424B1: Prospectus filed pursuant to Rule 424(b)(1)

Published on February 7, 2025

Table of Contents

Filed pursuant to Rule 424(b)(1)

Registration No. 333-284251

PROSPECTUS

24,000,000 Shares

Titan America SA

Common Shares

This is an initial public offering of the common shares, no nominal value per share (common shares), of Titan America SA (TASA). We are offering 9,000,000 common shares. Titan Cement International SA, (the selling shareholder), is offering 15,000,000 common shares. We will not receive any of the proceeds from the common shares sold by the selling shareholder in this offering.

The initial public offering price is $16.00 per common share. Currently, no public market exists for our common shares. Our common shares have been approved for listing on the New York Stock Exchange (NYSE) under the symbol TTAM.

The selling shareholder has granted the underwriters an option for a period of 30 days after the date of this prospectus to purchase up to an additional 3,600,000 common shares from the selling shareholder at the initial public offering price less the underwriting discounts and commissions.

Upon completion of this offering, the selling shareholder will hold approximately 87% of the voting rights of our outstanding share capital immediately, assuming no exercise of the underwriters option to purchase additional common shares. As a result, we will be a controlled company as defined under the NYSE corporate governance requirements. See Risk Factors and ManagementCorporate GovernanceDirector Independence and Controlled Company Exception for additional information.

We are a foreign private issuer under applicable Securities and Exchange Commission rules, and as a result, will be subject to reduced public company reporting requirements for this prospectus and future filings with the Securities and Exchange Commission.

Our business and an investment in our common shares involve significant risks. You should carefully consider the risks that are described under the caption Risk Factors beginning on page 32 of this prospectus before making a decision to invest in our common shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share |

Total | |||||||

| Initial public offering price |

$ | 16.00 | $ | 384,000,000 | ||||

| Underwriting discounts and commissions(1) |

$ | 0.80 | $ | 19,200,000 | ||||

| Proceeds, before expenses, to us |

$ | 15.20 | $ | 136,800,000 | ||||

| Proceeds, before expenses, to the selling shareholder |

$ | 15.20 | $ | 228,000,000 | ||||

| (1) | See Underwriting for additional information regarding total underwriter compensation. |

The underwriters expect to deliver our common shares to purchasers against payment on or about February 10, 2025.

Joint Book-Running Managers

(*in alphabetical order)

| Citigroup* | Goldman Sachs & Co. LLC* |

Bookrunners

| BofA Securities | BNP PARIBAS | Jefferies | HSBC | SOCIETE GENERALE | Stifel |

February 6, 2025

Table of Contents

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 32 | ||||

| 69 | ||||

| 71 | ||||

| 72 | ||||

| 73 | ||||

| 75 | ||||

| MANAGEMENTS DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

76 | |||

| 116 | ||||

| 127 | ||||

| 174 | ||||

| 183 | ||||

| 187 | ||||

| 191 | ||||

| 193 | ||||

| 206 | ||||

| 207 | ||||

| 213 | ||||

| 216 | ||||

| 222 | ||||

| 223 | ||||

| 224 | ||||

| 225 | ||||

| F-1 |

Through and including the 25th day after the date of this prospectus, all dealers that effect transactions in our common shares, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers obligations to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

Neither we, the selling shareholder nor any of the underwriters have authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we may have referred you. We, the selling shareholder and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we, the selling shareholder nor any of the underwriters are making an offer to sell the common shares in any jurisdiction where the offer or sale is not permitted. This offering is being made in the United States and elsewhere solely on the basis of the information contained in this prospectus. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of the common shares. Our business, financial condition, results of operations and prospects may have changed since the date on the front cover of this prospectus.

Table of Contents

Unless otherwise indicated or unless the context otherwise requires, (a) all references in this prospectus to the Company, Titan America, we, us, our or similar terms refer to Titan America SA and its subsidiaries, following the contribution of Titan Atlantic Cement Industrial and Commercial S.A. (Titan Atlantic) to Titan America SA (the Contribution) in connection with the Reorganization Transactions (as defined below), (b) all references to TASA refer to Titan America SA and not its subsidiaries and (c) all references to Titan Cement International and our Parent refer to Titan Cement International SA, Titan Americas ultimate parent, and its consolidated subsidiaries other than Titan America and Titan Americas subsidiaries. All references to shares or common shares in this prospectus refer to the common shares of Titan America SA, no nominal value per share. Unless otherwise indicated, all references to tons in this prospectus refer to short tons. In connection with the completion of this offering, we will complete certain reorganization transactions and related transactions with Titan Cement International, as more fully described under Prospectus SummaryThe Reorganization Transactions (the Reorganization Transactions). Unless otherwise stated or the context otherwise requires, all information in this prospectus reflects the completion of the Reorganization Transactions and this offering. In addition, after the Contribution, on January 1, 2025 Titan America LLC divested its wholly-owned subsidiaries, ST Equipment & Technology LLC and ST Equipment & Technology Trading Company LLC (collectively, the STET segment) in a sale for cash, to be settled no later than January 31, 2025, to Titan Cement Netherlands B.V., a wholly-owned subsidiary of Titan Cement International, which is outside the scope of this offering. The STET segment is a nonreportable operating segment included in the Companys historical financial results.

The data included in this prospectus regarding markets and the industry in which we operate, including the size of certain markets and our position and the position of our competitors within these markets, are based on reports of government agencies, independent industry sources such as Dodge Construction Network, an independent business analysis and consultancy group focused on the commercial construction sector, the Portland Cement Association, a non-governmental cement industry association, Cement Products Magazine, an independent industry publication, and other research consultants, as well as our own estimates relying on our managements knowledge and experience in the markets in which we operate. Our managements knowledge and experience is based on information obtained from our customers, distributors, suppliers, trade and business organizations and other contacts in the markets in which we operate. We believe these estimates to be accurate as of the date of this prospectus. However, the assumptions and estimates of our and our industrys future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in Risk Factors. These and other factors could cause future performance to differ materially from our assumptions and estimates and those of independent third parties. See Special Note Regarding Forward-Looking Statements. While we believe our internal research is reliable and the definitions of our market and industry are appropriate, neither such research nor these definitions have been verified by any independent source.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

We own or have rights to trademarks, trade names or service marks that we use in connection with the operation of our business. Solely for convenience, the trademarks, trade names and service marks referred to in this prospectus are listed without the ® and TM symbols, but we will assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, trade names and service marks.

PRESENTATION OF FINANCIAL INFORMATION

This prospectus includes financial information which has been derived from TASAs audited consolidated financial statements as of December 31, 2023 and 2022 and for the years ended December 31, 2023, 2022 and

1

Table of Contents

2021, TASAs unaudited interim condensed consolidated interim financial statements as of September 30, 2024 and for the nine months ended September 30, 2024 and 2023, and the related notes, which are collectively referred to as consolidated financial statements or financial statements, and can be found beginning on page F-1 of this prospectus.

We maintain our books and records in U.S. dollars. We prepare our audited consolidated financial statements in accordance with International Financial Reporting Standards (IFRS Accounting Standards) as issued by the International Accounting Standards Board (IFRS). The definition of IFRS also encompasses all valid International Accounting Standards, as well as all interpretations of the International Financial Reporting Interpretations Committee, including those formally issued by the Standing Interpretations Committee. None of the consolidated financial statements in this prospectus were prepared in accordance with accounting principles generally accepted in the United States (U.S. GAAP). In this prospectus, unless otherwise specified, all monetary amounts are in U.S. dollars and all references to $ mean U.S. dollars.

We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that precede them.

We have historically conducted our business through Titan America LLC (a wholly-owned subsidiary of Titan Atlantic) and Titan America LLCs subsidiaries. Titan America SA has not commenced operations and has nominal assets and liabilities. Upon completion of the Reorganization Transactions prior to the completion of this offering, Titan Atlantic will become a subsidiary of Titan America SA. Our financial statements present the historical financial position and results of operations of Titan Atlantic and its consolidated subsidiaries, including Titan America LLC and its subsidiaries.

We refer to the terms Adjusted EBITDA, Free Cash Flow, Net Debt and Ratio of Net Debt to Adjusted EBITDA in various places in this prospectus. These are supplemental financial measures that are not prepared in accordance with IFRS and should not be viewed as a substitute for IFRS measures. Although our management uses these non-IFRS financial measures when planning, monitoring and evaluating our performance, any analysis of non-IFRS financial measures should be used only in conjunction with results presented in accordance with IFRS. The non-IFRS financial measures we present may not be comparable to similarly-named measures reported by other companies.

We define Adjusted EBITDA as net income before finance cost, net, income tax expense, depreciation, depletion and amortization, further adjusted to remove the impact of additional items such as (gain)/loss on disposal of fixed assets, asset impairment (recovery)/loss, foreign exchange (gain)/loss, net, derivative financial instrument (gain)/loss, net, fair value loss on sale of accounts receivable, net, share-based compensation and other non-recurring items, including certain IPO transaction costs associated with this offering. Net income is the IFRS measure most directly comparable to Adjusted EBITDA.

Free Cash Flow is comprised of net cash provided by operating activities, less net payments for capital expenditures, which includes (i) investments in equipment, (ii) investments in identifiable intangible assets and (iii) proceeds from the sale of assets, net of disposition costs. The IFRS measure most directly comparable to Free Cash Flow is net cash provided by operating activities.

Net Debt comprises the sum of short and long-term borrowings, including accrued interest and current and non-current lease liabilities less cash and cash equivalents. Net Debt is used by management to measure the effective level of our indebtedness.

We define the Ratio of Net Debt to Adjusted EBITDA as the ratio derived by dividing Net Debt by Adjusted EBITDA.

2

Table of Contents

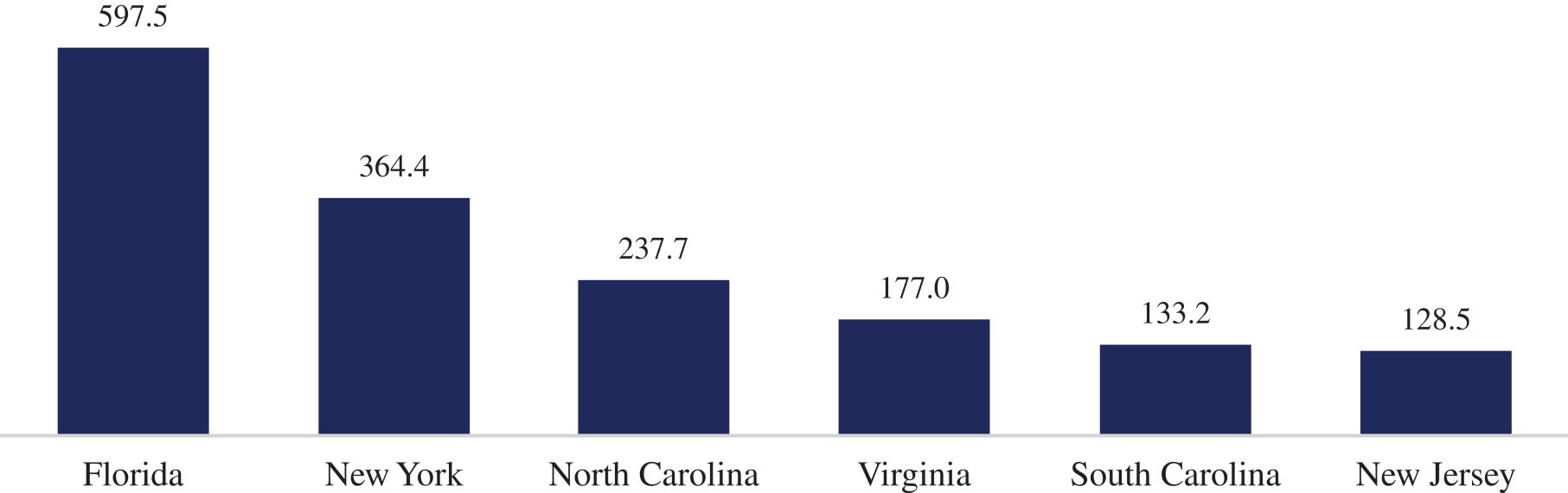

Company Introduction

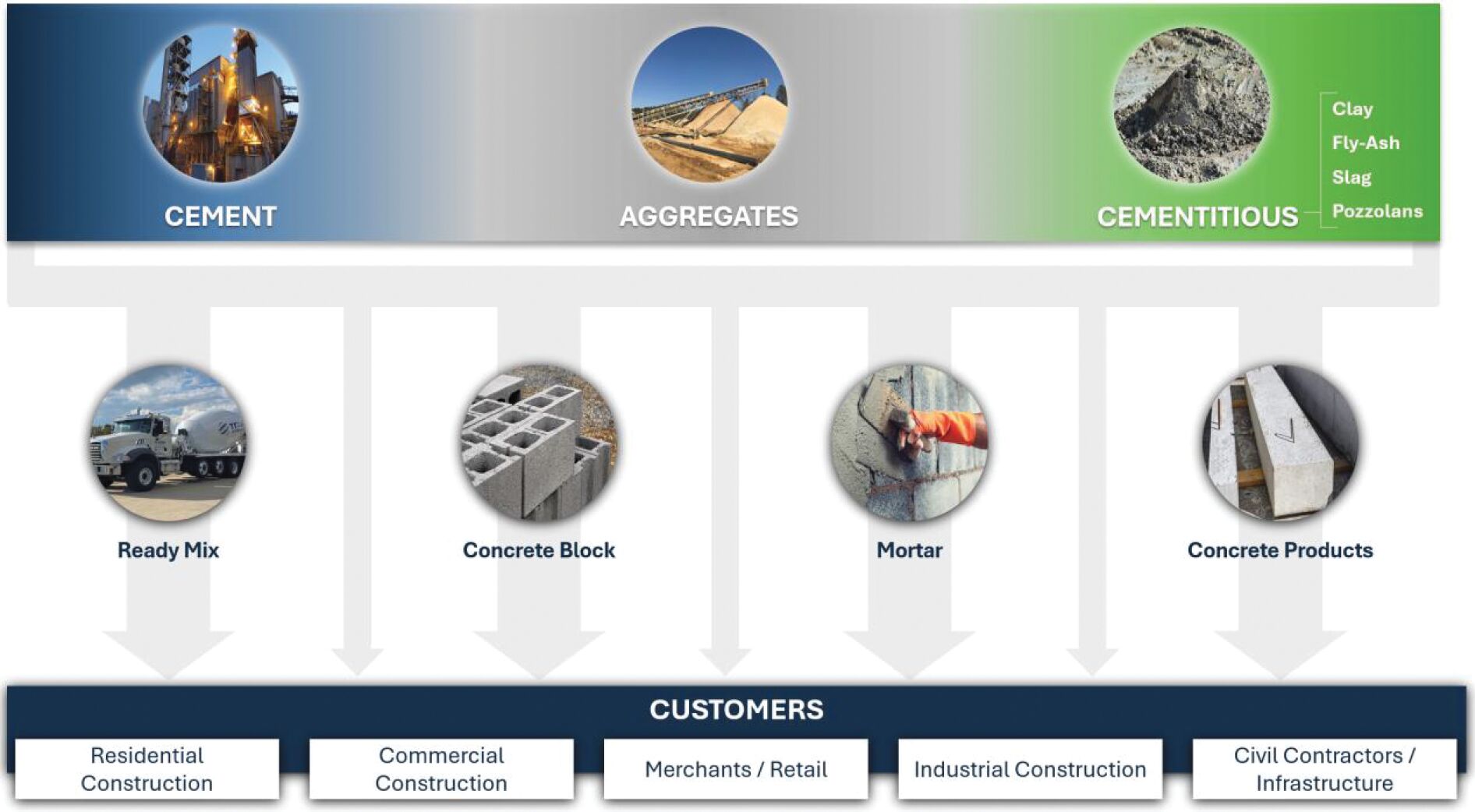

Titan America is a leading vertically integrated, multi-regional manufacturer and supplier of heavy building materials and services operating primarily on the Eastern Seaboard of the United States (the Eastern Seaboard). We are a leading provider of materials that contribute to lower carbon emissions than traditional building materials and/or beneficial reuse of waste materials. We are a leading provider of heavy building materials in Florida, the New York and New Jersey Metropolitan area (Metro New York), Virginia, North Carolina and South Carolina (Virginia and the Carolinas, together with Metro New York and their adjacent areas, the Mid-Atlantic). We serve markets that benefit from population growth, economic growth and technology and innovation trends that are among the strongest in the United States.

We have built what we believe is a unique and differentiated building materials platform in the markets we serve. Today, our manufacturing, logistics and customer support capabilities span across critical building materials and products, including cement and supplementary cementitious materials (SCMs), aggregates, ready-mix concrete, concrete block and other ancillary products. Additionally, we believe that our market leadership in lower carbon cement and green concrete solutions positions us to benefit from growing demand for building materials that contribute to lower carbon emissions. We believe our vertically integrated business model and continued investment in our extensive logistical capabilities have enabled us to grow with our diverse customer base across infrastructure, residential and non-residential end markets. By leveraging these competitive advantages across our two reportable segments, the Mid-Atlantic and Florida, we believe that we are in a strong position to drive meaningful growth and enhanced profitability into the future.

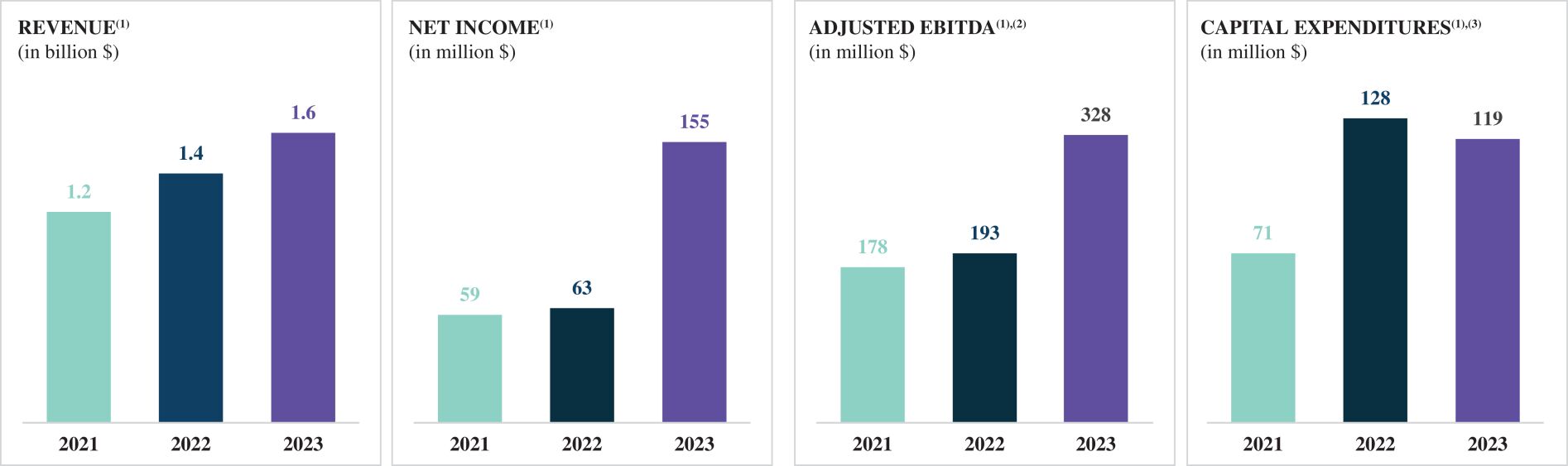

Our executive management team has led Titan America to experience growth in scale, product portfolio and geographic footprint. This growth was driven by our management teams targeted investment strategy, which has enhanced production capacity and strengthened distribution and logistics capabilities in high-growth markets. These efforts include expanding cement and SCM storage, scaling import capacity and leveraging digital investments to optimize logistics execution and boost asset reliability across our vertically integrated operations. Between fiscal years 2013 and 2023, we have grown our sales from $539 million to approximately $1.6 billion (an 11% compound annual growth rate (CAGR)), our net income went from a loss of $65.4 million to a positive $155.2 million and our Adjusted EBITDA increased from $36 million to $328 million (a 25% CAGR), while our net income margin has grown from negative 12% to positive 10% during that same period.

As a result of our continuous investment program to modernize and scale our operations, we have experienced 50% revenue growth, 150% net income growth and 65% Adjusted EBITDA growth from fiscal 2019 to fiscal 2023. Additionally, we have reduced our cement operations CO2 emissions per metric ton of cementitious materials by 18%, from 718 kg of net CO2 per metric ton in 2019 to 587 kg of net CO2 per metric ton in 2023.

Our scaled, vertically integrated network of more than 100 facilities includes some of the largest cement plants, import terminals, mines, ready-mix concrete plants, fly ash processing plants and concrete block production lines in our core markets. Our cement plants are capable of producing approximately 3.8 million tons of cement annually, over 95% of which contains up to 10% lower CO2 emissions than standard use ordinary Portland cement (Lower-Carbon Cement). Our cement manufacturing activities are supported by a network of mining operations containing a total of 474 million tons of reserves as of May 1, 2024, which we are in the process of expanding through various opportunities.

3

Table of Contents

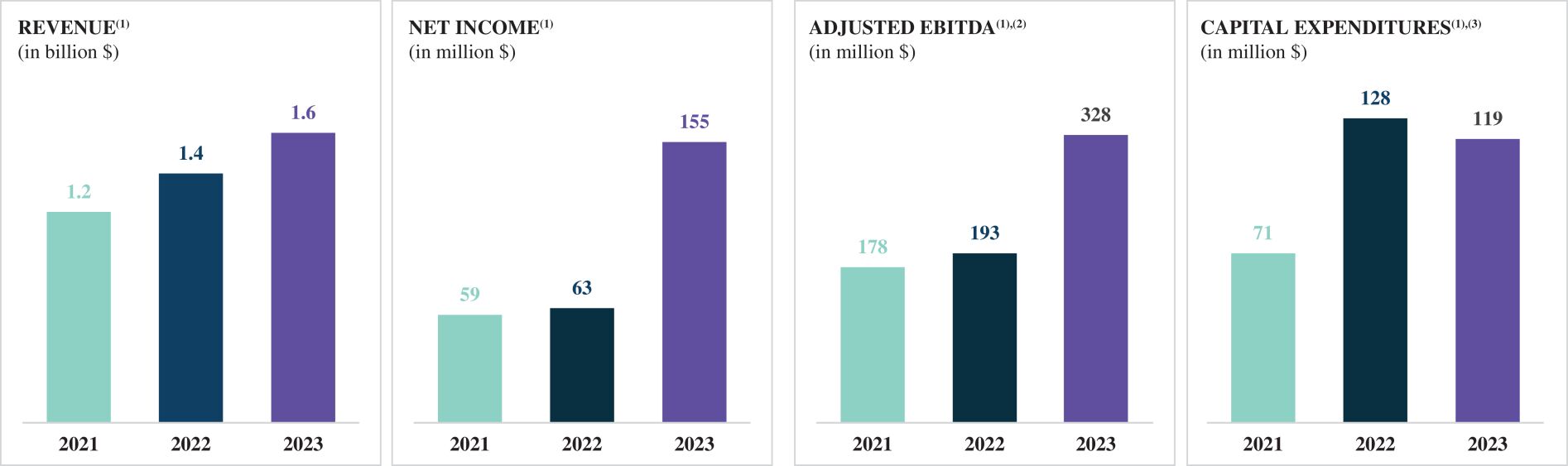

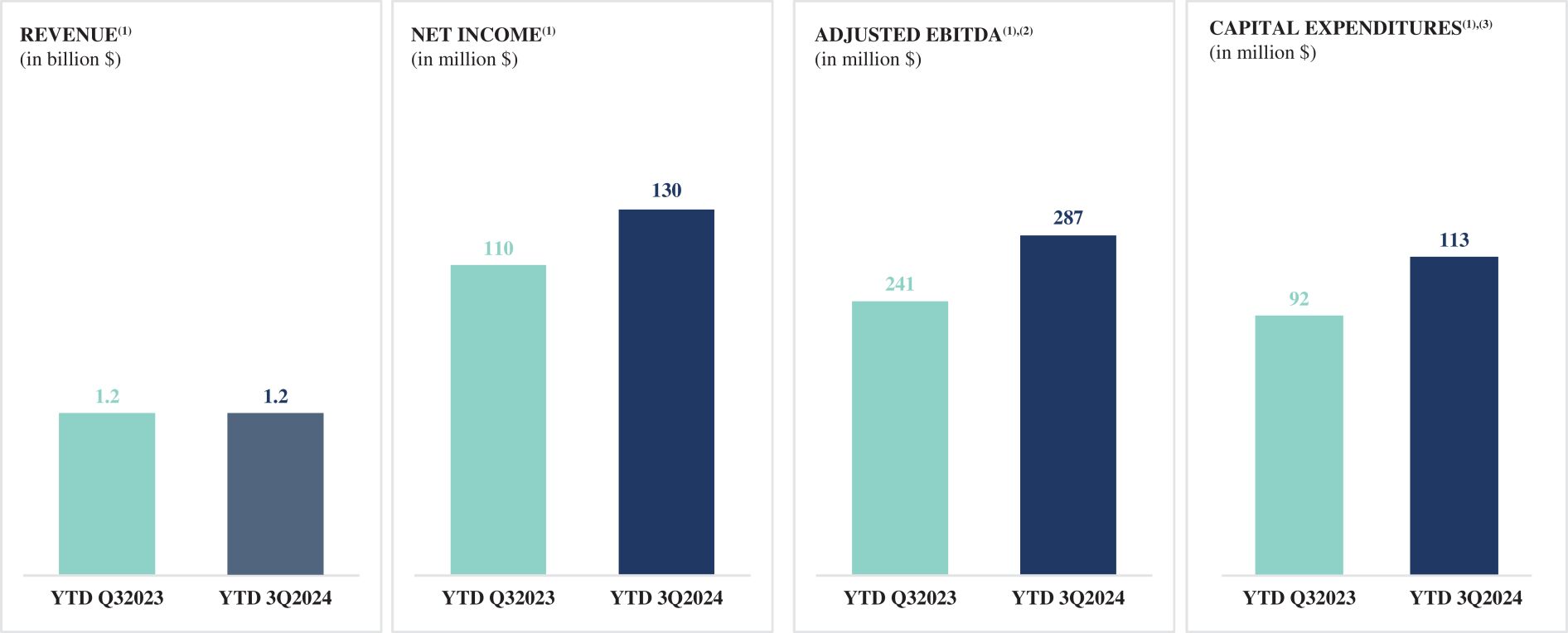

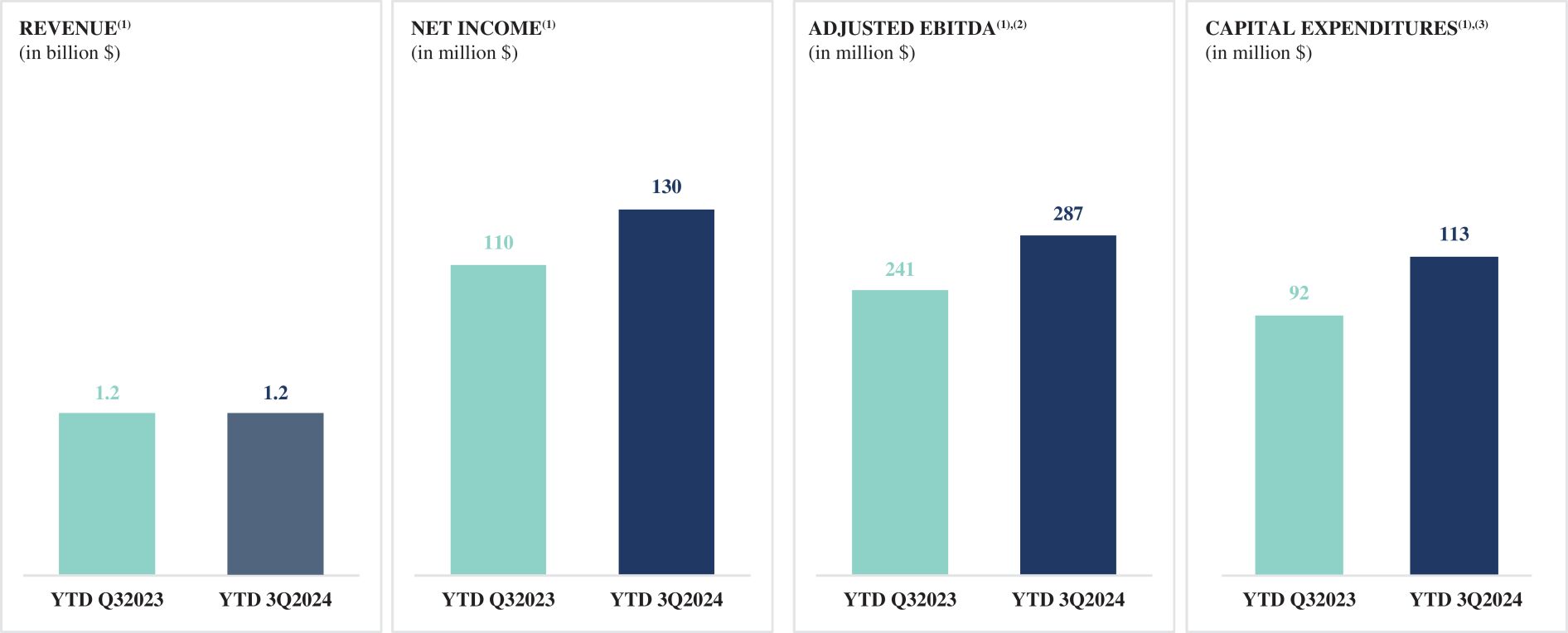

The following charts present a summary of revenue, net income, Adjusted EBITDA(1)(2) and Capital Expenditures(1)(3) for the fiscal years ended December 31, 2023, 2022 and 2021 and the nine months ended September 30, 2024 and 2023:

| (1) | After the Contribution of Titan Atlantic to Titan America SA, on January 1, 2025, Titan America LLC divested its STET segment in a sale for cash, to be settled no later than January 31, 2025, to Titan Cement Netherlands B.V., a wholly-owned subsidiary of Titan Cement International, which is outside the scope of this offering. |

| (2) | Adjusted EBITDA is a non-IFRS financial measure we use to evaluate the performance of our business. For the definition of this measure, see Managements Discussion and Analysis of Financial Condition and Results of OperationsNon-IFRS Measures. |

| (3) | Capital Expenditures includes investments in property, plant and equipment and investments in identifiable intangible assets. |

In the fiscal year ended December 31, 2023, Titan America delivered $1.6 billion of revenue, net income of $155.2 million and Adjusted EBITDA of $328.4 million. In the nine months ended September 30, 2024, Titan America delivered $1.2 billion of revenue, net income of $129.5 million and Adjusted EBITDA of $286.9 million. Titan America also delivered 6% of revenue growth for the last twelve months ended September 30, 2024.

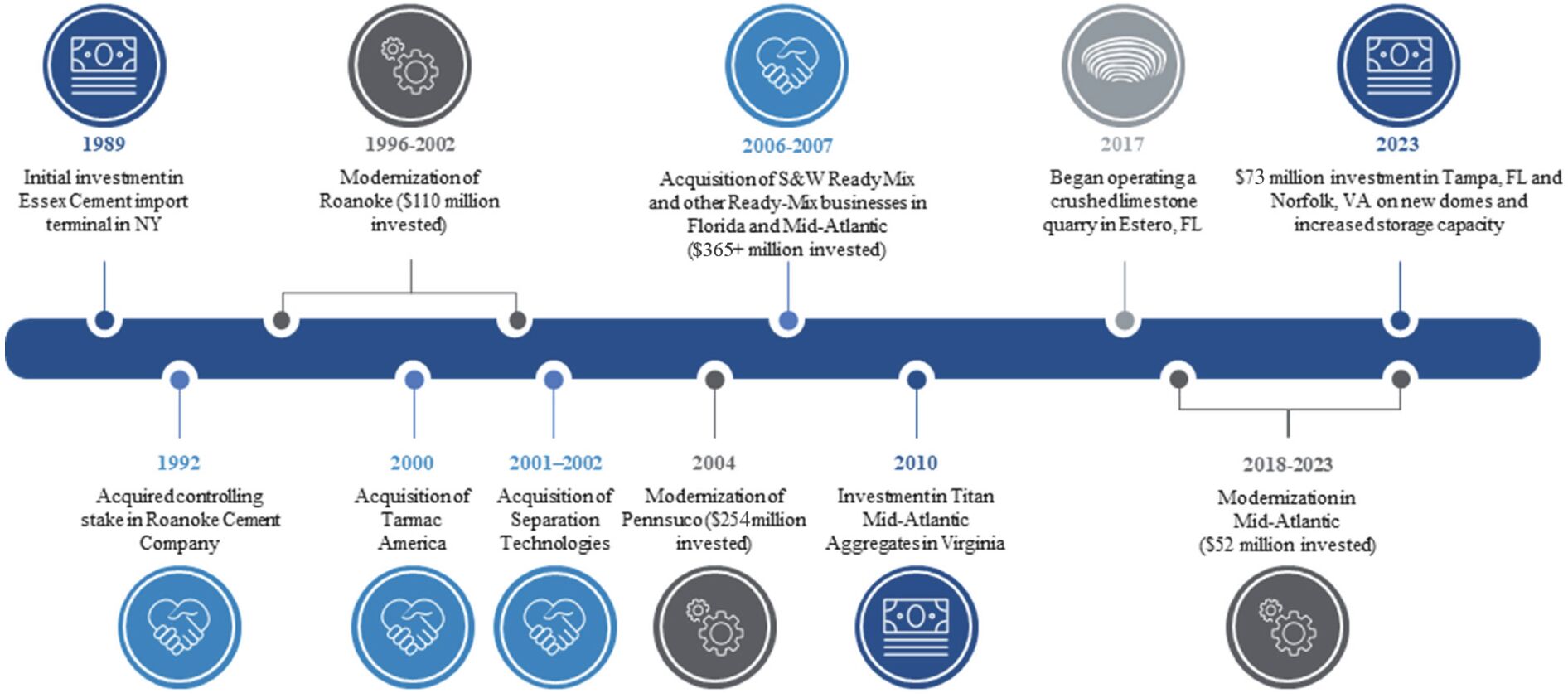

Since our initial investment in the Essex Cement import terminal in Metro New York in 1989, we believe we have built one of the most comprehensive, capable and reliable building materials platforms on the Eastern Seaboard through focused and strategic investments.

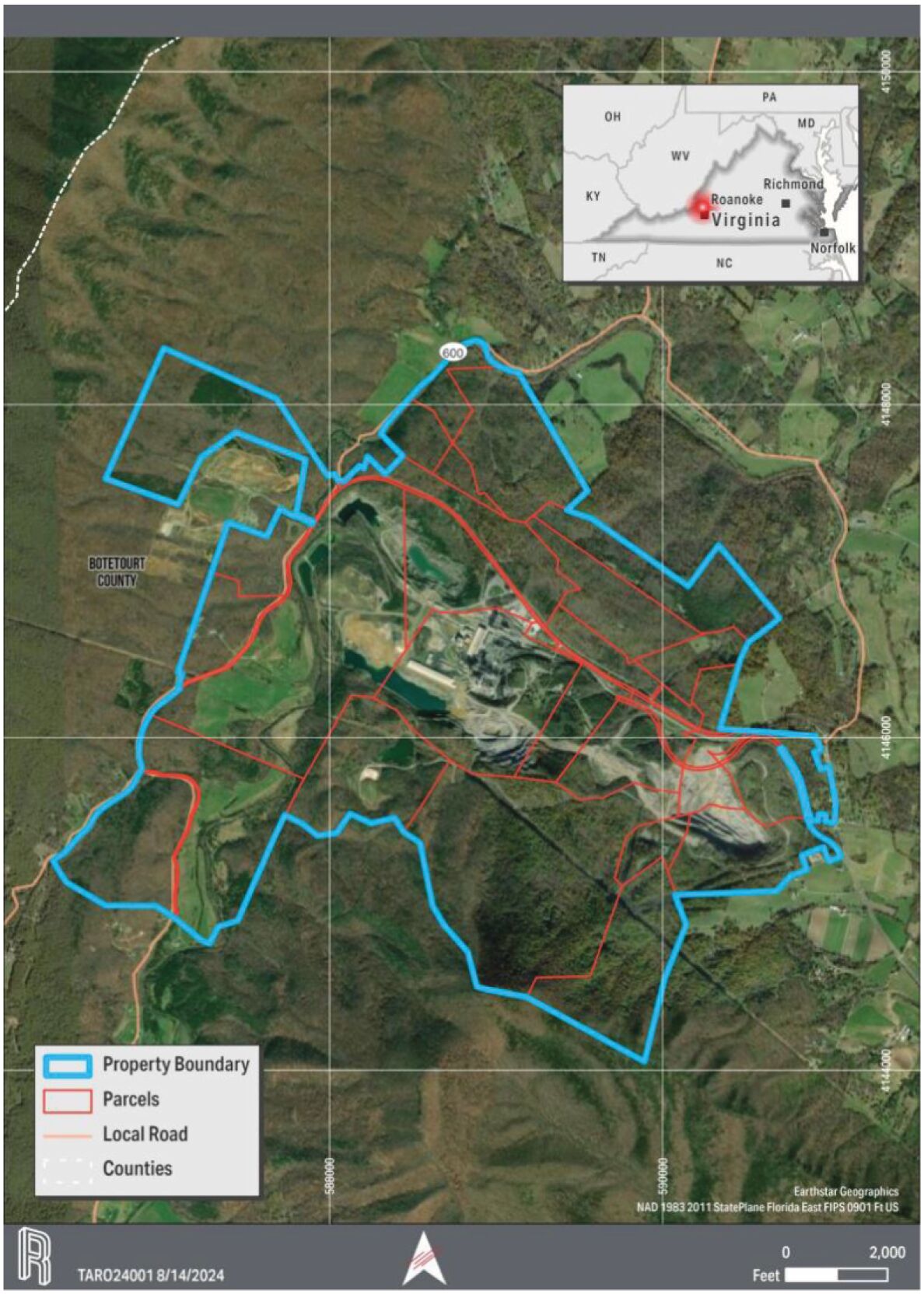

In 1992, we acquired 59% of Roanoke Cement Company and all its related assets, establishing our domestic manufacturing and regional distribution capabilities in the Mid-Atlantic region through the addition of the Roanoke cement plant in Troutville, Virginia (our Roanoke Plant), a marine import terminal in South Norfolk, Virginia (our Norfolk Terminal) and a rail-connected distribution network in Virginia and North Carolina.

4

Table of Contents

Between 1996 and 2002, we invested $110 million in our Roanoke Plant, which included a major modernization of its clinker and cement production process, as well as the addition of a preheater/precalciner, a new clinker cooler, new clinker silos, a new finish mill and a new packaged cement line.

In 2000, we acquired Tarmac America Inc., including the remaining 41% of Roanoke Cement Company, giving us initial positions in ready-mix concrete and block operations across the State of Florida, as well as our Pennsuco facility in Medley, Florida (Pennsuco) that produces cement, aggregates, ready-mix concrete and concrete block.

In 2002, we acquired Separation Technologies (ST), a market leader in fly ash beneficiation and marketing.

Throughout the early 2000s, we made significant investments to expand and improve the logistics and import capabilities of the business establishing a cement import terminal at the Port Tampa Bay, Florida (our Port Tampa Bay Terminal), and modernizing the Essex import operation at Port Newark in Metro New York (our Essex Terminal).

Between 2001 and 2006, we invested approximately $254 million in our Pennsuco plant, which included modernization efforts with the commissioning of a state-of-the-art clinker production line, significantly increasing clinker production capacity at much lower energy consumption rates, and the addition of a new finish mill and a new packaging operation.

Between 2006 and 2007, we invested approximately $365 million to significantly expand our ready-mix footprint through the acquisition of the S&W Ready Mix Concrete Company (S&W Ready Mix), which operated 26 concrete plants in the Carolinas, the Mechanicsville Concrete Company and five plants under the Powhatan Ready Mix brand in and around Richmond, Virginia. We also completed acquisitions of three ready-mix businesses on the west coast of Florida, including nine concrete plants located in and between Tampa and Fort Myers. In addition to these acquisitions, we installed 11 greenfield ready-mix concrete plants and one block production line throughout our territory which expanded our geographic footprint and improved density of delivery and manufacturing capacity in growing markets.

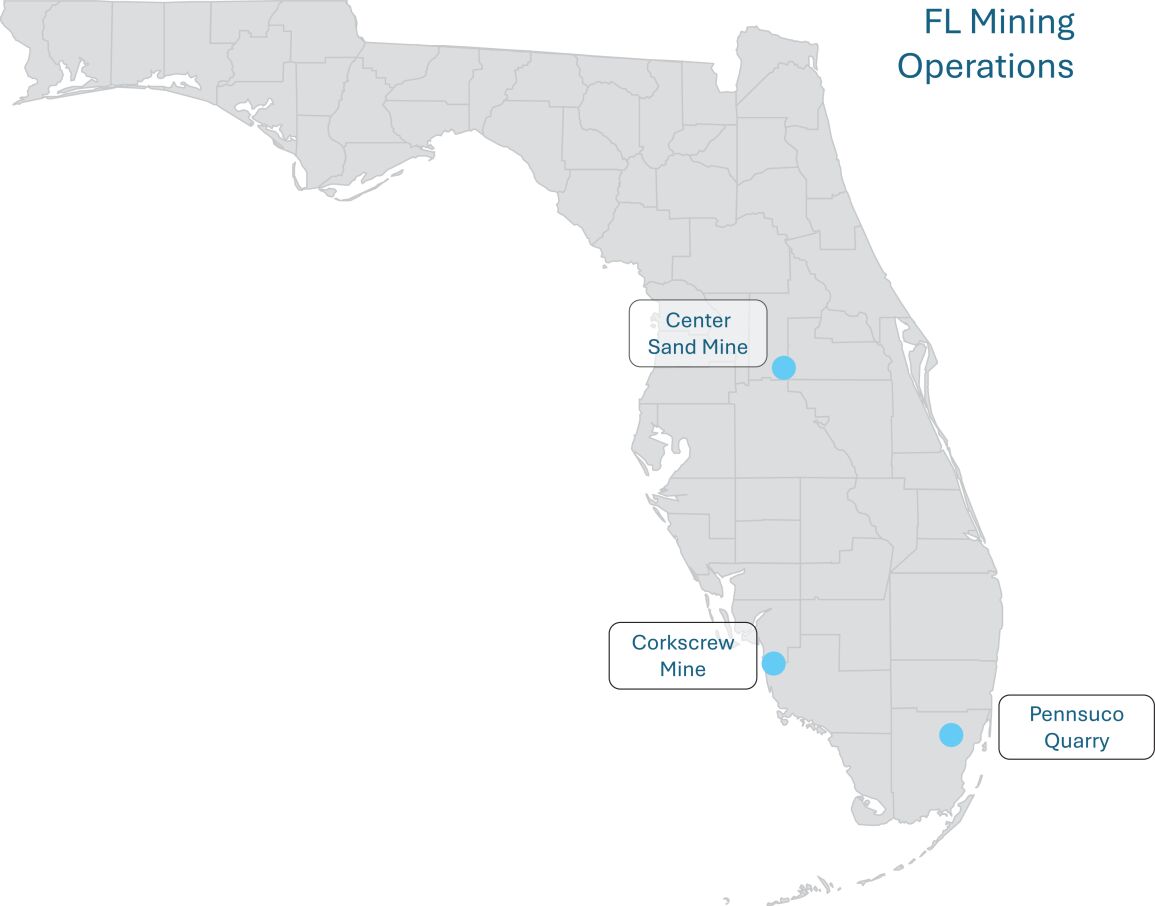

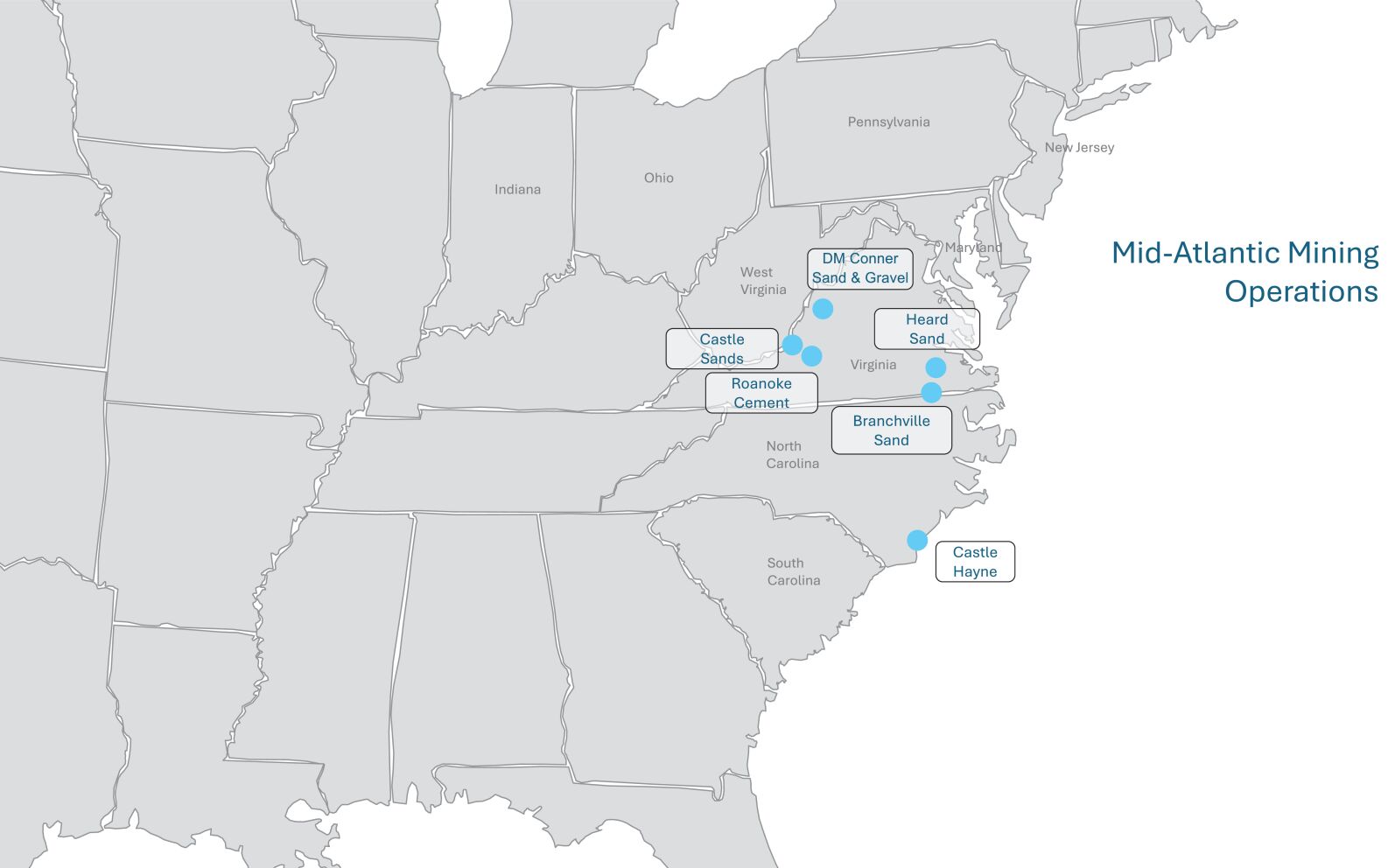

In early 2010, we invested in a sand mine in Sussex County, Virginia, followed by commencing our operations in New Castle, Virginia (our Castle Sands Operation) in 2011 and Branchville, Virginia in 2019.

From 2014 to 2023, we invested $53 million in an overland conveyor and two new draglines at the Pennsuco quarry.

In 2017, we entered into a long-term mining royalty agreement and began operating a crushed limestone quarry in Estero, Florida, near Fort Myers. We upgraded the operations by installing a dragline and mobile mining fleet, as well as expanding the existing permit to substantially increase the base of reserves, all of which provide a stable source of aggregates for both external sale and internal consumption.

Between 2018 and 2023, we invested $52 million in modernizing our logistics network in the Mid-Atlantic, including (i) investments in increasing silo storage capacity and installation of an automated loadout system at our Roanoke Plant, (ii) expansion of the Winston-Salem, Charlotte, Selma and Wilmington rail terminals to allow for multiple products, optimized storage and distribution capabilities and (iii) installation of a hybrid loadout system at the Norfolk Terminal capable of loading both trucks and rail cars.

In 2023, we completed a $73 million investment at our Port Tampa Bay Terminal and our Norfolk Terminal, constructing new domes, adding multi-product storage capacity of approximately 70,000 tons each, as well as on other repairs and refurbishments.

5

Table of Contents

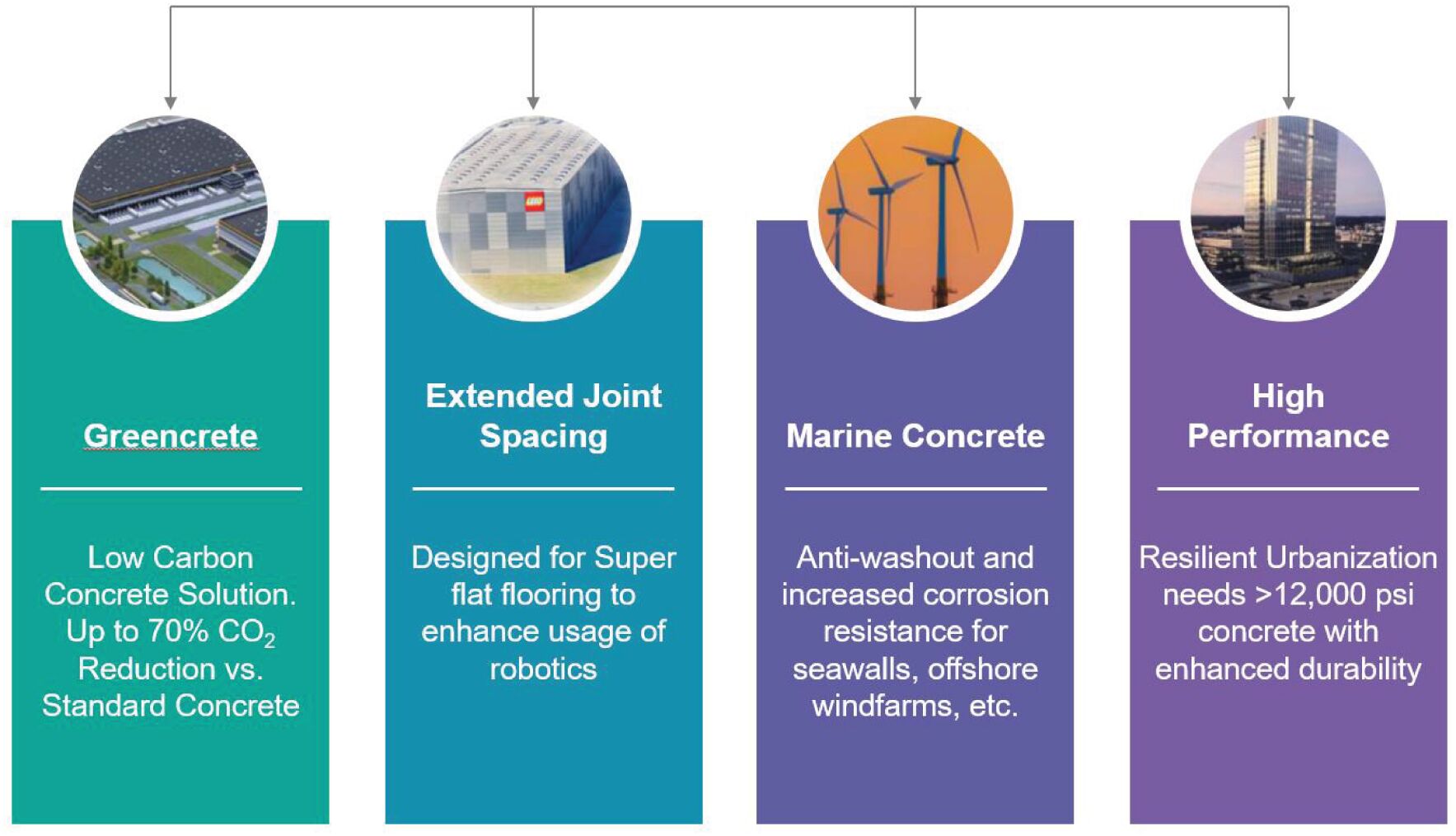

Recent investments we have made seek to capitalize on dynamic growth themes in the U.S. economy, including decarbonization, circular economy, resilient urbanization, infrastructure modernization, refurbishment and renovation, new construction technologies and high-performance products. We believe these initiatives contribute to and will act as significant drivers of growth.

We have developed new cement types requiring less carbon intensive inputs that perform equally or better than conventional cements, resulting in lower CO2 content of the final product. We have replaced over 95% of our standard use Ordinary Portland Cement (OPC) production with Lower-Carbon Cement, improving the CO2 emissions per ton of product by up to 10% compared to OPC. We are currently investing in the development of our Type IT cement (a ternary cement blend) that requires even less amount of clinker while delivering equal or better performance than Lower-Carbon Cement. Depending on the type of SCM used (such as fly ash, slag, calcined clay or natural pozzolans) the total reduction in clinker quantity can reach up to 50% compared to OPC cements, resulting in a significant reduction of the CO2 emissions per ton of product.

We are also committed to digital transformation. We are early adopters of artificial intelligence and machine learning (AI/ML) technologies in our industry, which we employ to increase plant reliability and capacity utilization, improve product quality, proactively manage operating and maintenance costs and improve energy efficiency. These initiatives place our cement plants in the top five most efficient in the U.S. cement industry out of companies participating in a 2022 Portland Cement Association (PCA) survey. We created a Digital Center of Excellence in 2022, which has driven digital transformation across our entire supply chain and fostered continuous improvement and fine-tuning of existing industrial AI/ML solutions, as well as the development and implementation of similar solutions in our commercial and logistics activities. Our investments in state-of-the-art operations and process control systems have also resulted in the deployment of predictive maintenance systems, based on data analytics for equipment faults and process anomaly detection to improve the reliability of our operations, and predictive quality analytics that improve product quality and consistency.

Throughout the United States, we operate and maintain two cement plants, three marine import terminals, seven active mine locations, 82 ready-mix locations with 92 batch plants, eight concrete block locations with 13 production lines, seven fly ash plants and 21 distribution hubs that can handle various combinations of our products.

Our Reportable Segments

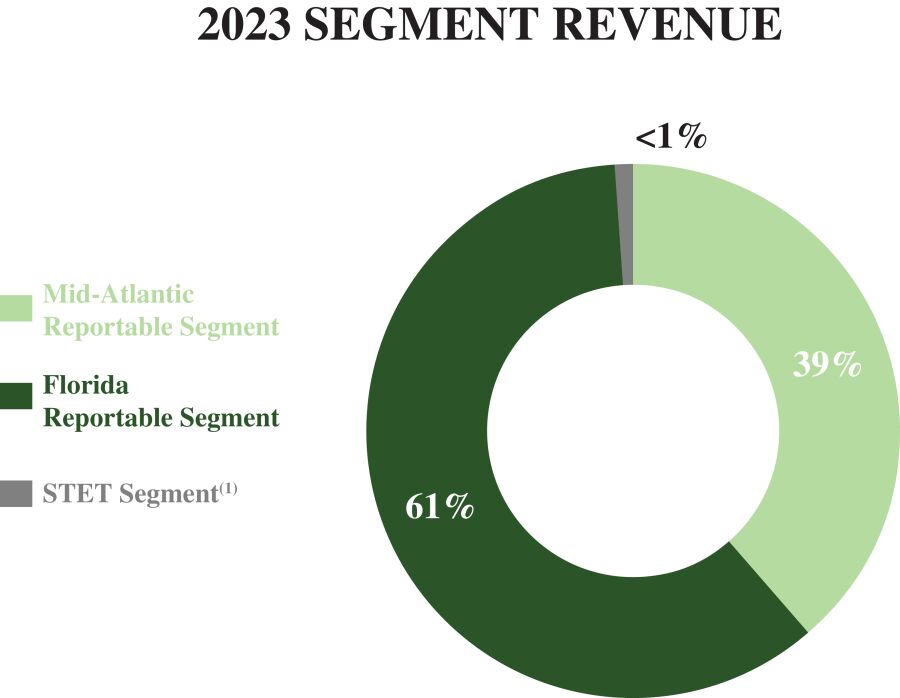

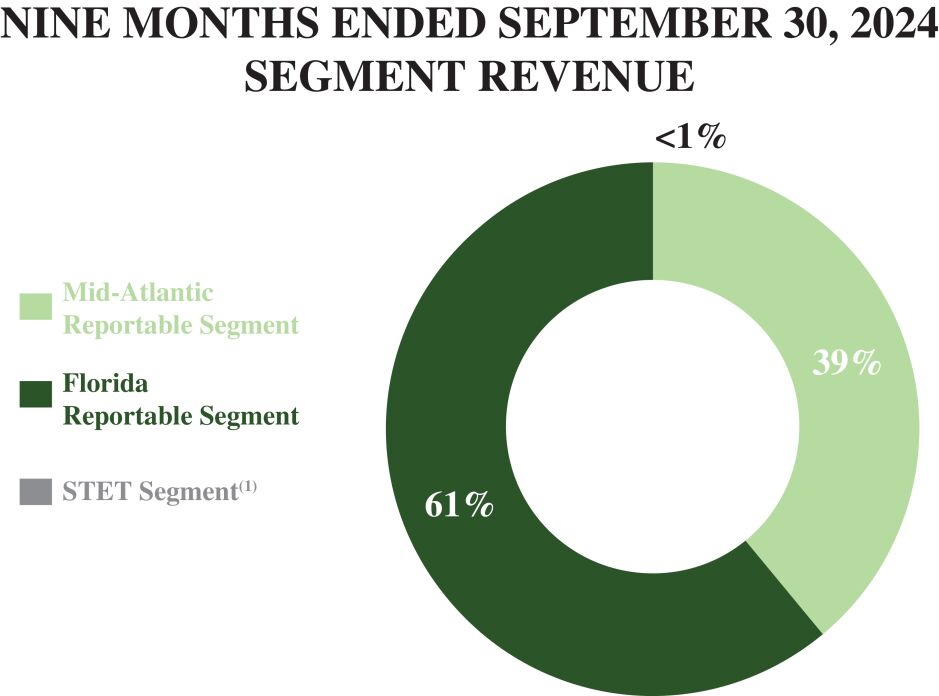

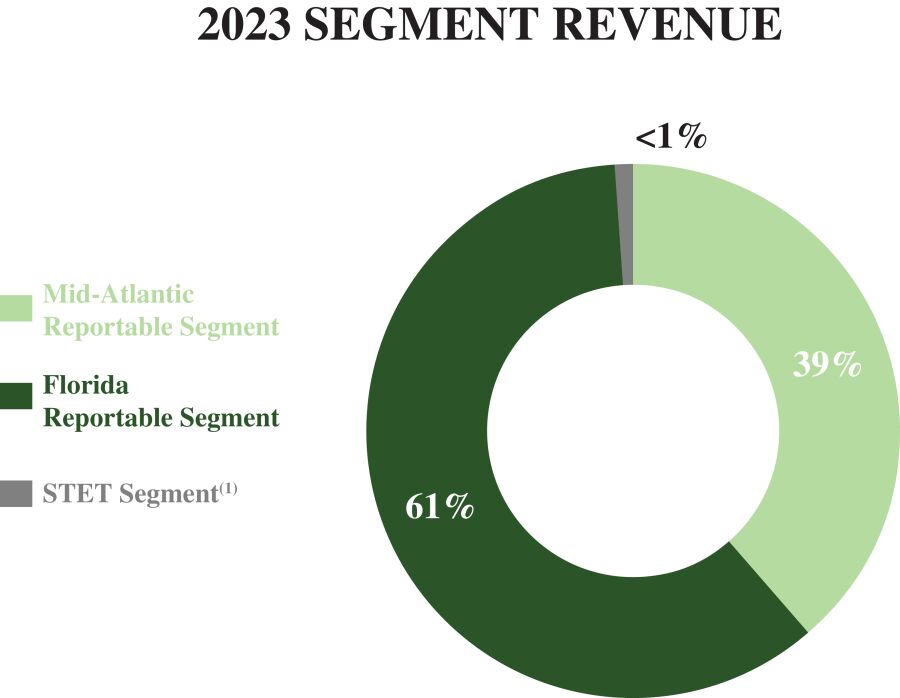

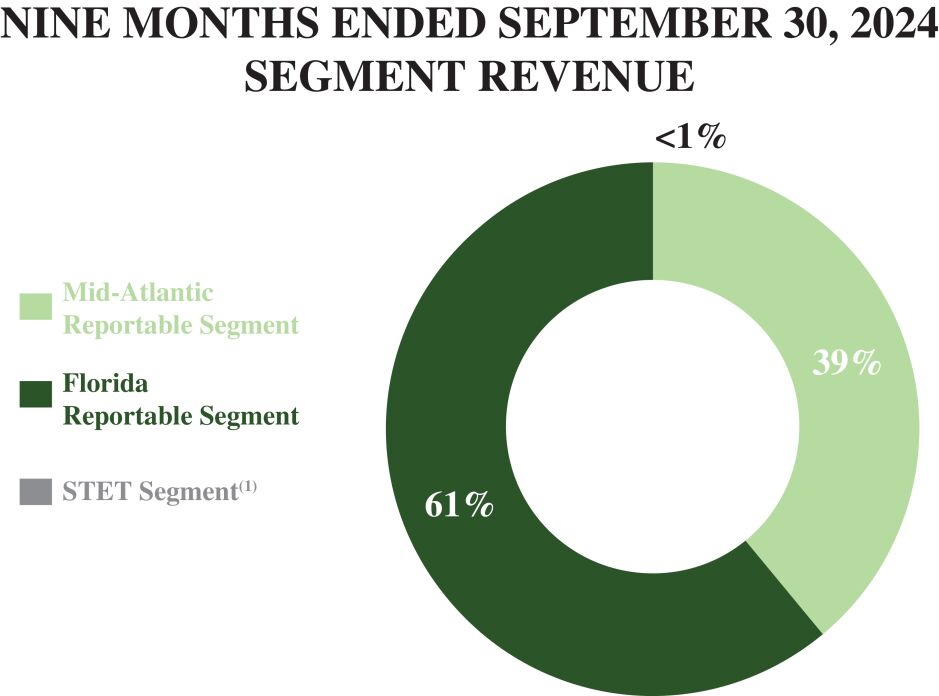

Due to the regional nature of our business, we report our operating results in two reportable segments: Florida and Mid-Atlantic. We run our operations nimbly allowing us to pivot resources to markets we support with the greatest demand based on market conditions.

6

Table of Contents

The following charts show revenue by segment for the fiscal year 2023 and the nine months ended September 30, 2024:

|

|

| (1) | Represents the revenue associated with the STET segment. The STET segment is a nonreportable operating segment that develops, manufactures, sells and services triboelectrostatic separators and related equipment used to beneficiate fly ash, industrial minerals, and food and feed organics. After the Contribution of Titan Atlantic to Titan America, on January 1, 2025, Titan America LLC divested the STET segment in a sale for cash, to be settled no later than January 31, 2025, to Titan Cement Netherlands B.V., a wholly owned subsidiary of Titan Cement International, which is outside the scope of this offering. |

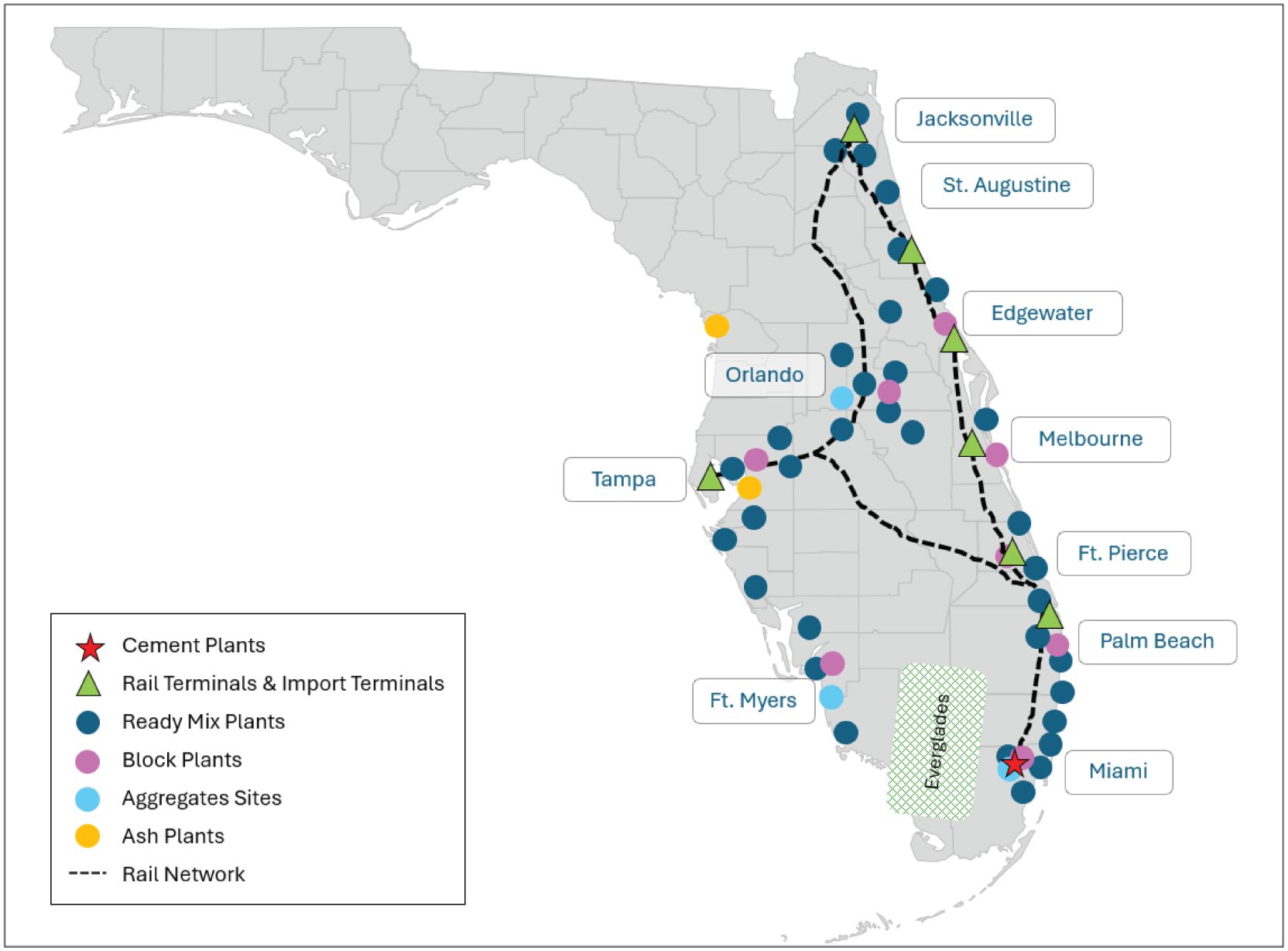

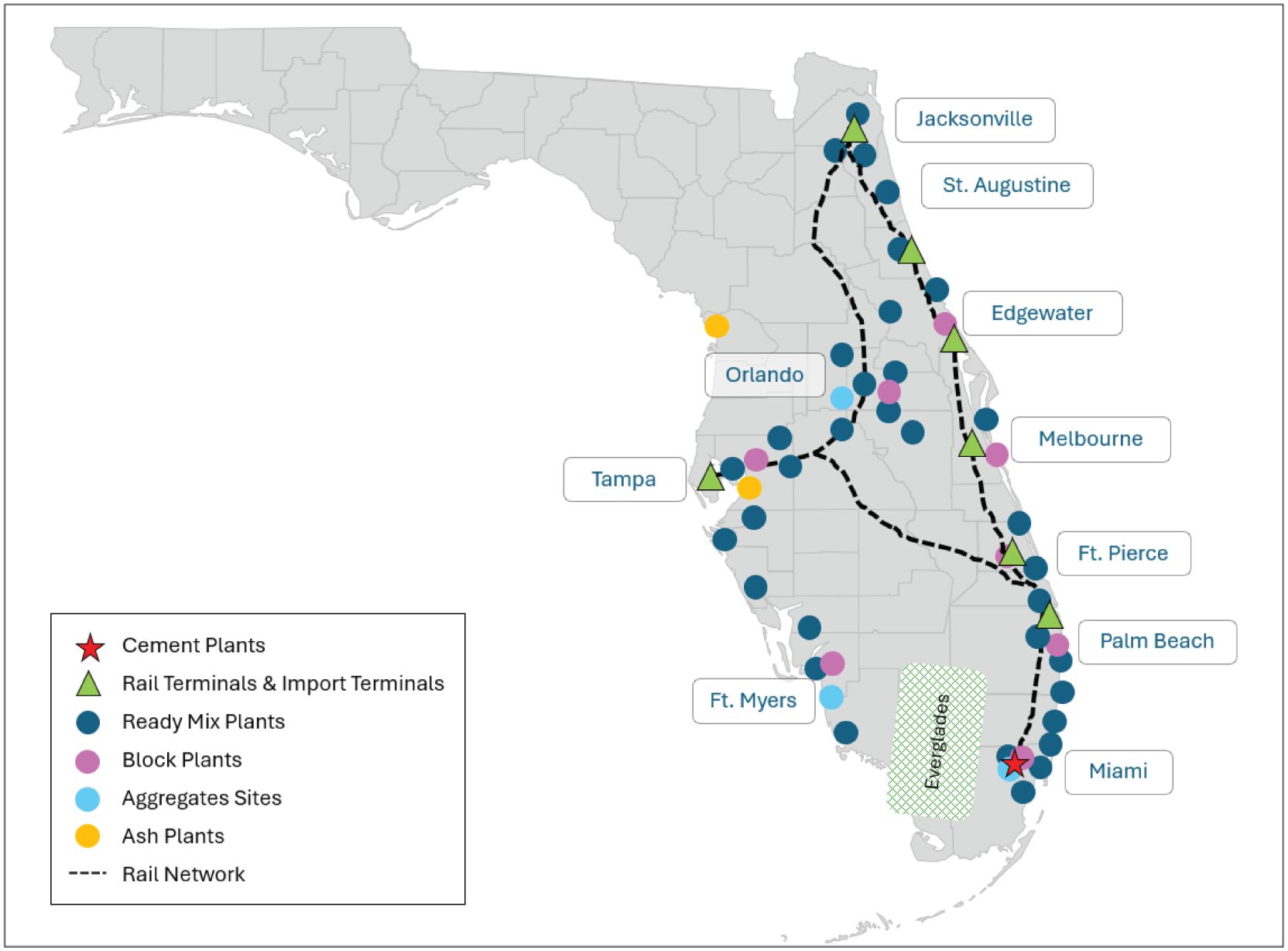

Florida Reportable Segment

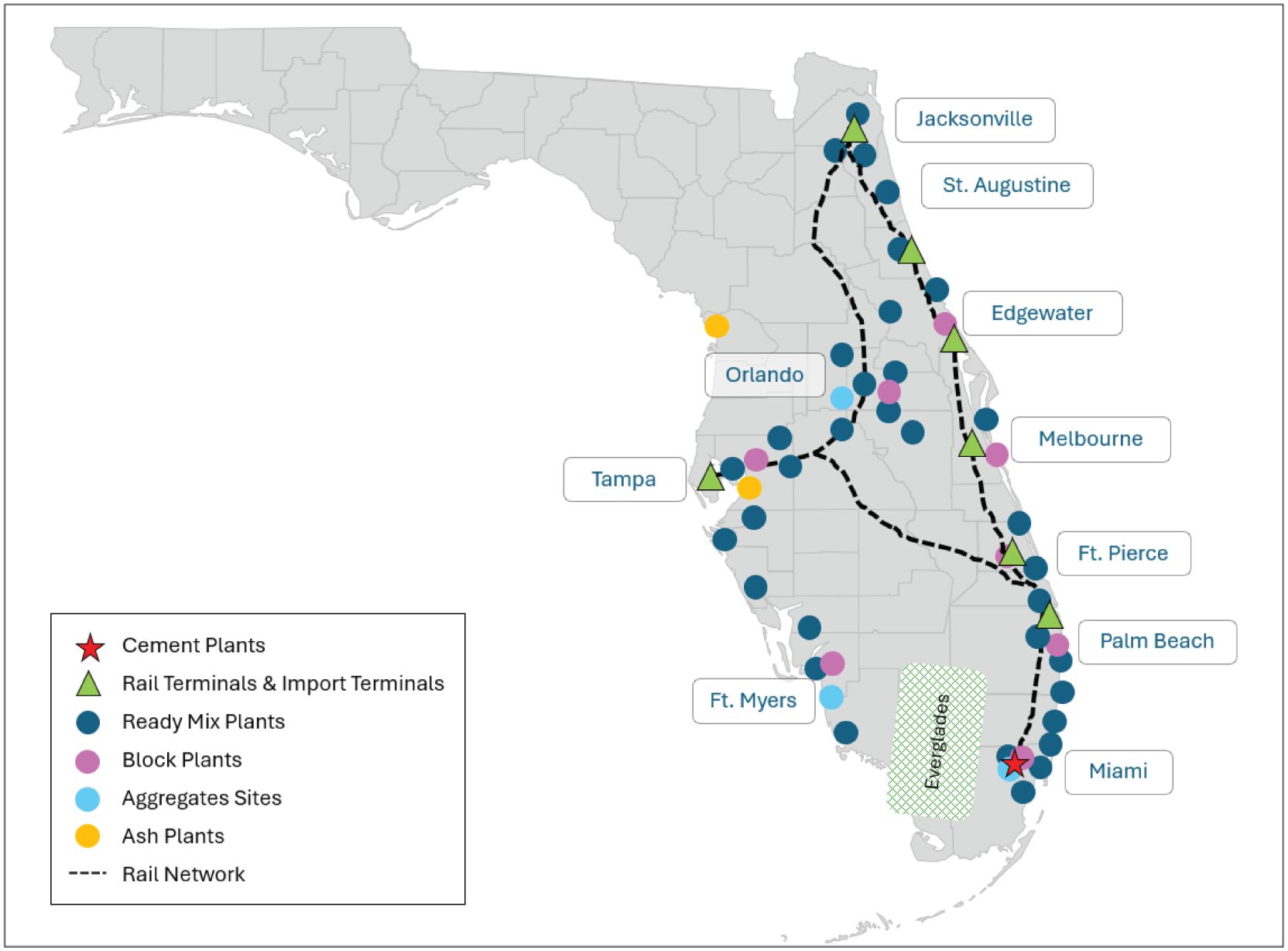

Our Florida reportable segment consists of our cement, aggregates, ready-mix concrete, concrete block and fly ash operations within the State of Florida. We currently operate one cement plant, three mines, 40 ready-mix locations with 45 batch plants, eight concrete block locations with 13 production lines, two fly ash facilities and one multi-product marine import terminal along with related logistics infrastructure.

7

Table of Contents

The Florida Titan Network

In fiscal year 2023, our Florida reportable segment generated $969.9 million in segment external revenue and $221.2 million in segment adjusted EBITDA, an increase of $161.4 million in segment external revenue and $90.7 million in segment adjusted EBITDA compared to fiscal year 2022. In the nine months ended September 30, 2024, our Florida reportable segment generated $762.4 million in segment external revenue and $197.0 million in segment adjusted EBITDA, an increase of $33.1 million in segment external revenue and $37.2 million in segment adjusted EBITDA compared to the nine months ended September 30, 2023.

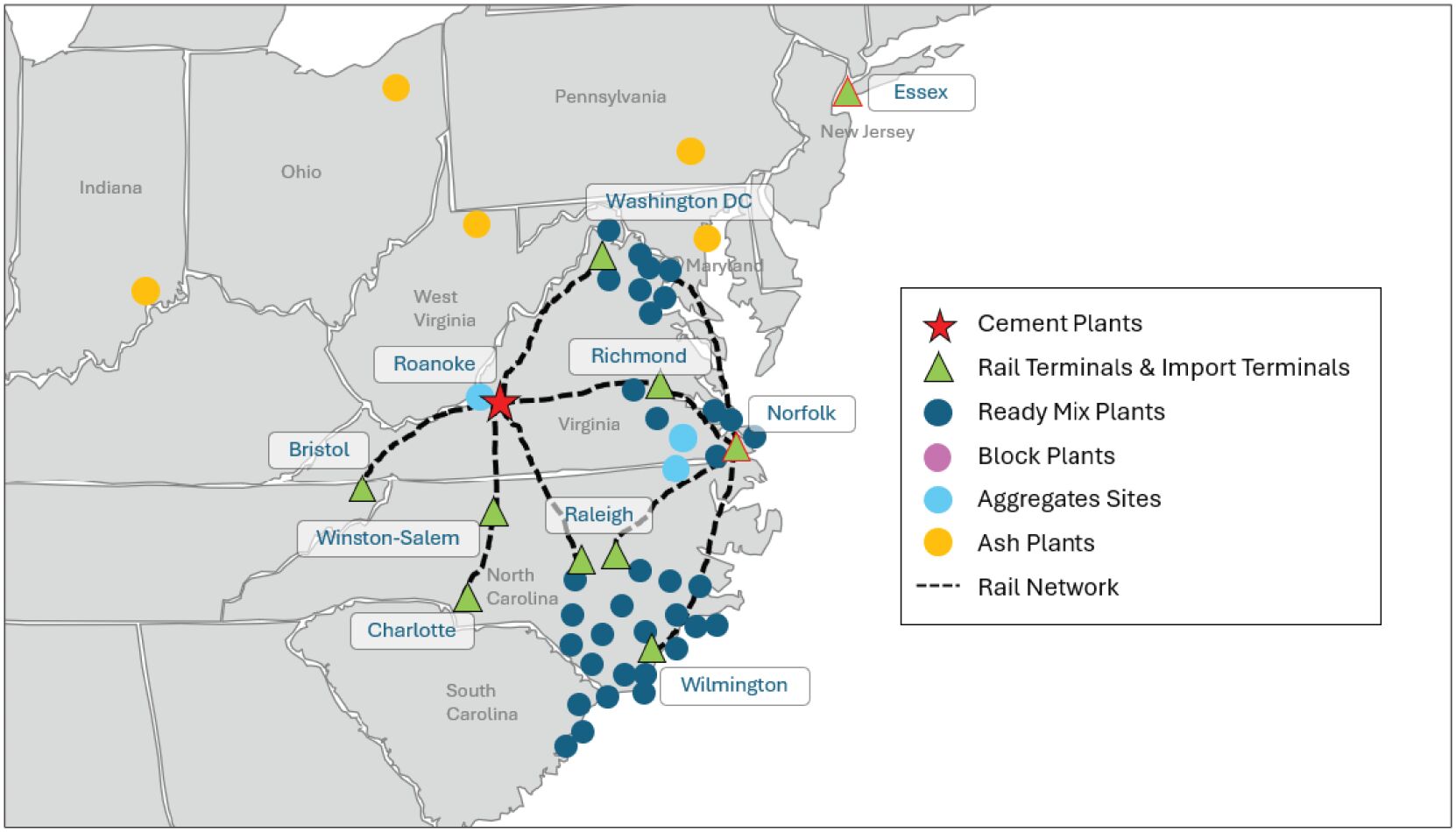

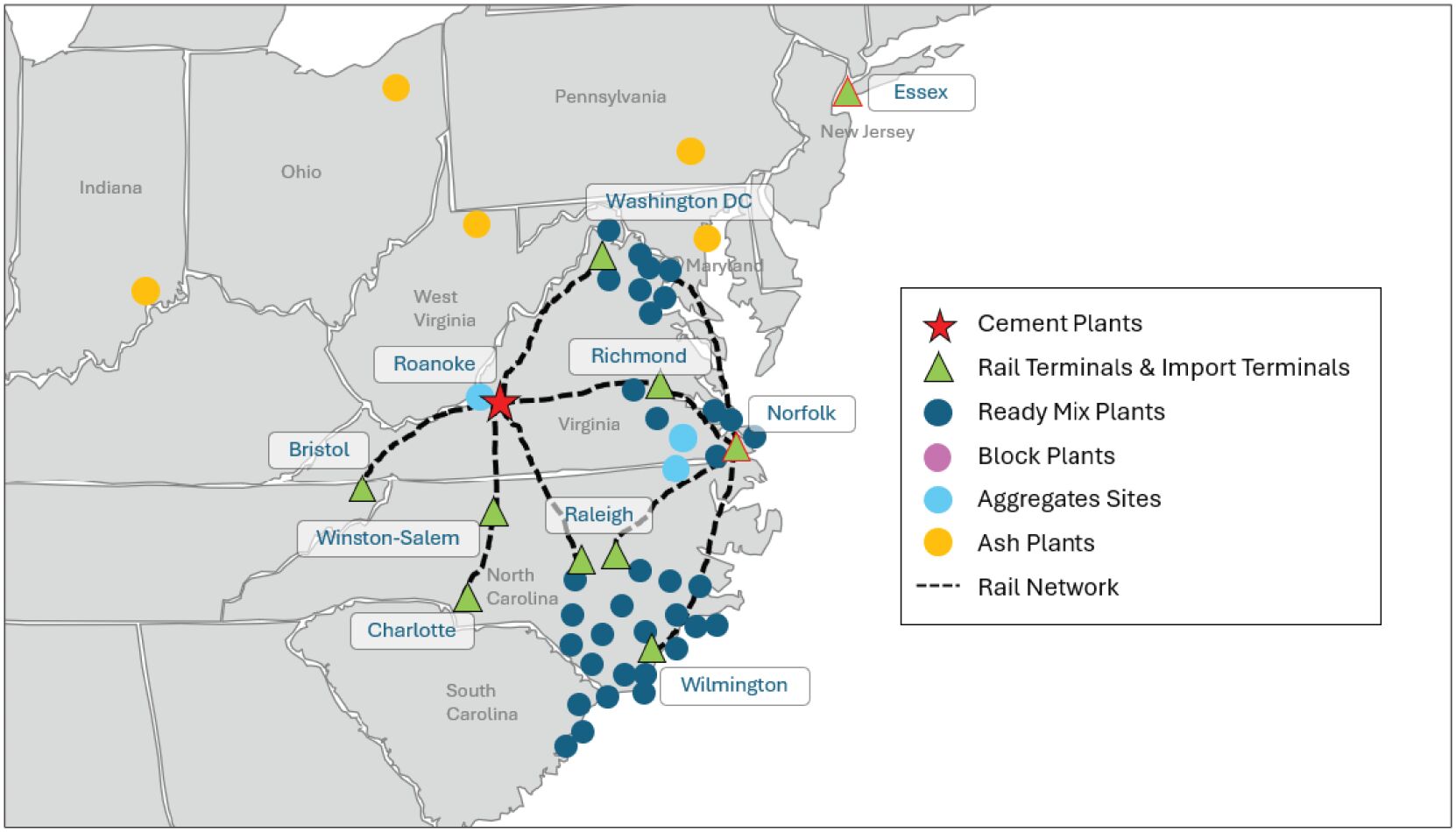

Mid-Atlantic Reportable Segment

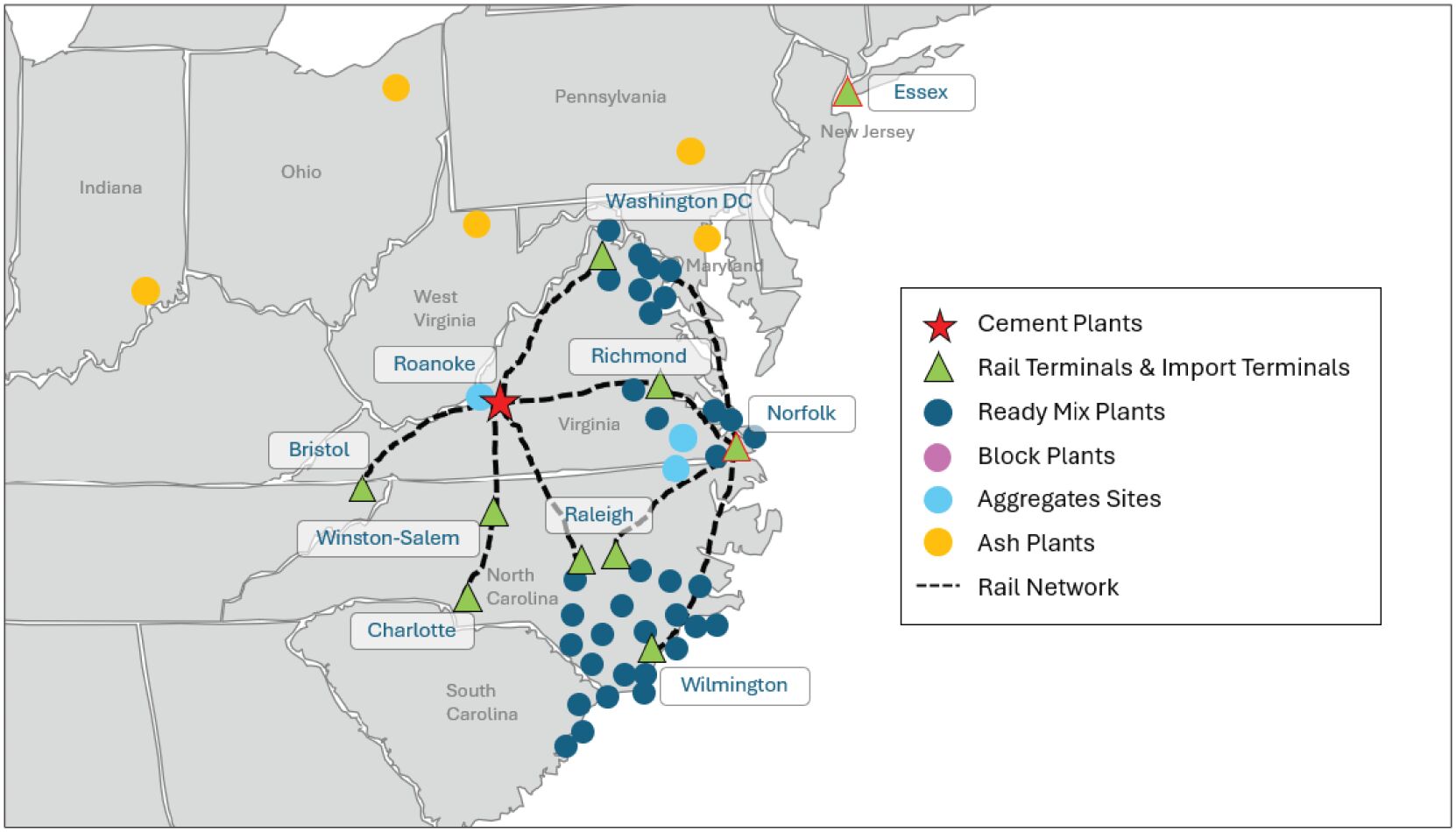

Our Mid-Atlantic reportable segment consists of our cement, aggregates, ready-mix concrete and fly ash operations throughout the Mid-Atlantic region, most concentrated in Virginia, North Carolina, South Carolina, New York and New Jersey, capable of serving surrounding states such as Maryland, West Virginia, Kentucky, Tennessee, Pennsylvania, Ohio and Indiana areas with fly ash. We currently operate one cement plant, four mines, 42 ready-mix locations with 47 batch plants, along with related logistics infrastructure and import terminals.

8

Table of Contents

The Mid-Atlantic Titan Network

In fiscal year 2023, our Mid-Atlantic reportable segment generated $619.7 million in segment external revenue and $118.3 million in segment adjusted EBITDA, an increase of $66.4 million in segment external revenue and $45.5 million in segment adjusted EBITDA compared to fiscal year 2022. In the nine months ended September 30, 2024, our Mid-Atlantic reportable segment generated $481.0 million in segment external revenue and $100.5 million in segment adjusted EBITDA, an increase of $19.4 million in segment external revenue and $11.5 million in segment adjusted EBITDA compared to the nine months ended September 30, 2023.

Our Industry

Our products primarily serve the large and highly fragmented construction materials industry in the Eastern Seaboard. We are a well-established, leading player in the construction materials value chain where there are high barriers to entry. These barriers to entry include the capital-intensive nature of the heavy construction materials production process, as well as stringent regulations requiring new entrants to receive permits and approvals to operate, including acceptance from local communities. We primarily serve the residential, non-residential and infrastructure construction end markets.

Key End Markets of the Construction Industry

Residential Construction

Our products have broad applications in the single family and multifamily residential construction industry, with uses across the new build and renovation/refurbishment spectrum. Cement products are utilized in the concrete and mortar that forms the foundation of the house. Cement products are also leveraged to create or otherwise build concrete building blocks, pavers, driveways, sidewalks, mortar and grout.

Non-residential Construction

Our products are used in the non-residential construction industry to build commercial and industrial buildings, including, manufacturing facilities, shopping centers, data centers, warehouses, hospitals, schools, hotels and restaurants. Cement is often favored as a construction input for the non-residential sector due to its ease of use, strength, durability and versatility.

9

Table of Contents

Infrastructure Construction

Our products are used in the infrastructure construction industry to build, renovate and refurbish bridges, roads, highways, airports, military facilities, tunnels, water and sewage treatment and distribution facilities, and any other project that is funded by federal, state or local governments.

Key Trends in the Construction Industry

We believe we are at the beginning of a powerful multiyear growth cycle across our three end markets, underpinned by a structural residential housing shortage and boosted by significant federal and state spending in infrastructure and manufacturing onshoring.

Residential Housing Shortage

It is estimated that the U.S. residential market is underbuilt by 3.4 million homes as of May 2024, with the six key states in which we operate accounting for 860,000, or 25%, of the shortage, according to the PCA. We believe this shortage is the result of strong demand for housing, driven by a rapid increase in household formation by millennials and other age groups. According to the PCA, 89 million people in the United States are in the prime first-time home buyer age range of 25 to 44 as of May 2024. Housing demand is also increasing as a result of population growth including migration domestically across the United States and immigration into the United States.

Government Support and Investment in Critical U.S. Infrastructure

The Infrastructure Investment and Jobs Act of 2021 (IIJA) authorized $1.2 trillion of transportation and infrastructure spending, with $550 billion going towards new investments and programs and the rest budgeted for continued investment in existing vital infrastructure. Under the IIJA, the six key states in which we operate will receive an aggregate of $81.7 billion in additional federal funds for infrastructure projects announced as of June 11, 2024. According to the PCA, the IIJA is expected to require approximately 52 million tons of cement over the next five years across the United States, with 39% of that volume going to the construction and renovation of roads, bridges and other major projects, which we expect will result in increased demand for cement, aggregates and related products. As of May 13, 2024, improvements and repairs are underway on more than 257,000 miles of roads and 13,000 bridges across the United States, and over $300 billion is expected to be invested in roads and bridges over the life of the IIJA.

Investment in Manufacturing

According to McKinsey & Company, the U.S. manufacturing sector is poised for robust growth through 2029, driven by strong government incentives, technological innovation and a strategic focus on building more resilient supply chains and sustainable production systems. The Dodge Momentum Index (DMI), which measures non-residential building projects that are in the planning stage, has grown in recent months, indicating significant increases in manufacturing-related construction spending as a result of businesses efforts to reshape supply chains and leverage federal policies that support demand for heavy industrial projects. Key federal policies promoting domestic manufacturing include the CHIPS and Science Act and the IRA, which direct more than $422 billion in incentives.

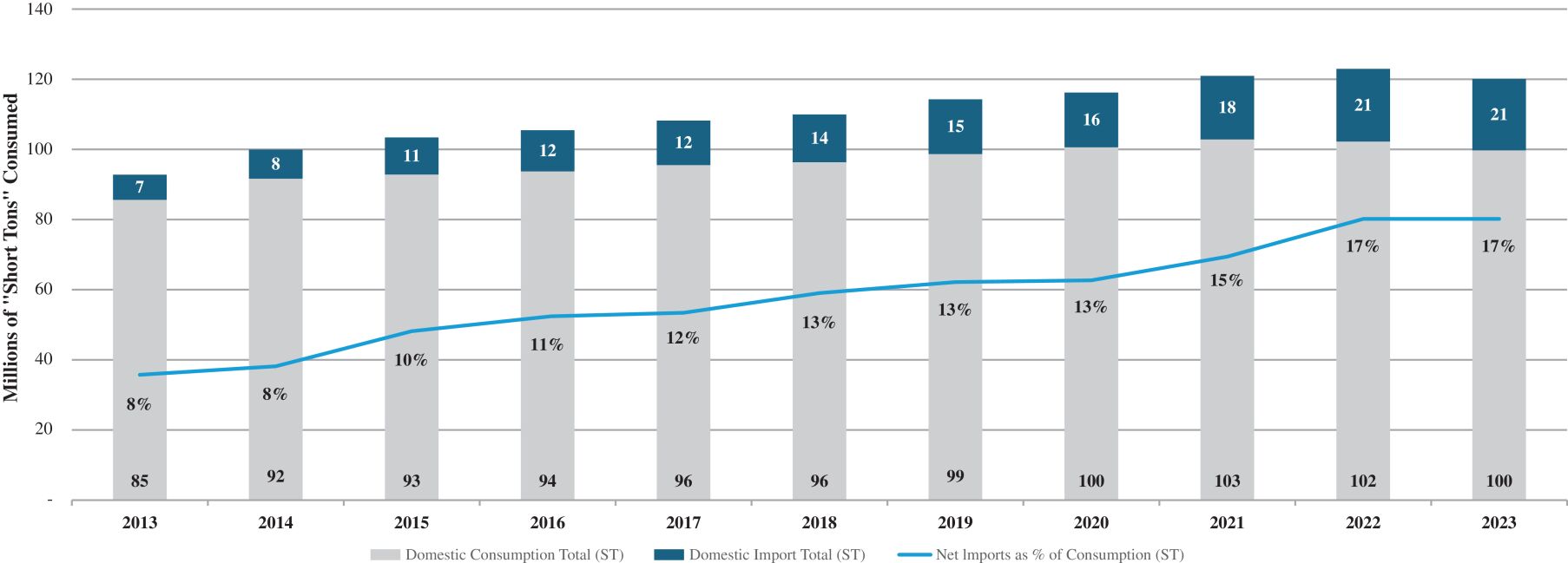

Domestic Cement Production Deficit, Florida Aggregates Shortage

According to the United States Geological Survey (USGS), the amount of cement produced domestically in recent years has plateaued at or around 100 million tons per annum. However, domestic demand for cement has continued to grow, surpassing domestic production capacity. The amount of imported cement consumed in the

10

Table of Contents

United States has grown significantly since 2013, from 7 million tons in 2013 to 21 million tons in 2023. We believe the supply/demand imbalance in domestic cement production will drive the long-term need for import capacity.

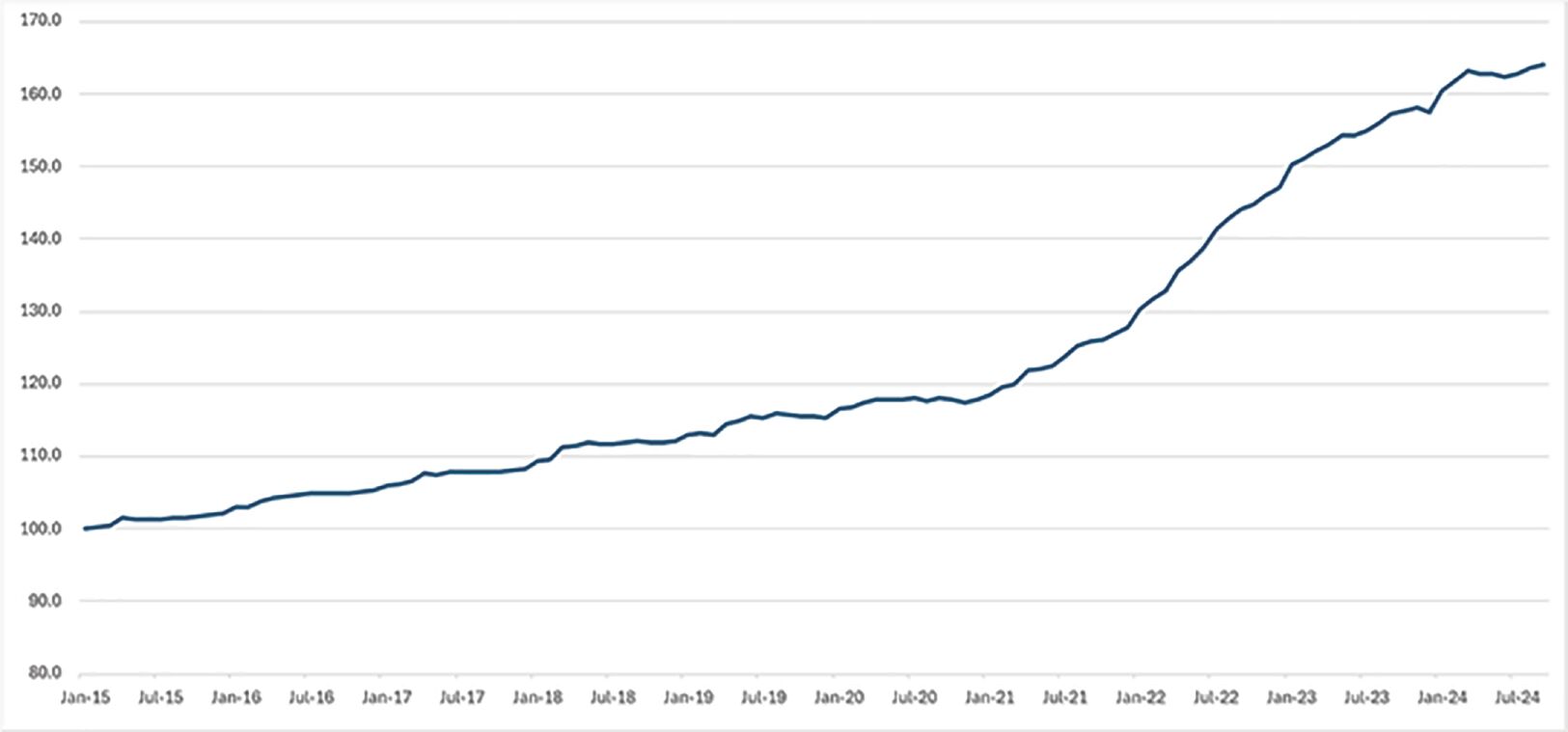

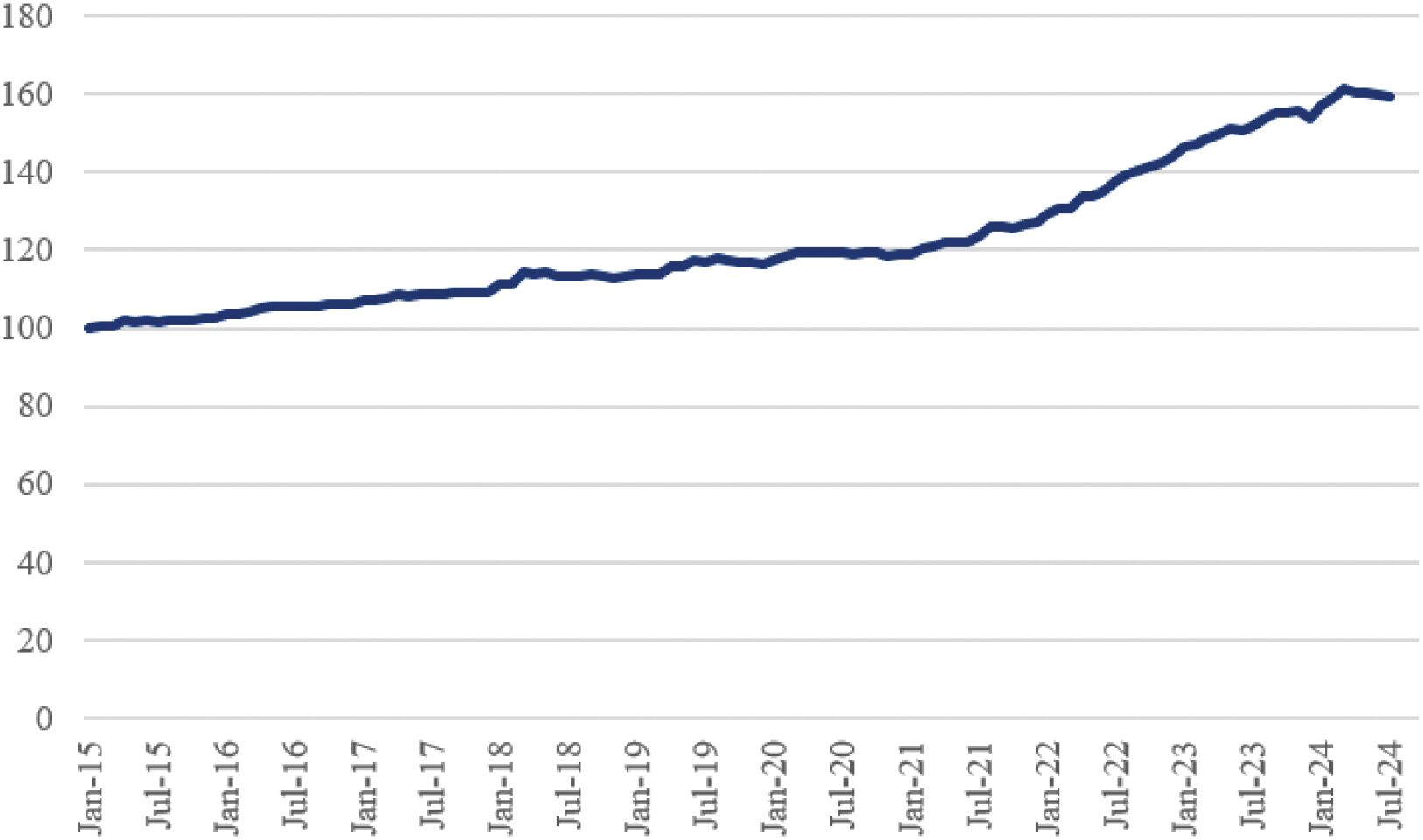

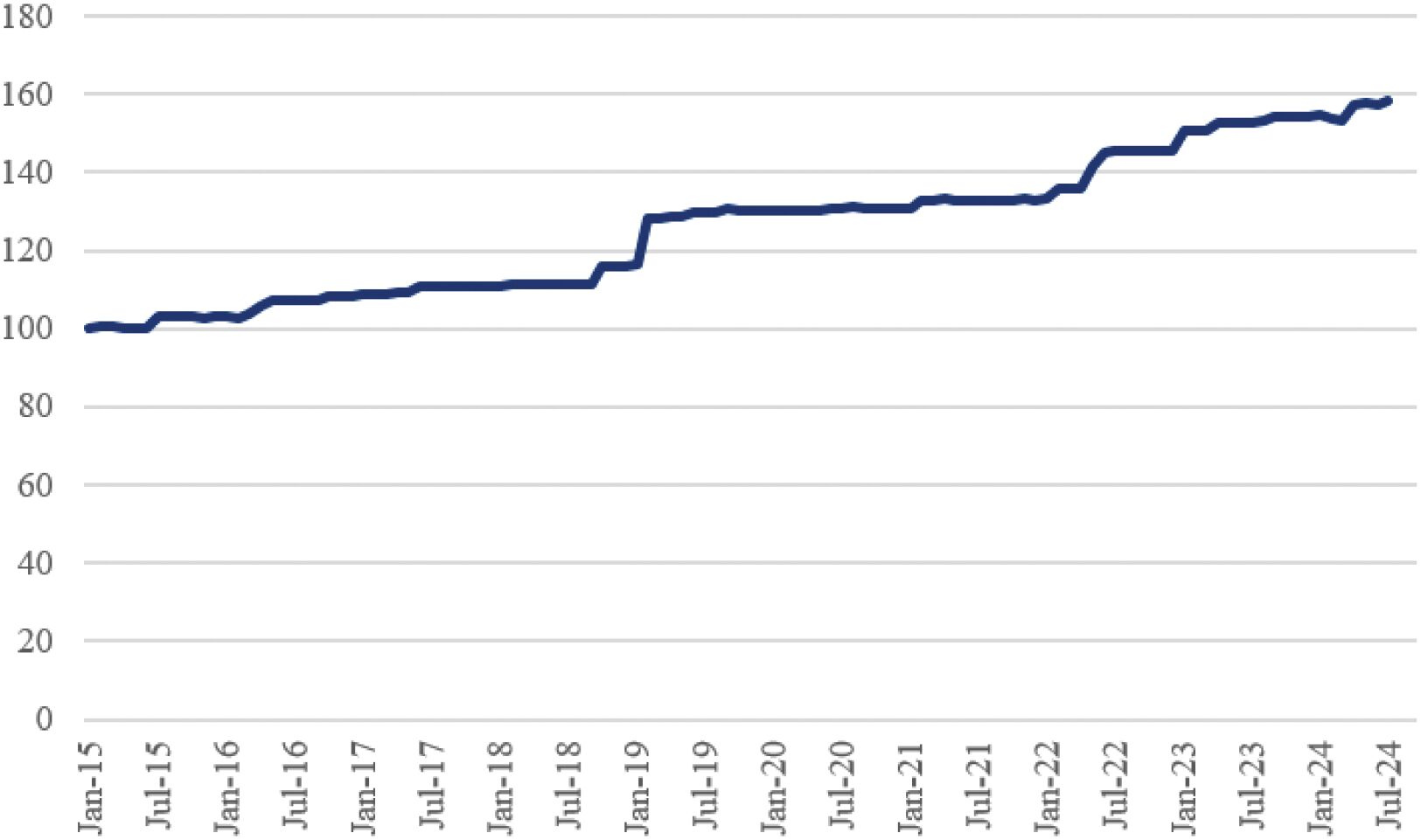

Pricing Growth Across our Core Products

Prices for our core products have consistently risen over the last decade through economic cycles, as demand for cement, aggregates and related products has increased with ongoing growth in residential, non-residential and infrastructure construction across the United States. Factors impacting the industry-wide growth in pricing of our core products include increased energy, labor and logistics input costs, greater demand for cement and related products coupled with stagnant domestic clinker and cement production and capacity and investments in decarbonization and meeting increasingly stringent environmental regulations.

Increasing Demand for Lower-Carbon Cement and Other Green Products and Solutions

Communities, consumers and businesses increasingly have a heightened awareness and desire to embrace more sustainable practices. This social shift towards carbon reduction is not only fostering innovation but is also creating opportunities for the development of greener construction products and methods. According to S&P Global, 45% of companies included in the S&P 500 index have committed to net-zero emissions targets. These companies are often at the forefront of this shift, having committed to significant reductions in their carbon footprints, including those related to their construction activities. Additionally, metropolitan statistical areas (MSAs) such as Miami-Dade and New York have made the significant environmental commitments of being net-zero on carbon emissions by 2050 and 2040, respectively. These commitments will provide significant funding to less carbon intensive construction and product development.

In response, manufacturers of heavy construction materials, including us, are prioritizing the development and use of less carbon-intensive raw materials and SCMs, alternative fuels and carbon capture, utilization and sequestration (CCUS) technologies. These trends are expected to accelerate as more companies, municipalities and industries align with global sustainability goals, further intensifying the development of less carbon-intensive construction materials and techniques.

Our Core Products

Our core products include cement, aggregates, ready-mix concrete, concrete blocks and fly ash. We sell our products to residential, non-residential and infrastructure end markets along the Eastern Seaboard. See IndustryOur Core Products.

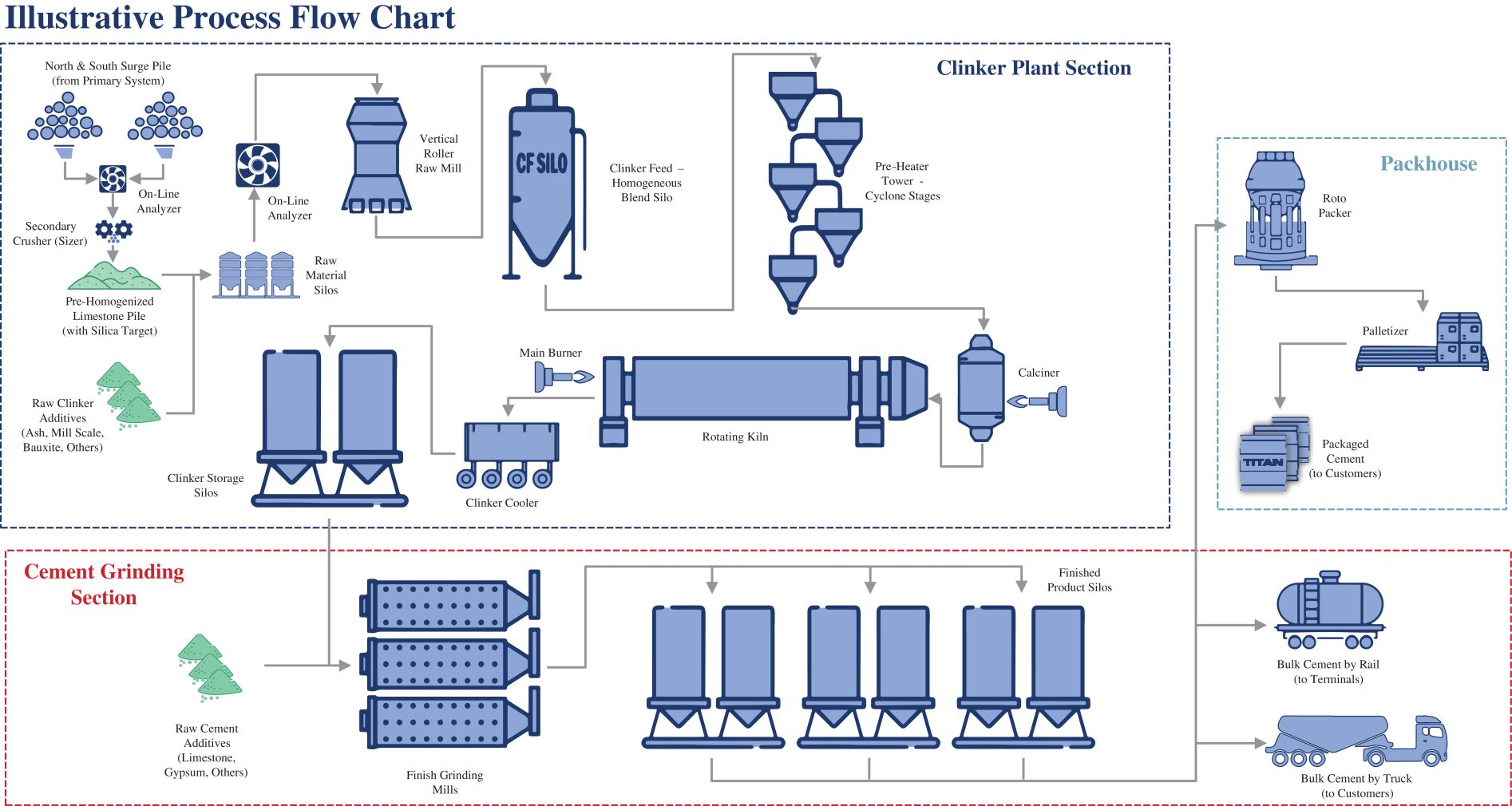

Cement

The cement production process leverages aggregates that are mined from quarries and transported to the cement manufacturing facility. Once quarry materials are brought to a cement production plant, they are ground into fine dust, fed into a kiln, heated by combustion of conventional and alternative fuels and transformed into small granules known as clinker. The clinker is then ground with gypsum, limestone and other additives to become cement. Companies in the cement industry manufacture multitudes of cement variations, including but not limited to, OPC, Portland-limestone, masonry, pozzolanic and other hydraulic types of cement, each with varying uses in specific construction and various applications. Companies in the cement industry sell the product primarily to concrete applications, along with various other end-use applications.

Aggregates

Aggregates products include crushed stone, sand and gravel and are primarily used in manufacturing concrete, asphalt and unbound base applications. Companies in the aggregates industry mine from quarries and sell the

11

Table of Contents

product to various end-use applications, including concrete producers. Due to the high weight-to-value ratio of aggregates, materials are typically transported economically over a limited distance.

Ready-Mix Concrete

Ready-mix concrete refers to unhardened mixed concrete delivered to job sites. Ready-mix concrete is manufactured in batching plants according to a set recipe and then delivered to construction sites in a freshly mixed state using trucks. It is mixed in specific proportions of cement, water, aggregates and sometimes additives, ensuring consistency and quality. This method allows for precise control over the concretes properties, such as strength and workability, making it a convenient option for various construction projects.

Concrete Blocks

Concrete blocks are made from a mixture of cement, water and aggregate, and are used in building construction. Florida is the largest concrete block market in the United States since concrete blocks are required by the South Florida building code due to their energy efficiency, storm and fire resistance qualities, termite resistance and design flexibility. We believe that the expected increase in severe weather events caused by climate change may continue to increase demand for concrete blocks due to their storm and fire resistance qualities.

Fly Ash

SCMs, such as fly ash, are used in cement and concrete production to enhance the durability, impermeability, workability and sustainability of concrete. Fly ash is generated as a by-product of coal combustion in the generation of electricity by utilities and can be recycled for use as a replacement to clinker in the cement production process, improving grinding efficiency and reducing the carbon footprint of the final product.

Our Competitive Strengths

We believe we are well positioned to capitalize on favorable trends for future growth because of the following competitive strengths:

Leading Market Positions in Several Fast-Growing Economic Mega-Regions of the Eastern Seaboard with Strategically Placed Facilities and Terminals

We are one of the largest suppliers of cement in Florida, Virginia and the Carolinas, and occupy a leading position in Metro New York. Based on cement imports and cement plant capacity divided by the total size of the market as reported by PCA, we occupy 31.3% of the Florida market, 30.0% of the Virginia and the North Carolina markets and 24.1% of the Metro New York market. This makes us one of the largest suppliers of building materials in three out of the 11 economic mega-regions of the United States, areas that contain multiple metropolitan areas that are densely populated and offer attractive demographics and population growth.

Our cement plants and marine and land terminals are strategically located to increase proximity and shorten transport time to our end customers across our three economic mega-regions. Our network of facilities allows us to maximize logistical efficiency while maintaining a significant geographic reach. For example, our Roanoke Plant combined with our Norfolk Terminal and an extensive logistics network of rail terminals, loadouts and storage facilities, efficiently services our markets and customers in Virginia, Tennessee, West Virginia, South Carolina and North Carolina. In Florida, our Pennsuco facility is the only plant on the FEC rail network serving the east coast of Florida, while our Port Tampa Bay Terminal supports Tampa and the west coast of Florida, one of the fastest growing regions in the country.

12

Table of Contents

Vertically Integrated Business Model Providing Strategic Flexibility and Reliable Production

We believe we have established a vertically integrated business model that allows us to reliably supply our customers with high-quality products. Additionally, our vertical integration gives us visibility into the needs of customers up and down the value chain.

Our vertically integrated manufacturing and distribution network of more than 100 facilities includes two cement plants, three marine import terminals, rail-connected logistics terminals, mines, ready-mix concrete batch plants, block production lines and fly ash processing plants across our core markets. We believe that our extensive, high-capacity logistics network provides flexible and reliable sourcing to help meet the needs of our customers, even in times of market disruptions.

Our vertical integration allows us full control of the quality, availability and supply of raw materials and intermediates for production of consistently high-quality products across the construction value chain, as evidenced by our multiple NRMCA Producer Excellence in Quality Awards. For example, we use our own limestone to produce clinker, cement and aggregates. We leverage our internally-supplied clinker and SCMs to produce our cement, which is then used together with our aggregates to manufacture our concrete products. Our ready-mix concrete and concrete block operations source nearly 100% of their cement inputs from our own internal supply.

We believe our vertically integrated business model helps us establish a strong presence in the market with increased proximity to our customers, providing a 360-degree view of their needs. In addition to providing convenience and communication, it gives us the capability to develop, test and optimize new products for the market. We believe that all of these factors differentiate us in the marketplace and, as a result, position us for customer retention and growth.

Comprehensive Logistics Network with Strategically Placed Facilities and Terminals

The construction materials sector is a localized industry due to the high cost of transportation of cement, concrete, aggregates and other products. Further, customer job sites operate on extremely time-sensitive workflows and rely on consistent and readily-available supplies of key construction products. Customers can neither rely on, nor can suppliers afford, long supply chains. Reliability and timeliness of supply are critical success factors.

Our production and import facilities and extensive intermodal logistics networks are strategically placed to increase proximity and shorten transport time to our end customers. These networks connect our aggregate sites, import terminals and cement plants to regional markets across the Eastern Seaboard. We believe our network delivers efficiency, flexibility and security of supply for our customers.

Intense Focus on Customer Service and Solutions

Through our more than 120 years of industry experience and focus on operational excellence, we believe we have fostered deep customer trust and satisfaction. We have direct access up and down the value chain, and a 360-degree view that allows us to identify emerging market trends and customer preferences and the opportunity to provide tailored, engineered solutions.

Our product development program is centered around driving innovation, productivity, performance and sustainability across our portfolio, with a keen focus on meeting emerging market demands and enhancing our competitive edge. Our initiatives are strategically designed to leverage technological advancements, optimize operational efficiency of our own operations and those of our customers and deliver high-performance, environmentally sustainable solutions to our customers and the broader concrete construction value chain.

13

Table of Contents

We offer several benefits to our customers, including high quality products, customized products and solutions, sustainable products, technical support, a reliable supply chain, innovative products and solutions and a relentless focus on serving our customers.

Significant Installed Capacity Ready to Capture Market Growth

As the industry enters what we believe to be a new multi-year growth phase, we have expanded our capacity with the goal of meeting what we expect will be a growing demand for our products and services. Our average cement sales volume over the past three years was approximately 5.6 million tons and our three marine import terminals are capable of receiving and distributing approximately 6.3 million tons of cement annually, as of December 31, 2023. This capacity is a result of significant investments that we have made to expand our import terminals along the Eastern Seaboard, including a combined $73 million to increase capacity at our Port Tampa Bay Terminal and our Norfolk Terminal.

Our Port Tampa Bay Terminal averaged over 650,000 tons of imported cement annually over the last three years, with an ability to manage approximately 2.5 million tons annually. We are also permitted and able to import, store and ship over 700,000 tons of aggregates per year at our Port Tampa Bay Terminal. At our Norfolk Terminal, we imported approximately 450,000 tons of cement annually over the last three years, and we can manage approximately 1.9 million tons annually. Our Essex Terminal averaged over 850,000 tons of cement imports annually over the last three years, with capabilities to manage approximately 1.9 million tons annually. With our differentiated multi-product capabilities, we can import different types of cements, SCMs, aggregates and other bulk products.

The Eastern Seaboard requires imports of cement, aggregates and SCMs to supplement domestic production. With construction activity expected to increase in the coming years, the need for imported construction products is expected to rise. Cement imports have always been an integral and flexible part of our business model. With our import capabilities, we are able to flex our supply to meet market demand, such as quickly increasing our imports to meet increased demand while expanding our geographic reach and the ability to cost effectively serve these market areas.

Proven Track Record of Successful Innovation Merging Global Trends with Local Needs

We believe our latest product and technology developments position us at the forefront of innovation and sustainability, directly addressing emerging market trends and enhancing our competitive strengths across the construction industry. Furthermore, we believe our focus on innovation allows us to better address high growth and high margin product and service opportunities.

Our innovation helps to solve critical industry and society needs, addressing themes such as (i) the path to net-zero emissions, (ii) construction productivity, (iii) novel construction technologies, (iv) circular economy and (v) climate adaptation. Each of these initiatives underscores our commitment to leading the market with high-performance, sustainability-minded solutions.

An Independent Business that Benefits from the Support of a Well-Established Parent Company

Established in 1902, Titan Cement International, our parent, is a leading global cement producer. Since our initial investment in the United States in 1989, we have operated as a largely independent U.S. subsidiary. While our operations are all handled domestically and our current U.S. management team has driven significant growth in the business since 2014, we benefit from intercompany loans and credit facilities made available to us through Titan Global Finance PLC (TGF), a wholly owned subsidiary of Titan Cement International. These intercompany loans and credit facilities are based on financial terms contained in the arms length agreements consummated among TGF and its third-party lenders, each of which benefit from Titan Cement Internationals credit rating.

14

Table of Contents

The intercompany loans and credit facilities made available to Titan America contain no financial or other covenants and utilize the favorable market pricing obtained by TGF as a result of Titan Cement Internationals credit rating. For these reasons, we believe the overall pricing and terms of the intercompany agreements are better than those that Titan America could independently secure in the credit markets. We also benefit from services agreements with Titan Cement International, pursuant to which Titan Cement International provides us with technical, functional and other support services, including the services of the in-house engineering team of our parent company, with whom we partner to develop proprietary technology that aims to make cement production faster, more cost-efficient and better for the environment. With essentially two teams working on developing new technology and processes to improve our operations, we believe we are at the forefront of innovation in our industry. See Certain Relationships and Related Party Transactions.

On a yearly basis, Titan America LLC enters into ordinary course of business supply agreements under the master supply agreement with Titan Cement Company S.A., an affiliate of TCI, for the purchase of a predetermined amount of cement and cementitious products for the following year at a price based on the arms length principle in accordance with the U.S. transfer pricing rules and the relevant OECD guidelines. See Certain Relationships and Related Party Transactions.

Dedicated Management Team with a Proven Track Record of Stable, Above-Market Growth and Fiscal Responsibility

Our executive management team collectively has approximately 225 years of combined experience, which is leveraged across the organization and supported by a strong set of local and regional managers who have operational expertise in the industry.

Our executive management team has successfully guided us through various economic cycles, including the COVID-19 pandemic. Under our current senior management teams leadership, we have grown our sales from $539 million in 2013 to $1.6 billion in fiscal 2023, our net income went from a loss of $65.4 million to a positive $155.2 million and our net income margin has grown from negative 12% to positive 10% during the same period.

We believe that our executive management teams experience navigating through economic cycles, as well as our diversified end markets and customer base and vertically integrated business model, provides increased stability for our business relative to other building materials manufacturers. The infrastructure, residential and non-residential end markets have historically operated on different cycles and benefit from varied demand drivers. The stability of our diversified end markets has allowed us to generate free cash flow throughout economic cycles, which our executive management team has historically deployed to manage leverage, invest in organic growth opportunities and make strategic acquisitions.

Growth Strategies

We intend to leverage our competitive strengths to create shareholder value through the following core growth strategies:

Cement Capacity Expansion

We are currently investing in the expansion of our Pennsuco facility and our Roanoke Plant that we expect will increase total cement production capacity by 29% to 4.9 million tons by 2030, compared to our current cement production capacity of 3.8 million tons as of September 30, 2024. With a goal of increasing cement production to three million tons at our Pennsuco facility and 1.8 million tons at our Roanoke Plant by 2030, we plan to invest in new grinding mills and repurpose existing assets for additional grinding capacity.

We expect that the additional cement capacity will allow us to meet higher demand with domestic production, while maintaining our flexibility provided by our import capabilities to further increase supply. The planned

15

Table of Contents

additional cement capacity includes (i) a flash calciner project at our Roanoke Plant, which will be partially funded by the DOE, and (ii) fine calcined clay production capacity, blended downstream without extra grinding, thus supporting lower carbon cement production.

We are also developing a plan to expand our Pennsuco facilitys cement storage by 30,000 tons and enhance loadout capabilities with new loading bays. We plan to engage an outside engineering firm to study upgrades to the existing systems and design the extra storage and loadout needed to handle three million tons of annual cement production.

To increase unloading capacity, Port Tampa Bay is currently investing $20 million in a new berth in front of our Port Tampa Bay Terminal. We will have priority right at this new berth with 72-hours written notice, subject to limited exceptions, as per an agreement with Tampa Port Authority, which allows us to berth our vessels without delay or restrictions in connection with other port traffic. With the goal of efficiently distributing our Pennsuco facilitys additional capacity, we plan to invest and expand existing rail terminals on the FEC railway to double existing cement rail volumes.

Supplementary Cementitious Materials: Grow Domestic Production, Imports and Volume from New Sources

We plan to invest in growth of domestic production and imports of SCMs, which are an important input in the long-term decarbonization of the cement industry. By capitalizing on our proprietary ST electrostatic separation technology, we are pursuing agreements with coal fired power plants for the reclamation and beneficiation of landfills and freshly generated fly ash sources across the Eastern Seaboard. This will provide new sources of fly ash to be utilized for the production of blended cements as well as used in engineered concrete formulations.

We expect that our investment in calcined clay, which is partially funded by the DOE, will result in additional sources of an important cementitious material utilized in the production of blended cements and other engineered concrete applications, further diversifying our product portfolio.

We plan to capitalize on our parent companys owned pozzolan reserves and our import terminals to supply pozzolan, another important element of blended cements and engineered ready-mix concrete formulations. We also will pursue long-term supply contracts to import other cementitious materials such as fly ash and slag from reliable sources around the world.

Aggregates: Strengthen Position through Investment in Reserves and Exploration

Through our exploration program we are focused on identifying and securing new coarse and fine aggregates sources that can efficiently serve our markets. In addition, we are pursuing potential new sources of aggregates outside our markets by rail and marine delivery. The size and layout of our Norfolk Terminal and Port Tampa Bay Terminal enables the inbound movements of offshore aggregates directly into our markets utilizing Panamax class vessels.

Since 2014, we have added critical reserves to our existing aggregates operations through the acquisition of incremental adjacent property, modifications to existing permits and applying new technologies, including ultra fines recovery, deploying innovative dredge equipment, recycling various construction concrete waste materials and optimizing process plant recoveries.

Strengthen Ready-Mix and Block Businesses through Focused Investment in Downstream Capabilities

To better capitalize on expected growth within our residential, non-residential and infrastructure construction end markets, we are planning to invest in expansion of the reach and capabilities of our ready-mix and block business.

16

Table of Contents

Within our ready-mix concrete business, we intend to invest in 10 to 15 new fixed and portable plants over the next five years. We specifically intend to create a mobile ready-mix concrete division to focus on serving public and private mega-projects, by installing the mobile units right at the customer job sites. We believe that this model will result in planning and operational efficiencies for both our customers and us. This will also allow us to remain close to our customers to provide tailored solutions for services and products.

We intend to expand our block business geographic footprint with at least two additional production locations in the next five years, while at the same time augmenting our existing capabilities at our 13 production lines.

We expect our success in ready-mix concrete and block to continue to help drive growth across all products of our vertically integrated model.

Tapping into New Value Pools and Accelerating Green Growth through Continued Investment in and Development of Financially Attractive, Less Carbon-Intensive Products and Solutions

We intend to continue investing in and developing our portfolio of less carbon-intensive products and solutions as we drive toward achieving our goal of carbon neutrality across the cement and concrete value chain by 2050. We believe we can grow our revenue as the demand for differentiated less carbon-intensive products and solutions is expected to accelerate over the coming years.

Our product development program is centered around driving innovation, productivity, performance and sustainability across our portfolio, with a keen focus on meeting emerging market demands and enhancing our competitive edge to drive revenue growth and margin expansion. Our initiatives are strategically designed to leverage technological advancements, optimize operational efficiency of our own operations and those of our customers and deliver high-performance, environmentally sustainable solutions to our customers.

We plan to build on the foundation of our recently developed high-performance concrete and cementitious products tailored to meet increasingly demanding construction needs for infrastructure and commercial markets. These products and solutions include:

| | High-strength and high-modulus elasticity concretes, which are designed for increasingly tall and slender high-rise buildings in major urban markets. |

| | High-durability concretes developed for projects requiring extended service life in extreme conditions, including landmark tunnels and bridges. |

| | Marine and underwater concretes, designed and specialized for corrosive environments. |

| | Our GreenCrete® product line, which offers independently validated less carbon-intensive concrete mixtures (based on third-party measurements of embodied CO2 content relative to industry benchmark specifications) while enhancing performance across all applications. |

| | BrightCem®, an industry-first performance-based cement with a reduced CO2 footprint. |

| | Proprietary 3D mortars for both residential and marine applications. |

| | Extended joint spacing concrete, which addresses specific challenges in the automation of the warehouse and distribution industry, providing a durable low joint surface to allow the use of robotic solutions. |

Our lower carbon and high performing cements and supplementary cementitious materials are critical to enable these concrete mixes. We believe that our high-performance products not only enhance the quality of construction but also support sustainable and resilient development.

Leverage our Vertically Integrated Business Model to Grow our Existing Market Positions

Externally, our ability to manufacture and deliver aggregates, cement, SCM, ready-mix concrete and concrete blocks allows us to act as a single-source supplier for customers across all construction end markets. Our

17

Table of Contents

extensive logistics network, comprised of marine and land terminals, railways, trucks, modern infrastructure and technology, enables us to service customers, including major project sites. In 2023, we completed a $73 million investment at our Port Tampa Bay Terminal and our Norfolk Terminal, constructing new domes, adding multi-product storage capacity of approximately 70,000 tons each, as well as on other repairs and refurbishments.

Customers rely on suppliers with condensed, local supply chains due to the cost-intensive nature of transporting cement products. We intend to leverage our vertically integrated business and robust logistical network to serve our existing clients and to grow our current market positions.

Drive Digitalization as a Critical Enabler for Top-Line and Margin Growth with Dynamic Manufacturing, Logistics and Customer Experience Solutions

We plan to continue investing in digital transformation and AI/ML technologies as we see it as a critical enabler to drive operational excellence and growth. We are among the first cement producers to implement a full set of AI/ML digital solutions that have improved the productivity, efficiency and reliability of our manufacturing operations. Both of our cement plants are now utilizing RTO that improves equipment throughput while minimizing energy consumption, AI/ML-based predictive maintenance tools that improve the reliability and stability of the operations and AI/ML-based predictive quality analytics that improve product quality and consistency. We believe that our position as a technological innovator in our markets positions us to take advantage of growth opportunities and develop further efficiencies in our operations.

Capitalizing on the knowledge and experience gained from the industrial digitalization applications, we are developing and implementing an AI/ML application for real-time optimization of our logistics and distribution network managing the scheduling and delivery of our concrete products. These algorithms will allow for better scheduling of daily deliveries, taking into account external disruptions like weather and traffic events and keeping the customer aware of their product delivery status. This advanced digital application coupled with a dynamic, end-to-end cloud-based customer portal will transform the way our customers interact with us, improving the overall customer experience while contributing to distribution cost reduction and productivity increases of our ready-mix concrete operations.

Enhance our Platform Capacity and Utilization through the Implementation of Internal Initiatives Supporting Growth and Profitability

Our current executive management team has a robust track record of driving improvement in the business and a proven ability to execute strategic initiatives since 2014. In addition to the above strategies, we have a slate of initiatives focused on growth, driven by operational excellence, asset utilization, pricing, raw material procurement, cost controls and freight/distribution logistics, targeting improvements in our cost structure and overall profitability. Lastly, we are making strategic investments in new assets to enhance our material storage and distribution facilities, mineral reserves and delivery capacity.

Expand into Adjacent Market Segments within the Construction Value Chain

In addition to our growth strategies pertaining to our existing geographies and core products, we are constantly evaluating opportunities to expand via greenfield development or potential acquisitions into adjacent market segments across the construction value chain. This evaluation process represents a strategic effort to capitalize on high-growth opportunities within the construction industry and emerging market needs from our customers. Successful expansion can generate additional revenue with margins that are enhancing to our core business, capitalizing on market demand and our ability to offer high-quality, durable products and services tailored to the specific needs of customers up and down the construction value chain.

For example, we are exploring an expansion into the precast market, specifically production of lintels, sills and pavers. We have the raw materials and technical capabilities to produce these high-margin products and we

18

Table of Contents

maintain commercial relationships and channels to the end user markets. These product markets represent an obvious adjacency into which we can grow.

We intend to remain disciplined in our approach with an aim to generate strong returns through capital deployment. We believe our capital resources provide us with ample financial flexibility to execute organic and inorganic growth opportunities.

The Reorganization Transactions

On May 9, 2024, Titan Cement International, our parent company, announced its intention to complete an initial public offering of its U.S. business. Prior to the date of this prospectus, Titan Cement International contributed the 1,734,440 shares it held in Titan Atlantic, representing 100% of the equity in Titan Atlantic, to TASA in exchange for 175,342,465 common shares of TASA. The Contribution was immediately preceded by a share split of TASAs then-current common shares at a 10:1 ratio. After the Contribution of Titan Atlantic to Titan America SA, on January 1, 2025, Titan America LLC divested the STET segment in a sale for cash, to be settled no later than January 31, 2025, to Titan Cement Netherlands B.V., a wholly-owned subsidiary of Titan Cement International, which is outside the scope of this offering. The STET segment is immaterial to the results of operations, financial position, and cash flows of the Company.

Additionally, we will enter into a shared services agreement with Titan Cement Company S.A., a wholly-owned subsidiary of Titan Cement International (the Shared Services Agreement). The Shared Services Agreement will govern various interim and ongoing relationships between us and Titan Cement International following the completion of this offering. For more information on the Shared Services Agreement, refer to the section titled Certain Relationships and Related Party TransactionsShared Services Agreement.

Agreements relating to the Reorganization Transactions will be made in the context of a parent-subsidiary relationship and the terms of these agreements may be more or less favorable to us than if they had been negotiated with unaffiliated third parties. See Risk FactorsRisks Related to the Reorganization Transactions and Our Relationship with Titan Cement International.

We believe, and Titan Cement International has advised us that it believes, that the Reorganization Transactions and this offering will provide a number of benefits to our business. These intended benefits include:

| | improving our strategic and operational flexibility; |

| | allowing us to adopt the capital structure, investment policy and dividend policy best suited to our financial profile and business needs; |

| | providing us with our own equity to facilitate capital investments and acquisitions; and |

| | enabling potential investors to invest directly in our business. |

However, we cannot assure you that we will be able to achieve these and other anticipated benefits of the Reorganization Transactions, and the benefits of the Reorganization Transactions may be delayed or not occur at all. See Risk FactorsRisks Related to the Reorganization Transactions and Our Relationship with Titan Cement International.

19

Table of Contents

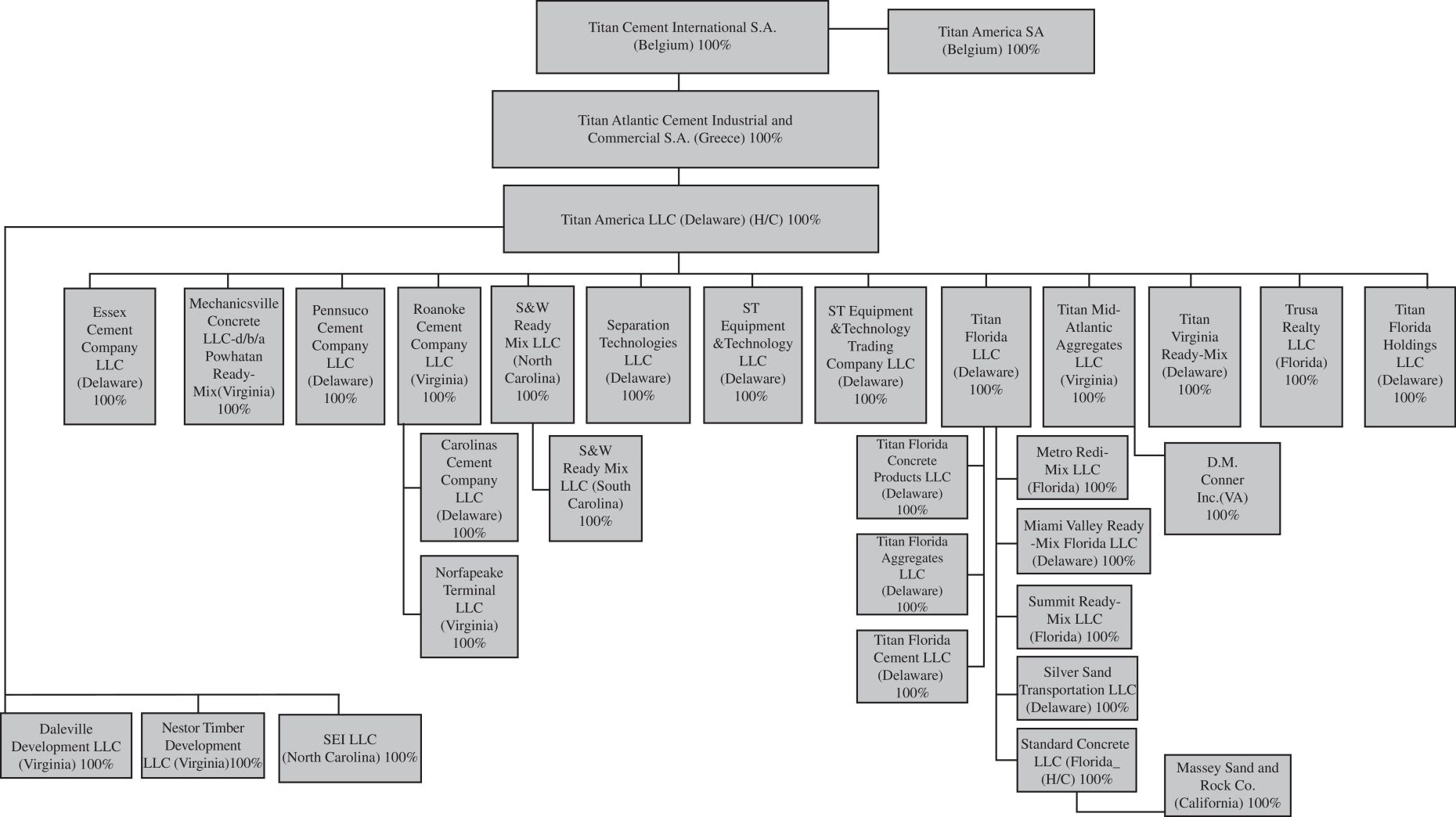

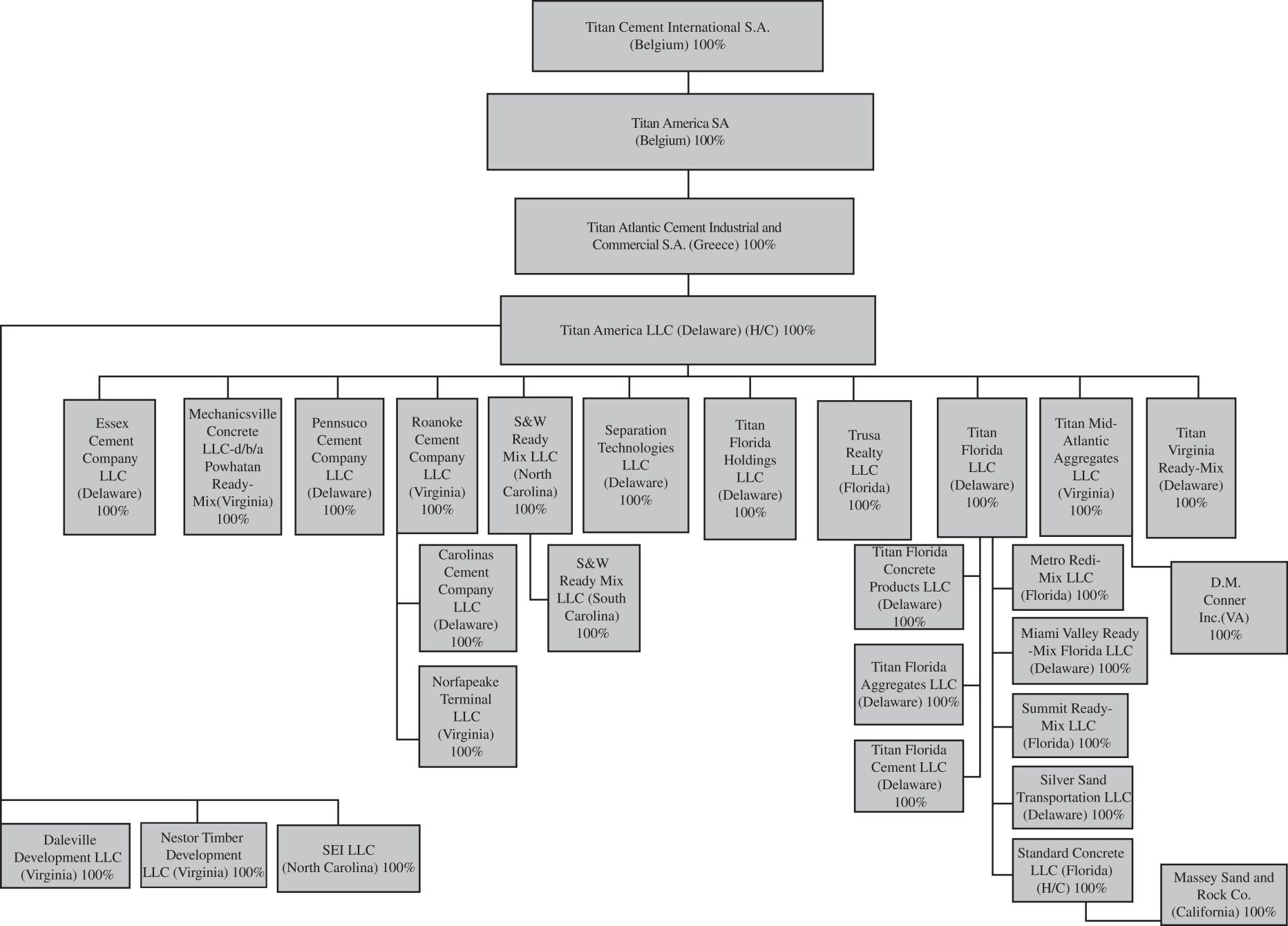

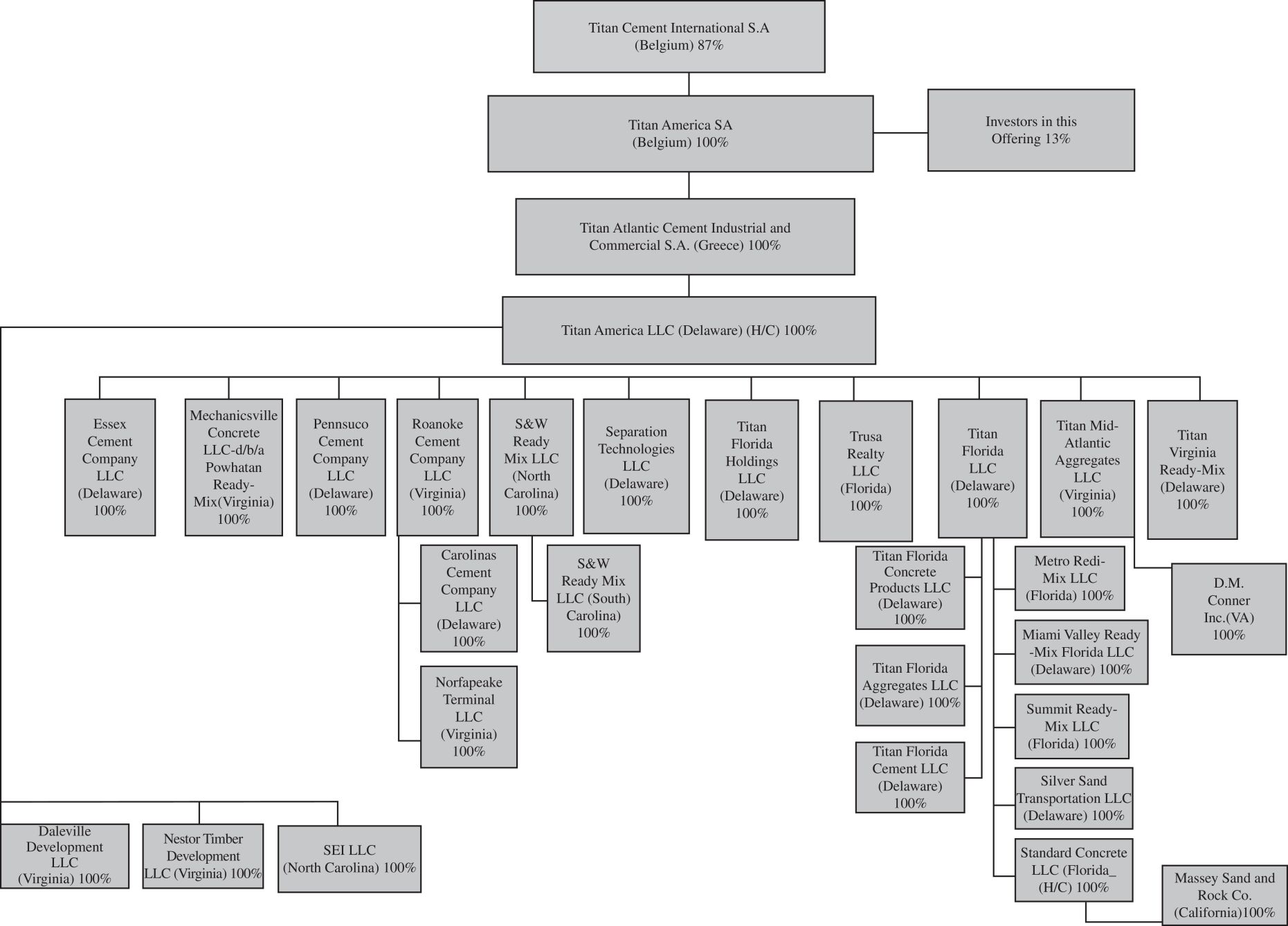

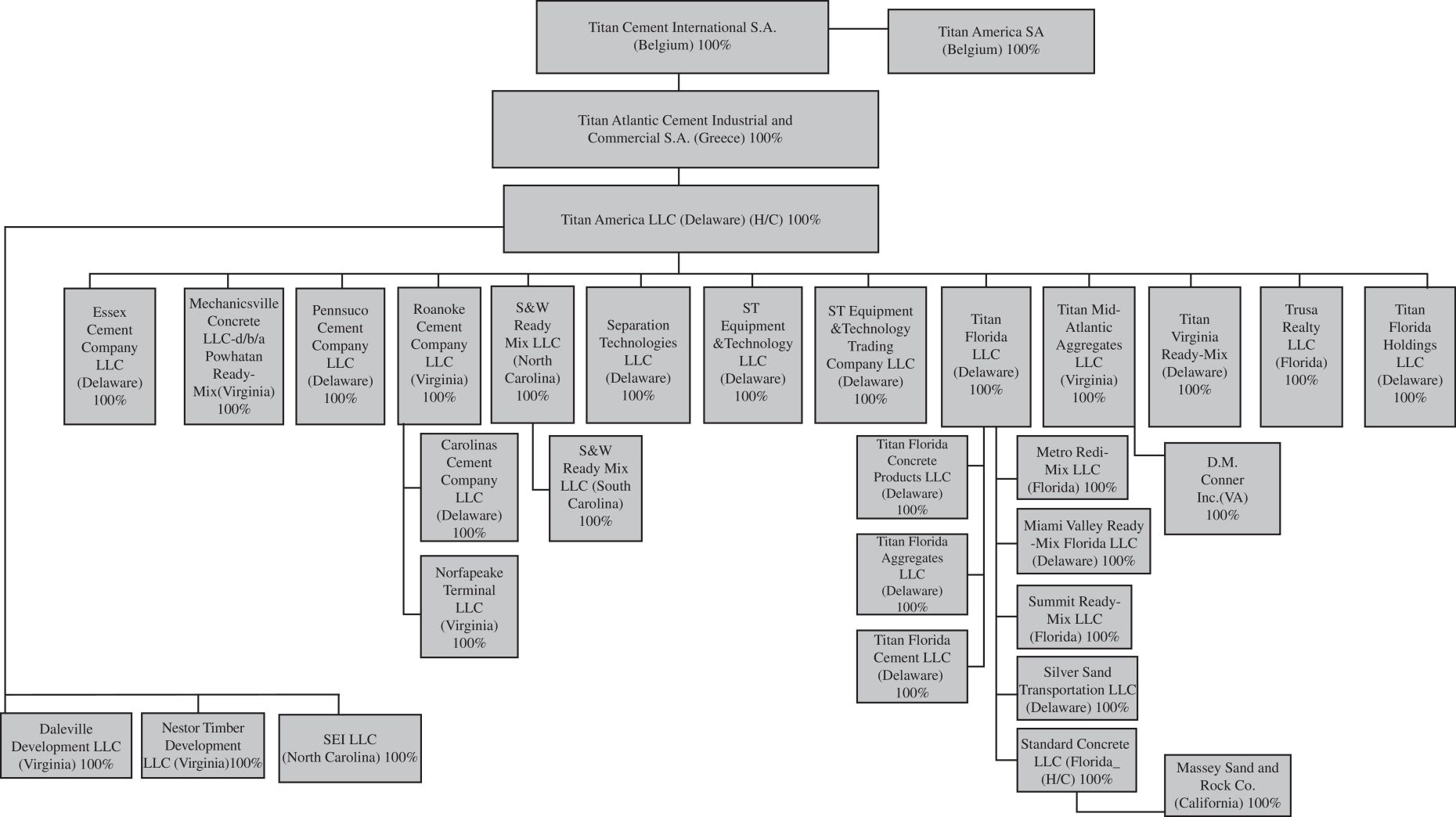

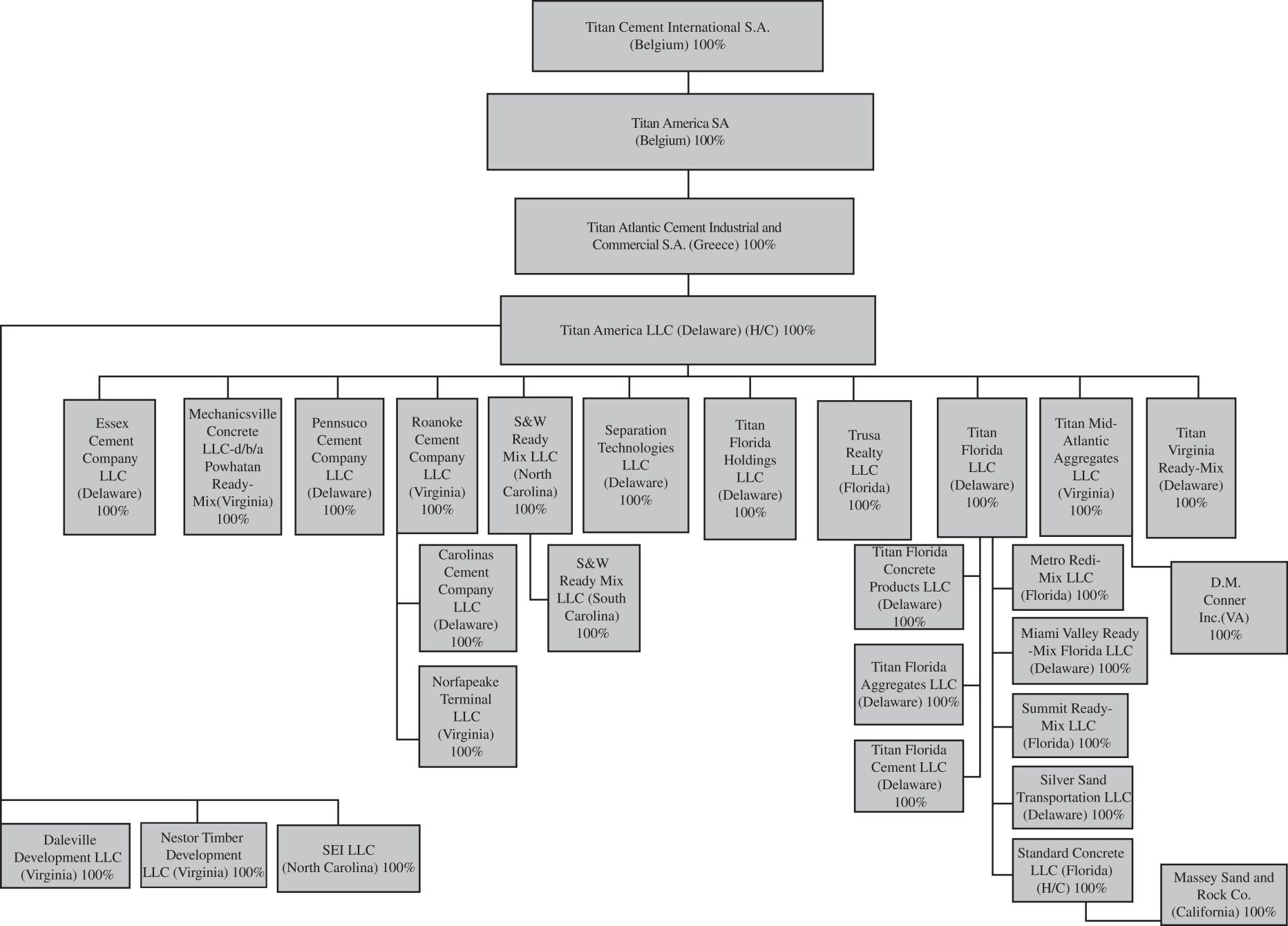

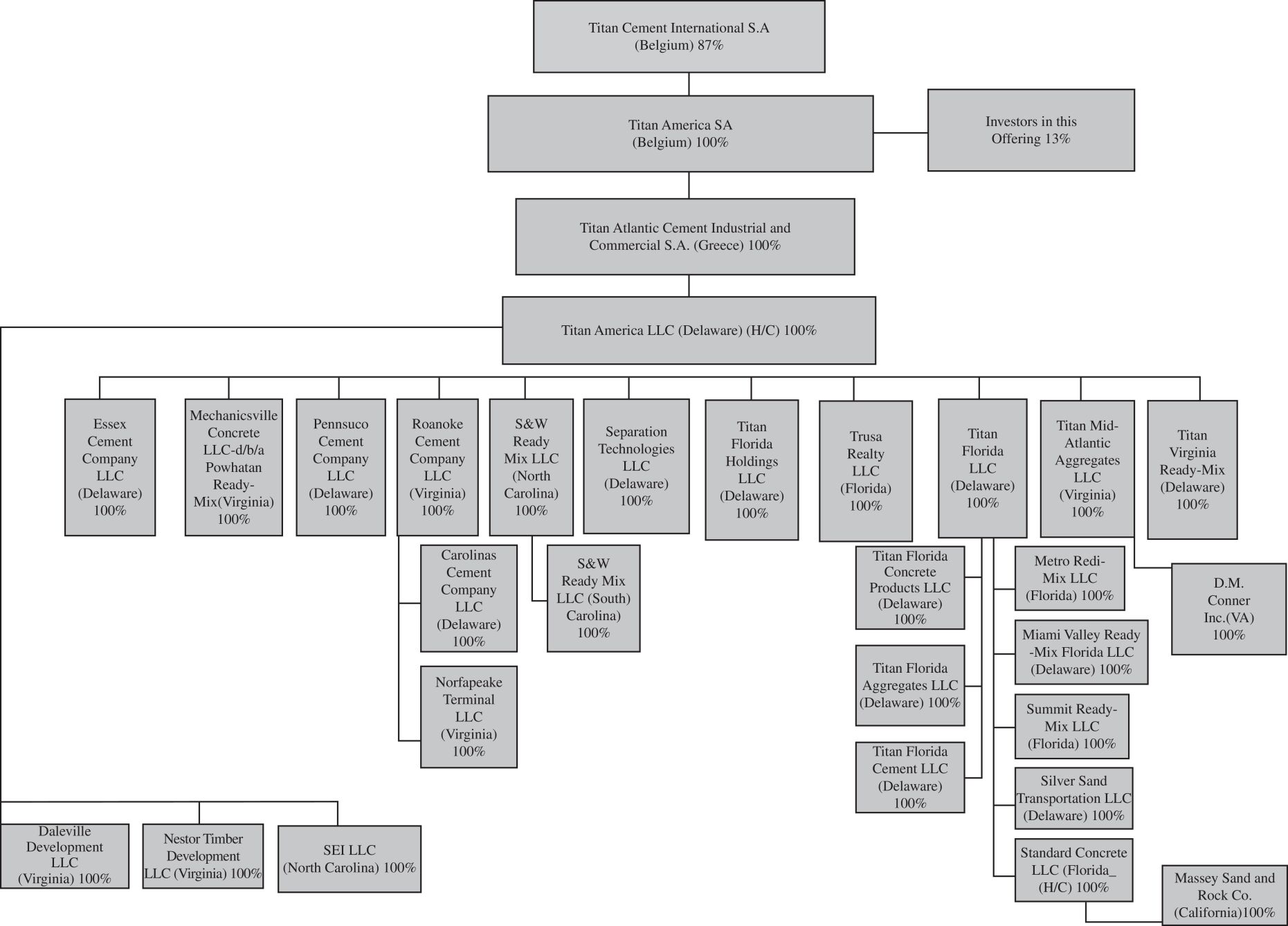

Set forth below are organizational charts displaying the corporate structure of Titan Group as follows: (i) prior to the Reorganization Transactions and the offering, (ii) after the Reorganization Transactions and before the offering and (iii) after the Reorganization Transactions and after the offering:

Organizational Chart Prior to the Reorganization Transactions and the Offering

20

Table of Contents

Organizational Chart After the Reorganization Transactions and Prior to the Offering

21

Table of Contents

Organizational Chart After the Reorganization Transactions and After the Offering

Corporate Information

We were incorporated on July 17, 2024 as a company with limited liability (société anonyme/naamloze vennootschap) incorporated and operating under the laws of Belgium. We are registered with the Register of Legal Entities (registre des personnes morales/rechtspersonenregister) of Brussels (French-speaking division) and are registered with the Crossroads Bank for Enterprises (Banque-Carrefour des Entreprises/Kruispuntbank van Ondernemingen) under number 1011.751.174.

Our principal executive offices are located at 1000 Bruxelles, Square de Meeûs 37, Belgium, which is also our registered office. We also have offices at 5700 Lake Wright Drive, Suite 300, Norfolk, Virginia 23502, and our telephone number is +1 (757) 858-6500. Our website is www.titanamerica.com. The information contained on, or accessible through, our website is not incorporated by reference into this prospectus, and you should not consider any information contained in, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase common shares in this offering.

22

Table of Contents

Our Shareholder

We are owned by Titan Cement International, the parent company of the Titan group of companies. Established in 1902 in Greece, Titan Cement International is a multinational cement and building materials producer with cement production facilities in ten countries, serving customers in more than 25 countries globally. Immediately prior to the completion of this offering, Titan Cement International beneficially owned 100.0% of our outstanding common shares, and will beneficially own approximately 87% of our common shares following the completion of this offering, assuming no exercise of the underwriters option to purchase additional common shares. If the underwriters exercise their option to purchase additional common shares, Titan Cement International will beneficially own approximately 85% of our common shares following the completion of this offering. We also currently expect to be a controlled company under corporate governance standards and to take advantage of certain corporate governance exceptions related thereto. See Risk FactorsRisks Related to the Offering and Ownership of our Common Shares.

Recent Developments

Preliminary, Unaudited Estimated Financial Information for the Year Ended December 31, 2024

We have presented below preliminary, unaudited estimates of certain financial information for the year ended December 31, 2024, as well as comparable information for the year ended December 31, 2023, which was derived from our financial statements for the year ended December 31, 2023, as we believe they are useful to investors in understanding our recent comparative operating performance.

We have provided ranges, rather than specific amounts, for certain information below, primarily because our financial closing and analysis procedures for the year ended December 31, 2024 are not yet completed. The unaudited financial information for the year ended December 31, 2024 set forth below is preliminary, based upon our estimates and currently available information and subject to revision based upon, among other things, our financial closing procedures, the completion of our financial statements procedures and completion of our audit for the year ended December 31, 2024. During the course of the preparation of our financial statements by management, which will be further subjected to an audit, additional items that require adjustments to the preliminary financial information presented below may be identified. The preliminary financial information for the year ended December 31, 2024 presented below should not be viewed as a substitute for financial statements prepared in accordance with IFRS. In addition, the preliminary financial information is not necessarily indicative of the results to be achieved in any future period and should be read together with the sections entitled Special Note Regarding Forward-Looking Statements and Risk Factors and our consolidated financial statements and related notes included elsewhere in this prospectus.

We will complete the preparation of our financial statements for the year ended December 31, 2024 following the completion of this offering and expect to complete such preparation no earlier than March 2025. Although we are currently unaware of any items that would require us to make adjustments to the information set forth below and do not expect that actual results will differ materially from the information set forth below, it is possible that we may identify such items as we complete our financial statements and any resulting changes could be material.

The preliminary financial data included in this prospectus has been prepared by, and is the responsibility of, Titan America SAs management. PricewaterhouseCoopers LLP has not audited, reviewed, examined, compiled,

23

Table of Contents

nor applied agreed-upon procedures with respect to the preliminary financial data. Accordingly, PricewaterhouseCoopers LLP does not express an opinion or any other form of assurance with respect thereto.

| Years Ended December 31, | ||||||||||||

| 2024 | 2024 | 2023 | ||||||||||

| ($ in thousands) | (Low) | (High) | (Actual) | |||||||||

| IFRS Results of Operations: |

||||||||||||

| Revenue |

$ | 1,625,000 | $ | 1,635,000 | $ | 1,591,601 | ||||||

| Net income |

$ | 159,000 | $ | 169,000 | $ | 155,244 | ||||||

| Non-IFRS Measures: |

||||||||||||

| Adjusted EBITDA |

$ | 365,000 | $ | 372,000 | $ | 328,373 | ||||||

We expect revenue to be between $1,625,000 and $1,635,000, representing an estimated increase of approximately 2.10% to 2.73% for the year ended December 31, 2024 compared to the year ended December 31, 2023, primarily as a result of increases in product pricing which more than offset declines in external sales volumes of cement and aggregates. Positive contributions from infrastructure and commercial construction were offset by a soft residential construction environment and adverse weather conditions in the second half of the year.

We expect net income to be between $159,000 and $169,000, representing an estimated increase of approximately 2.42% to 8.86% for the year ended December 31, 2024 compared to the year ended December 31, 2023, primarily as a result of improved gross profit which benefitted from lower energy and imported material costs. The improvement in gross profit was partially offset by higher general and administrative expenses, including costs associated with this offering. In addition, net income was affected by higher income tax expense associated with a higher level of pre-tax income and a higher expected effective tax rate.

We expect Adjusted EBITDA to be between $365,000 and $372,000, representing an estimated increase of approximately 11.15% to 13.29% for the year ended December 31, 2024 compared to the year ended December 31, 2023. Adjusted EBITDA grew at a faster rate than net income primarily as a result of the year-over-year changes in the items depicted in the table below.

Adjusted EBITDA is a supplemental financial measure that is not presented in accordance with IFRS. The following table provides a reconciliation of net income to Adjusted EBITDA for the year ended December 31, 2024 (at the low end and high end of the estimated net income range set forth above) and for the year ended December 31, 2023. Please see Managements Discussion and Analysis of Financial Condition and Results of OperationsNon-IFRS Measures for a discussion of Adjusted EBITDA.

| Years Ended December 31, | ||||||||||||

| 2024 | 2024 | 2023 | ||||||||||

| ($ in thousands) | (Low) | (High) | (Actual) | |||||||||

| Net income |

$ | 159,000 | $ | 169,000 | $ | 155,244 | ||||||

| Finance cost, net |

26,000 | 25,700 | 22,244 | |||||||||

| Income tax expense |

57,600 | 59,000 | 47,134 | |||||||||

| Depreciation, depletion and amortization |

100,500 | 99,500 | 91,079 | |||||||||

| Loss on disposal of fixed assets |

2,500 | 2,400 | 3,852 | |||||||||

| Asset impairment (recovery)/loss |

| | (609 | ) | ||||||||

| Foreign exchange loss/(gain), net |

(20,500 | ) | (21,000 | ) | 11,981 | |||||||

| Derivative financial instrument (gain)/loss, net |

22,500 | 22,000 | (10,967 | ) | ||||||||

| Fair value loss on sale of accounts receivable, net |

5,000 | 4,500 | 6,113 | |||||||||