EX-96.1

Published on January 13, 2025

Exhibit 96.1

TECHNICAL REPORT SUMMARY FOR PENNSUCO QUARRY, MIAMI-DADE COUNTY, FLORIDA

REPORT CPI-17-6713F-A

| PREPARED BY

Continental Placer Inc. 17945 Hunting Bow Circle, Suite 101 Lutz, Florida 33558 |

|

|||

| PREPARED FOR

Titan America LLC 5700 Lake Wright Drive, Suite 300 Norfolk, Virginia 23502 |

|

|||

SIGNATURE DATE: AUGUST 30, 2024

EFFECTIVE DATE: MAY 24, 2024

TABLE OF CONTENTS

| 1 |

EXECUTIVE SUMMARY |

1 | ||||

| 1.1 |

INTRODUCTION | 1 | ||||

| 1.2 |

PROPERTY DESCRIPTION |

1 | ||||

| 1.3 |

GEOLOGY AND MINERALIZATION |

1 | ||||

| 1.4 |

STATUS OF EXPLORATION |

1 | ||||

| 1.5 |

MINERAL RESOURCE AND RESERVE ESTIMATES |

2 | ||||

| 1.6 |

DEVELOPMENT AND OPERATIONS |

3 | ||||

| 1.7 |

CAPITAL AND OPERATING COST ESTIMATES |

4 | ||||

| 1.7.1 |

Capital Costs |

4 | ||||

| 1.7.2 |

Operating Cost |

4 | ||||

| 1.7.3 |

Summary |

5 | ||||

| 1.8 |

PERMITTING REQUIREMENTS |

5 | ||||

| 1.9 |

QUALIFIED PERSONS CONCLUSIONS AND RECOMMENDATIONS |

6 | ||||

| 2 |

INTRODUCTION |

7 | ||||

| 2.1 |

ISSUER OF REPORT |

7 | ||||

| 2.2 |

TERMS OF REFERENCE AND PURPOSE |

7 | ||||

| 2.3 |

SOURCES OF INFORMATION |

7 | ||||

| 2.4 |

QUALIFIED PERSONS |

8 | ||||

| 2.5 |

PERSONAL INSPECTION |

8 | ||||

| 2.6 |

REPORT VERSION |

8 | ||||

| 3 |

PROPERTY DESCRIPTION |

9 | ||||

| 3.1 |

PROPERTY DESCRIPTION AND LOCATION |

9 | ||||

| 3.2 |

MINERAL RIGHTS |

11 | ||||

| 3.3 |

SIGNIFICANT ENCUMBRANCES OR RISKS TO PERFORM WORK ON PROPERTY |

11 | ||||

| 3.4 |

LEASE AGREEMENTS OR ROYALTIES |

11 | ||||

| 4 |

ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE, AND PHYSIOGRAPHY |

12 | ||||

| 4.1 |

TOPOGRAPHY AND VEGETATION |

12 | ||||

| 4.1.1 |

Mining Area |

12 | ||||

| 4.1.2 |

Processing Area |

12 | ||||

| 4.2 |

ACCESSIBILITY AND LOCAL RESOURCES |

12 | ||||

| 4.2.1 |

General |

12 | ||||

| 4.2.2 |

Road Access |

12 | ||||

| 4.2.3 |

Rail Access |

12 | ||||

| 4.2.4 |

Air |

12 | ||||

| 4.3 |

CLIMATE |

13 | ||||

| 4.4 |

INFRASTRUCTURE |

13 | ||||

| 4.4.1 |

Power |

13 | ||||

| 4.4.2 |

Water |

14 |

i

| 4.4.3 |

Personnel |

14 | ||||

| 4.4.4 |

Supplies |

14 | ||||

| 5 |

HISTORY |

16 | ||||

| 5.1 |

PRIOR OWNERSHIP | 16 | ||||

| 5.2 |

DEVELOPMENT AND EXPLORATION HISTORY | 16 | ||||

| 6 |

GEOLOGICAL SETTING, MINERALIZATION, AND DEPOSIT |

18 | ||||

| 6.1 |

REGIONAL GEOLOGY | 18 | ||||

| 6.2 |

LOCAL GEOLOGY | 20 | ||||

| 6.3 |

PROPERTY GEOLOGY AND MINERALIZATION | 20 | ||||

| 6.4 |

STRATIGRAPHY AND MINERALOGY | 21 | ||||

| 7 |

EXPLORATION |

23 | ||||

| 7.1 |

EXPLORATION OTHER THAN DRILLING |

23 | ||||

| 7.1.1 |

Geophysical Testing |

23 | ||||

| 7.1.2 |

Pond Surveys and Bathymetry |

23 | ||||

| 7.2 |

DRILLING PROGRAMS |

23 | ||||

| 7.2.1 |

Drilling History |

23 | ||||

| 7.2.2 |

2020 and 2021 Drilling Campaigns |

23 | ||||

| 7.2.3 |

2024 Drilling Campaign |

23 | ||||

| 7.3 |

HYDROGEOLOGY INFORMATION |

26 | ||||

| 7.4 |

GEOTECHNICAL INFORMATION |

26 | ||||

| 8 |

SAMPLE PREPARATION, ANALYSES, AND SECURITY |

27 | ||||

| 8.1 |

SAMPLE PREPARATION AND ANALYSES |

27 | ||||

| 8.1.1 |

2000 Drilling Program |

27 | ||||

| 8.1.2 |

2001 Testing Program |

27 | ||||

| 8.1.3 |

2024 Drilling Program |

27 | ||||

| 8.1.3.1 |

CTL Laboratory Protocol |

28 | ||||

| 8.1.3.2 |

UES Laboratory Protocol |

29 | ||||

| 8.1.4 |

2024 Geophysical Drilling Program |

29 | ||||

| 8.2 |

QUALITY ASSURANCE/QUALITY CONTROL |

29 | ||||

| 8.3 |

OPINION OF THE QUALIFIED PERSON ON ADEQUACY OF SAMPLE PREPARATION |

30 | ||||

| 9 |

DATA VERIFICATION |

31 | ||||

| 9.1 |

OPINION OF THE QUALIFIED PERSON ON DATA ADEQUACY |

31 | ||||

| 10 |

MINERAL PROCESSING AND METALLURGICAL TESTING |

32 | ||||

| 11 |

MINERAL RESOURCE ESTIMATES |

33 | ||||

| 11.1 |

DEFINITIONS |

33 | ||||

| 11.2 |

KEY ASSUMPTIONS, PARAMETERS AND METHODS |

33 | ||||

| 11.2.1 |

Resource Classification Criteria |

33 | ||||

| 11.2.2 |

Market and Economic Assumptions |

33 | ||||

| 11.2.3 |

Cut-Off Grade |

34 | ||||

| 11.2.4 |

Summary of Resource Model ParamEters |

35 | ||||

| 11.3 |

RESOURCE MODEL |

35 |

ii

| 11.3.1 |

Geodatabase |

35 | ||||

| 11.3.2 |

Geologic and Geochemical Model |

35 | ||||

| 11.3.3 |

Resource Area Description |

36 | ||||

| 11.4 |

MINERAL RESOURCES | 38 | ||||

| 11.4.1 |

Estimate of Mineral Resources |

38 | ||||

| 11.4.2 |

Geologic Confidence and Uncertainty |

38 | ||||

| 11.5 |

OPINION OF THE QUALIFIED PERSON |

38 | ||||

| 12 |

MINERAL RESERVE ESTIMATES |

39 | ||||

| 12.1 |

DEFINITIONS |

39 | ||||

| 12.2 |

KEY ASSUMPTIONS, PARAMETERS AND METHODS |

39 | ||||

| 12.2.1 |

Reserve Classification Criteria |

39 | ||||

| 12.2.2 |

Cut-Off Grade |

39 | ||||

| 12.2.3 |

Market Price |

40 | ||||

| 12.3 |

MINERAL RESERVES |

40 | ||||

| 12.4 |

OPINION OF THE QUALIFIED PERSON |

44 | ||||

| 13 |

MINING METHODS | 45 | ||||

| 13.1 |

GEOTECHNICAL AND HYDROLOGIC CONSIDERATIONS |

45 | ||||

| 13.1.1 |

Reserve Characteristics |

45 | ||||

| 13.1.2 |

Slope Stability |

45 | ||||

| 13.1.3 |

Hydrology |

46 | ||||

| 13.2 |

Mine Operating Parameters |

46 | ||||

| 13.3 |

STRIPPING AND DEVELOPMENT |

47 | ||||

| 13.4 |

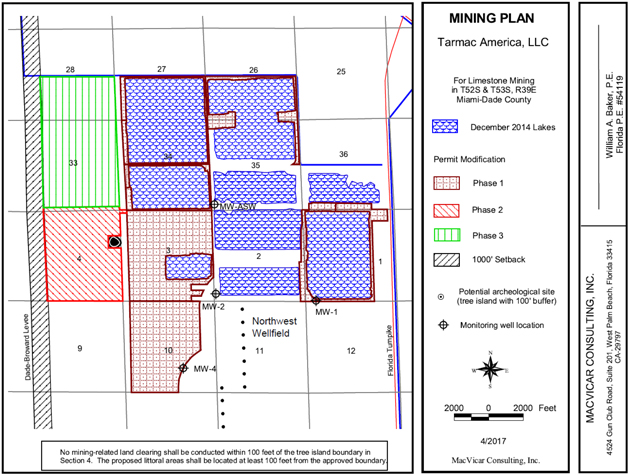

MINING PLAN |

49 | ||||

| 13.4.1 |

Dragline Excavation |

49 | ||||

| 13.4.2 |

Dredging |

49 | ||||

| 13.5 |

MINE PLANT, EQUIPMENT AND PERSONNEL |

49 | ||||

| 13.6 |

CONCLUSION |

50 | ||||

| 14 |

PROCESSING AND RECOVERY METHODS | 51 | ||||

| 14.1 |

PRIMARY CRUSHING |

51 | ||||

| 14.2 |

OVERLAND CONVEYOR |

51 | ||||

| 14.3 |

SURGE PILE |

51 | ||||

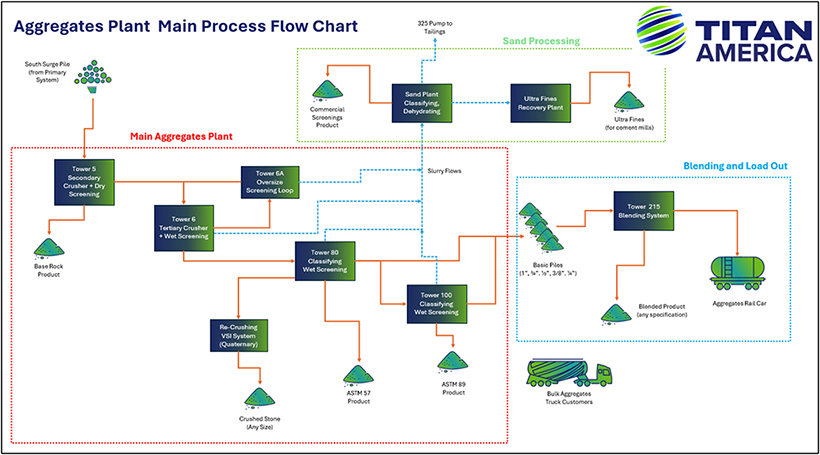

| 14.4 |

AGGREGATE PLANT |

51 | ||||

| 14.4.1 |

Secondary and Tertiary Crushing |

51 | ||||

| 14.4.2 |

Manufactured sand Production (Screenings) |

53 | ||||

| 14.4.2.1 |

Manufactured Sand |

53 | ||||

| 14.4.2.2 |

Ultra Fines Recovery |

53 | ||||

| 14.4.3 |

Finished Aggregates |

53 | ||||

| 14.4.4 |

Plant Yield |

53 | ||||

| 14.5 |

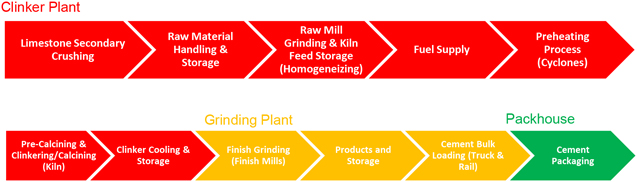

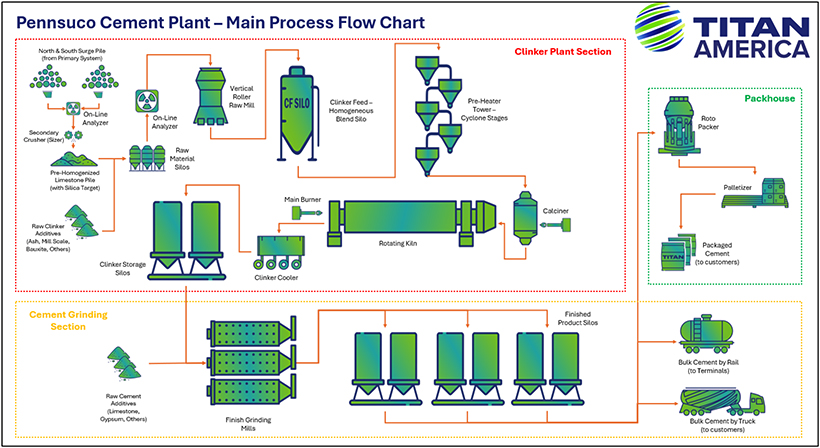

CEMENT PROCESS PLANT DESCRIPTION |

54 | ||||

| 14.6 |

PLANT THROUGHPUT AND DESIGN |

56 | ||||

| 14.7 |

PLANT OPERATIONAL REQUIREMENTS |

56 | ||||

| 14.7.1 |

Energy |

56 |

iii

| 14.7.2 |

Water |

56 | ||||

| 14.7.3 |

Process Materials |

56 | ||||

| 14.7.4 |

Personnel |

57 | ||||

| 14.8 |

APPLICATION OF NOVEL OR UNPROVEN TECHNOLOGY |

57 | ||||

| 15 |

INFRASTRUCTURE |

58 | ||||

| 15.1 |

INTERNAL ROADS |

60 | ||||

| 15.2 |

RAIL |

60 | ||||

| 15.3 |

NATURAL GAS |

60 | ||||

| 15.4 |

ELECTRIC POWER |

60 | ||||

| 15.5 |

ALTERNATIVE FUELS INFRASTRUCTURE |

60 | ||||

| 15.5.1 |

Tire-Derived Fuel |

61 | ||||

| 15.5.2 |

Processed Engineered Fuel |

61 | ||||

| 15.5.3 |

Summary |

61 | ||||

| 15.6 |

FUEL STORAGE |

61 | ||||

| 15.7 |

Dumps |

61 | ||||

| 16 |

MARKET STUDIES |

62 | ||||

| 16.1 |

MARKET OUTLOOK AND PRICE FORECAST |

62 | ||||

| 16.1.1 |

Introduction |

62 | ||||

| 16.1.2 |

Market Past and Future Impacts |

62 | ||||

| 16.1.2 1 |

Cement |

62 | ||||

| 16.1.2.2 |

Construction Aggregates |

63 | ||||

| 16.1.2.3 |

Competitor Analysis Cement |

64 | ||||

| 16.1.2.4 |

Competitor Analysis Aggregates |

64 | ||||

| 16.1.3 |

Market Review Conclusions |

65 | ||||

| 16.1.4 |

Competitive Advantages |

65 | ||||

| 16.2 |

SALES AND DISTRIBUTION CHANNELS |

66 | ||||

| 16.2.1 |

Distribution Channels |

66 | ||||

| 16.2.1.1 |

Cement |

66 | ||||

| 16.2.1.2 |

Aggregates |

66 | ||||

| 16.2.1.3 |

Rail Distribution |

66 | ||||

| 16.3 |

COMMODITY PRICES |

68 | ||||

| 16.3.1 |

Price Forecasts and Key Influencing Factors (e.g., Economic Conditions) |

68 | ||||

| 16.4 |

MATERIAL CONTRACTS |

68 | ||||

| 16.4.1 |

Description of Different Types of Contracts Involved |

68 | ||||

| 16.4.2 |

Overview of Critical Terms and Conditions in the Contracts |

68 | ||||

| 17 |

ENVIRONMENTAL STUDIES, PERMITTING AND PLANS, NEGOTIATIONS, OR AGREEMENTS WITH LOCAL INDIVIDUALS OR GROUPS | 69 | ||||

| 17.1 |

ENVIRONMENTAL STUDIES AND PERMITTING REQUIREMENTS |

69 | ||||

| 17.1.1 |

Lake Belt Area |

69 | ||||

| 17.1.2 |

Required Permits |

72 | ||||

| 17.2 |

WASTE DISPOSAL, SITE MONITORING AND WATER MANAGEMENT |

73 | ||||

| 17.2.1 |

Location of Mine Waste and Water Management Facilities |

73 |

iv

| 17.3 |

POST-MINING LAND USE AND RECLAMATION |

73 | ||||

| 17.3.1 |

Upland Reclamation |

73 | ||||

| 17.3.2 |

Shoreline Reclamation |

73 | ||||

| 17.3.3 |

Mine Closure Costs |

74 | ||||

| 17.4 |

LOCAL OR COMMUNITY ENGAGEMENT AND AGREEMENTS |

74 | ||||

| 17.5 |

OPINION OF THE QUALIFIED PERSON |

74 | ||||

| 18 |

CAPITAL AND OPERATING COSTS |

75 | ||||

| 18.1 |

SUMMARY AND ASSUMPTIONS |

75 | ||||

| 18.2 |

MINING CAPITAL SUMMARY |

75 | ||||

| 18.2.1 |

Stripping |

75 | ||||

| 18.2.2 |

Sustaining Capital |

75 | ||||

| 18.2.3 |

Mining method extension |

75 | ||||

| 18.2.4 |

Contingency |

75 | ||||

| 18.3 |

PROCESSING CAPITAL COSTS |

75 | ||||

| 18.4 |

MINING OPERATING COST |

76 | ||||

| 18.4.1 |

Introduction and Estimate Results |

76 | ||||

| 18.4.2 |

Depreciation and Amortization |

76 | ||||

| 18.4.3 |

SUMMARY |

77 | ||||

| 19 |

ECONOMIC ANALYSIS |

78 | ||||

| 19.1 |

KEY PARAMETERS AND ASSUMPTIONS |

78 | ||||

| 19.1.1 |

Commodity Prices |

78 | ||||

| 19.1.2 |

Inflation |

78 | ||||

| 19.1.3 |

Labor |

78 | ||||

| 19.1.4 |

Production Parameters |

78 | ||||

| 19.1.5 |

Operational Costs |

78 | ||||

| 19.1.6 |

Capital Expenditures |

79 | ||||

| 19.1.7 |

Tax Rate |

79 | ||||

| 19.2 |

ECONOMIC VIABILITY |

79 | ||||

| 19.2.1 |

Economic viability |

79 | ||||

| 19.2.2 |

Measures of Economic Viability |

80 | ||||

| 19.3 |

Sensitivity Analysis |

80 | ||||

| 19.4 |

CONCLUSION |

81 | ||||

| 20 |

ADJACENT PROPERTIES |

82 | ||||

| 21 |

OTHER RELEVANT DATA AND INFORMATION |

83 | ||||

| 21.1 |

LAND OWNERSHIP IN SECTION 27 |

83 | ||||

| 21.2 |

AGGREGATES TAILINGS RECOVERY FOR CLINKER MANUFACTURING |

83 | ||||

| 21.3 |

CONSUMPTION OF QUARRY TAILINGS FOR RAW MILL PRODUCTION |

84 | ||||

| 22 |

INTERPRETATION AND CONCLUSIONS |

85 | ||||

| 22.1 |

INTERPRETATIONS AND CONCLUSIONS |

85 | ||||

| 22.2 |

RISKS AND UNCERTAINTIES |

85 | ||||

| 23 |

RECOMMENDATIONS |

86 | ||||

| 24 |

REFERENCES |

87 | ||||

| 25 |

RELIANCE ON INFORMATION PROVIDED BY THE REGISTRANT |

89 | ||||

| 26 |

DATE AND SIGNATURE PAGE |

90 |

v

LIST OF TABLES

| Table 1-1. Pennsuco Site - Summary of Limestone Mineral Resources Effective May 24, 2024 |

2 | |||

| Table 1-2. Pennsuco Site - Summary of Limestone Mineral Reserves Effective May 24, 2024 |

3 | |||

| Table 5-1. Record of Site Ownership |

16 | |||

| Table 5-2. Record of Site Improvements and Operational Developments |

16 | |||

| Table 5-3. Record of Drilling Campaigns and Areas Explored |

17 | |||

| Table 7-1. Exploration Drilling |

23 | |||

| Table 11-1. Parameter Assumptions |

35 | |||

| Table 11-2. Summary of Limestone Mineral Resources at the Effective Date of May 24, 2024 |

38 | |||

| Table 12-1. Summary of Limestone Mineral Reserves Effective May 24, 2024 (Page 1 of 2) |

42 | |||

| Table 17-1. Permit Status |

72 | |||

| Table 18-1. Summary of Mining and Cement Processing Operating Costs over LOM |

76 | |||

| Table 19-1. Economic Analysis Model |

80 | |||

| Table 19-2. Sensitivity Analysis |

81 |

vi

LIST OF FIGURES

| Figure 3-1. Property Location and Site Boundary. |

10 | |||

| Figure 4-1. Miami-Dade County Temperature and Precipitation Data Recorded from 1981-2010 (U.S. Climate Data, 2024) |

13 | |||

| Figure 4-2. Regional Infrastructure |

15 | |||

| Figure 6-1. Geologic Map of Southern Florida (Scott, 2001) |

19 | |||

| Figure 6-2. Typical Stratigraphic Column [Modified From (Scott, 2001)] |

21 | |||

| Figure 6-3. Cross Section of the Permitted Area |

22 | |||

| Figure 7-1. Plan View Map of the 2024 Drilling Campaign |

25 | |||

| Figure 11-1. Silica distribution in the deposit |

34 | |||

| Figure 11-2. Resource Area |

37 | |||

| Figure 12-1. Reserves Map |

43 | |||

| Figure 13-1. Historic Phreatic Water Level Elevation (Source: Annual Lake Belt Report) |

46 | |||

| Figure 13-2. Final Quarry Limits |

48 | |||

| Figure 14-1. Aggregate Plant Main Process Flow Chart |

52 | |||

| Figure 14-2. Cement Plant Process |

54 | |||

| Figure 14-3. Cement Plant Process Flow Chart |

55 | |||

| Figure 14-4. Pit to Product Mass Balance |

56 | |||

| Figure 15-1. Site Infrastructure Features |

58 | |||

| Figure 15-2. Plant Area Infrastructure |

59 | |||

| Figure 16-1. Total Florida Cement Consumption Actual and Forecast |

62 | |||

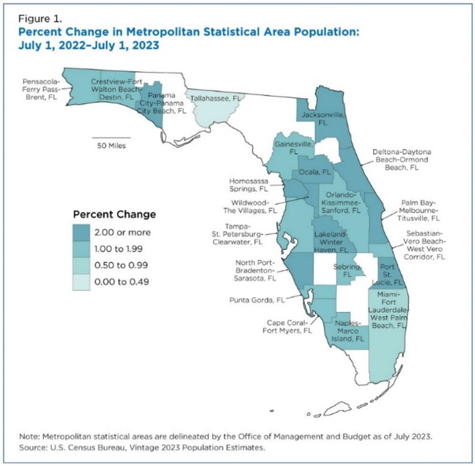

| Figure 16-2. Year-Over-Year Florida Population Growth by County |

63 | |||

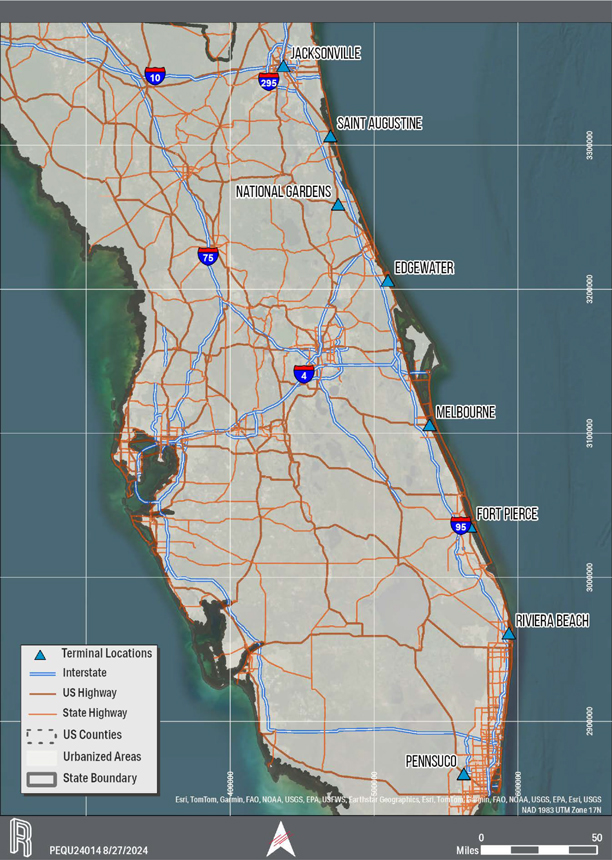

| Figure 16-3. Titan Florida Cement & Aggregate Terminal Locations Along the FEC Railway |

67 | |||

| Figure 16-4. Producer Price Index by Industry: Cement and Concrete Product Manufacturing (U.S. Bureau of Labor Statistics, 2024) |

68 | |||

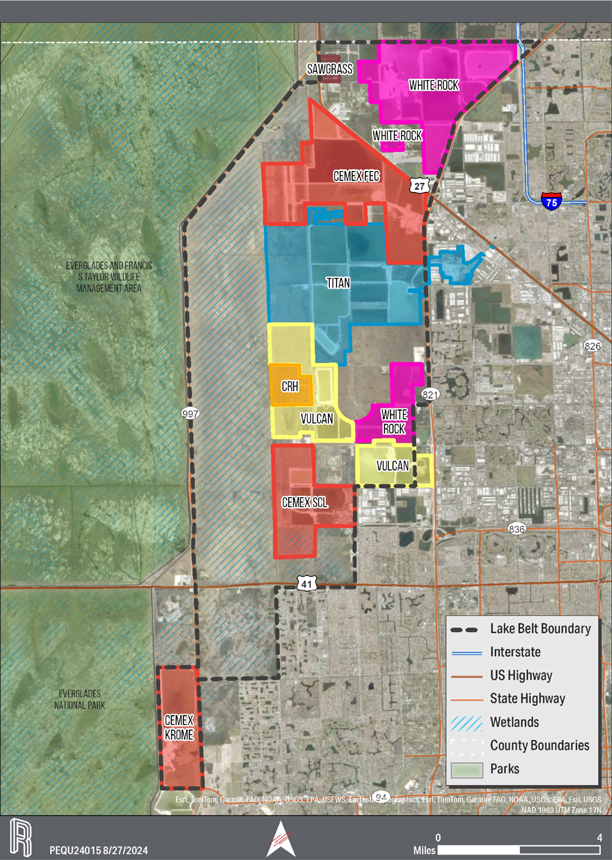

| Figure 17-1. Lake Belt Area |

70 | |||

| Figure 17-2. Lake Belt Phases (MacVicar Consulting, 2017) |

71 | |||

| Figure 21-1. Section 27 with Titans Parcels shown in blue |

83 | |||

| Figure 21-2. Drill and Barge Used for 2008 Fines Drilling Campaign |

84 |

vii

GLOSSARY OF TERMS AND ABBREVIATIONS

| Symbol / Abbreviation |

Description |

|

| |

minute (plane angle) or foot/feet | |

| |

second (plane angle) or inch/inches | |

| ° |

degree | |

| °F |

degrees Fahrenheit | |

| AF |

alternative fuel | |

| Al2O3 |

alumina or aluminum oxide | |

| BTU |

British thermal unit | |

| CaO |

calcium oxide | |

| DERM |

Department of Environmental Resources Management | |

| DOT |

Department of Transportation | |

| EIS |

Environmental Impact Statement | |

| ERP |

Environmental Resource Permit | |

| ESA |

Endangered Species Act | |

| F.A.C |

Florida Administrative Code (FAC) | |

| Fe2O3 |

Iron oxide | |

| FDEP |

Florida Department of Environmental Protection | |

| FEC |

Florida East Coast | |

| Fe2O3 |

iron oxide or ferric oxide | |

| FGS |

Florida Geological Survey | |

| FP&L |

Florida Power & Light | |

| K2O |

potassium oxide | |

| kt |

kiloton | |

| Kt/a |

kilotons per annum | |

| kV |

Kilovolt | |

| kW |

Kilowatt | |

| kWh |

kilowatt hour | |

| LOI |

Loss on ignition | |

| LOM |

Life of Mine |

viii

| MCF |

one thousand cubic feet | |

| MG |

million gallons | |

| MgO |

magnesium oxide | |

| MW |

Megawatt | |

| Na2O |

sodium oxide | |

| NGVD |

National Geodetic Vertical Datum | |

| PEF |

Process engineered fuel | |

| QP |

qualified person | |

| RER |

Miami-Dade County, Department of Regulatory and Economic Resources | |

| ROZA |

Rock mining overlay zoning area | |

| SiO2 |

silicon dioxide | |

| SO3 |

sulfur trioxide | |

| t |

US ton | |

| t/h |

tons per hour | |

| t/a |

ton per year (annum) | |

| TDF |

Tire derived fuel | |

| TiO2 |

titanium dioxide | |

| US |

United States | |

| US$ |

US Dollar | |

| USACE |

United States Army Corps of Engineers | |

| USFWS |

United States Fish and Wildlife Service | |

| XRF |

x-ray fluorescence | |

| ZnO |

zinc oxide |

ix

1 EXECUTIVE SUMMARY

1.1 INTRODUCTION

Titan America LLC (Titan) is a leading U.S. manufacturer of construction materials used in residential, commercial, industrial, infrastructure, and energy applications. Titan has retained Continental Placer Inc. (CPI) to prepare this Technical Report Summary (TRS) for the Pennsuco facility (site) located in the state of Florida, USA.

The purpose of this TRS is to support the disclosure of Mineral Resource and Mineral Reserve estimates for the site as of May 24, 2024. This TRS is intended to fulfill 17 Code of Federal Regulations (CFR) §229, Standard Instructions for Filing Forms Under Securities Act of 1933, Securities Exchange Act of 1934 and Energy Policy and Conservation Act of 1975 Regulation S-K, subsection 1300, Disclosure by Registrants Engaged in Mining Operations. The Mineral Resource and Mineral Reserve estimates presented herein are classified according to 17 CFR §229.1300 (Item 1300) Definitions.

The Mineral Reserves are mined to support the on-site aggregates plant and cement facility.

This TRS was prepared by CPI. No prior TRS has been filed with respect to the site.

1.2 PROPERTY DESCRIPTION

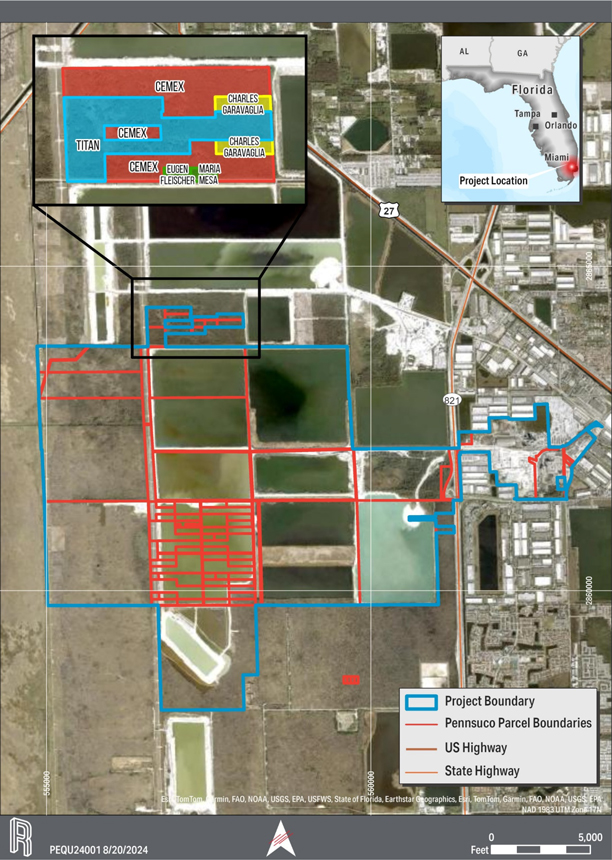

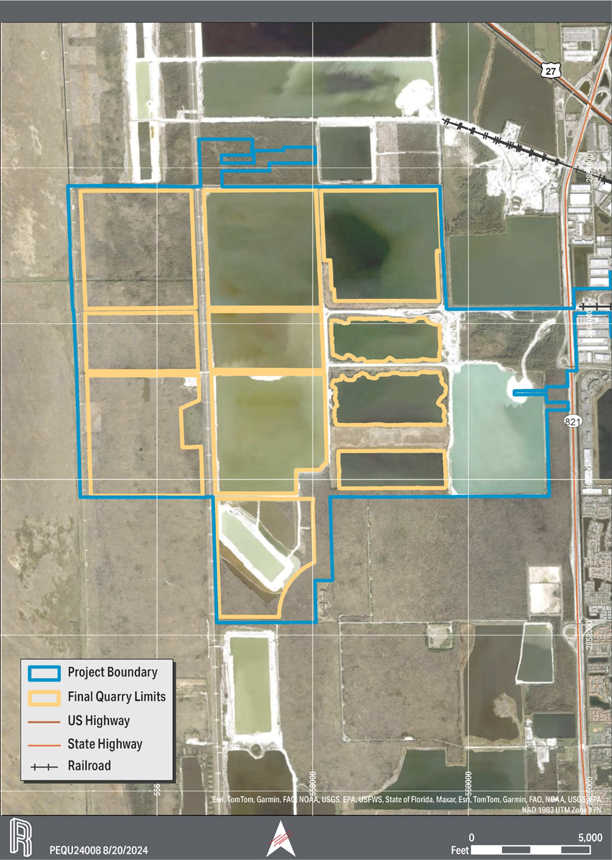

The site is in Miami-Dade County, Florida, and is positioned approximately 14 miles northwest of the Miami city center. The site comprises 68 separate property tracts, all of which are owned by Titan or through its subsidiary companies. In total, the property encompasses 6,465 acres.

The property is bisected by the Florida Turnpike. The area west of the turnpike is the area of the mining activity and the area to the east is the location of the aggregate plant, cement facility, ready mix concrete plant, and the concrete block plant, plus support facilities.

1.3 GEOLOGY AND MINERALIZATION

Limestone extraction is from the Miami Limestone Formation. The Miami Limestone is regionally extensive and underlies a thin veneer of unconsolidated organic sediments. It comprises two primary lithologies: an upper zone of poorly to moderately indurated, sandy, oolitic limestone, and a lower, thicker zone of poorly to well indurated, sandy, fossiliferous limestone. The upper 20 to 35 feet exhibit a higher calcium content. The silica content increases with depth as calcium content decreases. Solution features become more common with depth.

1.4 STATUS OF EXPLORATION

The mine site has been thoroughly explored through numerous drilling and mapping campaigns. The areas planar semi-horizontal lithology lends itself to a simplified stratigraphic understanding and easily reliably correlated drill holes.

1

1.5 MINERAL RESOURCE AND RESERVE ESTIMATES

Table 1-1 shows the resulting Resource tonnage estimate for the quarry effective May 24, 2024. Resource tonnages are exclusive of Reserves, which means the Resources converted to Reserves are not included in the estimates presented in this TRS.

The following are limestone Mineral Resource estimates at the surge pile, as of May 24, 2024:

Table 1-1. Pennsuco Site - Summary of Limestone Mineral Resources Effective May 24, 2024

| Resource Category |

Limestone (tons) |

|||

| Measured Resources |

27,235,000 | |||

| Indicated Resources |

20,081,000 | |||

|

|

|

|||

| Total Measured and Indicated |

47,316,000 | |||

|

|

|

|||

| Notes: (1) Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. (2) Mineral Resources are exclusive of Mineral Reserves. (3) Mineral Resources point of reference is the limestone surge pile at the plant area. (4) Mineral Resources Reasonable Prospects for Economic Extraction (RPEE) commodity price is based on a 2025 cement price of $136 per ton and a blended aggregates price of $21.00 per ton. Both prices are Free on Board (FOB) the plant. (5) Tons are rounded to the nearest thousand. (6) Sums may not be exact because of rounding. (7) There is no certainty that all or any part of the Mineral Resources estimated will be converted into Mineral Reserves (8) A density factor of 1.55 t/ bank yd3 was applied. |

The Qualified Person (QP) opines that the modeling of the Miami Limestone deposit at the site adequately characterizes the quality and geology of the ore body. Such interpretations were made based on drilling campaigns, other exploration activities, and the mining history at the site. Material density is considered a key assumption in the determination of mineral resources. Through exploration, material testing and mass balance calculations the in-situ density factor utilized is 1.55 tons per bank cubic yard. The QP also opines that the Resource estimates have been developed following customary and industry standard practices in the construction materials mining industry. No proprietary methods, standards or software were used in the Resource estimate.

Table 1-2 exhibits the resulting Reserve tonnage estimate for the quarry effective May 24, 2024.

2

Table 1-2. Pennsuco Site - Summary of Limestone Mineral Reserves Effective May 24, 2024

| Reserve Category |

Limestone (tons) |

SiO2 (%) |

||||||

| Proven |

240,886,000 | 13.71 | ||||||

| Probable |

193,180,000 | 18.29 | ||||||

|

|

|

|

|

|||||

| Total Proven and Probable |

434,066,000 | 15.75 | ||||||

|

|

|

|

|

|||||

| Notes: (1) Price is $136/ton of cement and $21.00/ton of aggregates. U.S. dollars FOB plant site. (2) There is no cut-off grade (3) Mineral Reserves point of reference is the limestone surge pile at the plant area. (4) There is a 95% recovery to the surge pile. (5) Tons are rounded to the nearest thousand. (6) Sums may not be exact because of rounding. (7) A density factor of 1.55 t/ bank yd3 was applied. |

Given the extent of geologic information, mine planning activities, and operating history at the site, the QP is confident the Reserves can be extracted and processed at the quantity and quality required to meet the sites production schedule and produce Portland cement that will achieve or exceed the quality standards set forth by ASTM International (ASTM).

As part of this study, an economic analysis that included capital expenditure estimates for development, infrastructure relocations, fleet acquisitions, plant upgrades, and regulatory projects was performed. Operating expenses were obtained from the cost tracking performed by Titan over its 20 plus-year history of operating the site.

The site has a long history of successfully operating the quarry; therefore, the operational and technical feasibility of mining and processing the limestone is well understood.

The QP opines that the Reserve estimate has been developed following customary standards in the construction materials mining industry. The QP is of the opinion that all relevant technical and economic factors are not likely to be significantly influenced by additional geological investigation, and that any technical and economic issues are not material to the operation of the site.

1.6 DEVELOPMENT AND OPERATIONS

The mineral deposit at the quarry is layers of limestone that originated from a combination of depositional and erosional processes associated with sea-level fluctuation during the late Pleistocene era. The geology is composed of three major sedimentary formations as discussed in Section 6.3. The total thickness of the combination of the Miami Limestone layers varies from 70 to 85 feet. The current quarry excavation extends over an area of approximately 3,045 acres and will expand over the life of the mine (LOM) to 4,655 acres.

The quarry currently averages an annual production of approximately 10 million tons of limestone to feed both the aggregate plant and the cement plant.

Mining is conducted using draglines. In the future, the use of a dredge(s) is planned to recover the permitted remnant material from the quarry floor. The dredge method will also allow for excavation of the material remaining around the perimeter of the quarry that is inaccessible using a dragline. A comprehensive independent dredge mining method study has been commissioned to evaluate dredge technology for the operation.

3

The excavated material from the dragline is stockpiled along the working face to decant. This stockpiled limestone is transported by 100-ton haul trucks to the primary crusher. From the crusher, the material is transferred by belt conveyor to the surge pile, where it is fed to either the aggregate plant or the cement plant.

Based on historical performance of both the aggregate and cement plant, including Title V air permit limitations, the annual production from the quarry is 9.9 million tons. This consists of:

| Cement plant feed

Aggregate plant feed |

3.0 million tons per annum (t/a)

6.9 million t/a |

Projected quarry production:

| Current operations

Dragline

Proposed operations

Dragline

Dredge |

9.9 million t/a

7.4 million t/a

2.5 million t/a |

Based on these production levels, the mine life based on the current Reserves (as defined in Section 12) of:

| | The dragline Reserve life is through 2062 and is a 38-year life for cement raw feed due to the current targeted silica chemistry, from January 2025 at a production level of 9.9 million t/a. |

| | The dredge Reserve life is through 2083 and is a 56-year life from January 2028, 21 years beyond the dragline life with the additional years at a production level of 2.5 million t/a. This life of mine value is for aggregates production only due to silica content, until modifications are made in the cement plant and/or feed correctives are added to the raw meal. |

1.7 CAPITAL AND OPERATING COST ESTIMATES

Capital and operating costs are primarily estimated using a combination of historical performance, historical fuel and labor costs, equipment quotes from recent projects, and vendor quotes for mobile equipment.

1.7.1 CAPITAL COSTS

Over the evaluation period, the capital costs are:

| | Stripping. The quarry performs stripping activities to prepare the mining area. These activities include removing overburden in advance of the blasting schedule. The estimated cost is $84.7 million |

| | Sustaining. The capital associated with mining activities is based on 9.9 million t/a of extracted limestone |

| | Sustaining capital for mobile equipment: replacement and refurbishment of haul trucks, loaders, and auxiliary equipment. |

| | Sustaining capital for draglines annual capitalizable maintenance, significant refurbishments, and major component replacement, as well as on dragline relocation |

| | Sustaining capital for primary crushers and the overland conveyor system. |

The total sustaining capital costs over the evaluation period are: $199.1 million.

| | Mining Expansion - A dredge is currently scheduled to be commissioned in 2028 to extract the remnant material. Based on the current engineering study, the capital cost will be incurred in 2026/2027. The estimated cost is $25 million. |

1.7.2 OPERATING COST

The operating cost estimate for the mining operation was prepared using historical trends and detailed cost models, which were used during the 2024 annual budgetary planning process. The costs are for all activity up to delivery to the surge pile. The 2024 fixed and variable cost for the sites mining activity is estimated at $5.09 per ton delivered to the surge pile.

4

In addition to the fixed and variable costs, the applicable amortization and depreciation are added to determine the total mining cost per ton into the primary surge pile. The amortization and depreciation include allowance for previously incurred capital costs. The existing capital cost of $46.1 million is assumed to be depreciated over a 10-year life. Future capital cost from 2025 onwards of $295.0 million is depreciated over 15 years from the date the asset is placed in service.

Furthermore, the capital cost includes depletion of $0.18 per ton mined.

1.7.3 SUMMARY

The projected total mining cost during the evaluation period is $5.09 per ton delivered to the surge pile in 2025 and increases over the evaluation period to reflect the changes in depreciation and annual inflation based on the Consumer Price Index adjustment.

1.8 PERMITTING REQUIREMENTS

The site is situated in the Miami-Dade County Lake Belt area (Lake Belt), which contains high-quality limestone and encompasses +/-51,000 acres of wetlands. The Lake Belt was recognized legislatively as a critical state Resource. The Lake Belt is the subject of the Lake Belt Plan, which separated the Lake Belt into two areas: areas where rock mining would potentially be allowed, and the Pennsuco wetlands, a contiguous area that would be protected from mining and preserved, to the extent feasible as natural lands.

Each producer in the Lake Belt is responsible for its own facility permits and site-specific impacts; however, each facility is subject to the overall Lake Belt Plan mine phase planning. Phases 1 and 2 of the Lake Belt Plan were subject to a National Environmental Policy Act (NEPA) Environmental Impact Statement (EIS) evaluation led by the United States Army Corps of Engineers (USACE), including associated studies. Notably, the Florida Department of Environmental Protection (FDEP) Environmental Resource Permit (ERP) (e.g., mine permit) and the USACE Section 404 Dredge and Fill Permit (discussed herein) are submitted by each producer in the Lake Belt to the Lake Belt Committee for review and approval before each phase of mining. Currently, producers in the Lake Belt are operating within the approved Phase 1 and Phase 2 areas.

The upcoming permitting efforts for Phase 3 mining and associated wetlands impacts and mitigation will require modification of the USACE 404 Dredge and Fill Permits and FDEP ERP. The Phase 3 permitting effort will also require obtaining a Miami-Dade Class IV Wetland Permit and a Miami-Dade Lake Excavation Permit. Phase 3 mine permit applications for the Lake Belt producers will be submitted prior to December 31, 2024.

All other permits required to allow mining are in place and are current.

5

1.9 QUALIFIED PERSONS CONCLUSIONS AND RECOMMENDATIONS

The following is a summary of the Resource and Reserve estimates for the site:

| | Geology is well known and understood and proven to supply suitable stone both for cement raw material and quality aggregates. |

| | Mining operations and practices have been well established over many decades. Addition of dredge mining to maximize the recovery of the Resource is a well-established and proven mining practice. |

| | The processing of raw materials and manufacture of cement has been in place for many decades and is a very low emissions cement facility. |

| | All necessary infrastructure is in place and has served the operation for many decades. |

| | All necessary permits are in place and future permitting is expected to enable extraction of all Reserves included in the estimate. |

| | Costs are well understood and predictable with the operations having been economical for many years and reasonably expected to be so for the projected LOM. |

The QP opines that no issues are unresolved with the technical or economic factors considered in determining RPEE that supports the Resource estimate and that the risk of material impacts on the Reserve estimate is low.

The following actions are recommended for the site:

| | Advance Phase 3 permitting. |

| | Evaluate the fines recovery from Pit 3 for use in the cement process. |

| | Add a second ultra fines handling system to decrease aggregates processing tailings with recovered material used in the cement mill. |

| | Evaluate the use of bauxite for alumina control in place of fly ash to use more limestone Reserve in the cement process. |

6

2 INTRODUCTION

2.1 ISSUER OF REPORT

Titan is a leading U.S. manufacturer of construction materials that are used in residential, commercial, industrial, infrastructure, and energy applications. Titan has retained CPI to prepare this TRS for the Pennsuco Site located in the state of Florida, USA.

2.2 TERMS OF REFERENCE AND PURPOSE

The purpose of this TRS is to support the disclosure of Mineral Resource and Mineral Reserve estimates for the site as of May 24, 2024. This TRS is intended to fulfill 17 CFR §229, Standard Instructions for Filing Forms Under Securities Act of 1933, Securities Exchange Act of 1934 and Energy Policy and Conservation Act of 1975 Regulation S-K, subsection 1300, Disclosure by Registrants Engaged in Mining Operations. The Mineral Resource and Mineral Reserve estimates presented herein are classified according to 17 CFR §229.1300 (Item 1300) Definitions.

Unless otherwise stated, all measurements are reported in U.S. customary units and currency in U.S. dollars ($).

This TRS was prepared by CPI. No prior TRS has been filed with respect to the site.

The quality of information, conclusions, and estimates contained herein is consistent with the level of effort involved in CPIs services, based on the:

| | Information available at the time of preparation |

| | Data supplied by outside sources |

| | Assumptions, conditions, and qualifications set forth in this TRS |

2.3 SOURCES OF INFORMATION

This study is supported by Titan technical, operational, market, and financial reports, as well as studies and field programs performed by Titan and other external parties, published government reports, published government and historical data, and public information available at the time of writing.

Titan provided the following information:

| | Property history |

| | Property data |

| | Drill hole records |

| | Sampling protocols |

| | Laboratory protocols |

| | Sample analysis data |

| | Mine operations data |

| | Limestone crushing and handling data |

| | Site infrastructure information |

7

| | Environmental permits and related data/information |

| | Historical and forecast capital and operating cost data |

The documentation reviewed and other sources of information are listed in Section 24 of this TRS.

2.4 QUALIFIED PERSONS

The QP for this TRS is CPI. CPI was established in 1988, and is an environmental, engineering, and geological consulting firm with offices in Albany, New York; Lutz, Florida; and Mechanicsburg, Pennsylvania. CPI offers expertise in geologic, hydrogeologic, Reserve analysis, environmental, mine engineering and mapping services to private-sector clients throughout North America.

2.5 PERSONAL INSPECTION

Since 2002, CPI personnel have been on site on multiple occasions to provide technical support for geology, mine planning, and operations.

The CPI QP, Nathan Moore, conducted a site visit from May 17 to May 25, 2024, and completed the following tasks:

| | Visited the core storage area and inspected cores from prior exploration programs |

| | Reviewed logging and sampling procedures |

| | Inspected several locations in the mine, observing the characteristics of the deposit geology |

| | Discussed grade control mapping and sampling procedures |

| | Visited some of the mine stockpile areas |

| | Visited the processing facilities and inspected the sampling points used to determine the tonnages and grades processed |

| | Visited the site sample preparation facility and assay laboratory |

| | Held discussions with site personnel |

2.6 REPORT VERSION

This TRS, dated August 30, 2024, is the first TRS for the project.

8

3 PROPERTY DESCRIPTION

3.1 PROPERTY DESCRIPTION AND LOCATION

The site is in Miami-Dade County, Florida, approximately 14 miles northwest of the city center of Miami, as shown in Figure 3-1. The geodetic coordinates for the plant are approximately 25°5237 N and 80°2227 W.

The property spans multiple land sections and platted subdivisions and is bisected by the Florida Turnpike. The turnpike separates the two main activities of the site. Mining activity occurs west of the turnpike in unincorporated Miami-Dade County. The cement and aggregates processing plants are located on the east side of the turnpike in the Town of Medley, Miami-Dade County. The east side is associated with the sites physical address, 11000 NW 121st Way, Medley, Florida 33178.

The site has 68 tax folios totaling approximately 6,465 acres. Property ownership includes Tarmac Florida, Inc.; Tarmac Roadstone (U.S.A.) Inc.; Tarmac America LLC; Tarmac America, Inc.; Titan Florida LLC; and Sierra Everglades Investments LLC, which are all legal entities, holding companies, and/or subsidiaries under the control of Titan.

9

Figure 3-1. Property Location and Site Boundary.

10

3.2 MINERAL RIGHTS

All limestone mining rights are fully owned by deed for the 68 tax parcels identified in section 3.1 by subsidiaries of Titan.

3.3 SIGNIFICANT ENCUMBRANCES OR RISKS TO PERFORM WORK ON PROPERTY

An assessment of title commitments rendered no risks or encumbrances that preclude the proposed activity on the site. The pit shell design and operation layout address several other property interests, including:

| | Power lines. Two high-voltage electricity transmission lines cross the mining area from north to south. One easement is along the western boundary of Sections 3, 10, 15, 22, 27, and 34 (T52S, R39E). The other easement is along the western boundary of Sections 4 (T53S, R39E), 28, and 33 (T52S, R39E). The power lines are located on either Titan property with an easement to Florida Power and Light (FPL) or on FPL-owned property. There are right-of-way access points across the power lines. |

| | Gas line. A gas line runs through the cement plant area along NW 107th Avenue. A second gas line originates on the main line but follows NW 121st Way to the west. |

| | Wellfield. Allowable Land Uses within the Northwest Wellfield permits limestone quarrying, rock crushing, and aggregate plants but not concrete batch plants. Fuels and lubricants are allowed to be used in the rock mining operation; however, a variance from the Environmental Quality Control Board shall be needed for using hazardous materials other than fuels and lubricants and for generating hazardous and liquid wastes. |

| | Canals. Several Miami-Dade County reservations and setbacks are associated with canals and levees on or near the property. These canal restrictions are considered during mine planning and site expansion. |

| | Conservation easement. Limestone Proven Reserve for Pits J, K, and L are based on current permitting with a 1,500-foot setback from the Broward-Dade Levee. Additional Probable Reserves are based on decreasing the setback to the current maximum allowed, assuming that the 1,500-foot offset can be mitigated. |

3.4 LEASE AGREEMENTS OR ROYALTIES

Royalties are not paid on any current mining production, and none are expected to be due in the future. Titan owns all the property in the project area.

11

4 ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE, AND PHYSIOGRAPHY

4.1 TOPOGRAPHY AND VEGETATION

4.1.1 MINING AREA

The topography west of the Florida Turnpike in the mining areas is flatagricultural/open dense vegetation land or open water from mining and reclamation operations. The average elevation in the site is approximately 4 feet National Geodetic Vertical Datum (NGVD).

The mining activities are in the Lake Belt, encompassing 77.5 square miles of environmentally sensitive land at the western edge of the Miami-Dade County urban area. The wetlands and lakes of the Lake Belt, a significant part of the sites vegetation, offer the potential to buffer the Everglades from the adverse impacts of urban development.

4.1.2 PROCESSING AREA

East of the Florida Turnpike, the land is developed with structures for processing aggregates; manufacturing cement, concrete, and block; and all associated support uses to conduct business. These facilities are located in the town of Medley, Florida, at an elevation of approximately 7 feet NGVD.

4.2 ACCESSIBILITY AND LOCAL RESOURCES

4.2.1 GENERAL

The eastern portion of the site is located in Medley, Florida, a town incorporated in 1949 and within Miami-Dade County. The site is approximately 14 miles northwest of the city center of Miami. The address is 11000 NW 121st Way, Medley, FL 33178. The site has access to the Miami metropolitan area (Miami-Dade, Broward, and Palm Beach Counties). This tri-county area has a population of approximately 6.2 million people.

4.2.2 ROAD ACCESS

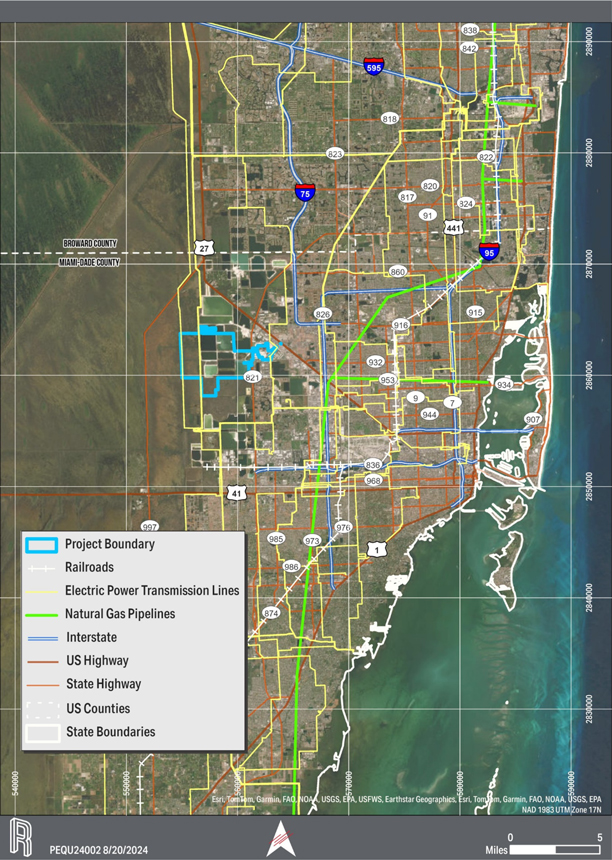

The site is accessed by the following highways: Florida Turnpike and Okeechobee Road (US Hwy 27), which both connect to FL-826 (north to south), FL-836 (east to west), and Interstates 75 and 95 (north to south). Nearby major roadways provide access to the Port of Miami.

4.2.3 RAIL ACCESS

The site is accessed by the Florida East Coast (FEC) Railway, which runs between Miami and Jacksonville, Florida.

4.2.4 AIR

The Miami International Airport is 3 miles southeast of the site, and the Opa-locka Airport/Metro-Dade General Aviation facility is located 6 miles to the northeast.

12

4.3 CLIMATE

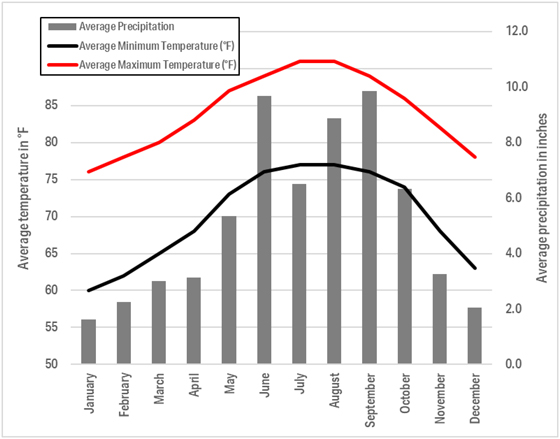

The site is in South Florida, which has a tropical climate. The area receives 61.9 inches of precipitation annually, on average (U.S. Climate Data, 2024). Figure 4-1 shows the average minimum and maximum monthly temperature and the average monthly precipitation from 1981 to 2010 in Miami-Dade County.

The mine remains in operation year-round, largely unaffected by the climate. Hazardous weather that may affect mine operations occurs occasionally throughout southern Florida in the form of severe winds, severe hail, and tornados (NWS, 2005). Flooding induced by hurricane activity is generally restricted to coastal areas.

Figure 4-1. Miami-Dade County Temperature and Precipitation Data Recorded from 1981-2010 (U.S. Climate Data, 2024).

4.4 INFRASTRUCTURE

Because of its proximity to the Miami-Dade County metropolitan area, the site has access to existing well-developed infrastructure, including potable water, industrial use water wells, power, gas supply, communications, and transportation. Details of the site Infrastructure are included in Section 15. Regional infrastructure is shown in Figure 4-2.

4.4.1 POWER

The plant relies on multiple sources of energy. The fuel for firing the kiln can be 100 percent gas, which is supplied by Florida City Gas. The use of natural gas can be supplemented by alternative fuels (AFs) including tire-derived fuel (TDF), processed engineered fuel (PEF), and recycled oil. Currently, the target is to provide 30 to 35 percent of the fuel requirement from AFs. Electrical supply to the site is provided by FPL via a 40 megawatt (MW) substation.

13

4.4.2 WATER

Industrial water used on site is withdrawn from a series of shallow wells covered under the Consumptive Water Use Permit, as discussed in Section 17. As part of the permit requirements, each well is metered, and reporting of consumptive use is provided to the authority. Potable water is supplied and serviced by the Town of Medley.

4.4.3 PERSONNEL

The site currently employs approximately 450 employees working in cement, aggregates, and ready-mix concrete and block operations. Employees include heavy equipment operators, skilled tradesman, engineers, support personnel, and managers. Accommodation for site employees is available in the nearby communities of Miami-Dade and Broward Counties, as well as the major metropolitan areas of Miami and Fort Lauderdale.

Because of the size of the metropolitan area and the presence of other mining operations, the site has a supply of qualified personnel with the required skill levels.

4.4.4 SUPPLIES

Supplies for plant operations (e.g., equipment, parts) are adequate and available in the region. The Town of Medley is primarily an industrial community with more than 1,800 businesses supporting its industrial and logistics function for the area.

14

Figure 4-2. Regional Infrastructure.

15

5 HISTORY

5.1 PRIOR OWNERSHIP

The site is named after the Pennsylvania Sugar Company, which established sugar cane operations in the area in the early 1900s, and later discovered the rich limestone Resource supporting the sugar cane factory.

Limestone availability was an important factor in establishing the local sugar industry. This limestone was used to manufacture lime and carbon dioxide, which was needed in the refining process. A lime kiln was built exclusively to support the local sugar industry. The lime production was successful, indicating the potential for cement manufacturing.

The site has been in operation as a cement production and aggregate facility since 1962. A record of ownership is provided in Table 5-1. Record of Site Ownership

Table 5-1. Record of Site Ownership

| Year |

Company |

Operations/Activity |

||

| 1919 | Pennsylvania Sugar Company | Constructed lime kiln to support sugar cane operations, quarried limestone to raise ground level | ||

| 1962 | Maule Industries | Constructed cement plant, including three kilns and an aggregate plant | ||

| 1978 | Lone Star Florida Cement Inc. | Cement and construction aggregates production | ||

| 1988 | Tarmac America, Inc. | Cement and construction aggregates production | ||

| 2000 | Tarmac Florida, Inc. | Cement and construction aggregates production | ||

| 2004 | Titan Florida LLC | Cement and construction aggregates production |

5.2 DEVELOPMENT AND EXPLORATION HISTORY

Eight significant cement plant and quarry modernization projects have taken place during the sites history, as shown in Table 5-2.

Table 5-2. Record of Site Improvements and Operational Developments

| Year |

Company |

Summary of Work |

||

| 1962 | Maule Industries | Cement plant constructed | ||

| 2006 | Titan Florida LLC | New kiln, preheater tower, finish mill 6 and packhouse installed | ||

| 2015 | Titan Florida LLC | System installed to consume used tires as fuel | ||

| 2016 | Titan Florida LLC | Aggregates plant reconstructed | ||

| 2017 | Titan Florida LLC | Page 732 Dragline Commissioned | ||

| 2019 | Titan Florida LLC | New natural gas line and hybrid burner installed, enabling coal replacement | ||

| 2020 | Titan Florida LLC | Alternative fuels plant commissioned to fuel clinker plant | ||

| 2021 | Titan Florida LLC | Artificial Intelligence system for kiln operations | ||

| 2023 | Titan Florida LLC | New raw materials storage commissioned | ||

| 2024 | Titan Florida LLC | Marion 7820 dragline commissioned |

16

Table 5-3 presents the recorded geologic exploration campaigns and their target areas. These campaigns confirmed the quantity and quality of limestone required for the continuous operation of the site. Titan has no data or records of exploration before 1978. More information about the campaigns since 1978 and data are presented in Sections 7 and 8.

Table 5-3. Record of Drilling Campaigns and Areas Explored

| Year |

Number of Drill Holes |

Areas Explored |

||

| 1978 | 13 | A, BC, F, G | ||

| 1980 | 4 | I, H, G, F | ||

| 1988 | 3 | BI | ||

| 1992 | 18 | BI, BC | ||

| 1996 | 6 | BC, F | ||

| 1997 | 9 | I, J, F, G, H | ||

| 2000 | 13 | BC, F, G, H, I | ||

| 2020 | 23 | BI, G, H, I | ||

| 2024 | 45 | All areas |

17

6 GEOLOGICAL SETTING, MINERALIZATION, AND DEPOSIT

6.1 REGIONAL GEOLOGY

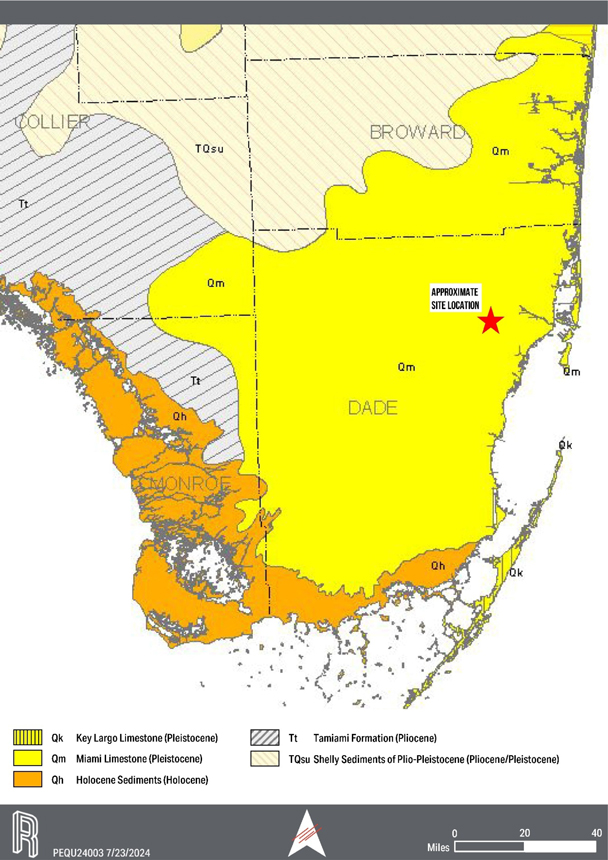

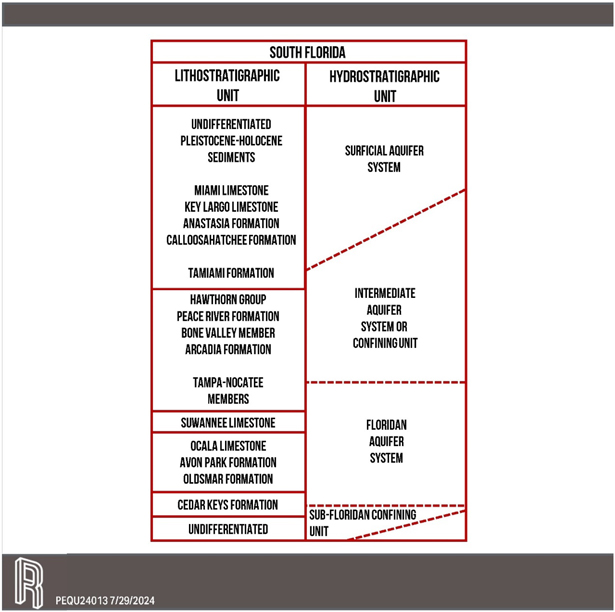

The southern portion of Florida is underlain by up to 20,000 feet of sedimentary rocks ranging in age from the Jurassic Period to the Holocene epoch (170 million years ago to present). Nearly the entire sequence consists of carbonate rock, either limestone or dolomite, with the upper 1,000 feet exhibiting a mixture of carbonates and deltaic clastics (Missimer, 1984). The entire sedimentary sequence was deposited in shallow marine conditions, suggesting that the Florida platform has been slowly subsiding for the majority of its geologic history. Figure 6-1 is adapted from (Scott, 2001) illustrates the surficial geologic units found in southern Florida.

18

Figure 6-1. Geologic Map of Southern Florida (Scott, 2001).

19

6.2 LOCAL GEOLOGY

The Miami Limestone Formation of Pleistocene age (2.58 to 0.01 million years ago) is the dominant surficial bedrock unit along the Atlantic coast in southern Florida. It extends inland, beneath the Everglades, where it is commonly covered by a thin veneer of organic sediments. The upper Miami Formation is composed of nearly spherical carbonate grains, known as ooids, cemented together. This rock type is termed an oolite and is recognized as a distinct zone of the Miami Limestone named the Oolitic facies (Draper, Maurrasse, Gross, & Gutierrez-Alonso, 2006). The lower portion of the Miami Limestone was, until recently, considered its own unit known as the Fort Thompson Formation. This lower portion predominantly consists of white to orangish gray, poorly to well-indurated, sandy, fossiliferous limestone. Fossils present include mollusks, bryozoans, and corals. For this reason, the lower portion is referred to as the Bryozoan facies. Both the upper and lower portions are now, collectively, the Miami Limestone. Underlying the Miami Limestone is the Tamiami Formation of Pliocene age (5.3 to 3.6 million years ago). The Tamiami is a variable mixture of limestone, coquina, quartz sand, and clay (Means, 2022).

6.3 PROPERTY GEOLOGY AND MINERALIZATION

The site geology has been documented through historical drilling programs and reports. The property geology was initially described in a 1997 Tarmac Report (Morse, 1997), which states:

Limestone is extracted from the Miami Oolite and Fort Thompson formations. These formations are composed of very shelly marine and freshwater limestones. The Miami Oolite is a thin layer, less than 6 feet thick, lying directly below an overburden of everglades muck averaging 4 to 6 feet thick. The Fort Thompson underlies the Miami Oolite and averages 55 to 65 feet thick. Underlying this is the Tamiami Formation which is silty sand of little commercial value.

Given the change of formation names by the Florida Geologic Survey, the site geology is best described from the most recent drilling campaigns of 2022 and 2024 as follows:

| | Everglades peat muck, which is a black organic-rich overburden, averaging 3 to 6 feet in thickness |

| | Miami Limestone with an overall thickness averaging 65 to 70 feet, with areas exceeding 80 feet, subdivided into three distinct facies: |

| | Oolitic Upper facies: 5 feet in thickness, comprising a hard white limestone with sandy texture, occasional oolitic sections, highly solutioned, usually infilled with sand silt and clastic rock fragments |

| | Middle facies: averaging 20 to 25 feet in thickness, comprising marine to freshwater limestones of light gray to buff coloring, micritic to fine grained with abundant calcite cemented infilled solution channels |

| | Bryozoan Lower facies: averaging 35 to 40 feet in thickness, comprising a complex sequence of fossiliferous tan to white sandy limestones; hardness varying from soft to hard with texture varying from micritic to medium grained |

| | Observed in some recent cores that recrystallization of the limestone has occurred |

| | Tamiami Formation, which generally underlies the Miami Limestone comprising fine to very fine unconsolidated sands and weakly cemented carbonates, grey to tan to grey-green in color |

The Miami Limestone is the source material for the production of cement and construction aggregates. Previous Resource reports and geological investigations subdivided the Miami Limestone into the Miami Oolite and the Fort Thompson Formations. The Miami Oolite would be synonymous with the Oolitic upper facies previously described. The Fort Thompson would be synonymous with the Middle facies and the Bryozoan facies combined.

20

Given the young geologic age of the formations, little to no geologic structure exists in the strata. The three geologic formations are flat lying with no discernible regional strike and dip. Locally, undulations are present in the lower contact of the Miami Limestone and the Tamiami Formation. Solution cavities infilled with siliceous sands and silts or calcareous infill form the microstructure and influence the chemical composition of the material.

6.4 STRATIGRAPHY AND MINERALOGY

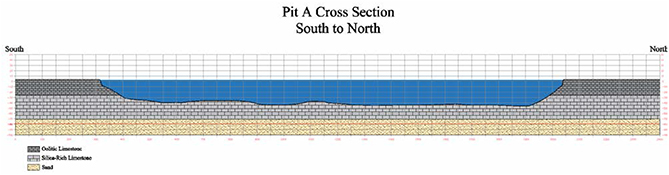

The site stratigraphy is relatively simple given the flat lying geology. The regional stratigraphy is shown in Figure 6-2 and the site stratigraphy is shown in Figure 6-3 cross section of a mining pit.

Figure 6-2. Typical Stratigraphic Column [Modified From (Scott, 2001)].

21

Figure 6-3. Cross Section of the Permitted Area.

The mineralization of the Miami Limestone is based upon the primary depositional environment and the secondary diagenesis involving the creation and infilling of solution channels. This is best observed in the relationship between calcium oxide (CaO) and silica (SiO2). The upper and middle facies combined have a higher CaO percent and lower SiO2 percent when compared to the lower facies. As a result, the upper 30 feet are primarily used for cement kiln feed, and the lower 35 to 40 feet are used for construction aggregates.

22

7 EXPLORATION

7.1 EXPLORATION OTHER THAN DRILLING

7.1.1 GEOPHYSICAL TESTING

The 2024 exploration campaign included down hole geophysics logging to acquire data verification for the in-situ density of the limestone deposit. Two holes were cored and geophysical surveys for density, gamma, and resistivity data were performed.

7.1.2 POND SURVEYS AND BATHYMETRY

Surveys have been completed periodically of the mined areas to determine dig depth and material recovery. As part of the 2024 exploration campaign, a comprehensive survey of the current quarries was completed. This survey provided bathymetry data that were used to calculate the remnant material unmined in each quarry.

7.2 DRILLING PROGRAMS

7.2.1 DRILLING HISTORY

The first recorded drilling campaign at the site was performed in 1978 by Lonestar. Seven drilling campaigns were conducted by previous site owners with differing levels of documentation. Before Titan ownership, databases from drilling campaigns contained core hole data (collar locations, geology, and limited assay information). In addition to this information, drilling campaigns conducted in 1996, 1997, and 2000 also include drill logs.

Titan performed drilling campaigns in 2020 (24 holes) and in 2021 (8 holes) using sonic drilling methods to validate the geology of the deposit. Drill logs, collar information, and assay data were assessed and documented for the holes. The three drilling campaigns are summarized in Table 7-1.

Table 7-1. Exploration Drilling

| Year |

# of Holes |

Description |

||

| 2020 | 24 | Sonic drilling to validate geology; areas: BC, F, G, H, I | ||

| 2021 | 8 | Sonic drilling to validate geology; areas: BI, G, H, I | ||

| 2024 | 43 | Sonic drilling for data verification and to better define the geologic model; all areas |

7.2.2 2020 AND 2021 DRILLING CAMPAIGNS

The 2020 and 2021 drilling campaigns were conducted for broad validation of geology for operational purposes. Detailed logging was not completed, and composite samples were collected for laboratory analysis and were based on mining horizon. Recovery was not recorded.

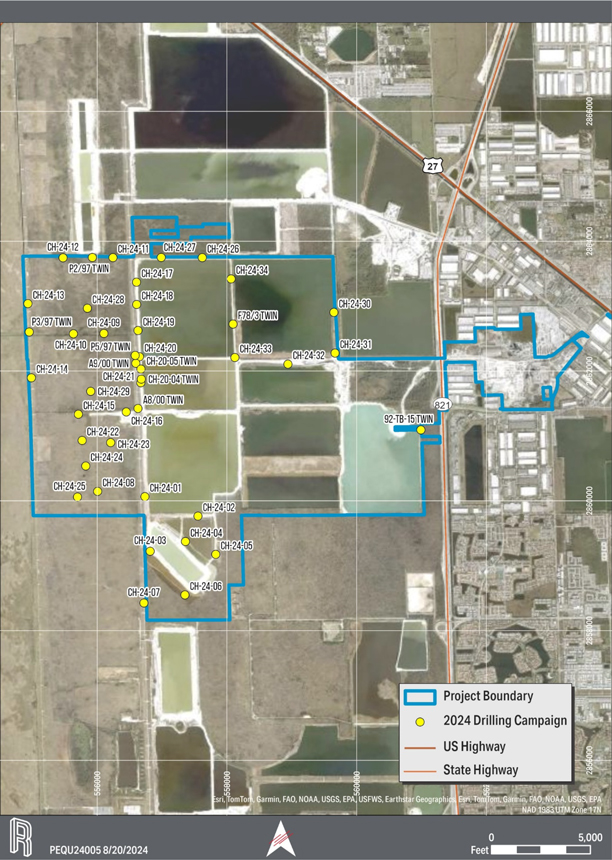

7.2.3 2024 DRILLING CAMPAIGN

The 2024 drilling campaign consisted of 43 holes across the site. Nine of the holes were drilled to twin previous holes for data verification. The other 34 holes were sited to better define the existing model or to cover areas with no subsurface data. The drilling contractor, Cascade Environmental, provided three sonic rigs to

23

complete the drilling campaign. All holes were drilled with a 4-inch diameter core barrel and a 6-inch casing where necessary, using 5-foot core runs. The CPI protocol for logging and storage was adhered to by the team of field geologists. The total footage drilled was 3,830 feet with an average sample recovery of 77 percent.

Figure 7-1 shows a plan view map of the site with drill holes.

24

Figure 7-1. Plan View Map of the 2024 Drilling Campaign.

25

7.3 HYDROGEOLOGY INFORMATION

No site-specific hydrogeology investigations or studies are known to exist. More comprehensive studies by the U.S. Geological Survey (Cunningham, Wacker, Robinson, Dixon, & Wingard, 2006) supported the 2009 Supplemental EIS on rock mining over the broader Lake Belt region (USACE, 2009), which supported subsequent permitting and addressed mitigation requirements.

7.4 GEOTECHNICAL INFORMATION

No geotechnical studies for excavation design are known to have been conducted for the site. Studies are not considered necessary because of the relatively shallow excavations and mining method where a buffer of shot rock at angle of repose lays against the unshot wall. The geology is less prone to dissolution features than limestones in central Florida, and no significant stability problems are known to have occurred over many decades of operation.

26

8 SAMPLE PREPARATION, ANALYSES, AND SECURITY

8.1 SAMPLE PREPARATION AND ANALYSES

8.1.1 2000 DRILLING PROGRAM

A drilling program was completed to test the cement plant blend silica (SiO2) content and construction aggregate material. This drilling program was conducted with a sonic coring rig operated by Boart Longyear. The program consisted of 13 holes of which 1,200 feet were cored and 1,093 feet were recovered, resulting in a recovery of 91 percent.

The cores were sampled at 2-foot intervals and split. One set of samples was sent to the on-site laboratory, and the other set was stored for future use. The samples were tested for SiO2 content using a standard acid insolubility test.

8.1.2 2001 TESTING PROGRAM

This campaign was conducted by Titan. The stored samples from the 2000 drilling campaign were reevaluated using the following procedure.

Roughly 300 feet (40 core sections) were resampled to provide complete coverage of the dataset. During the resampling of cores, reconstructing the deposit strata geology was possible to better understand the raw materials lithologic character. The on-site laboratory prepared all sieve analyses under these instructions. Each sample was washed/screened and sieved in three sizes of recorded weights:

| | +10 mesh size |

| | -10 + 200 mesh size |

| | -200 mesh size |

The samples were prepared and shipped to the Kamari Cement Plant laboratory facility in Greece to undergo a full chemical analysis.

8.1.3 2024 DRILLING PROGRAM

Cascade Environmental provided three drills for 14 days during the 2024 drilling campaign. Titan personnel identified the drill hole locations and provided access to the drillers based on the design provided by CPI. The drilled cores were bagged and placed near the drill holes for CPI to log.

CPI conducted comprehensive field-core logging across 43 drill holes, equivalent to 3,830 feet of drilling activity. On site, the core samples were bisected using a saw. The prepared samples were then dispatched to CTL Group (CTL) and Universal Engineering Services (UES), independent construction materials laboratories, for core hole testing.

All samples were split, and the half samples were stored in a locked container at the site. CPI supervised the storage of the samples.

Both laboratories (CTL and UES) are accredited by AASHTO ISO/IEC 17025 and have a validated USACE laboratory status. Additionally, CTL has ISO 9001 certification.

27

Ten-foot limestone core specimens were transported for chemical analysis using X-ray fluorescence (XRF) techniques. One sample underwent specific gravity testing on rock and clay components for every 10 limestone samples. Sample preparation followed the procedures outlined in ASTM C50. Chemical analysis was performed according to the guidelines set by ASTM C1271, while specific gravity evaluations followed the standards of ASTM C127.

8.1.3.1 CTL LABORATORY PROTOCOL

CTL received 12 of 43 borings directly from CPI with an additional 161 crushed samples received from UES. CTL adhered to the following protocol on 359 samples prepared; 22 samples followed AASHTO T84, 24 samples followed AASHTO T85, and 359 samples were XRF analyzed.

| | Sample Labeling and Splitting: |

| | The received samples were logged in the CTL laboratory information management system, and all bags were labeled accurately. |

| | All samples were dried at 110 degrees Celsius overnight. The weight of the dried samples and the as-received sample were recorded. |

| | Depending on whether specific gravity testing was required, two procedures were employed. |

| | Specific Gravity Testing: |

| | All samples were sieved through a #4 mesh sieve. The entire original sample was sieved. |

| | Weights of the passing and retained sieve size fractions were determined and recorded for each sample. |

| | A composite sample for XRF analysis was obtained from passing and retained fractions and sent to the chemistry laboratory for crushing, pulverizing, and XRF testing. |

| | The coarse size fraction (retained on the #4-mesh sieve) was treated as a #57 stone for the T85 testing. |

| | The sample passing #4 mesh sieve was treated as T84 (when applicable). |

| | Any material not used in the T84/T85 testing was stored separately as plus #4 and minus #4 sieve sizes, and materials used in the T84/T85 were also stored separately. |

| | Chemical Testing Only Specified: |

| | The dried as-received sample was split into two halves. One sample half was submitted for chemical preparation/testing, and the other half was saved and stored on site. Any remnant sample material from laboratory testing was returned to the site and is securely stored. |

| | Chemistry Laboratory Sample Preparation and Testing: |

| | Samples submitted to the chemistry laboratory were crushed using a jaw crusher. This operation was performed on composite samples (from specific gravity testing) and half of the original samples for chemical analysis only. |

| | The crushed portion of each sample was subsampled (using a standard splitter), and 100-gram specimens were ground to a minus 100 sieve for XRF analysis. |

| | Pulverized minus 100 material was mixed with flux (lithium metaborate) and fused to prepare a bead for XRF analysis. |

| | XRF analysis was performed on the fused bead. |

28

8.1.3.2 UES LABORATORY PROTOCOL

Of the 534 samples processed, UES adhered to the following protocol: 373 samples were XRF tested by American Engineering Testing (AET) (UESs Subcontracted Laboratory), and 161 samples were XRF tested by CTL.

The laboratory tests performed were AASHTO T27 to determine percent of +/- #4 material, AASHTO T84 Fine and T85 Coarse Specific Gravity & Absorption, and (AET) performed the Chemical Analysis by XRF.

The following process was implemented after samples were received and logged:

| | Oven-dry the sample to constant weight. Record total oven-dry sample weight. |

| | Sieve entire sample over #4 sieve and record weight retained and passing to determine percent of each (AASHTO T27). |

| | Prepare a representative sample of a minimum of 25 grams for XRF based on percent of plus #4 and minus #4. |

| | Ship XRF samples overnight to AET for testing. |

| | Perform AASHTO T85 Specific Gravity & Absorption on the Coarse Aggregate (plus #4 material) |

| | Perform AASHTO T84 Specific Gravity & Absorption on the Fine Aggregate (minus #4 material) |

AET protocols for XRF testing were:

| | Subsample the crushed portion of each received sample (using a standard splitter), and grind specimens to a minus 100 sieve for XRF analysis. |

| | Mix pulverized minus 100 material with flux (lithium metaborate) and fuse to prepare a bead for XRF analysis. |

| | Performed XRF analysis on the fused bead. |

| | Follow ASTM C114-22. |

8.1.4 2024 GEOPHYSICAL DRILLING PROGRAM

Coring and drilling, combined with geophysical logging, were performed at two additional drill hole locations at the site. These two drill holes were contracted with Lapis Global Consulting (Lapis). Through subcontracts to Lapis, J&R Precision Drilling provided coring and drilling services, and Marshall Miller & Associates and RMBAKER LLC provided geophysical logging services. The outcome from this program was used to aid in the development of the in-situ density for the limestone body.

8.2 QUALITY ASSURANCE/QUALITY CONTROL

Numerous drilling campaigns have been conducted at the property. Nine of the holes drilled during these campaigns were used to validate the geology and assimilate older data.

Assays before 2020 were not used because of unknown testing methodology. Assays for the 2020 drilling were used after verification of the data from two twinned drill locations.

The QP additionally noted that many previous drilling locations have since been mined and using past mining records verified the geologic model. These mined areas produced both cement grade and construction aggregate limestone.

29

For verification of the 2024 campaign, a random selection of 12 percent of the samples tested by CTL and UES were sent to Bowser Morner in Dayton, Ohio. A total of 92 samples were sent for verification and results fell within the standard deviation for the major component oxides in the low silica limestone:

| | SiO2 Mean = 6.47%, S.D. = 1.23 |

| | CaO Mean = 50.34%, S.D. = 1.06 |

| | Al2O3 Mean = 0.50%, S.D. = 0.14 |

| | MgO Mean = 0.61%, S.D. = 0.08 |

Limited variogram or geostatistical validation was completed for the site because the mine has operated for more than 40 years and the geology and chemistry is not complicated, is well understood, and has little variation.

8.3 OPINION OF THE QUALIFIED PERSON ON ADEQUACY OF SAMPLE PREPARATION

The QP opines that additional data verification is not necessary at this site because of the extensive surface and subsurface data available.

30

9 DATA VERIFICATION

The 2024 drilling campaign served as data verification of the older drilling and sample testing performed by others over the history of the operation. The analytical procedures of the 2020 and newer campaigns are comparable with modern procedures, and four 2024 drill hole locations were twinned with drill holes from 2020, which allowed for strong matching between geologic units and chemical analyses.

Older drill data were examined, but data verification was much weaker. Data from these older drill holes were reviewed for any major anomalies and overall site history rather than solid geochemical data. Often the old material that was recovered had been completely mined through since the old holes were drilled. Additionally, analytical methods have evolved and improved over time as well, and direct comparisons would not be as exact as desired. Geologic interpretation was made possible based on the detailed core logs, which were completed by experienced geologists. For verification of geology, five pre-2000 holes were twinned.

The confidence in the pre-2024 drilling campaigns is high based on the historical mining and production of cement and construction aggregates.

9.1 OPINION OF THE QUALIFIED PERSON ON DATA ADEQUACY

The QP opines that the adequacy of the data for the purposes used in this TRS is accurate and sufficient. The QP has determined that all referenced data in this TRS and all subsequent modeling meets industry quality standards for the purposes used in the estimation of Resources and Reserves.

31

10 MINERAL PROCESSING AND METALLURGICAL TESTING

The aggregate and cement plants have operated successfully for 63 years. The original testing for the processing system is no longer available. The QPs opinion is that no additional testing is necessary to have confidence in the estimation of Resources or Reserves because the mine has been successfully producing cement products using the processing plant installed at the site which has undergone numerous upgrades under the current ownership. The QP also notes that adequate quality control procedures are established to ensure the production of quality products.

32

11 MINERAL RESOURCE ESTIMATES

11.1 DEFINITIONS

A Mineral Resource is an estimate of mineralization, considering relevant factors such as cut-off grade, likely mining dimensions, location, or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable.

Mineral Resources are categorized based on the level of confidence in the geologic evidence. According to 17 CFR § 229.1301 (2021), the following definitions of Mineral Resource categories are included for reference:

An Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. An Inferred Mineral Resource has the lowest level of geological confidence of all Mineral Resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability. An Inferred Mineral Resource, therefore, may not be converted to a Mineral Reserve.

An Indicated Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. An Indicated Mineral Resource has a lower level of confidence than the level of confidence of a Measured Mineral Resource and may only be converted to a Probable Mineral Reserve. As used in this subpart, the term adequate geological evidence means evidence that is sufficient to establish geological and grade or quality continuity with reasonable certainty.

A Measured Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. As used in this subpart, the term conclusive geological evidence means evidence that is sufficient to test and confirm geological and grade or quality continuity.

11.2 KEY ASSUMPTIONS, PARAMETERS AND METHODS

11.2.1 RESOURCE CLASSIFICATION CRITERIA

Each drill hole data point within the model was defined with an influencing area or radius of influence (ROI) for Mineral Resource classification into either Inferred, Indicated, or Measured categories in increasing levels of confidence. The ROI for each category is listed as follows:

| | Inferred 5,280 feet |

| | Indicated 2,640 feet |

| | Measured 1,320 feet |

11.2.2 MARKET AND ECONOMIC ASSUMPTIONS

As an ongoing operation with decades of sales history, the market and economics is detailed in Section 17 and 19. The majority of the Resources are converted to Reserves, and details of the economic parameters are presented in Section 12.

33

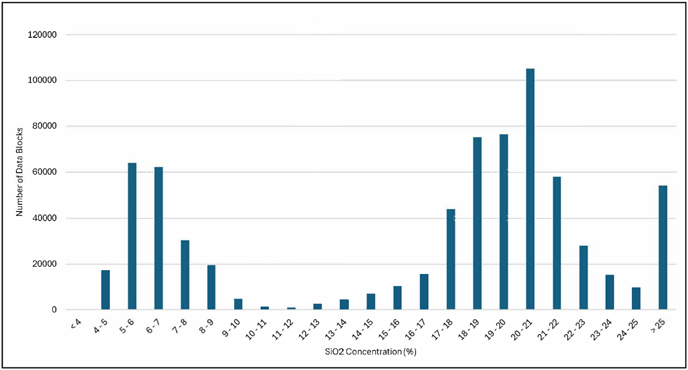

11.2.3 CUT-OFF GRADE

The limestone material mined on site is suitable for both cement and construction aggregate production. As such, a true cut-off grade does not exist, but Titan has set a raw mix target of 12 percent SiO2 for cement plant usage. The low silica upper part of the deposit defined by geology and geochemistry has a mean of 6.47 percent with a standard deviation of 1.23 percent, and this material can be used to meet the targeted 12 percent SiO2. Figure 11-1 illustrates the SiO2 distribution of the deposit.

Figure 11-1. Silica distribution in the deposit.

No grade considerations exist for limestone use as construction aggregate. Economic cut-off is not a factor because all material has approximately the same strip ratio.

All Resources are converted to recoverable at the surge pile utilizing a 95% recovery. There is a 5% loss attributed to mining and primary crushing of the material.

34

11.2.4 SUMMARY OF RESOURCE MODEL PARAMETERS

Key assumptions and parameters applied to estimate Mineral Resources are included in Table 11-1.

Table 11-1. Parameter Assumptions

| Modifying Factor |

Parameter |

|

| Proximity to Sample Point or ROI - Inferred | 5,280 feet | |

| Proximity to Sample Point or ROI - Indicated | 2,640 feet | |

| Proximity to Sample Point or ROI - Measured | 1,320 feet | |

| Property Offset (include slopes if applicable) | Variable | |

| Infrastructure Protection Offset | 100-foot minimum | |

| Mineability | Reasonably expected to be feasible to mine | |

| Depth | Bottom of limestone or maximum -80 feet NGVD | |

| Recovery Loss to Surge Pile | 5% |

11.3 RESOURCE MODEL

11.3.1 GEODATABASE

The geodatabase was developed through the assimilation of all existing drill hole data including both geology and assays. The data were checked for completeness and accuracy through the twinning of older datasets. In all cases, the geology of the older datasets wa

s usable, but not all assays were used because of unknown testing methodology (i.e., wet chemistry versus XRF) or testing on large composite samples.

11.3.2 GEOLOGIC AND GEOCHEMICAL MODEL

From the database geologic three-dimensional surfaces and solids were created to define the ore body. These models were created through a combination of hand drawn data points, drill holes, and triangulated irregular network modeling. The units are defined as:

| | Overburden Black brown organic peat, waste material |

| | Low Silica Limestone Ore with SiO2 less than 12 percent suited for cement kiln feed, oolite zone comprising of the upper and middle facies of the Miami Limestone |

| | High Silica Limestone Ore with SiO2 greater than 12 percent suited for construction aggregates, bryozoan zone equivalent to the lower facies of the Miami Limestone |

| | Sand Unmined non-ore SiO2 sand |

A geochemical three-dimensional block model was created using assay data and the geology model. The block model built in SURPAC software encompassed the entire site with each block containing important geospatial and geochemical parameters. The block model measured 23,040 × 23,360 feet and 100 feet vertically.

35

Block sizes were variable in size with the largest blocks measuring 40 × 40 × 10 feet and the smallest 10 × 10 × 2.5 feet. The total block count is 30,650,856 blocks. The following parameters were modeled:

| | Lithology |

| | Al2O3 |

| | CaO |

| | Cr2O3 |

| | Fe2O3 |

| | K2O |

| | MgO |

| | Mn2O3 |

| | NaO2 |

| | SiO2 |

| | SO3 |

| | TiO2 |

| | ZnO |

| | LOI |

All parameters were modeled or interpolated through inverse distance square using a search ellipse with a 20H:1V.

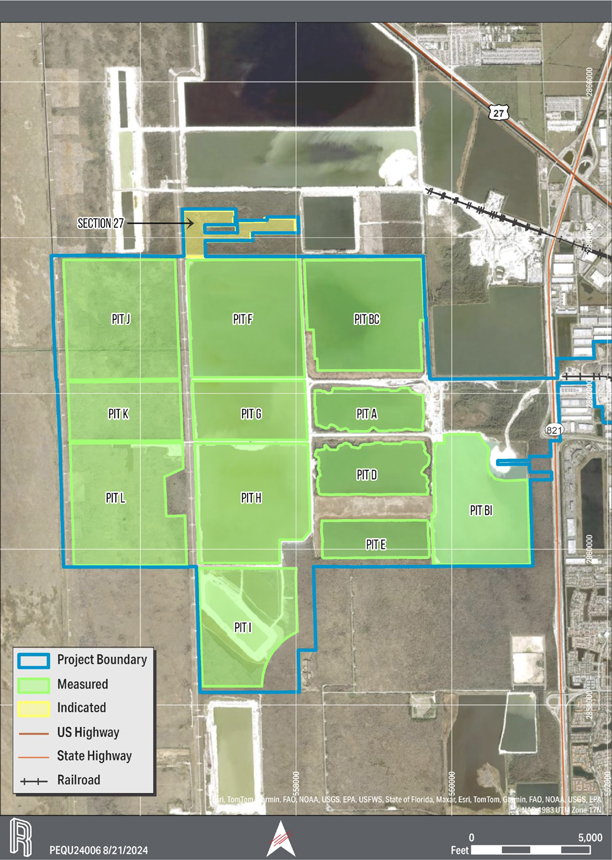

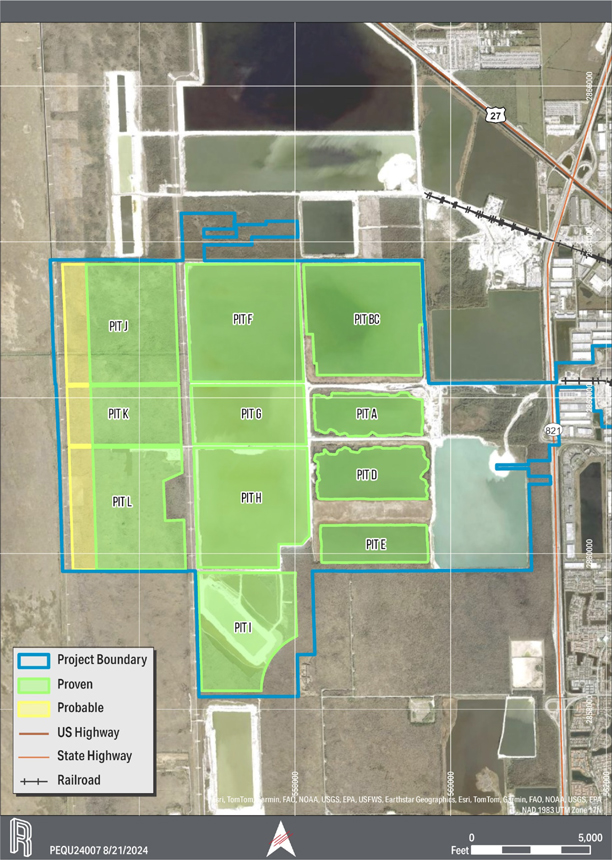

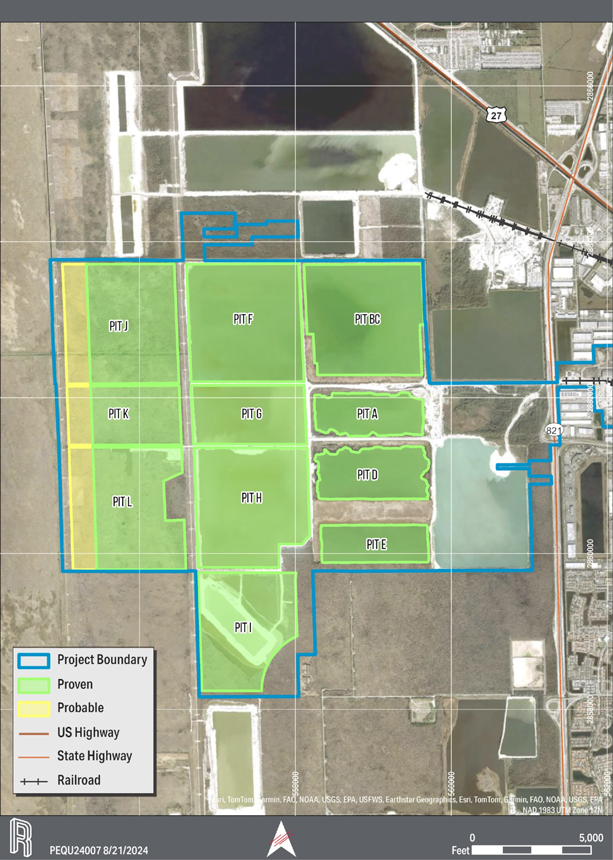

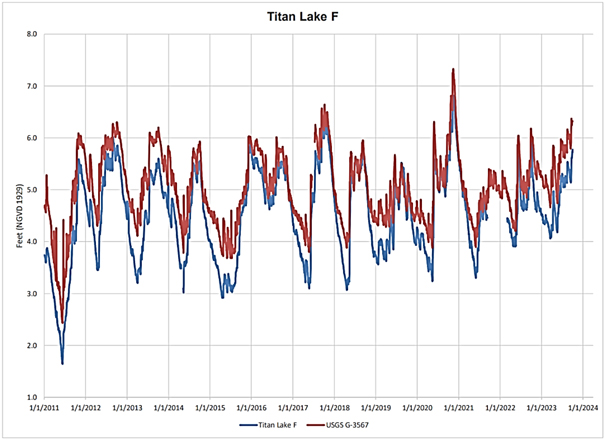

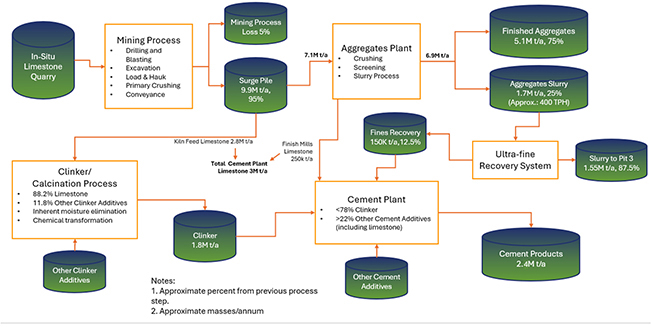

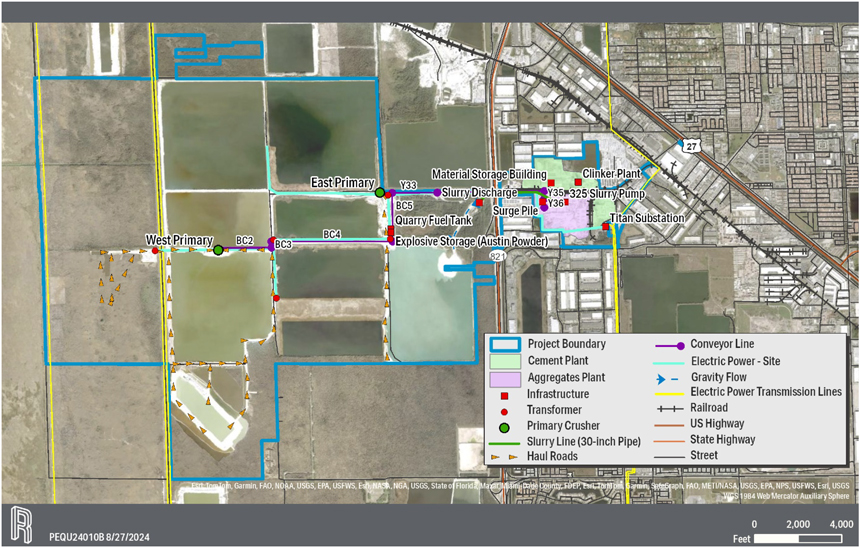

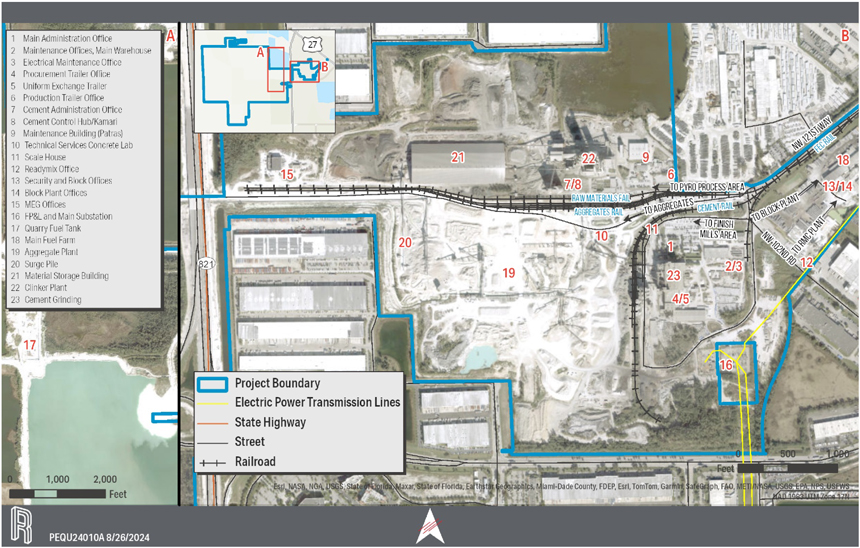

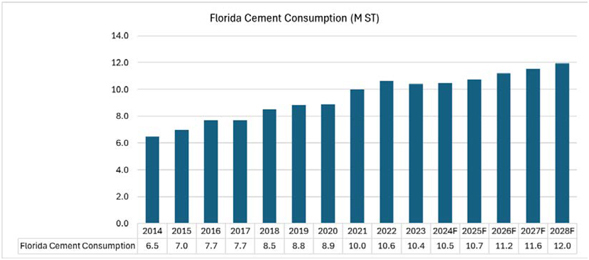

11.3.3 RESOURCE AREA DESCRIPTION