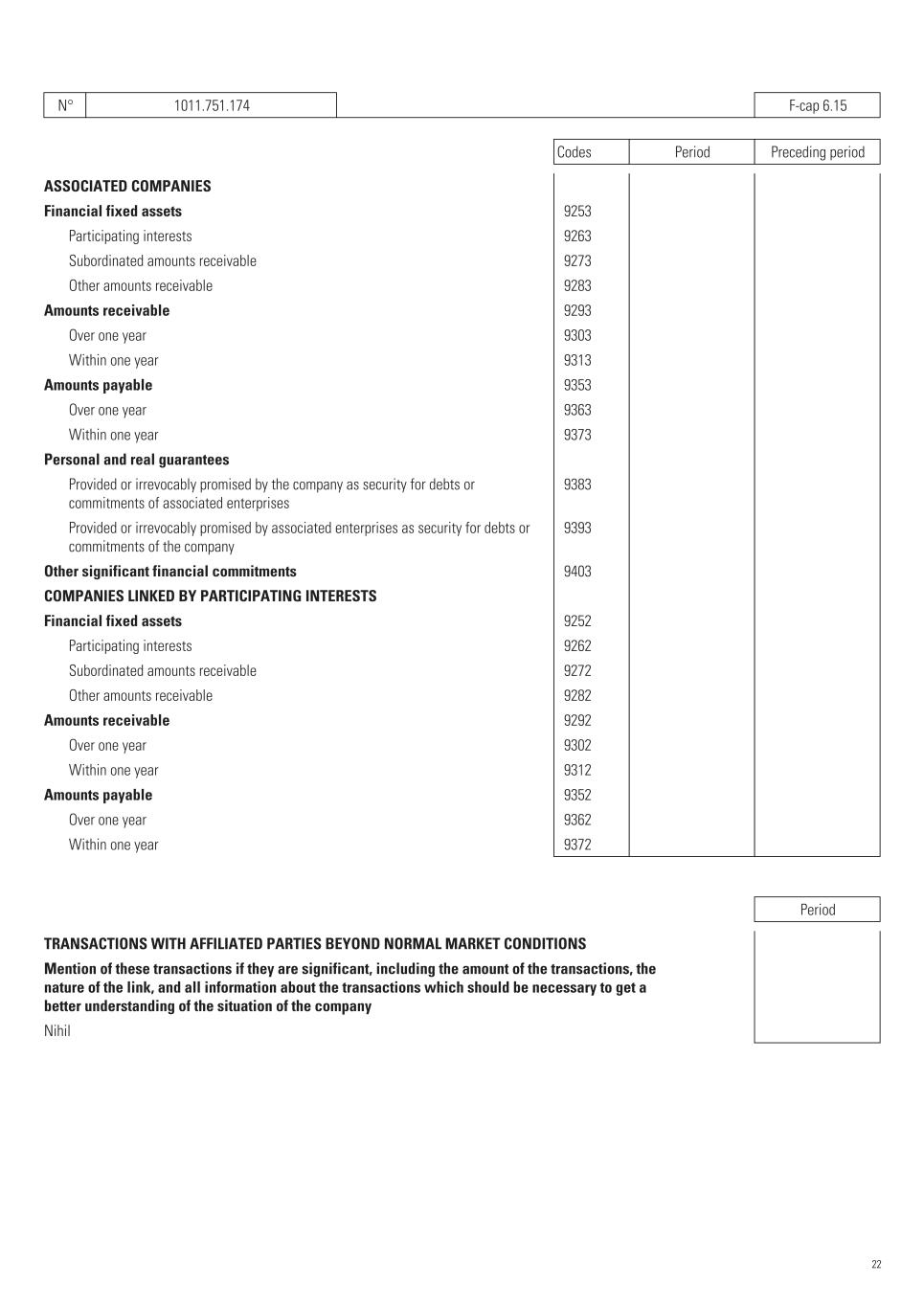

N° 1011.751.174 F-cap 6.15 Codes Period Preceding period ASSOCIATED COMPANIES Financial fixed assets 9253 Participating interests 9263 Subordinated amounts receivable 9273 Other amounts receivable 9283 Amounts receivable 9293 Over one year 9303 Within one year 9313 Amounts payable 9353 Over one year 9363 Within one year 9373 Personal and real guarantees Provided or irrevocably promised by the company as security for debts or commitments of associated enterprises 9383 Provided or irrevocably promised by associated enterprises as security for debts or commitments of the company 9393 Other significant financial commitments 9403 COMPANIES LINKED BY PARTICIPATING INTERESTS Financial fixed assets 9252 Participating interests 9262 Subordinated amounts receivable 9272 Other amounts receivable 9282 Amounts receivable 9292 Over one year 9302 Within one year 9312 Amounts payable 9352 Over one year 9362 Within one year 9372 Period TRANSACTIONS WITH AFFILIATED PARTIES BEYOND NORMAL MARKET CONDITIONS Mention of these transactions if they are significant, including the amount of the transactions, the nature of the link, and all information about the transactions which should be necessary to get a better understanding of the situation of the company Nihil 22

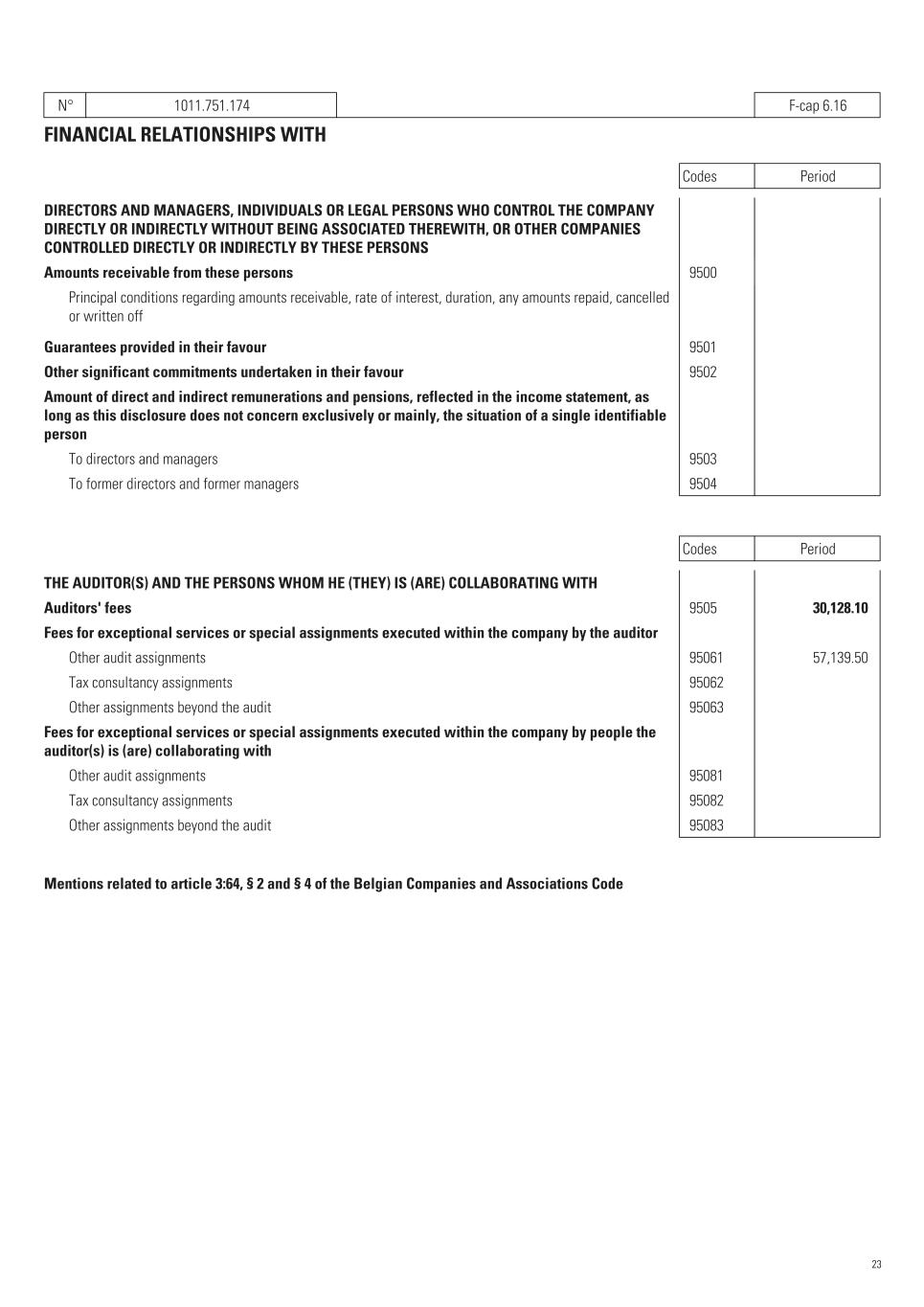

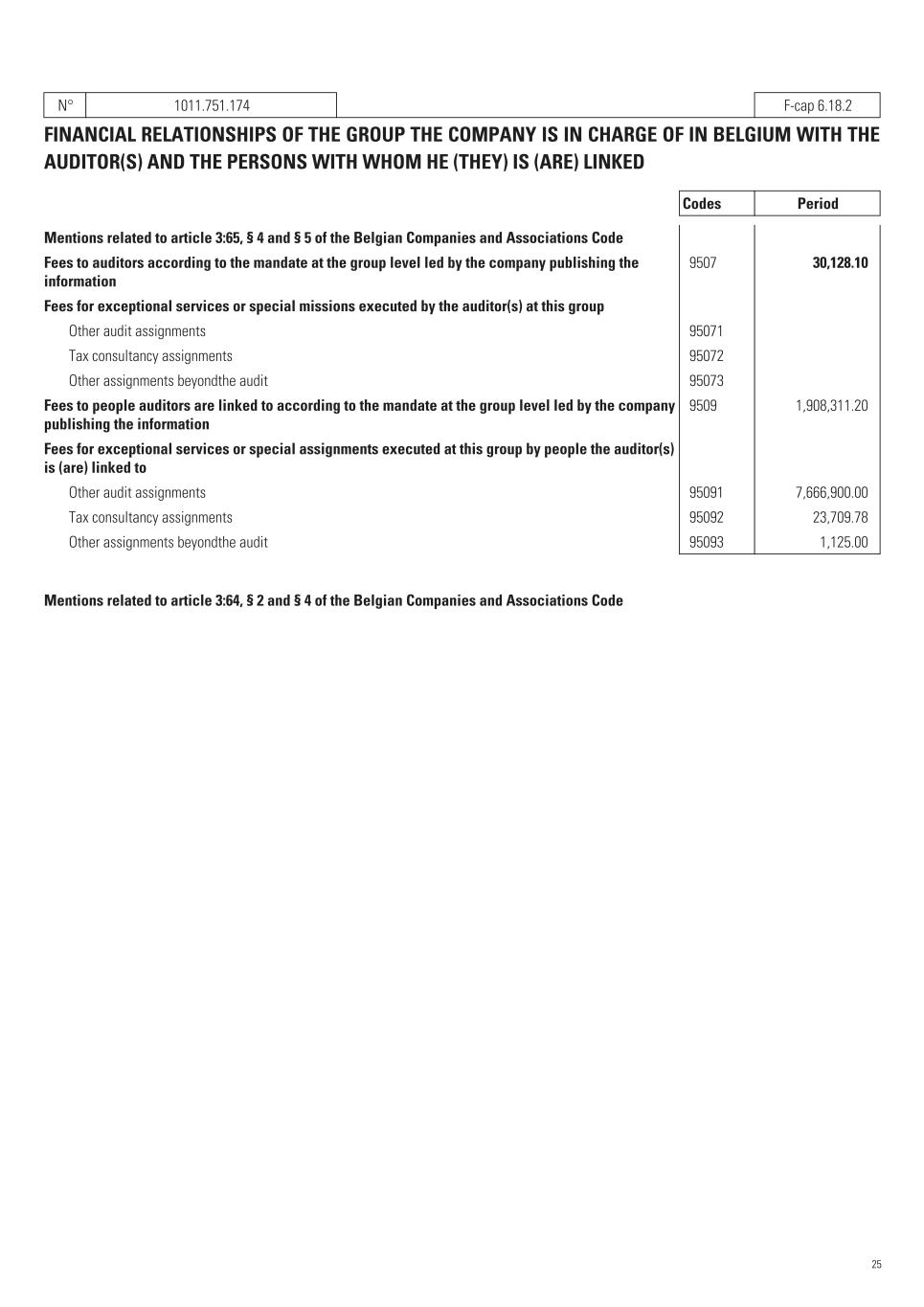

N° 1011.751.174 F-cap 6.16 FINANCIAL RELATIONSHIPS WITH Codes Period DIRECTORS AND MANAGERS, INDIVIDUALS OR LEGAL PERSONS WHO CONTROL THE COMPANY DIRECTLY OR INDIRECTLY WITHOUT BEING ASSOCIATED THEREWITH, OR OTHER COMPANIES CONTROLLED DIRECTLY OR INDIRECTLY BY THESE PERSONS Amounts receivable from these persons 9500 Principal conditions regarding amounts receivable, rate of interest, duration, any amounts repaid, cancelled or written off Guarantees provided in their favour 9501 Other significant commitments undertaken in their favour 9502 Amount of direct and indirect remunerations and pensions, reflected in the income statement, as long as this disclosure does not concern exclusively or mainly, the situation of a single identifiable person To directors and managers 9503 To former directors and former managers 9504 Codes Period THE AUDITOR(S) AND THE PERSONS WHOM HE (THEY) IS (ARE) COLLABORATING WITH Auditors' fees 9505 30,128.10 Fees for exceptional services or special assignments executed within the company by the auditor Other audit assignments 95061 57,139.50 Tax consultancy assignments 95062 Other assignments beyond the audit 95063 Fees for exceptional services or special assignments executed within the company by people the auditor(s) is (are) collaborating with Other audit assignments 95081 Tax consultancy assignments 95082 Other assignments beyond the audit 95083 Mentions related to article 3:64, § 2 and § 4 of the Belgian Companies and Associations Code 23

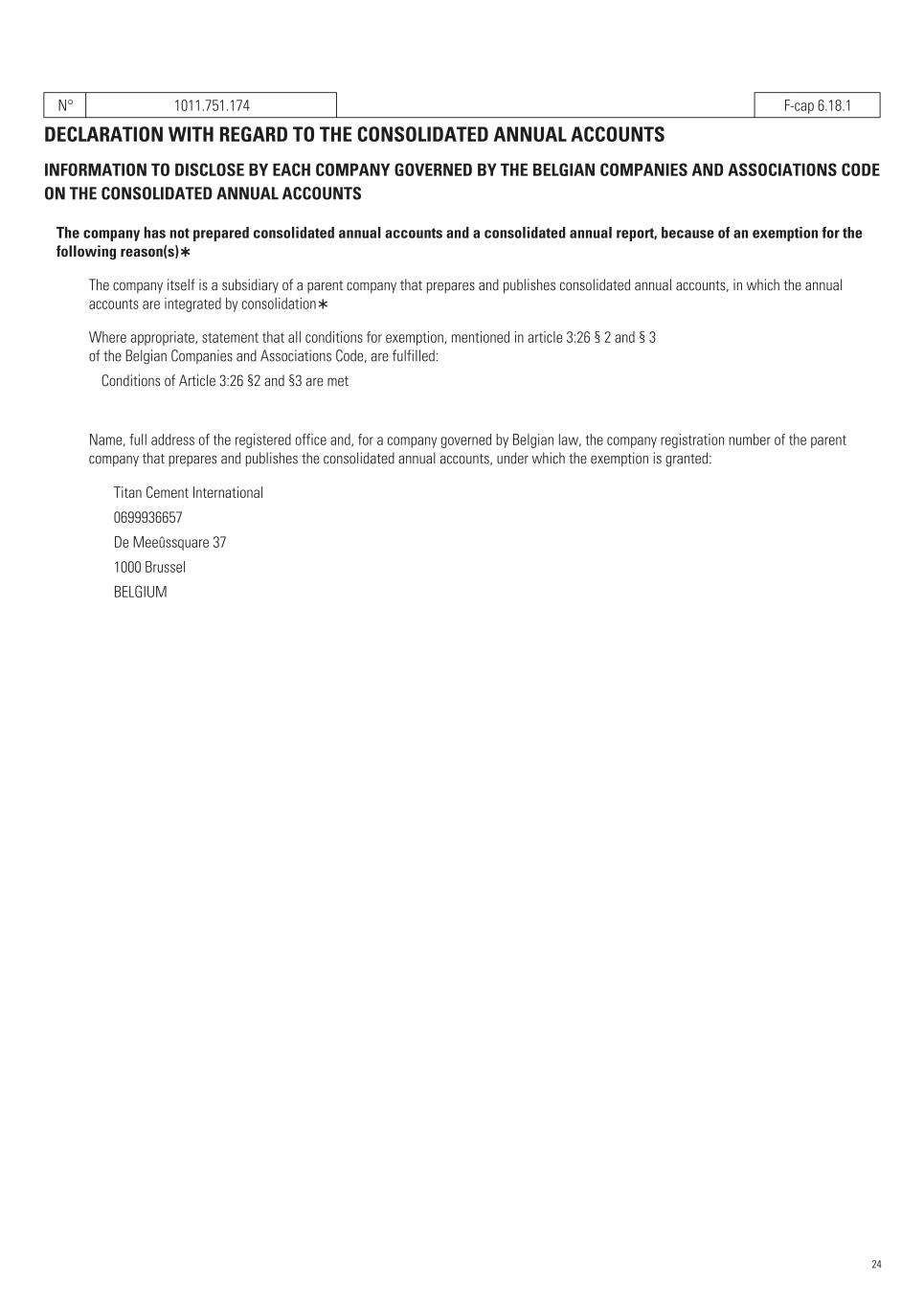

N° 1011.751.174 F-cap 6.18.1 DECLARATION WITH REGARD TO THE CONSOLIDATED ANNUAL ACCOUNTS INFORMATION TO DISCLOSE BY EACH COMPANY GOVERNED BY THE BELGIAN COMPANIES AND ASSOCIATIONS CODE ON THE CONSOLIDATED ANNUAL ACCOUNTS The company has not prepared consolidated annual accounts and a consolidated annual report, because of an exemption for the following reason(s)∗ The company itself is a subsidiary of a parent company that prepares and publishes consolidated annual accounts, in which the annual accounts are integrated by consolidation∗ Where appropriate, statement that all conditions for exemption, mentioned in article 3:26 § 2 and § 3 of the Belgian Companies and Associations Code, are fulfilled: Conditions of Article 3:26 §2 and §3 are met Name, full address of the registered office and, for a company governed by Belgian law, the company registration number of the parent company that prepares and publishes the consolidated annual accounts, under which the exemption is granted: Titan Cement International 0699936657 De Meeûssquare 37 1000 Brussel BELGIUM 24

N° 1011.751.174 F-cap 6.18.2 FINANCIAL RELATIONSHIPS OF THE GROUP THE COMPANY IS IN CHARGE OF IN BELGIUM WITH THE AUDITOR(S) AND THE PERSONS WITH WHOM HE (THEY) IS (ARE) LINKED Codes Period Mentions related to article 3:65, § 4 and § 5 of the Belgian Companies and Associations Code Fees to auditors according to the mandate at the group level led by the company publishing the information 9507 30,128.10 Fees for exceptional services or special missions executed by the auditor(s) at this group Other audit assignments 95071 Tax consultancy assignments 95072 Other assignments beyondthe audit 95073 Fees to people auditors are linked to according to the mandate at the group level led by the company publishing the information 9509 1,908,311.20 Fees for exceptional services or special assignments executed at this group by people the auditor(s) is (are) linked to Other audit assignments 95091 7,666,900.00 Tax consultancy assignments 95092 23,709.78 Other assignments beyondthe audit 95093 1,125.00 Mentions related to article 3:64, § 2 and § 4 of the Belgian Companies and Associations Code 25

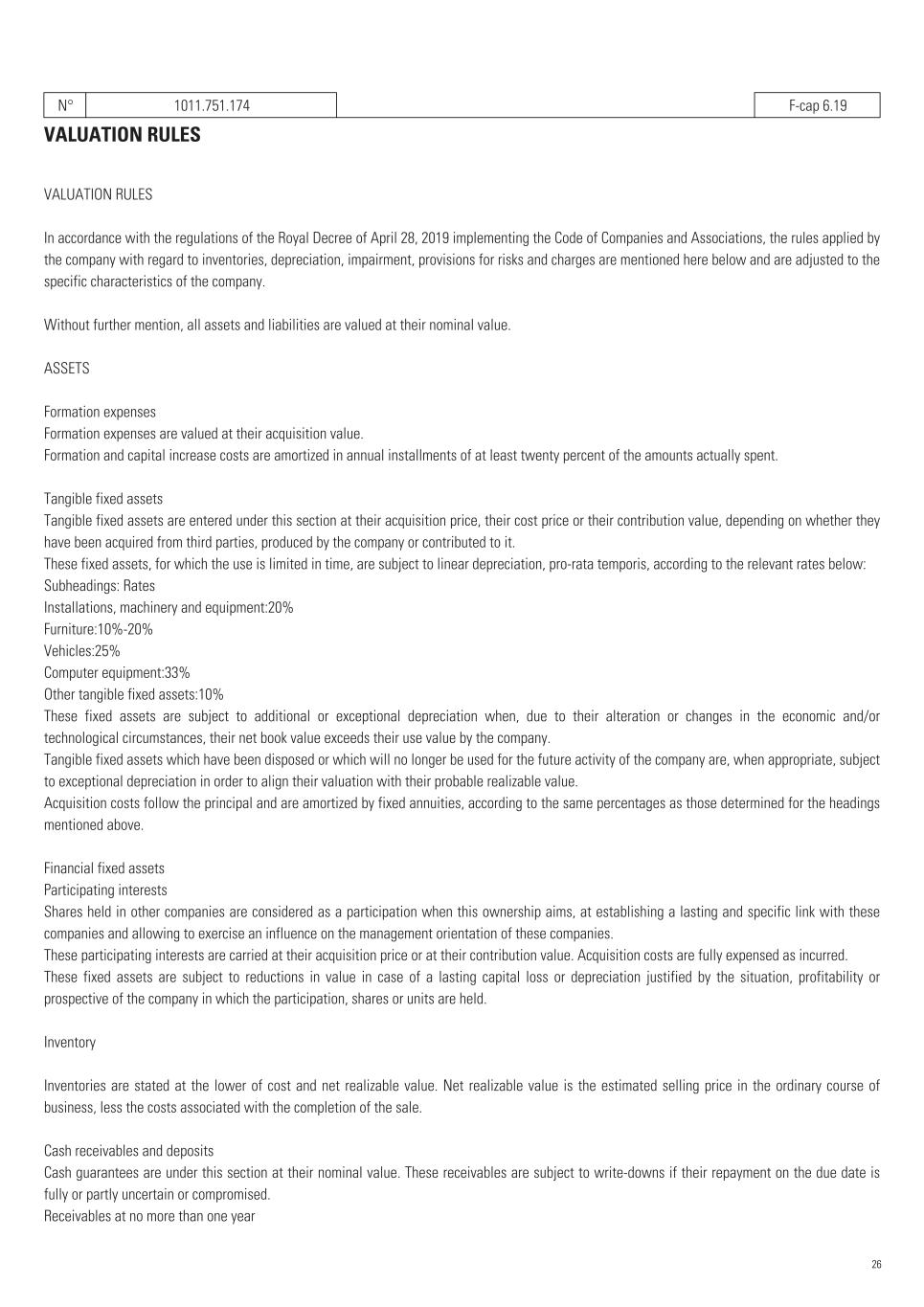

N° 1011.751.174 F-cap 6.19 VALUATION RULES VALUATION RULES In accordance with the regulations of the Royal Decree of April 28, 2019 implementing the Code of Companies and Associations, the rules applied by the company with regard to inventories, depreciation, impairment, provisions for risks and charges are mentioned here below and are adjusted to the specific characteristics of the company. Without further mention, all assets and liabilities are valued at their nominal value. ASSETS Formation expenses Formation expenses are valued at their acquisition value. Formation and capital increase costs are amortized in annual installments of at least twenty percent of the amounts actually spent. Tangible fixed assets Tangible fixed assets are entered under this section at their acquisition price, their cost price or their contribution value, depending on whether they have been acquired from third parties, produced by the company or contributed to it. These fixed assets, for which the use is limited in time, are subject to linear depreciation, pro-rata temporis, according to the relevant rates below: Subheadings: Rates Installations, machinery and equipment:20% Furniture:10%-20% Vehicles:25% Computer equipment:33% Other tangible fixed assets:10% These fixed assets are subject to additional or exceptional depreciation when, due to their alteration or changes in the economic and/or technological circumstances, their net book value exceeds their use value by the company. Tangible fixed assets which have been disposed or which will no longer be used for the future activity of the company are, when appropriate, subject to exceptional depreciation in order to align their valuation with their probable realizable value. Acquisition costs follow the principal and are amortized by fixed annuities, according to the same percentages as those determined for the headings mentioned above. Financial fixed assets Participating interests Shares held in other companies are considered as a participation when this ownership aims, at establishing a lasting and specific link with these companies and allowing to exercise an influence on the management orientation of these companies. These participating interests are carried at their acquisition price or at their contribution value. Acquisition costs are fully expensed as incurred. These fixed assets are subject to reductions in value in case of a lasting capital loss or depreciation justified by the situation, profitability or prospective of the company in which the participation, shares or units are held. Inventory Inventories are stated at the lower of cost and net realizable value. Net realizable value is the estimated selling price in the ordinary course of business, less the costs associated with the completion of the sale. Cash receivables and deposits Cash guarantees are under this section at their nominal value. These receivables are subject to write-downs if their repayment on the due date is fully or partly uncertain or compromised. Receivables at no more than one year 26

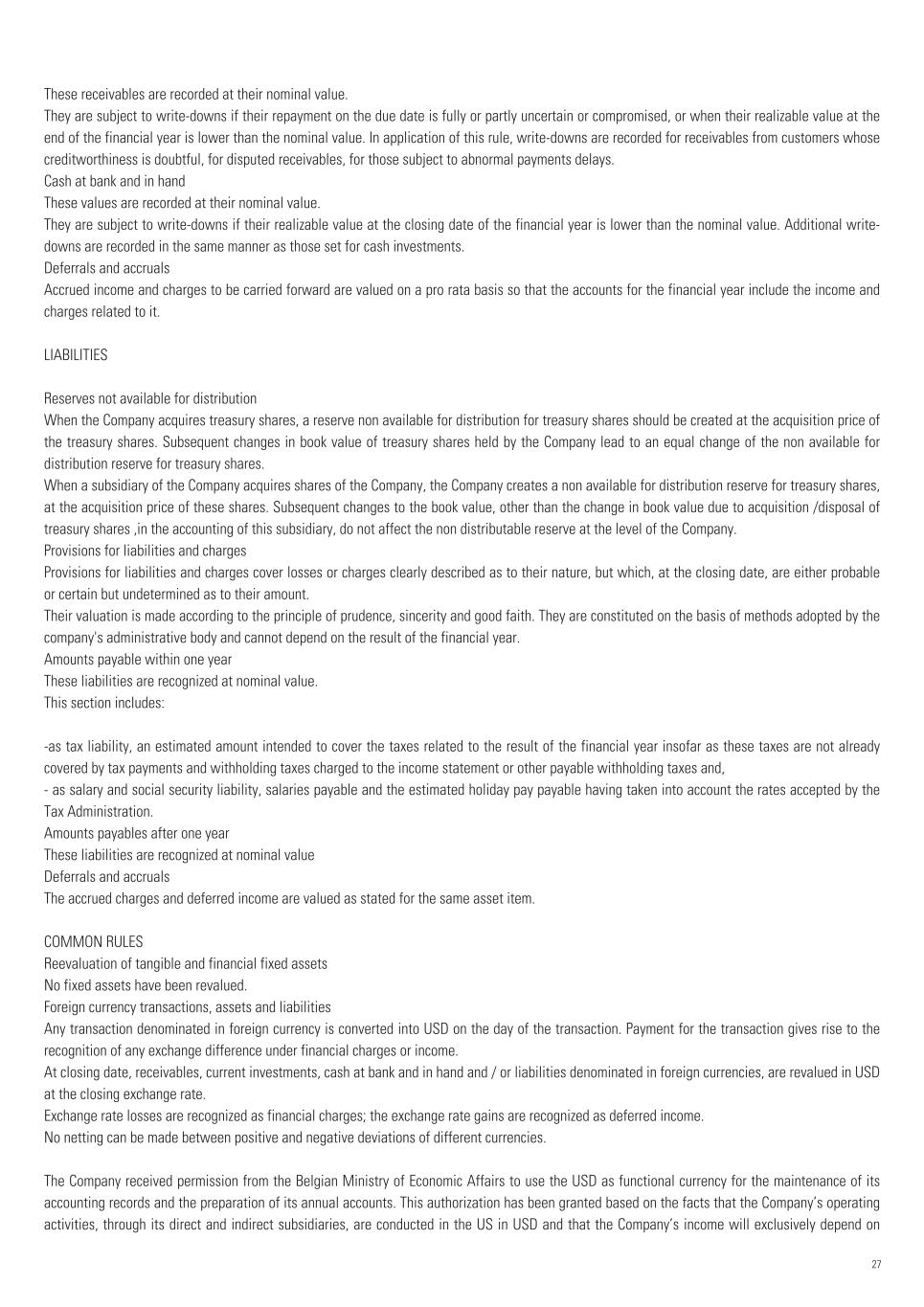

These receivables are recorded at their nominal value. They are subject to write-downs if their repayment on the due date is fully or partly uncertain or compromised, or when their realizable value at the end of the financial year is lower than the nominal value. In application of this rule, write-downs are recorded for receivables from customers whose creditworthiness is doubtful, for disputed receivables, for those subject to abnormal payments delays. Cash at bank and in hand These values are recorded at their nominal value. They are subject to write-downs if their realizable value at the closing date of the financial year is lower than the nominal value. Additional write- downs are recorded in the same manner as those set for cash investments. Deferrals and accruals Accrued income and charges to be carried forward are valued on a pro rata basis so that the accounts for the financial year include the income and charges related to it. LIABILITIES Reserves not available for distribution When the Company acquires treasury shares, a reserve non available for distribution for treasury shares should be created at the acquisition price of the treasury shares. Subsequent changes in book value of treasury shares held by the Company lead to an equal change of the non available for distribution reserve for treasury shares. When a subsidiary of the Company acquires shares of the Company, the Company creates a non available for distribution reserve for treasury shares, at the acquisition price of these shares. Subsequent changes to the book value, other than the change in book value due to acquisition /disposal of treasury shares ,in the accounting of this subsidiary, do not affect the non distributable reserve at the level of the Company. Provisions for liabilities and charges Provisions for liabilities and charges cover losses or charges clearly described as to their nature, but which, at the closing date, are either probable or certain but undetermined as to their amount. Their valuation is made according to the principle of prudence, sincerity and good faith. They are constituted on the basis of methods adopted by the company's administrative body and cannot depend on the result of the financial year. Amounts payable within one year These liabilities are recognized at nominal value. This section includes: -as tax liability, an estimated amount intended to cover the taxes related to the result of the financial year insofar as these taxes are not already covered by tax payments and withholding taxes charged to the income statement or other payable withholding taxes and, - as salary and social security liability, salaries payable and the estimated holiday pay payable having taken into account the rates accepted by the Tax Administration. Amounts payables after one year These liabilities are recognized at nominal value Deferrals and accruals The accrued charges and deferred income are valued as stated for the same asset item. COMMON RULES Reevaluation of tangible and financial fixed assets No fixed assets have been revalued. Foreign currency transactions, assets and liabilities Any transaction denominated in foreign currency is converted into USD on the day of the transaction. Payment for the transaction gives rise to the recognition of any exchange difference under financial charges or income. At closing date, receivables, current investments, cash at bank and in hand and / or liabilities denominated in foreign currencies, are revalued in USD at the closing exchange rate. Exchange rate losses are recognized as financial charges; the exchange rate gains are recognized as deferred income. No netting can be made between positive and negative deviations of different currencies. The Company received permission from the Belgian Ministry of Economic Affairs to use the USD as functional currency for the maintenance of its accounting records and the preparation of its annual accounts. This authorization has been granted based on the facts that the Company’s operating activities, through its direct and indirect subsidiaries, are conducted in the US in USD and that the Company’s income will exclusively depend on 27

dividends from its investments in the US activities. Moreover, the Company’s share capital is in USD and further to the IPO that took place in February 2025 on the NYSE, investors will expect the Company to prepare stand-alone and consolidated accounts in USD. The authorization is valid for the first financial year and can be extended upon submission of a new application. It is subject to the condition that the Administrative body of the company verifies and confirms on an annual basis that the reasons justifying the derogation are still valid and apply in full to the annual accounts in question. Free Text In 2024 costs were occurred, which were incremental and directly attributable to the Company's IPO, in the amount of USD 9,649,694,00. These costs were allocated between formation expenses and the profit and loss statement based on proportion of new/ existing shares in the total number of shares sold to public. The costs related to portion of the new shares in total shares sold to public, USD 3,617,318.57 were recorded in formation expenses to be amortized in the next 5 years, whereas remaining costs were recorded as expenses in the profit and loss. 28

N° 1011.751.174 F-cap 6.20 OTHER INFORMATIONS TO DISCLOSE Justification of the application of the going concern accounting rules (art. 3:6, §1, 6° of the CSA) : The annual accounts at 31 December 2024 have been drawn up on the assumption that the company will continue in business, given that it can count on the financial support of its shareholders. 29

N° 1011.751.174 F-cap 7 OTHER DOCUMENTS TO BE FILED IN ACCORDANCE WITH THE BELGIAN COMPANIES AND ASSOCIATIONS CODE ANNUAL REPORT App. 1 30

N° 1011.751.174 F-cap 8 AUDITORS' REPORT App. 2 31

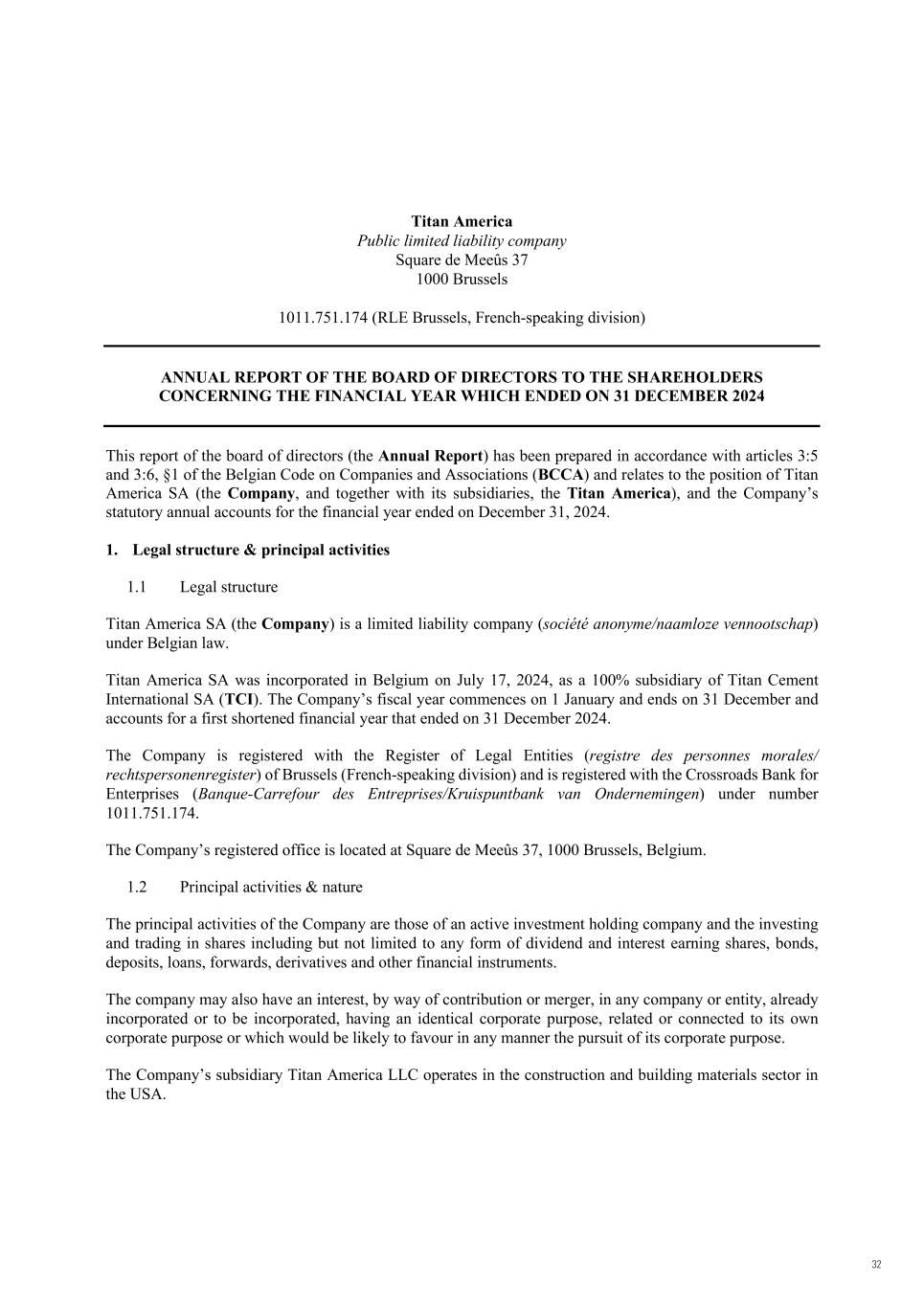

Titan America Public limited liability company Square de Meeûs 37 1000 Brussels 1011.751.174 (RLE Brussels, French-speaking division) ANNUAL REPORT OF THE BOARD OF DIRECTORS TO THE SHAREHOLDERS CONCERNING THE FINANCIAL YEAR WHICH ENDED ON 31 DECEMBER 2024 This report of the board of directors (the Annual Report) has been prepared in accordance with articles 3:5 and 3:6, §1 of the Belgian Code on Companies and Associations (BCCA) and relates to the position of Titan America SA (the Company, and together with its subsidiaries, the Titan America), and the Company’s statutory annual accounts for the financial year ended on December 31, 2024. 1. Legal structure & principal activities 1.1 Legal structure Titan America SA (the Company) is a limited liability company (société anonyme/naamloze vennootschap) under Belgian law. Titan America SA was incorporated in Belgium on July 17, 2024, as a 100% subsidiary of Titan Cement International SA (TCI). The Company’s fiscal year commences on 1 January and ends on 31 December and accounts for a first shortened financial year that ended on 31 December 2024. The Company is registered with the Register of Legal Entities (registre des personnes morales/ rechtspersonenregister) of Brussels (French-speaking division) and is registered with the Crossroads Bank for Enterprises (Banque-Carrefour des Entreprises/Kruispuntbank van Ondernemingen) under number 1011.751.174. The Company’s registered office is located at Square de Meeûs 37, 1000 Brussels, Belgium. 1.2 Principal activities & nature The principal activities of the Company are those of an active investment holding company and the investing and trading in shares including but not limited to any form of dividend and interest earning shares, bonds, deposits, loans, forwards, derivatives and other financial instruments. The company may also have an interest, by way of contribution or merger, in any company or entity, already incorporated or to be incorporated, having an identical corporate purpose, related or connected to its own corporate purpose or which would be likely to favour in any manner the pursuit of its corporate purpose. The Company’s subsidiary Titan America LLC operates in the construction and building materials sector in the USA. 32

0128528-0000007 EUO3: 2018272561.4 2 2. Development, results, risks and uncertainties 2.1 Management’s discussion and analysis of the statutory financial statements The Company’s functional currency is the United States Dollar (USD).On 17 June 2024, the Company submitted a request to the Accounting Standards Commission in Belgium, for an exemption in keeping accounts and preparing/publicising of annual accounts in a currency other than the euro, namely in US dollars (USD) on the basis that the Company’s operating activities, through Titan America LLC, are conducted in the USA in USD. Based on the data provided, the Accounting Standards Commission considered that the US dollar (USD) can be the functional currency of the Company. Consequently, the Accounting Standards Commission decided at its meeting of 2 October 2024, to issue a favourable opinion for the exemption requested by the Company. The Company in its first year of operations, ending 31 December 2024, reported Administrative expenses of USD 6,053,228 and a Loss for the year of USD 6,053,836. Almost all expenses relate to Legal and Other Professional Services that the Company received in preparation of its Initial Public Offering, launched in February 2025, for the trading of its common shares on the New York Stock Exchange (NYSE). . As at 31 December 2024 the Company reported Total Assets of USD 3,203,817,201 and Net Equity of USD 3,194,146,050 On 18 December 2024 the Extraordinary General Meeting of the Company’s Shareholders, approved the following: (i) a split of the Company's shares whereby one (1) ordinary share was split into ten (10) ordinary shares (the Share Split); and (ii) immediately after the Share Split, a contribution in kind by Titan Cement International of its participation in Titan Atlantic Cement Industrial & Commercial Single Member S.A. a Greek limited liability company (societe anonyme), having its registered office at 22A, Halkidos street, Athens 11143, Greece, and registered with the Greek business register under number 000854801000 (TACIC), which consists of the entire share capital of TACIC (1,734,440 shares), into the capital of the Company (the Contribution in Kind). The Contribution in Kind was valued at a total contribution value of USD 3,199,999,886.25. As a result of the Contribution in Kind, the share capital of the Company was increased by a total amount of USD 1,753,424,650, from USD 200,000 to USD 1,753,624,000 against the issuance of 175,342,465 new ordinary shares (the New Shares), which were fully subscribed by TCI. The New Shares were issued at an issuance price of USD 18.25 (rounded) per New Share (the Issuance Price), which corresponded to the sum of the par value of the Company's shares (i.e. USD 10 per share) and an issue premium per New Share of USD 8.25 (rounded). The total issue premium of USD 1,446,575,236.25 is booked on a separate, distributable issue premium account of the Company. The value of the contributed shares of TACIC of USD 3,199,999,886.25 is reported in the Investment in Subsidiaries account. 33

0128528-0000007 EUO3: 2018272561.4 3 2.2 Description of the principal risks and uncertainties The Company does not engage in speculative transactions or transactions which are not related to its business activities . (a) Currency volatility The company’s main source of income , through its participation in its US subsidiary , Titan America LLC ,is denominated in USD thus creating a natural hedge ,considering that the Company’s functional currency is the USD The foreign currency exposure derived from the Company’s limited liabilities in EURO is considered non material . (b) Liquidity and leverage risks The Company does not have any debt as at 31 Demeber 2024 while it maintains sufficient cash and other liquid assets in order to ensure the fulfilment of its financial obligations 3. Material events after the closing of the financial year and circumstances that could significantly influence the development of the Company In February 2025, the Company has proceeded with an initial public offering (“IPO”) on NYSE, issuing and selling 9,000,000 of new common shares at a price to the public of $16.00 per share. The issuance of these new shares was established before a notary public on 10 February 2025. Additionally, the IPO consisted of selling 15,000,000 existing common shares, which were sold by the Company’s parent, TCI, at a price to the public of $16.00 per share. Citigroup and Goldman Sachs & Co. LLC acted as joint lead book-running managers for the IPO. BofA Securities, BNP Paribas, Jefferies, HSBC, Societe Generale and Stifel acted as bookrunners for the IPO. A registration statement on Form F-1 (Registration No. 333-284251) relating to these securities was filed with the SEC and became effective on February 6, 2025. TCI has granted the underwriters a 30-day option to purchase up to an additional 3,600,000 common shares to cover over-allotments, if any, at the initial public offering price, less underwriting discounts and commissions. The underwiters exercised partially this option and purchased an additional 580,756 shares on 7 March 2025. The Company’s common shares began trading on the New York Stock Exchange under the ticker symbol “TTAM” on 7 February 2025 and the offering closed on February 10, 2025 as all of customary closing conditions were successfully met. Titan America received proceeds of USD 136,800,000, after deducting underwriting discounts and commissions, which will be used for capital expenditures and other general corporate purposes, including to fund investments in technologies and Titan America’s growth strategies and to pursue strategic acquisitions that complement Titan America’s business. Although material in nature, the IPO event is not considered to materially impact the development of the Company and its subsidiaries. No other circumstance was identified that could materially impact the activities or operations of the Company. 34

0128528-0000007 EUO3: 2018272561.4 4 4. Research and development Given the nature of the business as a holding company, no activities were performed in the area of research and development during the financial year which ended on 31 December 2024. 5. Information on existing branches of the Company The Company has no branches. 6. Conflicts of interest In the course of the financial year which ended on 31 December 2024, no actions or decisions have taken place that gave rise to a conflicting interest of a financial nature between the Company and (any of) its directors. 7. Use of authorized capital The board of directors has not made use of the authorized capital in the course of the financial year as closed per December, 31 2024. 8. Acquisition or disposal of own shares The Company has not acquired any own shares in the course of the financial year as closed per December 31, 2024. 9. Use of financial instruments The Company does not use financial instruments in the meaning of Article 3:6 § 1, 8° Belgian Companies Code. 10. Payments to Authorities The Company has not made any payments to Authorities, other than those required by law. 11. Viability statement The Board of Directors has assessed the prospects of the Company having regard on its current position and the major risks facing the Company which was considered as appropriate to draw conclusions. The Board of Directors have a reasonable expectation that the Company will be able to continue its activities in going concern and meet its liabilities as they fall due over the period of their assessment. 12. Allocation of the result In accordance with article 3:3, §1 of the Royal Decree of 29 April 2019 the balance sheet has been drafted after distribution of the result. The Board of Directors proposes to the Annual General Meeting of the Company, and requests it to: (i) acknowledge this Report and the report of the statutory auditor for the year ending on 31 December 2024; 35

0128528-0000007 EUO3: 2018272561.4 5 (ii) approve the statutory annual accounts of the Company, as presented, and whereby the result is allocated as follows: loss of USD 6,053,836 as at 31 December 2024 to be appropriated in full to Accumulated Losses; (iii) grant discharge to the directors for the performance of their mandate during the financial year which ended on 31 December 2024; (iv) grant discharge to the statutory auditor of the Company, PwC Reviseurs d’ Entreprises BV, represented by Mr. Didier Delanoye for the performance of its mandate during the financial year which ended on December 31, 2024 13. Declaration by the Board The Board of Directors hereby declares that, to the best of its knowledge: a. The financial statements, prepared in accordance with Belgian Generally Accepted Accounting principles, give a true and fair view of the assets, liabilities, financial position and profit or loss of the Company, b. The Annual Report and the Financial Accounts for the fiscal year 2024, taken as a whole, are fair, balanced and understandable, and provide the information necessary for shareholders to assess the Company’s performance, business model and strategy. Yours sincerely, On behalf of the board of directors, Marcel Cobuz Michael Colakides Chairman of the Board Director Brussels , 19 March 2025 36

PwC Bedrijfsrevisoren BV - PwC Reviseurs d'Entreprises SRL - Financial Assurance Services Maatschappelijke zetel/Siège social: Culliganlaan 5, 1831 Diegem Vestigingseenheid/Unité d'établissement: Culliganlaan 5, 1831 Diegem T: +32 (0)2 710 4211, F: +32 (0)2 710 4299, www.pwc.com BTW/TVA BE 0429.501.944 / RPR Brussel - RPM Bruxelles / ING BE43 3101 3811 9501 - BIC BBRUBEBB / BELFIUS BE92 0689 0408 8123 - BIC GKCC BEBB STATUTORY AUDITOR'S REPORT TO THE GENERAL SHAREHOLDERS’ MEETING OF TITAN AMERICA SA ON THE ANNUAL ACCOUNTS FOR THE YEAR ENDED 31 DECEMBER 2024 We present to you our statutory auditor’s report in the context of our statutory audit of the annual accounts of Titan America SA (the “Company”). This report includes our report on the annual accounts, as well as the other legal and regulatory requirements. This forms part of an integrated whole and is indivisible. We have been appointed as statutory auditor by the general meeting d.d. 17 July 2024. Our mandate will expire on the date of the general meeting which will deliberate on the annual accounts for the year ended 31 December 2026. This is the first year that we have performed the statutory audit of the Company’s annual accounts. Report on the annual accounts Unqualified opinion We have performed the statutory audit of the Company’s annual accounts, which comprise the balance sheet as at 31 December 2024, and the profit and loss account for the period from 17 July 2024 to 31 December 2024 (the “period”), and the notes to the annual accounts, characterised by a balance sheet total of USD 3,203,817,200.63 and a profit and loss account showing a loss for the period of USD 6,053,836.46. In our opinion, the annual accounts give a true and fair view of the Company’s net equity and financial position as at 31 December 2024, and of its results for the period, in accordance with the financial- reporting framework applicable in Belgium. Basis for unqualified opinion We conducted our audit in accordance with International Standards on Auditing (ISAs) as applicable in Belgium. Furthermore, we have applied the International Standards on Auditing as approved by the IAASB which are applicable to the year-end and which are not yet approved at the national level. Our responsibilities under those standards are further described in the “Statutory Auditor’s responsibilities for the audit of the annual accounts” section of our report. We have fulfilled our ethical responsibilities in accordance with the ethical requirements that are relevant to our audit of the annual accounts in Belgium, including the requirements related to independence. We have obtained from the board of directors and Company officials the explanations and information necessary for performing our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. 37

2 of 4 Responsibilities of the board of directors for the preparation of the annual accounts The board of directors is responsible for the preparation of annual accounts that give a true and fair view in accordance with the financial-reporting framework applicable in Belgium, and for such internal control as the board of directors determines is necessary to enable the preparation of annual accounts that are free from material misstatement, whether due to fraud or error. In preparing the annual accounts, the board of directors is responsible for assessing the Company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the board of directors either intends to liquidate the Company or to cease operations, or has no realistic alternative but to do so. Statutory auditor’s responsibilities for the audit of the annual accounts Our objectives are to obtain reasonable assurance about whether the annual accounts as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these annual accounts. In performing our audit, we comply with the legal, regulatory and normative framework applicable to the audit of the annual accounts in Belgium. A statutory audit does not provide any assurance as to the Company’s future viability nor as to the efficiency or effectiveness of the board of directors’ current or future business management. Our responsibilities in respect of the use of the going concern basis of accounting by the board of directors are described below. As part of an audit in accordance with ISAs, we exercise professional judgment and maintain professional skepticism throughout the audit. We also: Identify and assess the risks of material misstatement of the annual accounts, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control; Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control; Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by the board of directors; 38

3 of 4 Conclude on the appropriateness of the board of directors use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Company’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our statutory auditor’s report to the related disclosures in the annual accounts or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our statutory auditor’s report. However, future events or conditions may cause the Company to cease to continue as a going concern; Evaluate the overall presentation, structure and content of the annual accounts, including the disclosures, and whether the annual accounts represent the underlying transactions and events in a manner that achieves fair presentation; We communicate with the board of directors regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit. Other legal and regulatory requirements Responsibilities of the board of directors The board of directors is responsible for the preparation and the content of the directors’ report, as well as for the compliance with the legal and regulatory requirements regarding bookkeeping, with the Companies’ and Associations’ Code and the Company’s articles of association. Statutory auditor’s responsibilities In the context of our engagement and in accordance with the Belgian standard which is complementary to the International Standards on Auditing (ISAs) as applicable in Belgium, our responsibility is to verify, in all material respects, the directors’ report, as well as compliance with the articles of association and of certain requirements of the Companies’ and Associations’ Code and to report on these matters. Aspects related to the directors’ report In our opinion, after having performed specific procedures in relation to the directors’ report, the directors’ report is consistent with the annual accounts for the year under audit, and is prepared in accordance with the articles 3:5 and 3:6 of the Companies’ and Associations’ Code. In the context of our audit of the annual accounts, we are also responsible for considering, in particular based on the knowledge acquired resulting from the audit, whether the directors’ report is materially misstated or contains information which is inadequately disclosed or otherwise misleading. In light of the procedures we have performed, there are no material misstatements we have to report to you. 39

4 of 4 Statements related to independence Our registered audit firm and our network did not provide services which are incompatible with the statutory audit of the annual accounts and our registered audit firm remained independent of the Company in the course of our mandate. The fees for additional services which are compatible with the statutory audit of the annual accounts referred to in article 3:65 of the Companies’ and Associations’ Code are correctly disclosed and itemized in the notes to the annual accounts. Other statements Without prejudice to formal aspects of minor importance, the accounting records were maintained in accordance with the legal and regulatory requirements applicable in Belgium. The appropriation of results proposed to the general meeting complies with the legal provisions and the provisions of the articles of association. There are no transactions undertaken or decisions taken in breach of the Company‘s articles of association or the Companies’ and Associations’ Code that we have to report to you. Diegem, 3 April 2025 The statutory auditor PwC Bedrijfsrevisoren BV / PwC Reviseurs d’Entreprises SRL Represented by Didier Delanoye* Bedrijfsrevisor / Réviseur d'Entreprises *Acting on behalf of Didier Delanoye BV 40